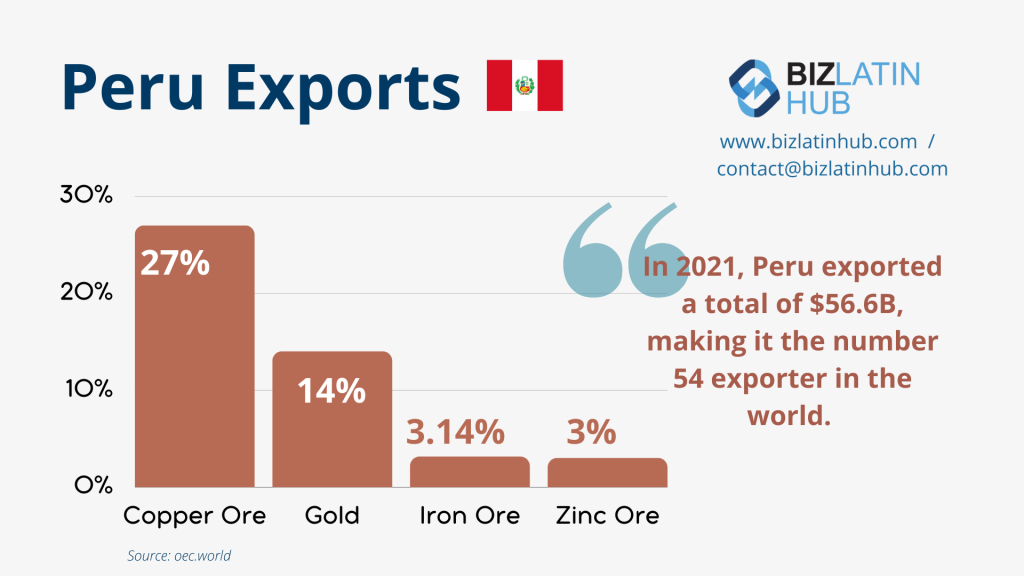

Multinational companies have expanded into new markets across the globe over recent decades thanks to globalization. For such firms, transfer pricing is a crucial aspect of the international trade regime, allowing them to fairly streamline costs for transferring goods and services among legally related entities. Therefore, maximizing potential advantages from Peru’s transfer pricing regulations is crucial to any multinational with a presence in the growing Andean nation.

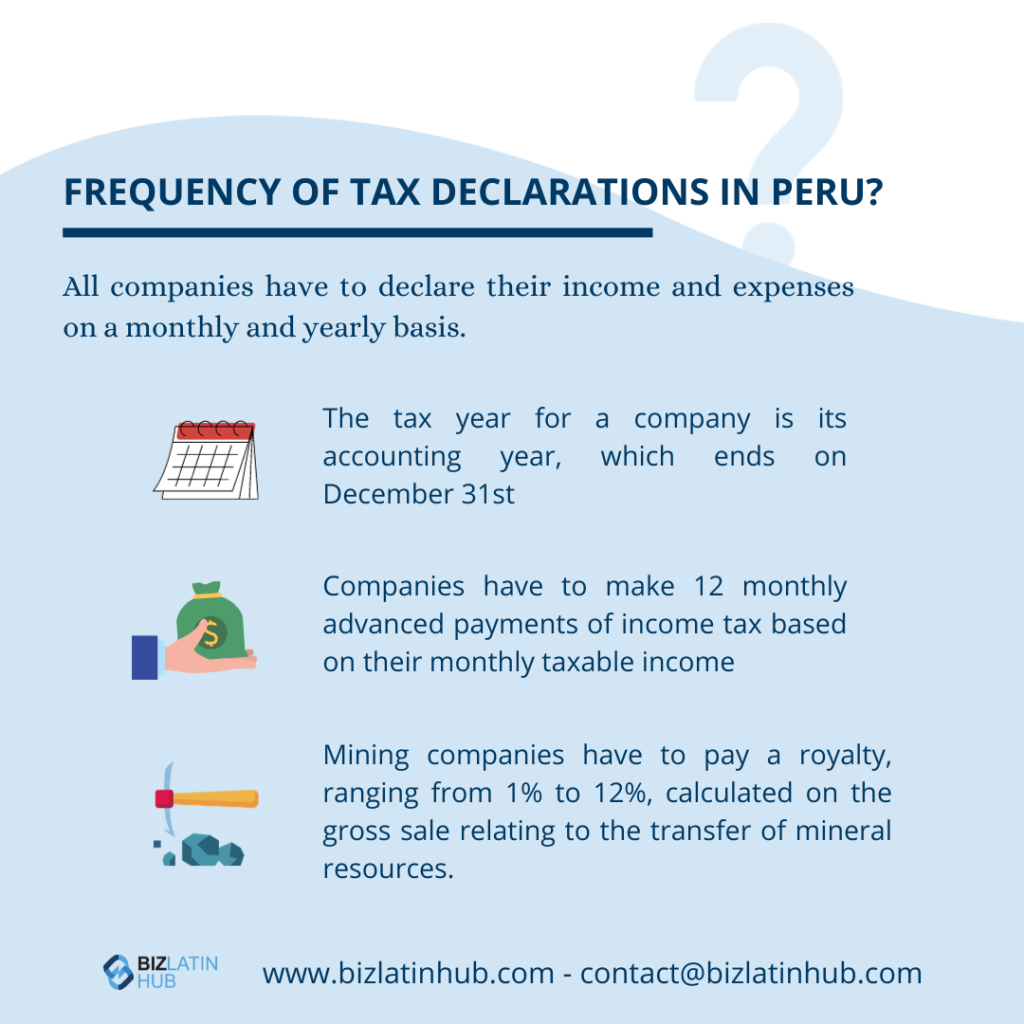

Transfer pricing regulations represent a crucial aspect of international taxes for foreign companies who form a company in Peru. Those regulations are overseen by the country’s tax authority, the National Superintendency of Customs and Tax Administration (SUNAT). Peru’s transfer pricing regulations have become more intricate and carefully followed in recent years, making it important to fall into line.

Biz Latin Hub can help you understand Peru’s transfer pricing and make sure that you stay 100% legal and fully above board. Our array of market leading back-office services will make sure you stay on the right side of compliancy, allowing you to relax and focus on growing your business.

Peru’s transfer pricing regulations

Peru’s transfer pricing regulations refer to the contractual and economic conditions which establish the cost, price, or rate for transactions between legally related parties for the transfer of services, goods, or loans, or other such exchanges.

The SUNAT maintains a transfer pricing control department dedicated to reviewing the validity of such processes, based on relevant legislation.

Peru’s transfer pricing regulations have been applicable since 2006, however, it became necessary to include far more extensive information about the organization overseeing a transfer following a legislative decree in 2016.

That modification was implemented in support of Peru’s attempt to join the Organization for Economic Cooperation and Development (OECD).

Why do these regulations exist?

Transfer pricing regulations are needed to avoid unfair practices in transactions between different entities within the same organization, in order to avoid skewed commercial competition in the market.

Where companies fail to present authorities with the required information related to transfer pricing in Peru, the consequences can include sizable financial penalties. According to Peru’s Tax Code, companies that fail to submit their declarations in good order are liable to pay a penalty equal to 0.6 percent of their net income.

Therefore, it is highly recommended to implement a comprehensive transfer pricing plan to guarantee its smooth management and to offer you adequate defense in the event of any challenge from authorities.

What is required for transfer pricing in Peru?

There are three key report types related to Peru’s transfer pricing regulations, namely a “Local Report,” a “Master Report,” and a “Country-by-Country Report,” with the size of the entity dictating which must be filed. Details of each are included below:

Local Report

For companies whose income exceeds 2,300 tax units, a Local Report must be submitted annually. This report includes incomes, as well as deductible costs or expenses for tax purposes that must be well supported in case the tax authority requests to review them. In Peru, more than 2,500 companies are required to issue this type of report.

Master Report

For companies whose income exceeds 20,000 tax units, a Master Report must be submitted annually. The Master Report allows the SUNAT to access information such as the structure of the group, the description of the group’s commercial activities, transfer pricing policies regarding intangibles, and operations in other countries, among others.

Country-by-Country Report

For multinational enterprise (MNE) groups whose income exceeds PEN$2700 million approx. (threshold not specified), which must be submitted annually. This report includes the taxes declared in each jurisdiction where the company has operations, income in each country, and distribution of income, among other data.

FAQs on transfer pricing in Peru

The main purpose of transfer pricing is to facilitate the proper calculation of costs for goods and services involved in any kind of transfer of assets and services between two related entities, where at least one person or entity involved in the transaction is legally resident in the country where the transfer pricing is taking place.

There are three key report types related to Peru’s transfer pricing regulations, namely a “Local Report,” a “Master Report,” and a “Country-by-Country Report,” with the size of the entity dictating which must be filed. Details of each are included below:

Local Report

For companies whose income exceeds 2,300 tax units, a Local Report must be submitted annually. This report includes incomes, as well as deductible costs or expenses for tax purposes that must be well supported in case the tax authority requests to review them. In Peru, more than 2,500 companies are required to issue this type of report.

Master Report

For companies whose income exceeds 20,000 tax units, a Master Report must be submitted annually. The Master Report allows the SUNAT to access information such as the structure of the group, the description of the group’s commercial activities, transfer pricing policies regarding intangibles, and operations in other countries, among others.

Country-by-Country Report

For multinational enterprise (MNE) groups whose income exceeds PEN$2700 million approx. (threshold not specified), which must be submitted annually. This report includes the taxes declared in each jurisdiction where the company has operations, income in each country, and distribution of income, among other data.

According to Peru’s Tax Code, companies that fail to submit their declarations in good order are liable to pay a penalty equal to 0.6 percent of their net income.

The SUNAT maintains a transfer pricing control department dedicated to reviewing the validity of such processes, based on relevant legislation.

Biz Latin Hub can help you understand Peru’s transfer pricing

With numerous legal and administrative considerations and significant financial repercussions for getting it wrong, it makes sense to seek out a locally-based partner who is experienced with Peru’s transfer pricing regulations to help you develop your transfer pricing plan.

If you are interested in understanding more about transfer pricing in Peru or need other tailored legal services to facilitate your operations in the South American country, engage with our multilingual team of legal experts at Biz Latin Hub.

Reach out to our team today to see how we can support you.

Learn more about our team and expert authors.