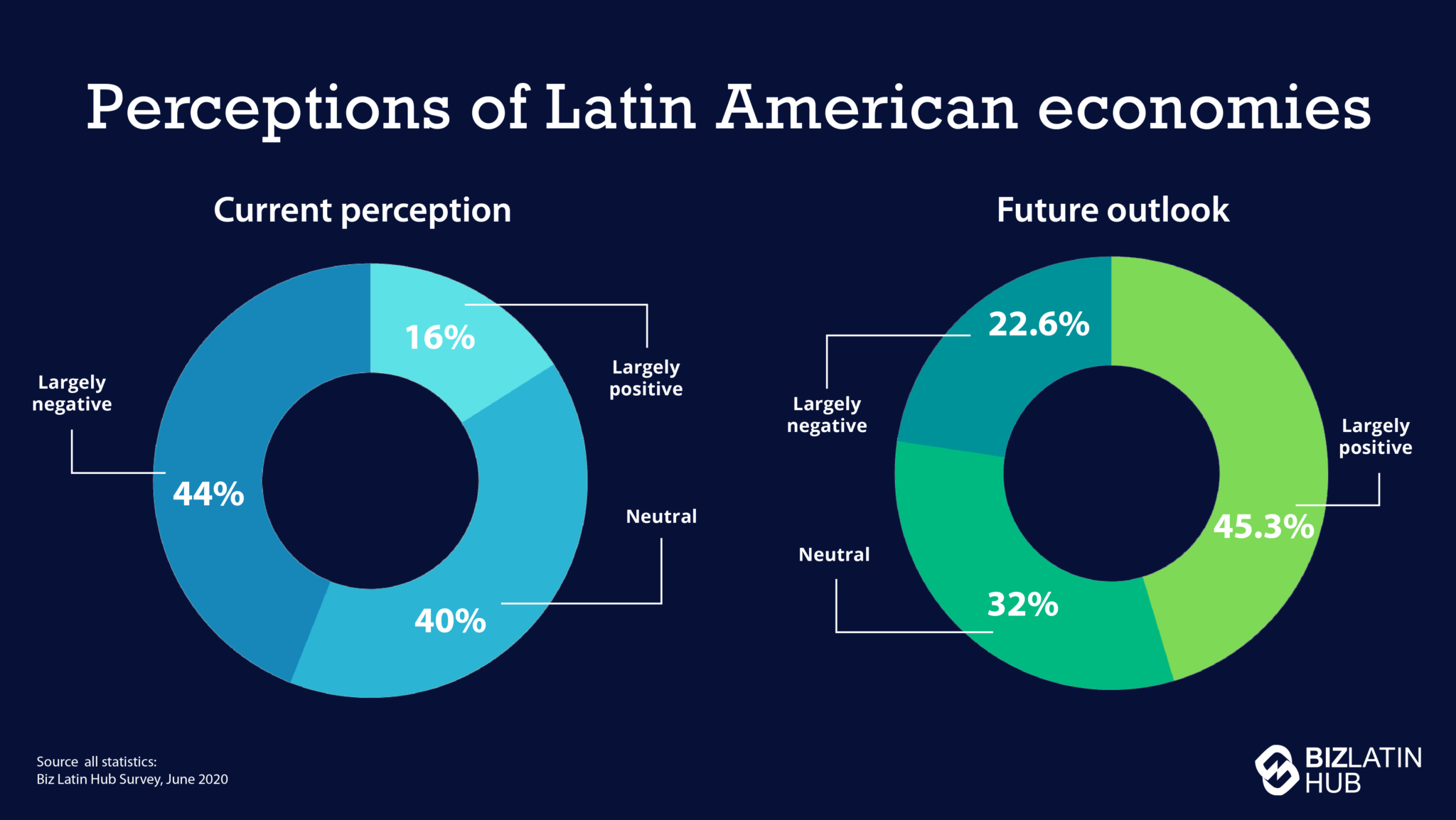

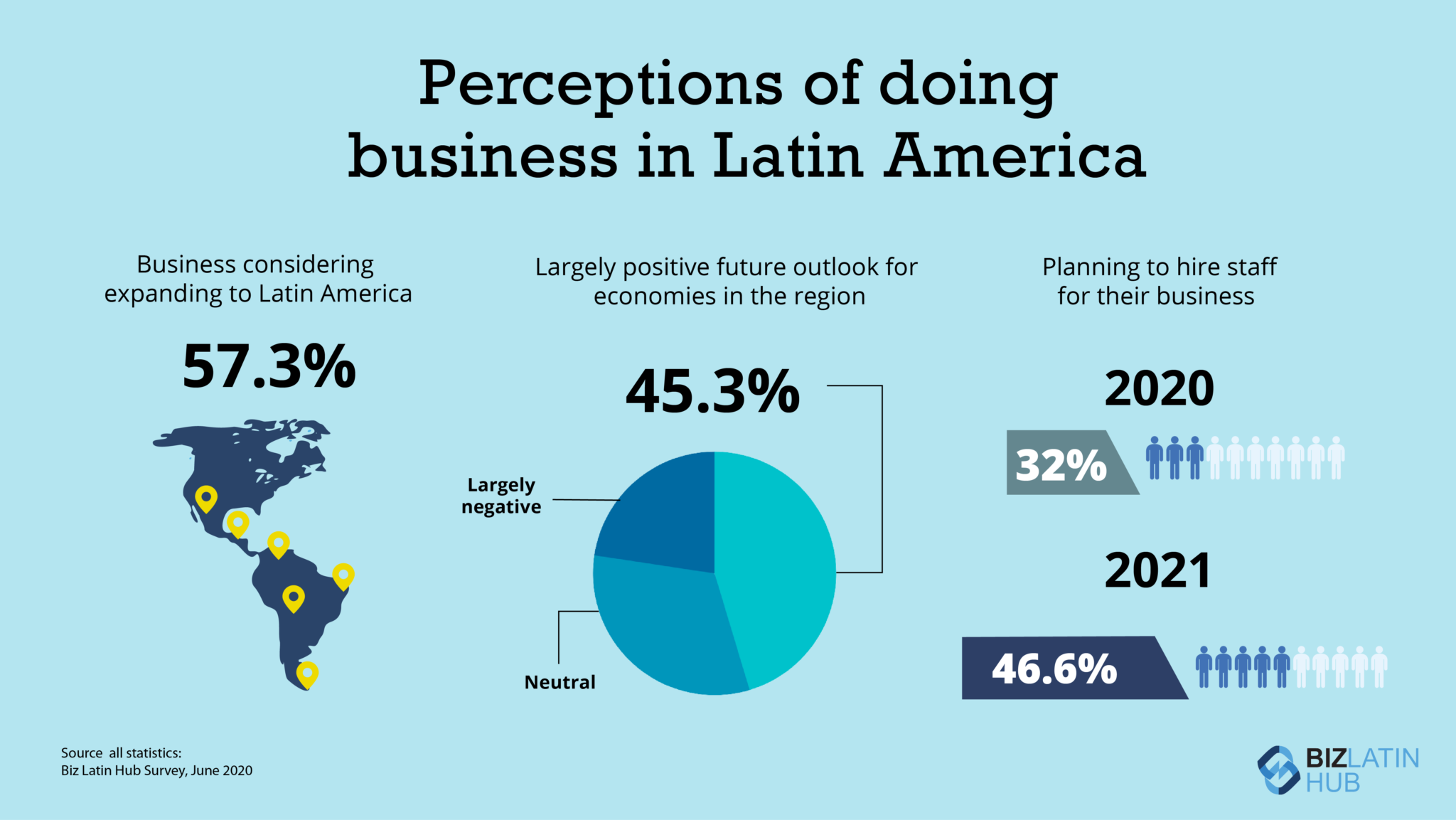

Our comprehensive 2024 survey of 75 business leaders reveals a landscape of measured optimism across Latin America’s diverse markets. With 57.3% of respondents actively considering regional expansion, the data points to significant growth potential despite ongoing global economic challenges. The survey captures insights from decision-makers spanning 40 countries, offering a unique perspective on the region’s business climate and future trajectory.

Economic Landscape and Growth Prospects

Latin America’s economic outlook for 2024-2025 shows promising signs of recovery and growth. The region is projected to achieve overall GDP growth of 2.2% in 2024, strengthening to 2.4% in 2025. This growth varies significantly across sub-regions, with Central America leading at 2.9%, followed by South America and the Caribbean both at 2.6%.

Several countries stand out as particularly dynamic markets in 2024:

| Country | Growth Rate | Key Drivers |

|---|---|---|

| Dominican Republic | 5.2% | Tourism revival, service sector expansion |

| Venezuela | 5.0% | Economic reforms, oil sector recovery |

| Costa Rica | 4.0% | Technology sector, sustainable development |

| Colombia | 2.4% | Digital transformation, green energy |

| Chile | 2.0% | Mining modernization, renewable energy |

Business Climate and Market Dynamics

The business environment across Latin America is experiencing significant transformation, driven by digital adoption and changing trade patterns. Our survey reveals that 88% of companies maintain active operations within the region, while 52% leverage their Latin American presence as part of a broader global strategy.

Payment practices and risk management have emerged as critical considerations for businesses operating in the region. The average credit term has improved to 53 days in 2024, down from 60 days in the previous year, though payment delays remain a challenge for 51% of businesses. This improvement reflects growing financial sector modernization and increased adoption of digital payment solutions.

Business leaders identified several key challenges shaping their strategic decisions:

Economic uncertainty remains the primary concern, cited by 46% of respondents, followed by competitive pressure (43%) and geopolitical impacts (29%). However, these challenges are increasingly balanced by emerging opportunities in digital transformation and regional integration.

Sector-Specific Growth Trajectories

The technology sector has emerged as a particular bright spot, with software development hubs experiencing 35% growth and fintech services expanding by 42% year-over-year. Manufacturing is benefiting from nearshoring trends, with projected investments of $14.8 billion in 2024, particularly in automotive and green manufacturing initiatives.

Professional services are undergoing rapid evolution, driven by widespread remote work adoption and increasing cross-border collaboration. The sector has seen a 48% increase in cross-border service provision, supported by significant investments in digital skills training and infrastructure development.

Regional Investment Landscape

Investment patterns across Latin America reflect growing confidence in the region’s long-term potential. Brazil’s manufacturing sector continues to attract significant foreign direct investment, while Mexico’s strategic position has strengthened its role in global supply chains. Colombia’s startup ecosystem has attracted $2.1 billion in venture capital funding for 2024, highlighting the region’s growing appeal to technology investors.

Chile’s renewable energy sector presents compelling opportunities, with the country targeting a 40% clean energy mix and committing $15 billion to mining sector modernization. Costa Rica’s highly skilled workforce of 55,000 IT professionals and its 98% renewable energy grid make it particularly attractive for technology and sustainable development investments.

Future Outlook and Strategic Opportunities

Looking ahead, business leaders express cautious optimism about Latin America’s growth trajectory. Investment priorities focus on three key areas: digital infrastructure development (42% of respondents), talent acquisition (38%), and market expansion (35%). The region’s improving business environment, coupled with strategic advantages in sectors like technology and renewable energy, positions it favorably for sustained growth.

Companies are increasingly viewing Latin America as a strategic hub for innovation and growth. The combination of improving regulatory frameworks, digital transformation, and skilled workforce development creates compelling opportunities across multiple sectors. As one survey respondent noted, “The region’s ability to adapt and innovate, particularly in digital services and sustainable development, makes it an increasingly attractive destination for long-term investment.”

Expand into Latin America with the Help of Trusted Legal Providers

At Biz Latin Hub, we understand the complexities of entering and operating in Latin American markets. Our team of local and expatriate professionals provides comprehensive market entry and back-office services, including:

- Company formation and legal representation

- Accounting and tax compliance

- Hiring and HR management

- Due diligence and market research

Contact our team for personalized guidance on your Latin American business journey.

Technical Appendix: Survey Methodology

Research Framework and Demographics

Our comprehensive research methodology encompassed:

- Sample size: 75 participants across 40+ countries

- Confidence level: 95% with standard margin of error

- Data collection period: Q4 2023

- Response validation: Multi-stage verification process

- Geographic distribution: 88% LATAM operations, 52% global presence

Respondent Profile

The survey captured insights from a diverse group of business leaders:

- 48% business owners

- 32% C-suite executives

- 20% senior specialists

Geographic Coverage

Respondents reported operations in the following regions:

- Latin America: 66 respondents (88%)

- Global operations: 39 respondents (52%)

- Multi-country presence: 33% in 5+ countries, 16% in 10+ countries

Countries of Operation

Survey participants maintained business operations across:

Americas

- Argentina

- Belize

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Cuba

- Dominican Republic

- Ecuador

- El Salvador

- Guatemala

- Guyana

- Honduras

- Mexico

- Nicaragua

- Panama

- Paraguay

- Peru

- United States

- Uruguay

- Venezuela

Europe and Asia Pacific

- Australia

- China

- France

- Holland

- Hong Kong

- India

- Italy

- Japan

- Malaysia

- New Zealand

- Poland

- Portugal

- Singapore

- Spain

- Sweden

- United Kingdom

Other Regions

- South Africa

- Suriname

Note: This research was conducted with rigorous statistical methods and data validation procedures to ensure accuracy and reliability of findings.