A Professional Employer Organization (PEO) in Argentina is an excellent tool for testing market entry and setting your business up for success. By handling essential HR tasks, a PEO allows you to focus on growth while navigating the legal and operational nuances of the country. Partnering with a trusted local expert is key, and Biz Latin Hub offers unparalleled support with its extensive experience across Latin America. From market entry to company incorporation in Argentina, we provide the services you need to thrive in Argentina and beyond.

Key Takeaways

| Is it legal to hire through a PEO in Argentina? | Yes, hiring in Argentina through a PEO is legal. It ensures compliance with labor laws, handles payroll and taxes, and simplifies employment without needing a local entity. |

| Benefits of hiring through a PEO in Argentina | Hiring through an PEO in Argentina offers quick market entry without a local entity, ensures compliance with complex labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations effortlessly. |

| Steps to hire through a PEO in Argentina | Assess the Need to Hire in Argentina Source Local Talent Choose a PEO Approve the Offer Letter Onboard the Employee via the PEO |

| Why employ Argentinian workers? | Employing workers through a PEO in Argentina streamlines market entry by managing HR, payroll, and legal compliance, allowing you to hire local talent quickly and focus on business growth without establishing a local entity. |

What is The Process for Hiring Through a Professional Employment Organization (PEO) in Argentina?

A quality Professional Employment Organization (PEO) in Argentina will be able to navigate and sort through the various employment contracts available in the country. Though similar to an Employer or Record (EOR) in Argentina, there is a slight deviation in how the employment relationship is legally observed. In our experiece the process usually looks like the below:

- Assess the Need to Hire in Argentina – Evaluate your business requirements and confirm the necessity of hiring locally.

- Source Local Talent – Identify qualified candidates either directly or with the help of a local recruitment agency.

- Choose a Professional Employment Organization (PEO) – Select a reliable PEO partner and fully understand their services and costs.

- Approve the Offer Letter – Finalize the employment offer, including salary, benefits, and compliance with local regulations.

- Onboard the Employee via the PEO – Ensure a smooth onboarding process, with the PEO handling legal and administrative formalities.

Remaining compliant is essentail when hiring employees through a PEO in Argentina. Understnading the most applicable aspects of the Argentine labor law, determined by the Constitution and as stated in the Labor Contract Law (Act 20,744) are summarized below:

Employment Contracts

There are three types of employment contracts in Argentina:

- Indefinite-term contracts – No legal requirement to have a written agreement. However, it is still recommended to sign a contract for the purpose of clarification regarding the terms and conditions of the employment relationship.

- Fixed-term contracts – It is mandatory to have a written contract of employment. The period of service cannot exceed five years.

- Part-time / temporary contracts – A written contract of employment is required.

Foreign workers

There are no restrictions on hiring foreign employees to join a company’s workforce.

Employment Termination

Employment contracts with an indefinite-term have an initial 3-month probationary period and 15 days notice is required from either party if they wish to terminate the contract. For all employment contracts, the same 15 days notice is required if the employee wishes to terminate the contract.

However, if the employer wishes to terminate the contract, the notice period increases with the employee’s length of service. For example, employees who have worked for less than three months are only required to be given 15 days notice. Employees who have worked for over five years must be given two months’ notice by their employer. The maximum notice period that small businesses are required to give employees is one month.

Regardless of the type of employment contract, if no prior notice is given, the employee is entitled to compensation. A Professional Employer Organization in Argentina will handle the various complexities of going through a termination.

What is a Professional Employer Organization (PEO) in Argentina?

A Professional Employer Organization (PEO), otherwise known as an ‘Employer of Record’ is an organization that provides and supports companies with their HR functions – from the very first stages of recruitment to the payments of taxes and benefits. By undertaking these time consuming tasks, the PEO makes it easier for the company to focus on growing their business. The services of a PEO are particularly useful when companies are seeking to hire a local workforce but do not want to set up a local legal entity.

Real Life Example: A British company wants to hire a bilingual engineer to join their team. They decide they want to hire an employee from Argentina (due to the highly educated workforce and the economic benefits of hiring foreign staff). The UK company knows the time and costs involved with setting up a local entity in Argentina and so they look at other, more cost-effective options. After some research, they decide to form a co-employment relationship with a Professional Employer Organization – PEO in Argentina. This enables the company to hire the Argentine employee without the need to have a fully incorporated company in Argentina. The PEO assists the company in finding the most suitable employee and then it deals with the administrative and legislative aspects of employing this chosen candidate. The individual is technically employed by the PEO, who ensures that all employment laws regulation is met, but the candidate is directed by the UK company.

Why use a Professional Employer Organization – PEO in Argentina?

Utilizing a Professional Employer Organization (PEO) in Argentina offers numerous benefits for your company. By outsourcing HR burdens to a PEO in Argentina, your company can concentrate on core business activities and direct employee management, allowing for increased focus on business growth and development.

Hiring a PEO also reduces recruitment and administrative expenses, providing cost savings, particularly if you want to hire local staff but do not have a fully incorporated company or branch office in Argentina.

Additionally, a PEO assists in the recruitment process by sourcing and selecting the most suitable and qualified candidates for your company’s specific needs. This saves you time and effort in finding the right staff.

By outsourcing payroll processing and other HR administrative tasks to a PEO, your company eliminates time-consuming responsibilities. This enables you to allocate your time and resources more effectively towards strategic business activities.

Lastly, a Professional Employer Organization – PEO in Argentina will ensure that your company complies with all Argentine employment laws and regulations. Their local expertise ensures that your employment relationships are established in full compliance with legal requirements, minimizing the risk of penalties or legal complications.

Foreign nationals aiming to register a business in Argentina must be aware of the essential employment laws and regulations. Companies must prioritize 100% compliance with legal requirements before engaging in an employment relationship in Argentina. A PEO can provide the necessary guidance and support in ensuring compliance with these regulations, as well as offering your company many other advantages, as listed above.

Employee Benefits and Rights in Argentina

In Argentina, workers have a comprehensive level of benefits. It is important that companies are aware of them and understand how to remain in compliance. Working with a PEO can simplify the process. If you choose to outsource back-office operations, payroll tasks will be handled by the PEO. The most important benefits workers in Argentina are entitled to are summarized below.

- Working Hours: In Argentina, the maximum working week is 48 hours, with a limit of eight hours per day. Payroll tasks will be handled by a Professional Employer Organization in Argentina if you choose to outsource back-office operations.

- Overtime: With the exception of managers and directors, employees are eligible for overtime pay. Any additional hours worked beyond the maximum daily limit qualify for overtime compensation. Weekday overtime is paid at a rate of the employee’s salary plus an extra 50%, while weekend overtime is compensated at a rate of the employee’s salary plus an additional 100%. Overtime hours cannot exceed 30 hours per month or 200 hours per year.

- Paid Vacation: Paid vacation duration varies based on the employee’s length of service. Employees who have worked for more than six months are entitled to 14 consecutive days of paid vacation. The number of vacation days increases with the number of years of service. For instance, employees who have completed five to ten years of service are granted 21 consecutive days of paid vacation. Complexities within payroll, such as vacation grants, can be effectively handled by a Professional Employer Organization in Argentina.

- Bonuses: Employees receive two installments of an annual bonus known as the 13th salary or Aguinaldo. This bonus is equivalent to 50% of the employee’s highest monthly salary within the previous six months. The first installment is paid on June 30th, and the second installment is paid on December 18th.

- Maternity Leave: Female employees are entitled to 90 days of maternity leave, with 45 days before and 45 days after childbirth.

- Sick Leave: Employees who have worked for up to five years are entitled to full compensation, equivalent to their salary, for a maximum of three months of sick leave per year. The duration of sick leave increases with the employee’s years of service.

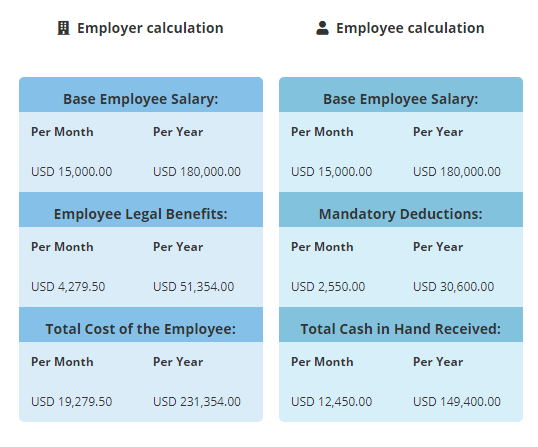

Why use a payroll calculator to understand the costs of a Professional Employment Organization (PEO) in Argentina

If you want to get an idea of the possible costs involved in payroll outsourcing in Argentina, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Argentina would cost, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs for a Professional Employer Organization – PEO in Argentina

Based on our extensive experience these are the common questions and doubts of our clients on hiring through a Professional Employer Organization – PEO in Argentina:

You can hire an employee by incorporating your own legal entity in Argentina to hire employees. Alternatively, you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Argentina. With an EOR you do not need an Argentinian legal entity to hire local employees.

A standard Argentinian employment contract must be written in Spanish (and can also be in English) and contain the following information:

– ID number and CUIL.

– City and date.

– Start date of the employment relationship.

– Relationship rules between superior and subordinate.

– The location where the service will be provided.

– Remuneration and bonifications/commissions.

– Method payment frequency.

– Duration of the contract.

– Social work.

– Penalties for non-compliance for both employer and employee.

– Main tasks.

– Probation Period.

– Cases of termination of contract

The mandatory employment benefits in Argentina are the following:

– Working tools necessary to carry out the work.

– Payment of social security contributions (health, pension, and labor risks).

– Social benefits (service premium, severance pay, and interest on severance pay).

– Paid time off (vacation and weekend off) always depends on the kind of work you have.

– Disabilities (common or labor origin).

– Extra salary called aguinaldo. The last best remuneration is taken and divided into two payments, one in July and one in December.

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

Slower to establish.

Permanent presence in the country.

All costs deductible through a local entity.

Ability to sign contracts and agreements locally.

Ability to invoice through local entity.

Legal entity compliance support required.

Hire employees directly.

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

Why Invest in Argentina?

Argentina is an attractive destination for foreign investment due to its diverse economy, vast market potential, and skilled workforce. With strengths in sectors such as agriculture, energy, manufacturing, and technology, Argentina’s economy offers numerous opportunities. As one of Latin America’s largest economies, its USD $630 billion GDP and 45-million-strong population provide a substantial consumer base. Additionally, its membership in the Mercosur trade bloc facilitates access to regional markets. Investors can simplify operations by partnering with a Professional Employer Organization (PEO) in Argentina to connect with local talent and manage administrative tasks.

The country’s skilled and educated workforce is a significant asset, with a literacy rate exceeding 99% and a strong emphasis on fields like engineering, technology, and business. Argentina also boasts a vibrant startup ecosystem, particularly in Buenos Aires, a hub for entrepreneurship and venture capital. For businesses seeking to enter innovation-driven sectors, Argentina offers a rich talent pool and a culture that fosters innovation. Engaging a PEO can streamline your entry into the country by handling HR and compliance processes while you focus on growth.

Natural resources and infrastructure are additional advantages. Argentina is a leading exporter of agricultural products such as soybeans, wheat, and beef, providing opportunities in agribusiness and food industries. Recent investments in infrastructure, including transport and energy, further enhance trade and logistics. The tourism sector also presents growth potential, given Argentina’s cultural and natural attractions. Businesses in these industries can benefit from partnering with a PEO to navigate back-office operations efficiently.

Biz Latin Hub can help with a Professional Employment Organization (PEO) in Argentina

Argentina is a country where business opportunities are plentiful which makes it an increasingly appealing jurisdiction to do business in. The Argentine workforce is competitive, educated and qualified.

If you want to hire local employees, but do not have an incorporated local entity and want to avoid the administrative burden of HR, then a Professional Employer Organization (PEO) in Argentina may be the perfect solution, both from a business-growth perspective and a financial one.

Contact our team of experts today and how we can support you throughout the hiring and recruitment process in Argentina.