When entering the Panamanian market, companies often face challenges managing payroll, HR compliance, and local employment laws. Using a Professional Employer Organization (PEO) or Employer of Record (EOR) in Panama allows you to hire employees quickly and compliantly without needing a legal entity. These services are especially useful for foreign companies that want to delay company formation in Panama while focusing on core business operations. Biz Latin Hub offers both PEO and EOR solutions to streamline your expansion into Latin America.

Key takeaways for a PEO payroll company in Panama

| Is it legal to hire in the Panama through PEO services? | Fully legal in the country, known as contratista de personal |

| How does legal representation work? | Fully covered by the PEO payroll company in Panama |

| Steps to hire through a PEO in the Dominican Republic | Sign a service agreement with the third-party PEO. Confirm the employment offer for the candidate. Share the employment offer with the candidate. After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the professional employer organization. The candidate reviews and signs the employment contract. The PEO completes all required employee registrations with Panamanian authorities. The employee starts work and reports to the hiring foreign company. |

| What are the working hours in Panama? | Up to eight hours a day, six days a week |

| What are the benefits of hiring through a PEO in the Dominican Republic? | Panama has a highly skilled workforce with advanced skills and knowledge situated in a global business hub. |

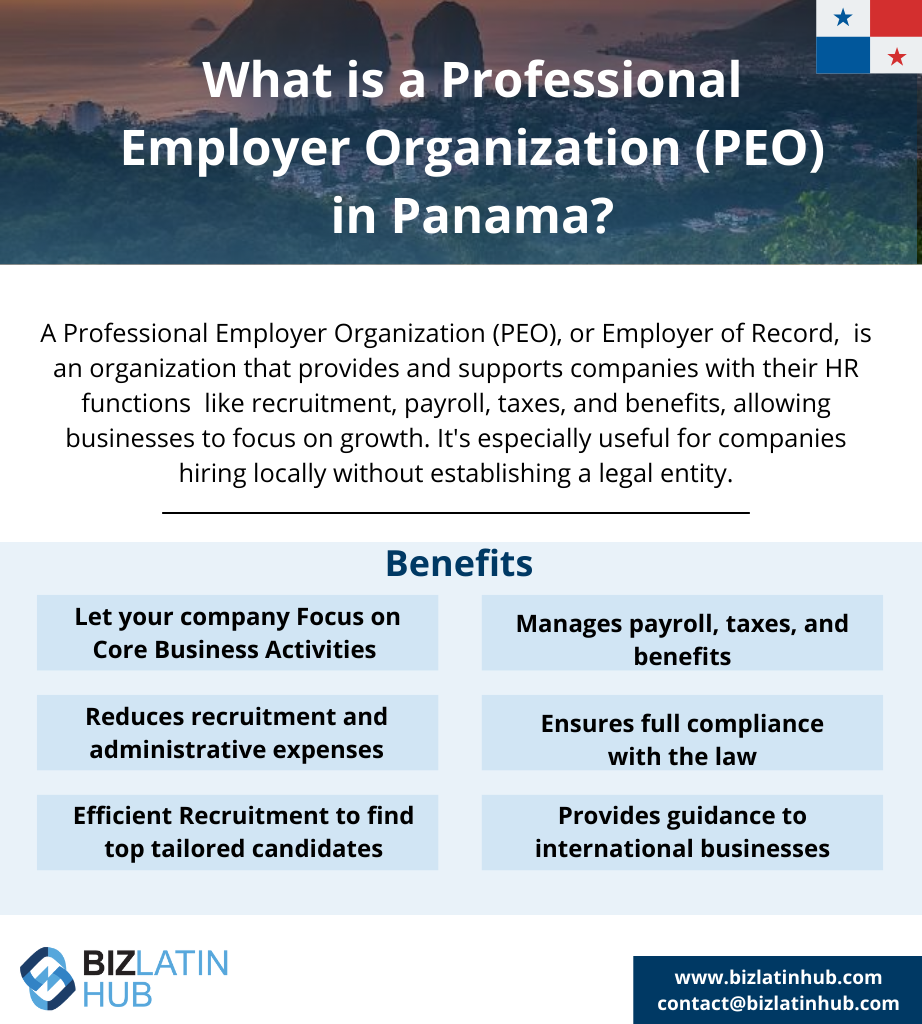

What Is a Professional Employer Organization (PEO) in Panama?

A PEO payroll company will support your business expansion by providing high-quality HR services that will give you time to focus on other vital aspects of your business. A PEO payroll company in Panama will be responsible for recruiting, hiring, firing, managing employee payroll, and paying all holiday and social benefits.

Operating as the official employer in the eyes of the local government, a PEO payroll company in Panama will be in charge of remunerating local personnel in the event of resignation, dismissal, maternity leave, retirement, and any other payments established by local labor regulations.

In addition, with extensive knowledge of local labor, tax, and corporate legislation, a PEO payroll company in Panama will also guarantee your business remains in good standing with authorities and will assist you with time-consuming administrative processes, such as drafting contracts and other documents and paperwork.

Key Advantages of PEO and EOR Services for Expanding into Panama

Working with a PEO payroll company allows you to enter the Panamanian market in a short time frame, allowing you to get your commercial operations underway in a timely manner. With abundant knowledge of local civil, corporate, tax, and labor regulations, a PEO payroll company in Panama is able to provide expert advice to avoid delays and overcome challenges often faced by foreign enterprises.

Claims related to your company’s employees will be addressed to the PEO payroll company, which is equipped to represent your business and resolve many employee-related legal and administrative issues that might affect your business venture.

Hiring local staff through a PEO payroll company in Panama will allow you to save money and avoid additional fees that may increase the cost of developing your business operations in the country. With years of experience helping companies find qualified personnel, a PEO payroll company will identify and recruit the most suitable staff for your company.

A payroll company will also monitor the work visa application process for foreign employees and reduce any chances of rejection. By outsourcing time-consuming and complex HR tasks, you will have time to manage other essential aspects of your newly established business.

Benefits of Using PEO & EOR Services in Panama:

- Accelerated hiring of local staff

- Full compliance with Panamanian labor and tax regulations

- Elimination of the need for a local entity (EOR)

- Centralized payroll, HR, and benefits administration

- Reduced legal and financial risk

- Seamless market entry and exit flexibility

- Local expertise and bilingual support team

Understanding Employer of Record (EOR) Services in Panama

To partner with a PEO, the hiring company enters into a contract with a third-party organization, appointing them as the professional Professional Employer Organization (PEO) for the staff they wish to hire in Panama. This arrangement ensures that, on official documentation in Panama, the third-party company (the PEO/EOR) is legally responsible for complying with all employment regulations for the employees.

This relieves the foreign company of the complexities of navigating Panamanian labor laws independently. By reducing the risk of non-compliance, the foreign company can concentrate on business development and market growth.

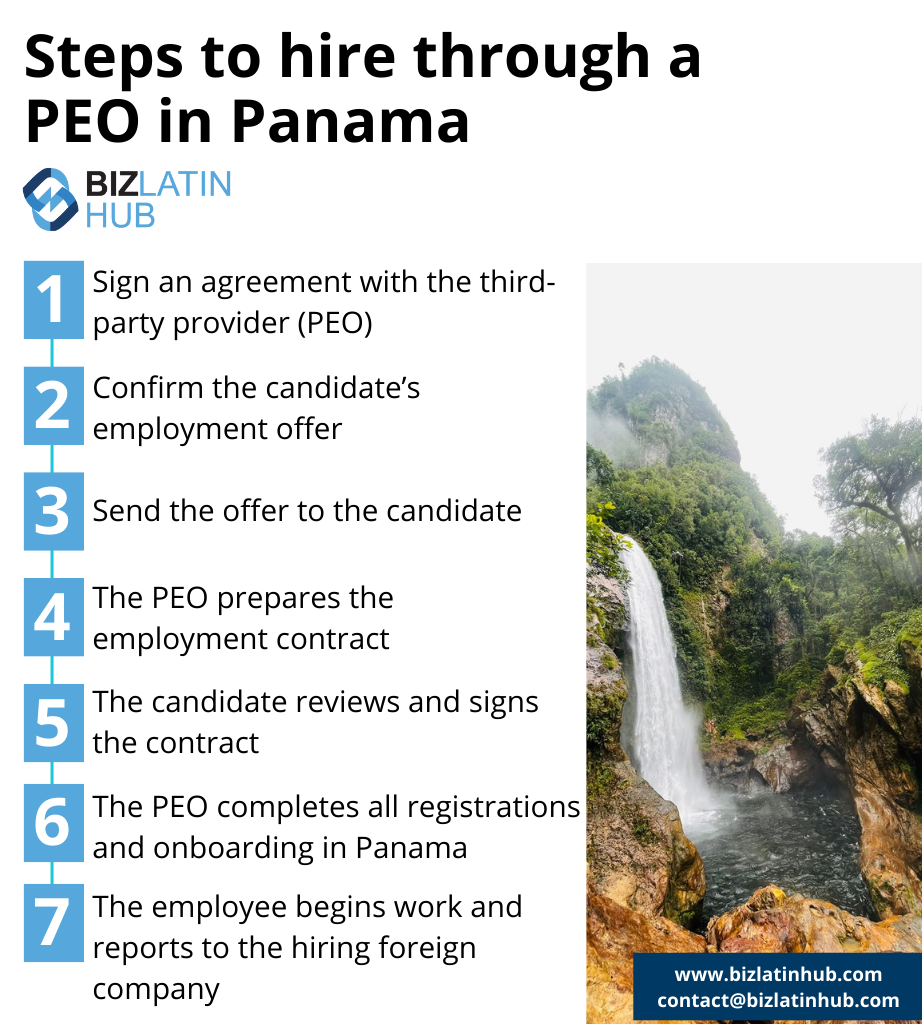

The process of hiring an employee through an Professional Employer Organization in Panama is simple and involves the following steps:

- Sign a service agreement with the third-party PEO.

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the employer of record.

- The candidate reviews and signs the employment contract.

- The PEO completes all required employee registrations with Panamanian authorities.

- The employee starts work and reports to the hiring foreign company.

PEO vs. EOR: Which Is Right for Your Business?

| Feature | PEO Panama | EOR Panama |

|---|---|---|

| Legal Employer | Client (must have legal entity) | Biz Latin Hub (EOR acts as legal employer) |

| Hiring Speed | Medium | Fast (no entity setup required) |

| Compliance Responsibility | Shared | Handled by EOR provider |

| Best For | Companies with a Panama legal entity | Market entry/testing without local presence |

| Contract Ownership | Between company and employee | Between EOR and employee |

This table highlights the key distinctions to help businesses decide which model — PEO or EOR — best fits their Panama market entry or expansion plans.

When expanding into Panama, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. In Panama, an EOR is known as a “contratista de personal” (personnel contractor) and is fully legal under Panamanian law, regulated by the Labor Code and registered with the Ministry of Labor and Social Security.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Panama. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Legal Frameworks Governing Professional Employer Organization (PEOs) in Panama

Panama has a well-developed legal framework governing EORs. Under Panamanian law, an EOR is known as a contratista de personal, which translates to personnel contractor. Personnel contractors are regulated by the Panamanian Labor Code and must be registered with the Ministry of Labor and Social Security.

One of the key advantages of using an EOR in Panama is that it allows companies to quickly and easily establish a presence in the country without the need to set up a separate legal entity. However, it is important to note that while EORs can help streamline the process of expanding into Panama, they are not a substitute for compliance with all applicable laws and regulations.

Employers must ensure that they are working with a reputable EOR that is in compliance with all relevant laws and regulations in Panama. This can help mitigate the risks associated with using an EOR, such as the risk of reputational damage or legal liability.

What benefits are mandatory under Panama labor law?

Labor laws in Panama include the following:

- Vacations: According to article 177 of the Labor Code, workers are entitled to 30 days of paid vacations per year.

- Bonus salary: Employees are entitled to a bonus equal to one month of salary each year. This bonus is split into 3 parts and is paid on April 15, August 15 and December 15.

- Social Security: Companies in Panama must comply with social security obligations. They must make contributions towards employee health insurance to the social security authority, Caja de Seguro Social, (Social Security Fund), as well as applicable pension and unemployment support.

- Maternity Leave: During pregnancy, female employees may receive a paid maternity leave of up to 6 weeks before birth, and a paid leave for up to 8 weeks afterwards.

- Minimum wage: This varies according to sector, type of business and location, so there is not one defined national minimum wage.

- Working hours: The maximum daytime working hours is 8 hours and the working week cannot exceed 48 hours. The maximum night-time working hours is 7 hours, which corresponds to 42 weekly hours.

- Contract types: periods for employment contracts can be indefinite, definite (‘fixed-term’), and specified for the time the employee takes to complete a determined project.

- Probation periods: A maximum time limit of 3 months. If the employer isn’t satisfied with the employee’s performance or work during this time, there is no obligation to hire them. Similarly, employees have no obligation to the company if they choose not to continue working within the specified period.

- Union membership: The Labor Code recognizes that employees have the right to organize in unions. Employees can choose from any union registered with the government. The employer is obligated to negotiate with the union that represents their staff. In addition, labor laws in Panama recognize workers’ right to strike and establishes prior negotiation procedures between the employer and the union before the employer suspends an employee.

How to use a payroll calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Panama, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Panama would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs for a PEO payroll company in Panama

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through a PEO payroll company in Panama:

You have the option to employ someone in Panama either by establishing your own legal entity within the country and utilizing it for hiring purposes, or by engaging an employer of record (EOR). An EOR, a third-party entity, enables you to recruit employees in Panama by serving as the legal employer.

A standard Panamanian employment contract should be written in Spanish (and can also be in English) and contain the following information:

– ID and address of the employer and employee.

– A specification of whether the employee has dependents or not.

– City and date.

– Work position.

– Work functions.

– Type of contract (indefinite, definite, for a specific task).

– The location where the service will be provided.

– Salary.

– Payment frequency (monthly, bimonthly).

– Probation period (optional but recommended).

– Working hours and clarification on the period (diurnal, nocturnal, or mixed).

The mandatory employment benefits in Panama are the following:

– Social security contributions (health, pension, educational insurance, and occupational risk).

– Vacations (30 calendar days per 11 months worked).

– Thirteen salary payments (payable on April 15th, August 15th, and December 15th of every calendar year.

– Sick leave (18 days per year).

The total cost for an employer to hire an employee in Panama can vary based on the salary. However, as an indication, the employer cost for mandatory employment benefits is 14.75% on top of the employee’s gross salary, although this can vary depending on specific conditions and agreements.

Please use our Payroll Calculator to calculate employment costs.

Forming a legal entity is different to hiring an EOR in the following ways:

– It is more time-consuming.

– Creates a permanent presence in the country.

– Expenses are deductible through a local entity.

– Enables the ability to execute contracts and agreements locally.

– Facilitates invoicing through a local entity.

– Requires compliance support.

– Empowers direct hiring of employees.

While a PEO functions as co-employer, an EOR assumes the role of the formal employer for your staff. Typically, an EOR provides a wider array of services compared to a PEO.

A PEO in Panama provides HR, payroll, and compliance support for companies that already have a local legal entity. It acts as a co-employer to help you manage staff, social security, and labor obligations.

An EOR in Panama legally hires employees on your behalf. It’s ideal for companies without a local entity who want to quickly onboard workers while staying fully compliant with local laws.

A PEO requires you to have a legal entity and shares compliance responsibilities. An EOR acts as the legal employer and is used when you don’t want to or can’t establish a legal entity.

Yes. EOR services are often used for initial market entry. Once your operations grow, you can set up your own company and transfer employees from the EOR structure to your entity.

Yes. Biz Latin Hub ensures all hiring, onboarding, tax contributions, and labor practices comply with the local legislation, including registration with Caja de Seguro Social and Dirección General de Ingresos (DGI).

Why invest in Panama?

With a gross domestic product (GDP) of USD$7.6 billion and a population of approximately 4.5 million, Panama punches above its weight. The nation recorded more than USD$2 billion of foreign direct investment (FDI) inflows in 2022, stimulated by a territorial tax system in which only income earned within the country is taxed.

The Central American country’s business-friendly approach sees it employ the lowest value-added tax (VAT) and income tax rates in Central America, while its politically stable government and secure banking sector have made it a highly popular destination for foreign investors and expats. Some of the country’s main export commodities include refined petroleum, coal tar oil, passenger and cargo ships, and gold.

Panama has an advantageous geographic location, linking Central America to South America, while also connecting the Caribbean Sea and the Atlantic Ocean via the iconic Panama Canal, through which roughly 14,000 ships transit each year, generating an estimated 8% of the nation’s GDP.

Biz Latin Hub can be your PEO Payroll Company in Panama

At Biz Latin Hub, our team of multilingual specialists is equipped to deliver excellence and help you recruit the most suitable employees to ensure the success of your commercial operations in Panama.

With our full portfolio of hiring international PEO services, we can be your single point of contact to incorporate your business in Latin America and the Caribbean.

Reach out to us now to receive personalized assistance.

Learn more about our team and expert authors.