If you are considering expanding into the Latin American region, PEO consulting services in Ecuador are not an option, due to legal restraints and labor law. The country is known to be business and investment friendly, meaning it is more straightforward to set up a company in Ecuador than in some other parts of Latin America.

There are a few other ways to enter the market, most of which provide solid long-term prospects as well. At Biz Latin Hub we can guide you through the alternatives to PEO consulting services in Ecuador and support you in whichever direction you decide to go. Our array of back-office services will make sure you stay legally compliant and fully above board.

Key Takeaways

| Is it legal to hire through an PEO in Ecuador? | No it is not compliant with Ecuadorian law. |

| Are there alternatives to PEO consulting services in Ecuador? | To remain compliant in Ecuador you must employ workers through a legal entity and not a third party. |

| Why invest in Ecuador? | Ecuador offers strategic access to international markets, abundant natural resources, and favorable trade agreements for braod investment opportunities. |

Why are PEO Consulting Services in Ecuador Not Usually Allowed?

This hinges on on a specific piece of labor law in Ecuador, known as the MANDATO CONSTITUYENTE No. 8 (ELIMINATION AND PROHIBITION OF OUTSOURCING, LABOR INTERMEDIATION, HOURLY LABOR CONTRACTING AND ANY FORM OF PRECARIZATION OF WORK RELATIONS).

It clearly states that “Outsourcing and labor intermediation and any form of precariousness of labor relations in the activities to which the company or employer is dedicated are eliminated and prohibited. The employment relationship will be direct and bilateral between worker and employer.”

This does mean you could establish and provide just PEO consulting services in Ecuador with contractors (civil contracts), but that you could not provide labor outsourcing (labor contracts). This indicates that you could form a company that can hire, through a civil agreement, people who work without an employment contract for foreign people or companies.

However, this would create some serious issues and face a number of heavy restrictions. For a start, you have to stick with service contracts with independent workers. These can be very hard to manage for anything other than a single short term project as you must avoid the creation of dependency (Labor).

It’s crucial to remember that under this type of agreement, you cannot mandate working hours, location, or dress code (except for safety reasons). You should also avoid situations that may indicate an employment relationship, such as the individual having administrative responsibilities, making decisions on behalf of the company, holding approval authority, or managing others.

Examples of factors that could be perceived as dependency include: (i) defining a work schedule, (ii) issuing unagreed-upon orders or requirements, (iii) complying with corporate provisions, etc. Regarding hiring a contractor, note that when engaging individuals via a service contract, you’re contracting for a service with defined deliverables and timelines, not for their time.

If the service provider has had to comply with the orders and guidance of the hiring party, it opens the possibility for a claim that the written contract merely simulated a civil relationship when, in reality, there was an employment relationship. Therefore, the service provider may claim payment for the benefits generated by such a relationship, along with relevant sanctions.

If the individual (or someone else) files a complaint with the authorities, the company must demonstrate that no employment relationship exists, placing the burden of proof on the company. If an employment relationship is found, the company may be liable for back payment of employment benefits, potential fines, or sanctions, with more serious legal consequences possible in extreme cases.

Given the complexities and difficulties of using contractors for anything beyond a single, well defined project, we recommend company formation as a much better option for hiring in Ecuador if you want regular employees.

What are PEO Consulting Services in Ecuador?

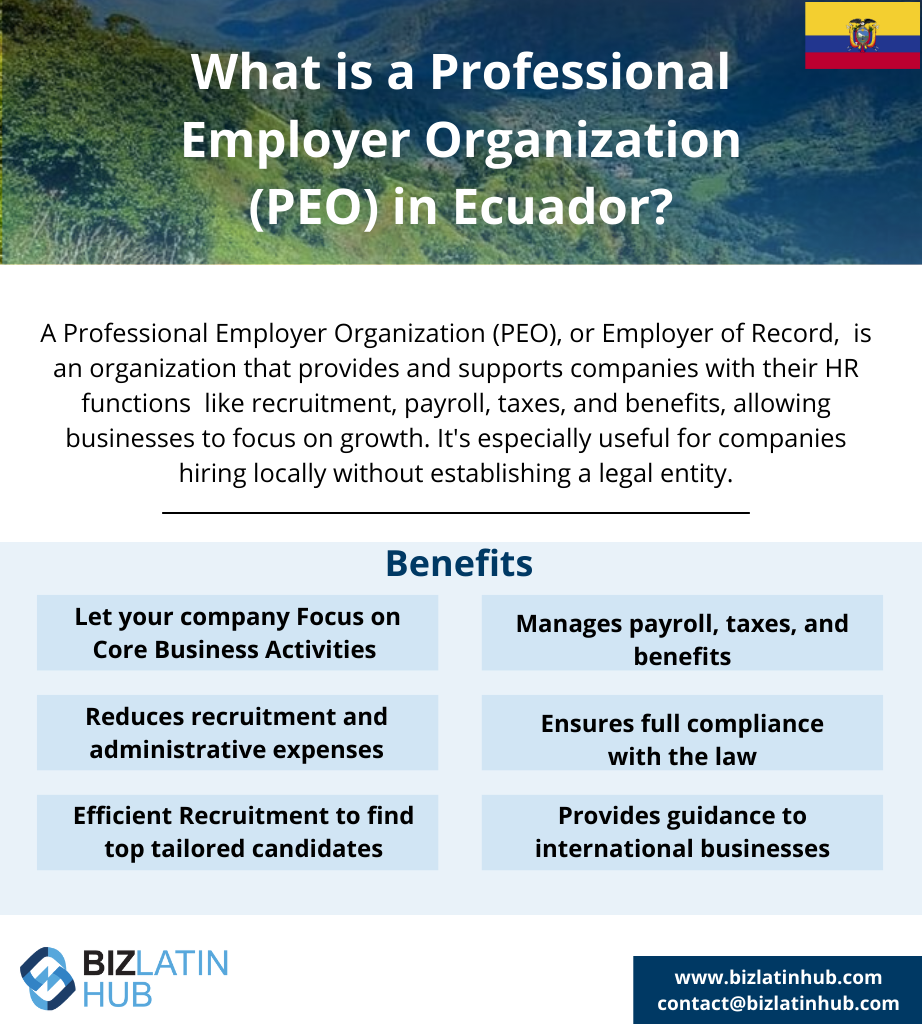

A PEO or Professional Employer Organization is similar to an employer of record (EOR), while providers will sometimes advertise themselves as a PEO payroll company, as this is one of the most sought after services they offer.

A PEO or Professional Employer Organization will take care of a range of employee-related concerns, including drawing up contracts in accordance with the law, honoring all statutory leave allowances, paying salaries and bonuses correctly, and complying with all tax-related matters.

When you hire through a PEO firm, not only do you tap into the local knowledge and contacts that the PEO firm has, while also removing a major administrative and compliance issue, but you also avoid the need to go through company formation and subsequent liquidation.

While hiring through a PEO company is a genuine option in many countries, the legal framework governing EORs in Ecuador is complex and only possible under certain situations. Most companies will find it hard to stay on the right side of the law and run a real risk of non-compliance.

What Does Employment Law in Ecuador Look Like?

As PEO consulting services in Ecuador are not an option for most circumstances, you may want to use a local employment law specialist.

They will take care of the regulatory and compliance concerns that are related to having employees in the country.

They will also inform you if changes to the relevant regulations are due to occur, such as increases in the minimum wage. These are some of the labor regulations to be aware of:

- Working hours: Ecuador has a standard working week of 40 hours long, generally made up of six days lasting eight hours each.

- Overtime: Employees mustn’t work more than two hours of overtime per day. Your professional employer organization in Ecuador will make sure compliance is a top priority, including overtime restrictions and wage duties.

- Paid vacations: After 12 months of employment, an employee is entitled to 15 consecutive days of paid leave, of which they must take at least six days during the following 12 months.

- Parenthood leave: Mothers are entitled to 12 weeks of maternity leave and by law must start at least a week before the due date of the birth, while fathers are allowed eight days of paternity leave.

- Profit sharing: In Ecuador, 15% of taxable profits by a company must be divided and shared with the employees, with each share of the profits depending on the amount of time that the employee has served, as well as seniority.

- Minimum wage: As of January 2024, the minimum wage was set at USD$460. If minimum wage fluctuates, a quality professional employer organization in Ecuador will be able to adapt the company to meet compliance standards.

PEO vs. EOR in Ecuador – What’s the Difference?

When expanding into Ecuador, businesses often need to understand their options for hiring and managing employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. In Ecuador, because EOR is not permitted, establishing a legal entity and then working with HR service providers is the compliant approach.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. However, this option is NOT legal in Ecuador due to specific labor laws (MANDATO CONSTITUYENTE No. 8) that prohibit outsourcing and labor intermediation for activities related to the employer’s business.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: Due to Ecuador’s labor laws, establishing a legal entity is the only compliant solution for hiring employees in Ecuador. Biz Latin Hub offers entity formation and HR compliance services, helping businesses navigate Ecuador’s regulations, establish entities, and ensure full HR compliance. While Ecuador does not permit EOR solutions, the country offers advantages including a dollarized economy, 100% foreign ownership of local companies, and a relatively straightforward company formation process for a stable long-term presence.

How to use a payroll calculator in Ecuador

If you want to get an idea of the possible costs involved with hiring in Ecuador, using a payroll calculator is one way to get a good estimate.

A payroll calculator will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Ecuador would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on hiring in Ecuador

Based on our extensive experience, these are the common questions and doubts of our clients on hiring in Ecuador:

How does one hire employees in Ecuador?

You can hire an employee by incorporating your own legal entity in Ecuador, and then using your own entity to hire employees.

What is in a standard employment contract in Ecuador?

A standard Ecuadorian employment contract should be written in Spanish (and can also be in English) and contain the following information:

- ID and address of the employer and employee

- City and date

- The location where the service will be provided.

- Type of tasks to be carried out

- Remuneration and bonifications/commissions (if applicable)

- Method payment frequency

- Duration of the contract.

- Probation period

- Work hours

- Additional benefits (if applicable)

What are the mandatory employment benefits in Ecuador?

The mandatory employment benefits in Ecuador are the following:

- Working tools necessary to carry out the work (if applicable)

- Payment of social security contributions (health, pension, and labor risks).

- Social benefits (service premium, severance pay, and interest on severance pay).

- Paid time off (vacation and Sunday rest).

- Disabilities (common or labor origin).

- Share of the profits.

- Overtime and surcharges (if applicable).

What is the total cost for an employer to hire an employee in Ecuador?

The total cost for an employer to hire an employee varies based on the salary structure.

Please use our Payroll Calculator to calculate employment cost. Remember that the cost will be directly in USD, as the country is fully dollarized.

What is the difference between hiring through an EOR and forming a legal entity?

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

- Slower to establish.

- Permanent presence in the country.

- All costs deductible through a local entity.

- Ability to sign contracts and agreements locally.

- Ability to invoice through local entity.

- Legal entity compliance support required.

- Hire employees directly.

What is the difference between a PEO and an EOR?

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

Why should I invest in Ecuador?

Incorporating a company in Ecuador has several advantages for international businesses. As mentioned before, the government has implemented some legislative changes that make Ecuador an inviting jurisdiction for foreign business. Some of the advantages for foreign companies looking to expand to Ecuador include:

- The government permits 100% foreign ownership of local companies.

- Incorporating a Limited Liability Company can be completed with just two shareholders.

- Ecuador has a low minimum share capital – only US$400. This encourages the expansion of startups and SMEs into the Ecuadorian marketplace.

- The US dollar is the national currency. In the year 2000, the Ecuadorian government adopted the US dollar as the national currency; bringing a range of benefits to the nation and making the region a more favourable investment destination.

Biz Latin Hub can provide alternatives to PEO consulting services in Ecuador

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in key cities around the region, including Quito.

Our portfolio includes accounting & taxation, company formation, due diligence, hiring & PEO in other countries, and corporate legal services, while our unrivaled regional presence means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Contact us today to find out more about how we can assist you.

If you found this article on hiring through a professional employer organization in Ecuador of interest, you may want to check out the rest of our coverage of this South American country. Or read about our team and expert authors.