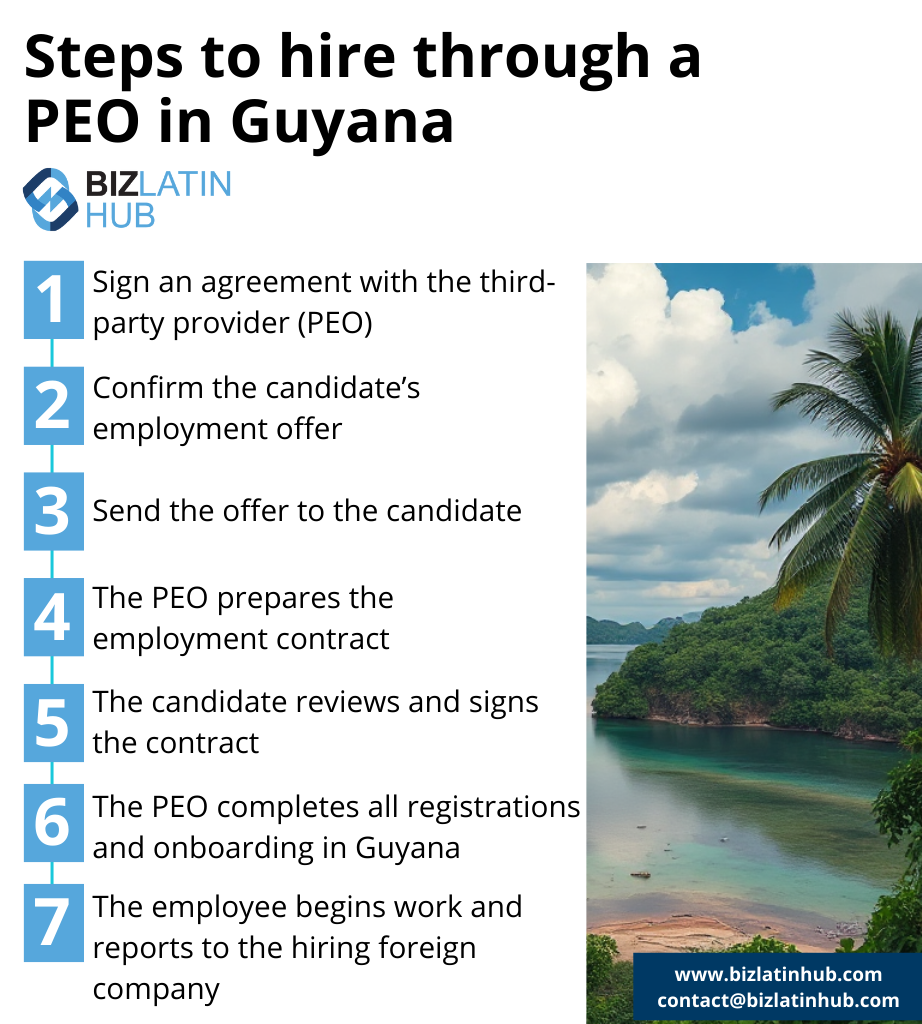

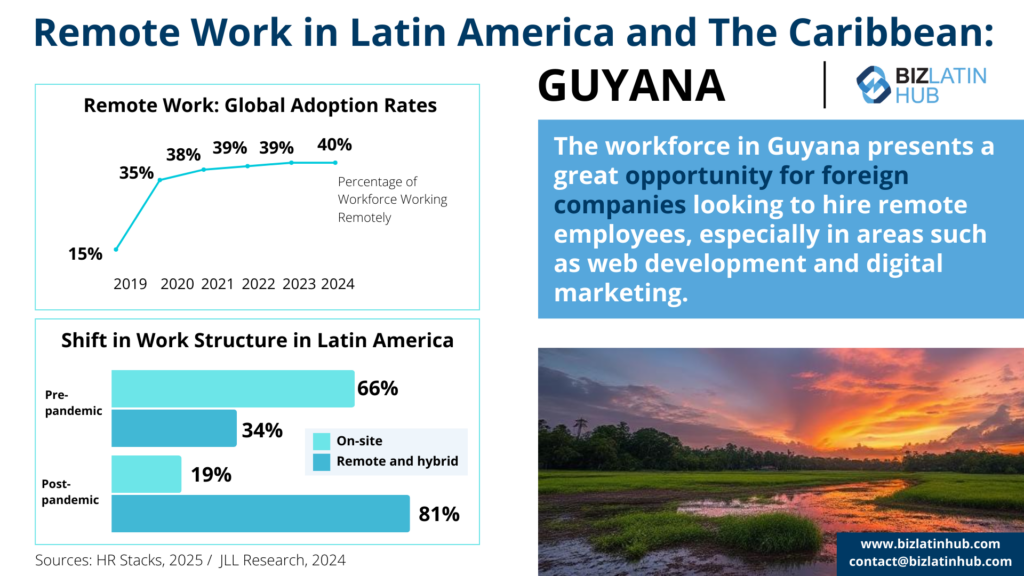

If you are interested in doing business in Guyana, you may want to consider the possibility of hiring staff through a professional employer organization (PEO). When you hire through a PEO in Guyana, you can get a local workforce without having to establish a legal entity, meaning your market entry is completed in only the time it takes to find your ideal staff, making it fast and easy.

Key takeaways on using an EOR in Guyana

| How much hiring support can you expect? | You will have full support over hiring and indeed over day-to-day operations in the country. |

| Is EOR legal in Guyana? | EOR services are fully legal in the country. |

| Presence in the country | Limited – company formation will be necessary for full presence. |

| What are the working hours in Guyana? | 40 hours weekly is the maximum time that an employee can work before requiring overtime pay rates. |

| What is the minimum monthly wage covered by an EOR in Guyana? | GYD$60,000 (approx USD$290) |

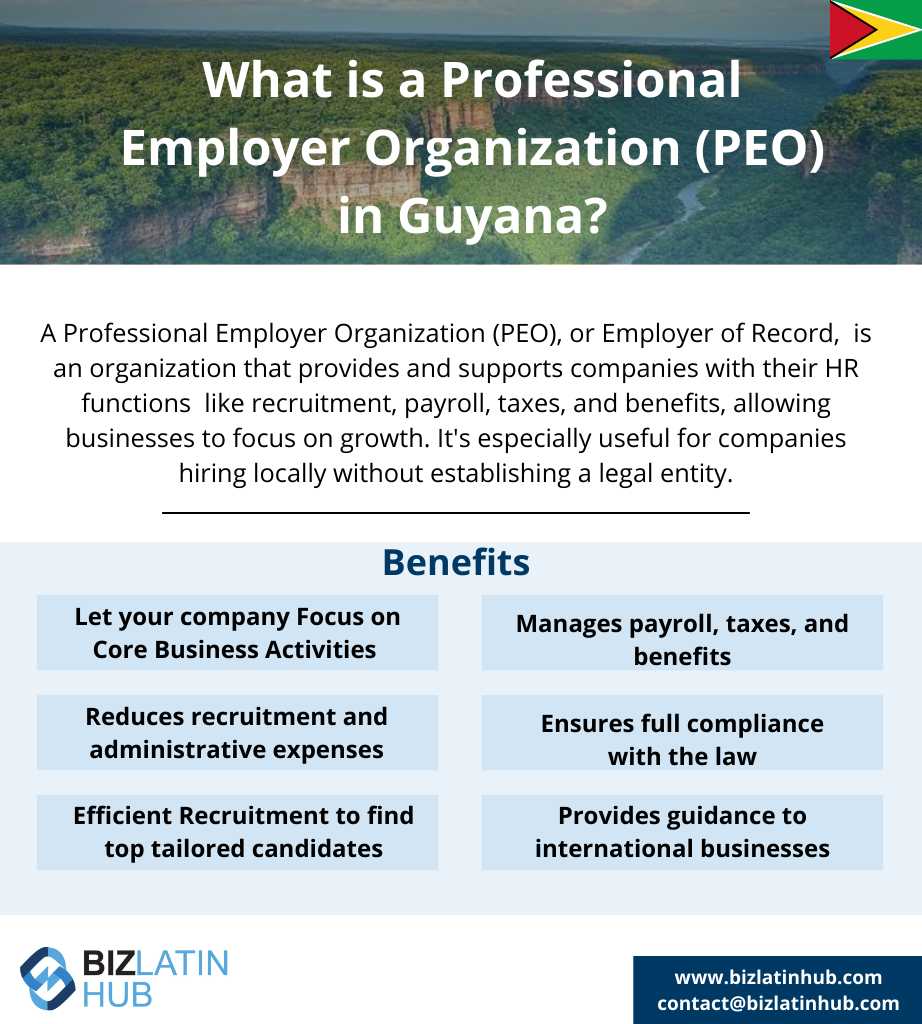

What can a PEO in Guyana do for you?

A PEO in Guyana will have a locally registered entity that will hire staff on your behalf. That means that while those workers are officially employees of the PEO firm, you will have total control over their daily tasks and working hours.

That means the PEO in Guyana will manage all aspects of payroll related to those workers, paying their salaries and calculating and complying with all statutory benefits, such as sick pay, vacations, and end of employment severance. They will also compute and oversee proper payment of the likes of national insurance, or any other contributions required by local authorities.

A PEO in Guyana will have an established recruitment network and, where needed, be able to take an active role in the recruitment and hiring of the outsourced staff you are seeking. That also means they will be able to lead on the likes of employee on-boarding and off-boarding, including registering and deregistering those workers with local authorities as appropriate.

Legal requirements your PEO will oversee

While a PEO in Guyana will be able to offer expert advice on all relevant aspects of local labor law, when you hire staff through them, you eliminate the need to worry about such concerns, because as part of their service agreement the PEO firm will guarantee your compliance with all local regulations and norms.

Some of the key requirements set out by Guyana’s labor laws that a PEO will take care of for you include:

- A standard working week of 40 hours.

- Honoring of all national holidays celebrated in Guyana.

- Honoring the legal entitlement related to sick leave.

- Employer contribution of 8.4% and employee contribution of 5.6% of each salary to national social security.

- Written contracts given to each employee and registered with the relevant authorities.

- Timely payment of salaries and any applicable additional payments, such as severance pay when employment ends.

6 Key benefits of using a PEO in Guyana

When you hire staff via a PEO in Guyana, you will enjoy the following 6 benefits:

- Cost reduction: While you will have to pay the PEO firm a fee for each staff member they employ and manage on your behalf, those costs are likely to be considerably lower than forming a company and employing a dedicated team to manage their payroll.

- Time saving: When you hire through a PEO in Guyana, you eliminate the need to establish a legal entity, meaning you can have staff working for you in weeks, if not days, depending on the profiles you are looking for.

- Overcome unfamiliarity: When you enter an unfamiliar market for the first time, the regulatory regime and culture of doing business can be unlike other jurisdictions where you operate. By hiring through a PEO firm, you are able to tap into their expert local knowledge and build up a clear picture of the market, prior to any potential deeper commitment.

- Legal protection: One of the key advantages of working with a PEO firm is their understanding of the local regulatory regime and guarantee that you will be in full compliance with it. Knowing that your company will remain in good standing with local authorities gives you peace of mind to focus on other aspects of your business.

- Limited commitment: By hiring staff through a PEO and eliminating the need to register a business locally, you are able to enter and leave the market in only the time it takes to find and release local staff, allowing for a swift and inexpensive departure from the market based on what your commercial strategy demands.

- Established network: As well as an established recruitment network that can help you find the right staff quickly, your PEO in Guyana will also have strong connections to the local business community, which may be beneficial to your enterprise in other ways.

PEO vs. EOR in Guyana – What’s the Difference?

When expanding into Guyana, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are fully legal in Guyana.

Note that PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Guyana. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate Guyana’s regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Hiring Local Talent with a PEO in Guyana

A dependable PEO in Guyana can manage the complex nature of various employment agreements within the nation. The main employment guidelines overseen by a Guyanese PEO are:

- Working Hours: The standard workweek spans 40 hours over 5 days, with overtime compensated at one and a half times the regular rate.

- Holidays: Guyana celebrates 15 national holidays, and employees are entitled to 12 days of annual leave.

- Sick Leave: Sick leave is not an entitlement. Employees are allowed both certified and uncertified sick leave. Payment for sick leave is made by the National Insurance Scheme after the third day of illness. Most Collective Agreements require the employer to make up any shortfall.

- Maternity/Paternity Pay: The maximum paid maternity leave period in Guyana is 13 weeks.

- Tax: Individuals who are ordinarily resident or domiciled in Guyana are subject to tax on their worldwide income. Individuals who are not ordinarily resident or domiciled in Guyana are taxable on income accruing in or derived from Guyana, including income from any employment exercised in Guyana, regardless of whether the income is received in Guyana.

- Value Added Tax (VAT): Taxable activities for purposes of the Guyana sales tax are sales of goods or supplies of services within Guyana and the import of goods. The standard rate is 14%. Certain goods and services may be zero-rated or exempt.

- Social Security: Contributions to the NIS are paid at the following rates on maximum monthly insurable earnings of GYD 280,000: For employees: 5.6% For employers: 8.4%. For self-employed persons: 12.5% (of their declared income up to GYD$256,800.)

- Termination of Contracts: Employees with less than one year of service require a two-week notice, whereas those with over a year need one month. Employers can’t terminate during authorized leaves and can dismiss instantly for serious misconduct. Employees with over a year of service are entitled to severance pay, increasing with years of service up to a maximum of 52 weeks.

FAQs on hiring through a PEO in Guyana

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through a PEO in Guyana:

You can hire an employee by incorporating your own legal entity in Guyana, and then using your own entity to hire employees, or you can hire through a , which is a third party organization that allows you to hire employees by acting as the legal employer.

Compliancy, such as the following:

A standard working week of 40 hours.

Honoring of all national holidays celebrated in Guyana.

Honoring the legal entitlement related to sick leave.

Employer contribution of 8.4% and employee contribution of 5.6% of each salary to national social security.

Written contracts given to each employee and registered with the relevant authorities.

Timely payment of salaries and any applicable additional payments, such as severance pay when employment ends.

Working Hours: The standard workweek spans 40 hours over 5 days, with overtime compensated at one and a half times the regular rate.

Holidays: Guyana celebrates 15 national holidays, and employees are entitled to 12 days of annual leave.

Sick Leave: Sick leave is not an entitlement. Employees are allowed both certified and uncertified sick leave. Payment for sick leave is made by the National Insurance Scheme after the third day of illness. Most Collective Agreements require the employer to make up any shortfall.

Maternity/Paternity Pay: The maximum paid maternity leave period in Guyana is 13 weeks.

Social Security: Contributions to the NIS are paid at the following rates on maximum monthly insurable earnings of GYD 280,000: For employees: 5.6% For employers: 8.4%. For self-employed persons: 12.5% (of their declared income up to GYD$256,800.)

Termination of Contracts: Employees with less than one year of service require a two-week notice, whereas those with over a year need one month. Employers can’t terminate during authorized leaves and can dismiss instantly for serious misconduct. Employees with over a year of service are entitled to severance pay, increasing with years of service up to a maximum of 52 weeks.

The total cost for an employer to hire an employee can vary depending on the salary. However, as a rough estimate, the employer’s cost for mandatory employment benefits is approximately 13% of the gross employee salary. This is in addition to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

Forming a legal entity is different from PEO in the following ways:

– Creates a permanent presence in the country.

– Expenses are deductible through a local entity.

– Enables the ability to execute contracts and agreements locally.

– Facilitates invoicing through a local entity.

– Requires compliance support.

– Empowers direct hiring of employees.

A PEO operates as a co-employer alongside your company, whereas an EOR serves as the official employer of your staff. An EOR typically offers a broader range of services than a PEO.

Access PEO services in Guyana with Biz Latin Hub

At Biz Latin Hub, our team of multilingual PEO specialists is ready to help you find the staff you need in Guyana and ensure your good standing with local authorities from the first day of operations. With out expertise in providing back-office services to foreign investors, including commercial representation, legal services, and accounting support, we can help you achieve your business goals in Guyana. We are present in 16 countries around Latin America and the Caribbean, and have trusted partners in many others.

Reach out now for further advice or a free quote.

Or learn more about our team of expert authors.