If you are interested in doing business in Guatemala, a number of possible options for entering the market are available. Depending on the size or timescale of your operation in the Central American nation, using an employer of record, or EOR in Guatemala could be your best option. These companies employ workers on your behalf and handle compliancy, but allowing you to retain full control over their activities.

Key takeaways on using an EOR in Guatemala

| How much hiring support will you have? | You will have full support and essentially full control over your workers on a day-to-day basis as well. |

| Is EOR in Guatemala legal? | EOR is fully legal in the country. |

| Presence in the country | Limited – company formation will be necessary for full presence |

| What are the working hours in Guatemala? | 44 hours per week is the maximum time that workers can serve before overtime has to be paid. |

| What is the minimum monthly wage covered by an EOR in Guatemala? | Varies according to sector and geography, between GTQ$3,171-$3,634 (approx. USD$410-$470) |

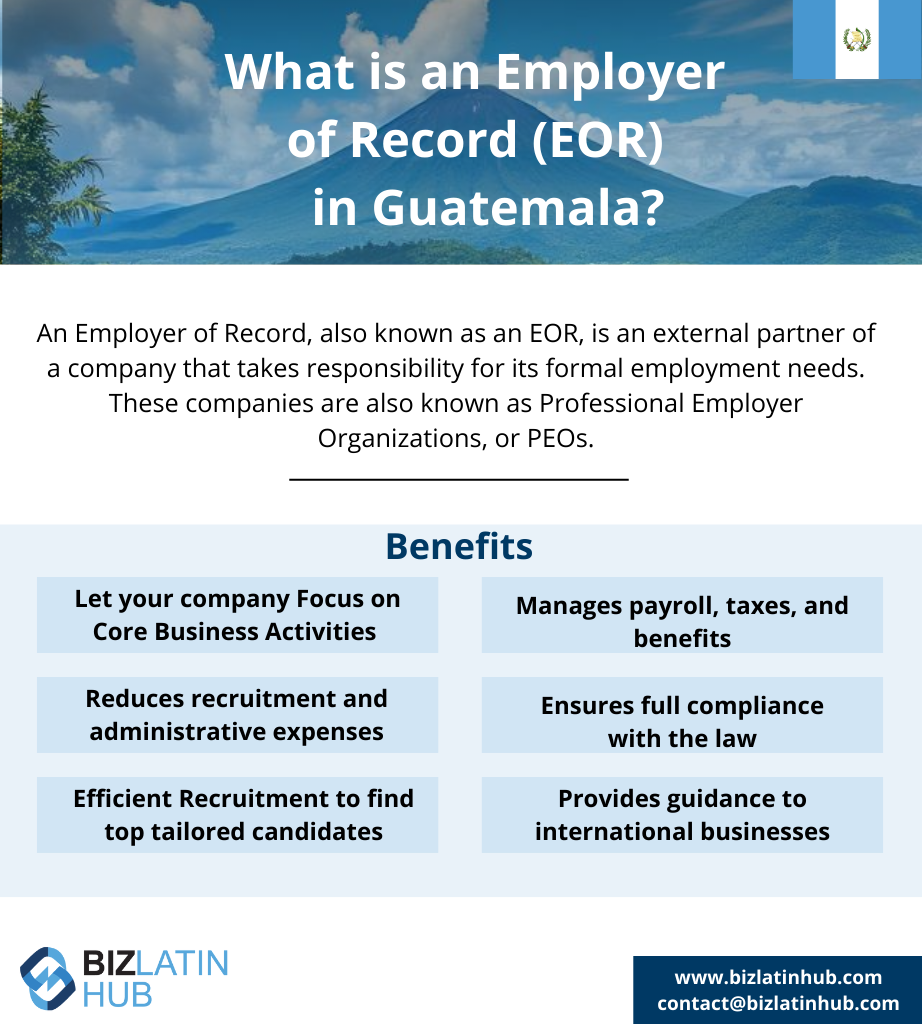

6 Key benefits of using an EOR in Guatemala

The six key benefits of using an EOR in Guatemala are:

- Using an EOR provides companies with protection from legal disputes.

- An EOR takes legal responsibility for fulfilling employee requirements. Therefore, you will be free from risk in that regard.

- Using an EOR will give your company quicker access to new markets, since you avoid the need for full company incorporation or registering a branch.

- Saving time, by avoiding the need to form and maintain a legal entity within Guatemala, you may save money by reducing costs.

- Working with an EOR may also facilitate company development. Leaving an EOR to deal with your staff will free you up to focus on other aspects of the business.

- Finally, hiring through an EOR in Guatemala will allow you to get a better impression of the market, local business culture, and labor law, meaning you will be well-informed ahead of any potential deeper investment.

How can an EOR in Guatemala hire staff for you?

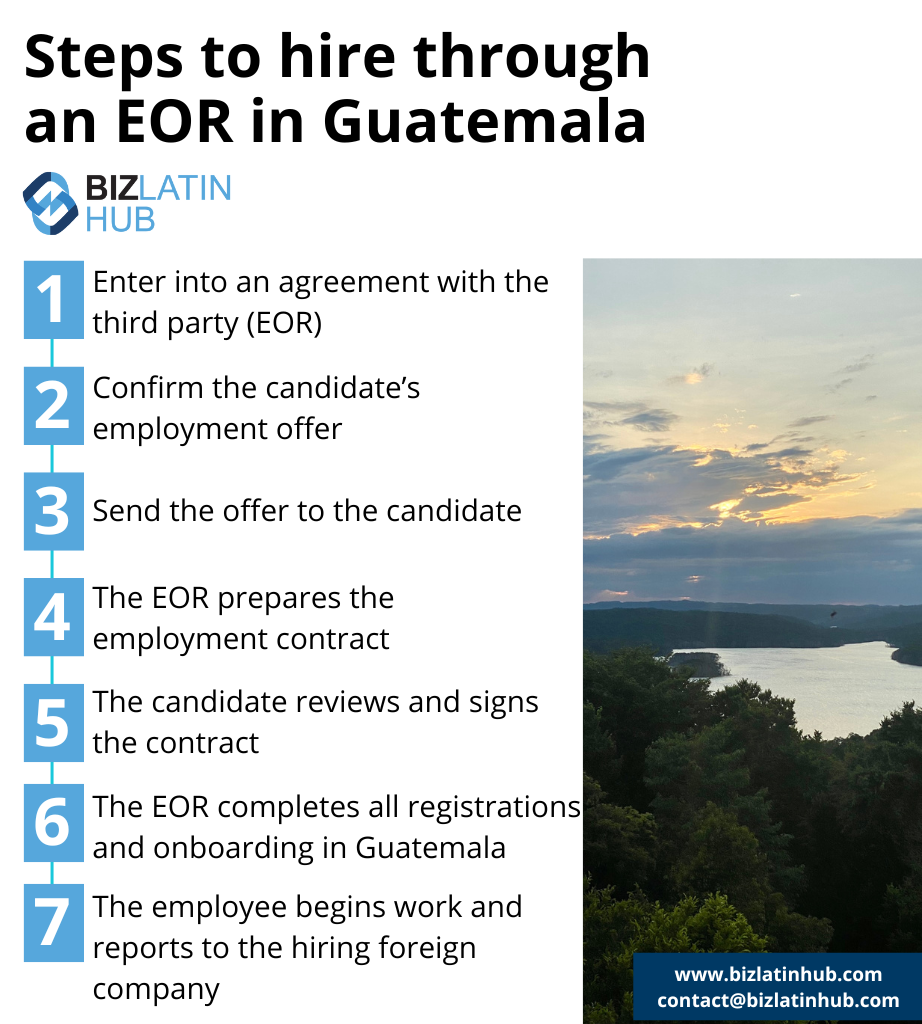

An EOR in Guatemala will hire local staff on your behalf via its locally registered entity. This means that the staff will be employed by the EOR in the eyes of local authorities, but you will maintain total managerial control over their day-to-day duties and task management.

Under such an arrangement, the EOR will oversee the payment of all salaries and statutory benefits related to those employees, including sick pay, severance, annual vacation, and national insurance contributions, for which you will reimburse the EOR. The EOR will also oversee all aspects of employee on-boarding and off-boarding, including drawing up contracts and registering or de-registering those employees with local authorities.

An EOR in Guatemala will also be able to offer you expert advice on the likes of local labor and related tax law, both prior to hiring employees and as new legislative developments emerge. Meanwhile, when you choose an EOR in Guatemala with an established international presence, you can expect all contracts and paperwork to be drawn up in both English and the official local language, Spanish.

In addition to overseeing all legal and administrative aspects of your hiring, maintaining, and firing staff, an EOR in Guatemala will also have an established recruitment network, through which they will be able to assist you in finding the ideal personnel.

What legal requirements will an EOR in Guatemala take care of?

Workers in Guatemala are entitled to a number of requirements that your company must provide. An EOR in Guatemala will be able to provide you with expert and up-to-date advice on all aspects of local labor law, and they will also remove the need for you to be concerned about it, because they will guarantee compliance.

Some of the key requirements set out by Guatemalan labor laws that an EOR will take care of for you include:

- Maximum working week: honoring the maximum working week of 44 hours.

- National holidays: Honoring of 11 national holidays celebrated in Guatemala.

- Bonuses: Honoring statutory bonuses due in July and December, equal to a month’s earnings.

- Extra entitlements: Honoring the legal entitlement to five days of sick leave, 12 weeks of maternity leave, and two days of paternity leave.

- Social security: Contribution of 12.67% of each salary to national social security.

- Contracts: Written contracts given to the employee registered with the relevant authority

- Termination: Timely payment of outstanding salary and applicable severance pay after contract termination.

EOR vs. PEO in Guatemala – What’s the Difference?

When expanding into Guatemala, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are fully legal in Guatemala.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Guatemala. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Guatemala, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

- Step 1: Select the country.

- Step 2: Select the currency you wish to deal in.

- Step 3: Indicate an employee’s monthly income.

- Step 4: Calculate your estimated costs.

- Step 5: Compare your costs to other options

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Guatemala would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on hiring through an EOR in Guatemala

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an EOR in Guatemala:

You can hire an employee by incorporating your own legal entity in Guatemala, and then using your own entity to hire employees, or you can hire through an employer of record (EOR), which is a third party organization that allows you to hire employees in Guatemala by acting as the legal employer. With an EOR you do not need a Guatemalan legal entity to hire local employees.

– General employee information (as mandated by Labor Code, Decree 330) and employer identification.

– Date of contract

– Start date of the employment relationship.

– Contract period.

– Job title.

– Place of work.

– Salary, benefits and payment frequency (quarterly or monthly).

– Work hours.

– Probation period and terms.

– Any other specific agreements negotiated between both parties.

– Signatures.

The mandatory employment benefits in Guatemala are the following:

– Social security contribution (“IGSS, Intecap & IRTRA”).

– Vacation.

– 13th salary (“Aguinaldo”).

– 14th salary (Annual Bonus for Private and Public Sector Employees, commonly known as “Bono 14”).

The total cost for an employer to hire an employee in Guatemala can vary depending on the salary. However, as a rough estimate, the employer’s cost for mandatory employment benefits is approximately 13% of the gross employee salary. This is in addition to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

Forming a legal entity is different to hiring an EOR in the following ways:

– Creates a permanent presence in the country.

– Expenses are deductible through a local entity.

– Enables the ability to execute contracts and agreements locally.

– Facilitates invoicing through a local entity.

– Requires compliance support.

– Empowers direct hiring of employees.

A PEO operates as a co-employer alongside your company, whereas an EOR serves as the official employer of your staff. An EOR typically offers a broader range of services than a PEO.

Why invest in Guatemala?

With major ports on its Pacific and Caribbean coasts, this nation of 17.5 million people is also a trade hub, with its international trade flows representing 30% of all trade for Central America. Some of the country’s main export commodities include agricultural products, metals, oil, and timber.

The country has also signed free trade agreements (FTAs) with the United States, the European Union, and numerous Latin American markets, such as Colombia, Costa Rica, the Dominican Republic, and Panama.

Guatemala has the largest economy in Central America, with a gross domestic product of USD$95 billion. In this context, and having registered consistent growth over recent decades, Guatemala is seen as an increasingly attractive destination for investment. In 2019, it registered foreign direct investment (FDI) inflows of almost USD$1 billion.

Biz Latin Hub can be your EOR in Guatemala

If you are interested in hiring staff quickly in Guatemala, engage with our multilingual team of legal, accounting, and recruitment specialists, who are equipped to support your commercial operations in the country. With our full suite of market entry and back-office services, we can be your single point of contact to successfully establish a branch in Guatemala.

Reach out now for further advice or a free quote. Learn more about our team and expert authors.