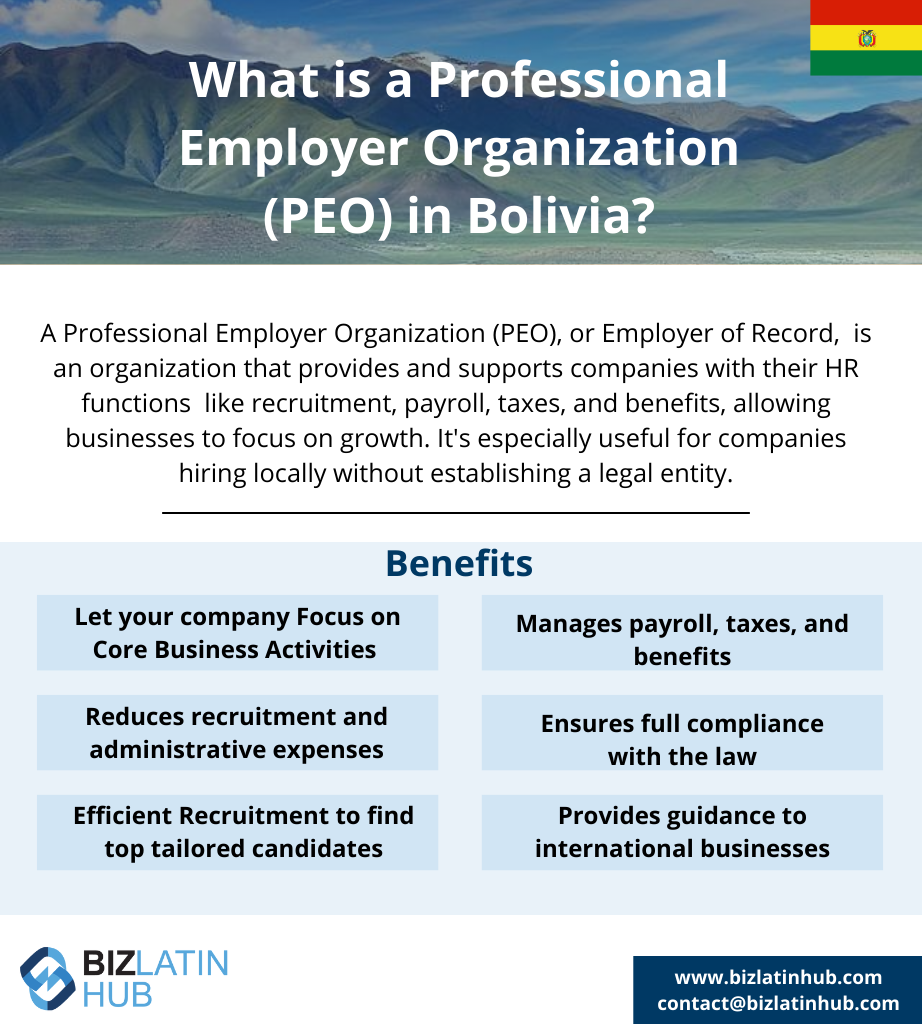

When expanding into Bolivia, companies often encounter administrative and regulatory challenges related to hiring and HR compliance. A Professional Employer Organization (PEO) or Employer of Record (EOR) in Bolivia allows your company to engage local workers without establishing a legal entity. These services streamline employment, payroll, and tax processes — letting you focus on growth. Biz Latin Hub offers tailored PEO and EOR solutions to support international companies entering the Bolivian market with company incorporation in Bolivia.

Key Takeaways

| Is it legal to hire in Bolivia through PEO services? | Regulations allow foregin companies to hire employees through PEO providors in Bolivia. |

| What are the benefits of hiring through a PEO in Bolivia? | Candidates hired by a PEO in Bolivia provider in accordance with local labor laws can be onboarded in days instead of the months it typically takes. |

| Steps to hire through a PEO in Bolivia | Sign an agreement with the third-party provider (PEO). Confirm the employment offer for the chosen candidate. Send the employment offer to the candidate. After acceptance, the PEO prepares and finalizes the employment contract. The candidate reviews and signs the contract. The PEO completes all required employee registrations in Bolivia. The employee begins work and operates under the foreign company’s direction. |

What Is a Professional Employer Organization (PEO) in Bolivia?

Contracting the services of a professional employer organization, or PEO in Bolivia enables you to recruit, hire, or fire local staff without needing to formally establish a company in the country because the PEO firm will do it all on your behalf.

The PEO will have an established recruitment process based on the local market and can help you manage time-consuming administrative activities tasks such as payroll management.

A professional employer organization, or PEO in Bolivia will also act as the registered employer before local authorities. However, the PEO client will still maintain the day-to-day relationship with employees, and will provide them with the relevant instructions for their daily work activities.

Key Advantages of PEO and EOR Services for Expanding into Bolivia

In many cases, with a PEO there will be no need to set up a company or branch in Bolivia. If your company has a smaller-scale operation or will develop its activities for a short period of time, it will likely not be necessary to establish a company in the country. In this sense, a PEO will be in charge of recruiting, hiring, firing, and paying all taxes and benefits to local employees. This will leave you time to focus on other aspects of your business.

Additionally, a PEO will request working permissions for foreign employees. In Bolivia, they will oversee any working visas or residency permits for foreign workers. Note that in Bolivia foreign workers can only represent 15 percent of the total payroll of a company.

Moreover, a PEO will manage all payments for employees. In Bolivia, the PEO will be responsible for payroll presentation, health insurance, pension fund, and tax payments related to employees.

A PEO will represent your company legally. Any claim related to the employees will be directed to the professional employer organization, or PEO in Bolivia that represents your business. A PEO has the necessary powers to resolve legal issues while offering a guarantee to the client that legal norms and labor law will be fully adhered to.

Lastly, a PEO can provide legal counsel on labor law. It is equipped to provide professional advice on matters related to employee hiring, constructive dismissal claims, and job compliance. This will help your company avoid legal problems that can diminish the profitability of your business operations in the country.

Benefits of Using PEO & EOR Services in Bolivia:

- Accelerated onboarding of local professionals

- Avoid complex entity setup processes

- Full labor law and tax compliance

- Integrated payroll and benefits management

- Minimal legal risk for foreign investors

- Scalable entry and exit flexibility

- Support from bilingual HR and legal experts

How to Partner With an Professional Employer Organization in Bolivia?

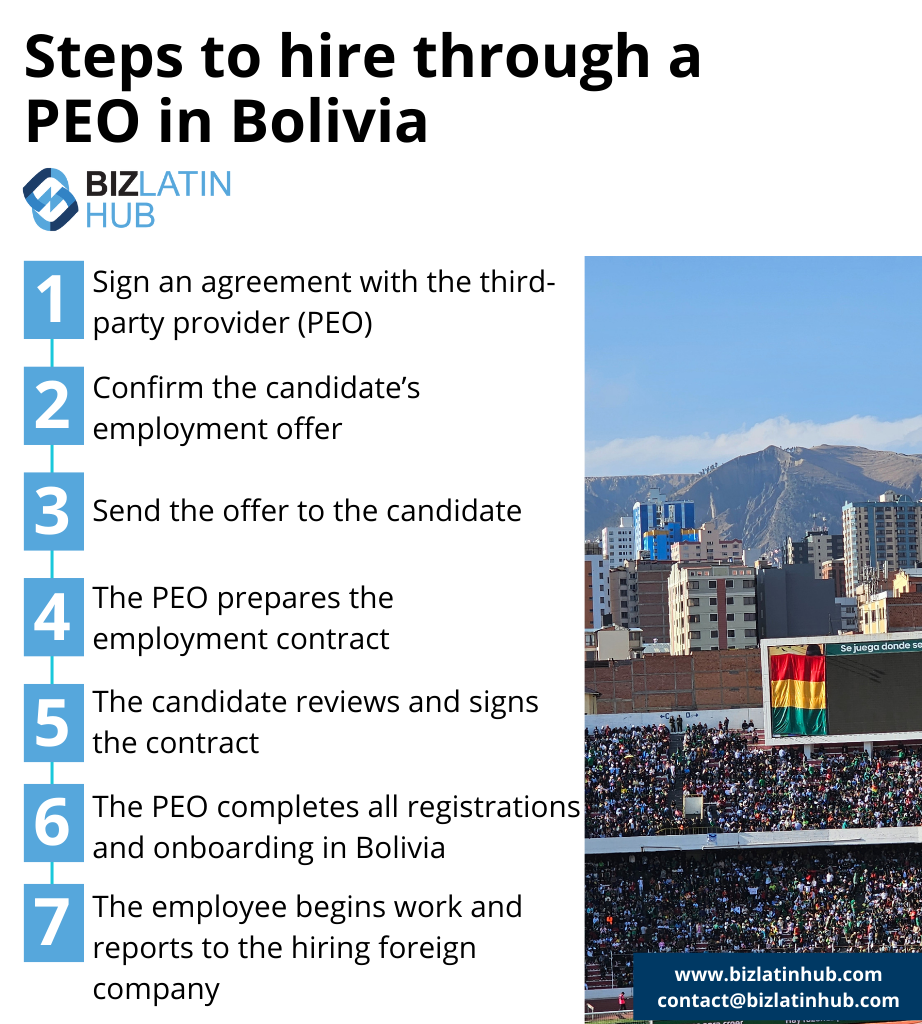

To partner with a PEO in Bolivia, the hiring company enters into an agreement with a third-party organization, designating it as the Professional Employer Organization (PEO) for the employees they wish to hire. This makes the PEO/EOR legally responsible for ensuring compliance with Bolivian employment regulations, as documented in official records.

This arrangement simplifies the hiring process for the foreign company, eliminating the need to navigate Bolivia’s complex labor laws independently. It reduces the risk of non-compliance and enables the company to focus on business development and market growth in Bolivia.

The process of hiring through a Professional Employer Organization in Bolivia is straightforward and includes these steps:

- Sign an agreement with the third-party provider (PEO).

- Confirm the employment offer for the chosen candidate.

- Send the employment offer to the candidate.

- After acceptance, the PEO prepares and finalizes the employment contract.

- The candidate reviews and signs the contract.

- The PEO completes all required employee registrations in Bolivia.

- The employee begins work and operates under the foreign company’s direction.

Are there any downsides to working with a professional employer organization, or PEO in Bolivia?

Although it has its advantages, the hiring process through an Employer of Record in Bolivia can present several issues. While the EOR structure offers businesses a convenient and faster way to hire employees in a new location, it also carries the risk of inadvertently establishing a permanent establishment. This risk arises when the business is perceived to exert substantial control over the activities of its employees in the new location or when it maintains a significant presence in a foreign country. Therefore, it is crucial that businesses evaluate their EOR arrangement thoroughly and ensure it is in strict compliance with local laws and regulations.

Another issue that may arise when working with an EOR is rising admin costs. When hiring a substantial number of employees, the expenses linked to the EOR structure can expand rapidly. For instance, the third-party EOR service provider may levy a premium for their services and impose additional costs for managing the benefits of a large workforce. By establishing a local entity, businesses can attain greater control over their workforce and potentially mitigate the expenses associated with the EOR structure.

Moreover, working with an EOR may worsen cultural and communication obstacles. Companies that need to become more familiar with the language and culture in Bolivia may experience problems—for example, communicating with employees and understanding local labor laws and regulations. Miscommunications, misunderstandings, and compliance issues are possible as a result.

Businesses that use EORs may have less ownership and control over their employees. Since the Employer of Record in Bolivia is the legal employer, the company may have less influence over hiring decisions or other employment-related matters.

Lastly, when partnering with an EOR, businesses might encounter challenges in creating a unified company culture. As employees work remotely and are overseen by a third-party organization, fostering a feeling of shared objectives and connection among the workforce can be challenging.

PEO vs. EOR: Which Is Right for Your Business?

When expanding into Bolivia, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Bolivia, allowing foreign companies to hire employees through third-party providers.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Bolivia. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Bolivia’s complex labor regulations, establish entities, and ensure full HR compliance with local requirements such as the 48-hour workweek and profit sharing obligations. Whether you need a fast market entry or a stable long-term presence in Bolivia, we can guide you through the process.

| Feature | PEO Bolivia | EOR Bolivia |

|---|---|---|

| Legal Employer | Client (entity required) | Biz Latin Hub (acts as legal employer) |

| Hiring Speed | Moderate | Fast |

| Compliance Responsibility | Shared | Fully handled by EOR provider |

| Best For | Established local operations | Testing or initial market entry |

| Contract Ownership | Company-employee | EOR-employee |

This table helps you understand the key differences when selecting a PEO or EOR for your hiring strategy in Bolivia.

What employee rights do I need to provide in Bolivia?

A professional employer organization, or PEO in Bolivia will make sure you stay compliant with all local laws. Some of the ones that are most relevant and important are collected here:

- Working hours

In Bolivia, the standard work day consists of 8 hours. However, employees are allowed to work up to 48 hours per week, with a maximum of 6 working days. It is important to note that women are only permitted to work 40 hours per week. - Overtime

Overtime in Bolivia is considered as work done during emergencies or to fulfill the employer’s requirements. It is regarded as extraordinary working hours and is compensated with an additional 100% pay. However, the total overtime hours should not exceed two hours per day. - Termination

The laws regarding employment termination in Bolivia require blue collar workers with six months of service to be given 15 days’ notice, blue collar workers with 1 year of service to be given 30 days’ notice, and white collar workers with more than 3 months of service to be given 90 days’ notice. - Vacation time

Under employment law in Bolivia, after completing one year of service with the same employer, employees are entitled to 15 days of paid vacation per calendar year. It is the employer’s responsibility to make sure that an employee uses their full allowance. - Sick leave

Employees are entitled to be paid for days missed through sickness. However, they must present an authorization letter signed by a registered doctor within three days of their return to work in order to receive payment. In the event of a longer-term absence, the authorization must be presented prior to that return. - Maternity and paternity leave

Under Bolivian employment law, maternity leave allowance totals 90 days, made up of 45 days before the day the baby is due to be born and 45 days after that date. Fathers are entitled to three days of paid paternity leave. New parents cannot be removed from their jobs until at least one year after the birth of a child. - Bereavement

For public employees, three days of paid bereavement leave must be granted to an employee in the event of the death of a parent, child, sibling, or spouse. Public employees are not legally entitled to any paid bereavement leave, however the three day allowance is generally observed. - Profit sharing

Companies resident in Bolivia must share 25% of their net annual profits with any employees who have worked for the company for at least three months, with profit shares earned by employees based on their salary level.

How to use a payroll calculator for professional employer organization, or PEO in Bolivia

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Bolivia, using a payroll calculator is one way to get a very good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Bolivia would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on hiring through a professional employer organization, or PEO in Bolivia

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an professional employer organization, or PEO in Bolivia.

1. How does one hire employees in Bolivia?

You can hire an employee by incorporating your own legal entity in Bolivia, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR) or PEO, which is a third party organization that allows you to hire employees in Bolivia by acting as the legal employer. With an EOR you do not need a Bolivian legal entity to hire local employees.

2. What is in a standard employment contract in Bolivia?

A standard Bolivian employment contract should be written in Spanish and contain the following information:

- ID and address of the employer and employee.

- City and start date.

- The location where the service will be provided.

- Job description.

- Remuneration and benefits (if applicable).

- Method payment and frequency.

- Probation period.

- Specification of daily and weekly working hours.

- Beneficiaries’ ID numbers and type of relationship with the employee.

- Confidentiality clause.

3. What are the mandatory employment benefits in Bolivia?

The mandatory employment benefits in Bolivia are the following:

- Working tools necessary to carry out the work (if applicable)

- Payment of social security contributions (health, pension, and labor risks).

- Social benefits (severance pay, aguinaldo)

- Paid time-off (vacation and Sunday rest).

- Disabilities (common or labor origin).

- Overtime and surcharges (if applicable)

- Sick Leave, maternity, and paternity Leave

- Work-Related Accident and Occupational Disease Coverage

For more information on mandatory employment benefits read our recent article on Employment laws in Bolivia

4. What is the total cost for an employer to hire an employee in Bolivia?

The total cost for an employer to hire an employee in Bolivia can vary based on the salary. However, the employer cost for mandatory employment benefits is approximately 16.71% percent of the gross employee salary and benefits.

Please use our Payroll Calculator to calculate employment costs.

5. What is the difference between hiring through an EOR and forming a legal entity?

Forming a legal entity differs from hiring through a EOR in the following ways:

It is slower to establish.

Creates a permanent presence in the country.

All costs are deductible through a local entity.

Provides the ability to sign contracts and agreements locally.

Provides ability to invoice through local entity.

Legal entity compliance support is required.

Company hires employees directly.

6. What is a PEO and how does it work in Bolivia?

A PEO provides HR and payroll solutions to companies that already have a Bolivian entity. It shares responsibilities in managing employment tasks compliantly.

7. What is an Employer of Record (EOR) in Bolivia?

An EOR enables your business to legally hire staff in Bolivia without creating a local entity — Biz Latin Hub acts as the legal employer on your behalf.

8. What are the differences between PEO and EOR in Bolivia?

A PEO shares employment responsibilities but requires you to have a local entity. An EOR assumes all employment liability and is ideal for foreign market testing.

9. Can I transition from EOR to my own entity later?

Yes. You can transfer staff from an EOR structure to your entity once established.

10. Are these services compliant with Bolivian labor regulations?

Yes. Biz Latin Hub ensures full compliance with Bolivian labor codes, pension contributions, and tax filings through local experts.

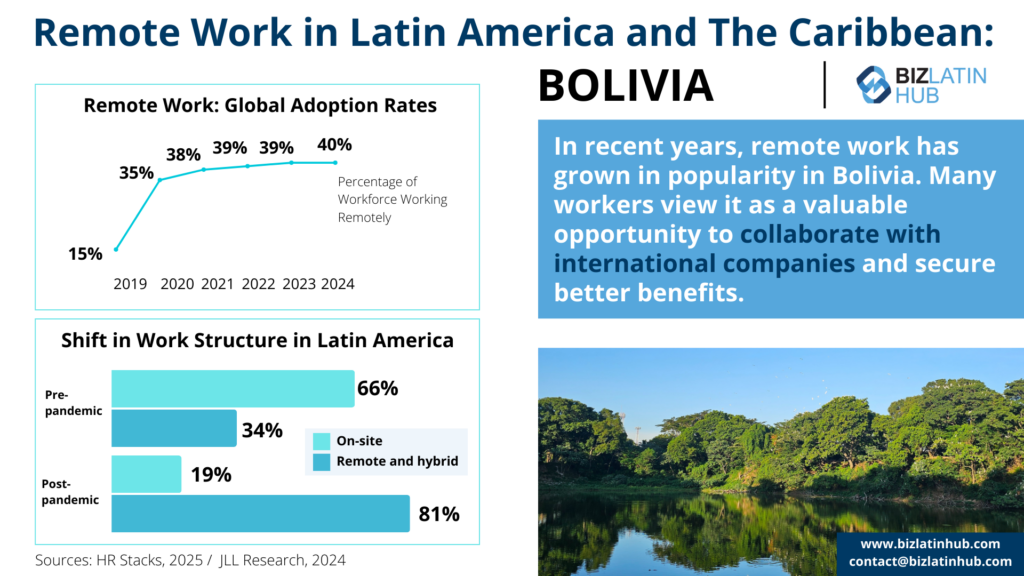

Why Invest in Bolivia?

Bolivia has shown consistent growth in gross domestic product (GDP) and gross national income (GNI) over recent years. With economic growth expected to bounce back in the future to pre-COVID-19 pandemic levels, the prospects for investment appear promising. A professional employer organization, or PEO in Bolivia will help you enter the market without over-committing, maintaining your freedom.

Biz Latin Hub can be your professional employer organization, or PEO in Bolivia

At Biz Latin Hub, our team of multilingual recruitment and legal specialists has the expertise required to support employers hiring staff in Bolivia, and guarantee full compliance with labor regulations in the country. With our full suite of PEO services in Bolivia, as well as other countries across Latin America and the Caribbean, we are your single point of contact to solve all of your hiring and payroll needs.

Reach out to us now for more information on how we can help you throughout the recruitment and hiring process in Bolivia.

Learn more about our team and expert authors and watch the following video to know more about how to expand into Latin America through a PEO solution.