For anyone interested in company formation in Uruguay and seeking quick market entry, one of the best options available could be payroll outsourcing. When you choose payroll outsourcing in Uruguay, you contract a local partner to take care of the administration of staff, saving you time and potentially providing you with staff in only the time it takes to find the right personnel.

Key takeaways on payroll outsourcing in Uruguay

| Hiring in Uruguay | Not part of standard payroll outsourcing in Uruguay, but available with PEO services |

| Payroll Compliancy in Uruguay | Your payroll outsourcing in Uruguay will handle everything for you |

| Uruguayan Legal Support | Provided |

| Working Hours in Uruguay | Up to 8 hours daily, six days a week |

| Monthly minimum wage (2024) in Uruguay | UYU$22,268 (approx. USD$500) |

Understand Payroll Outsourcing in Uruguay

Payroll outsourcing in Uruguay refers to the use of a service provider or a third party to manage administrative and payroll duties for the employees of a company operating in the country. By choosing to outsource payroll, your company will be able to avoiding having to hire local payroll professionals or deal with the sometimes complex administration it involves.

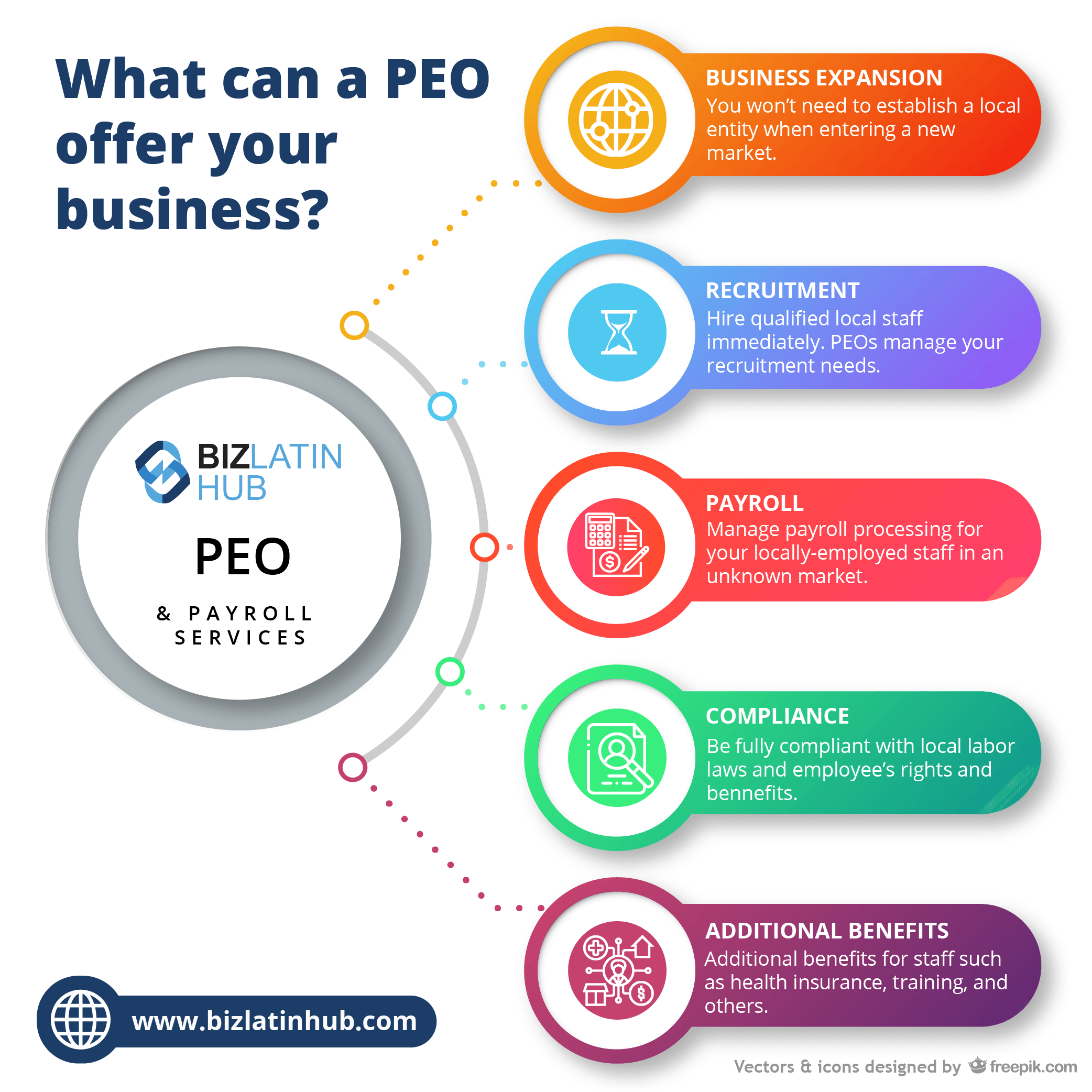

The level of service provided as part of payroll outsourcing can vary, with some organizations only offering a basic administrative service. A Professional Employer Organization (PEO), meanwhile, will be able to offer a more comprehensive service, overseeing the likes of recruiting, hiring, and firing, on top of managing employee payroll, including meeting all tax and statutory social benefit requirements.

A PEO will also handle employee on-boarding and off-boarding, drafting employee contracts and related paperwork, as well as keeping you informed about legislative changes that could affect your enterprise.

Some of the principal tasks you can expect a company offering payroll outsourcing in Uruguay to undertake include:

- Calculation of wages and salaries

- Withholding of income taxes, social security, and pension contributions

- Printing and delivery of salary receipts

- Making direct deposits of wages and benefits

- Development of management reports

- Presentation of required government reports

Benefits of Payroll Outsourcing

Some of the main benefits of choosing payroll outsourcing in Uruguay include:

Reduced administration: By outsourcing payroll in Uruguay, your company’s administrative burden will be reduced as you or your team will not have to manage employees’ benefits deductions, hiring, and dismissals. In addition, you will not have to stay aware of changes in labor regulations, which are not uncommon in the South American nation.

Good standing: Fines imposed by Uruguayan authorities for errors, omissions, or late payment of payroll taxes can put your reputation — or worse, your business operations — at risk. An experienced payroll provider will guarantee your company’s good health by fully complying with all corporate requirements.

Expert advice: By outsourcing payroll in Uruguay, you will be able to rely on ongoing legal advice and the business wisdom comes with having significant experience in the local market. Payroll outsourcing companies usually have a team of experts who handle various areas of human resources and payroll.

Latest software: By hiring a reliable company experienced in managing payroll, you should be able to count on them using the latest human resources management software, guaranteeing the proper, efficient administration of your staff.

Payroll Regulations in Uruguay

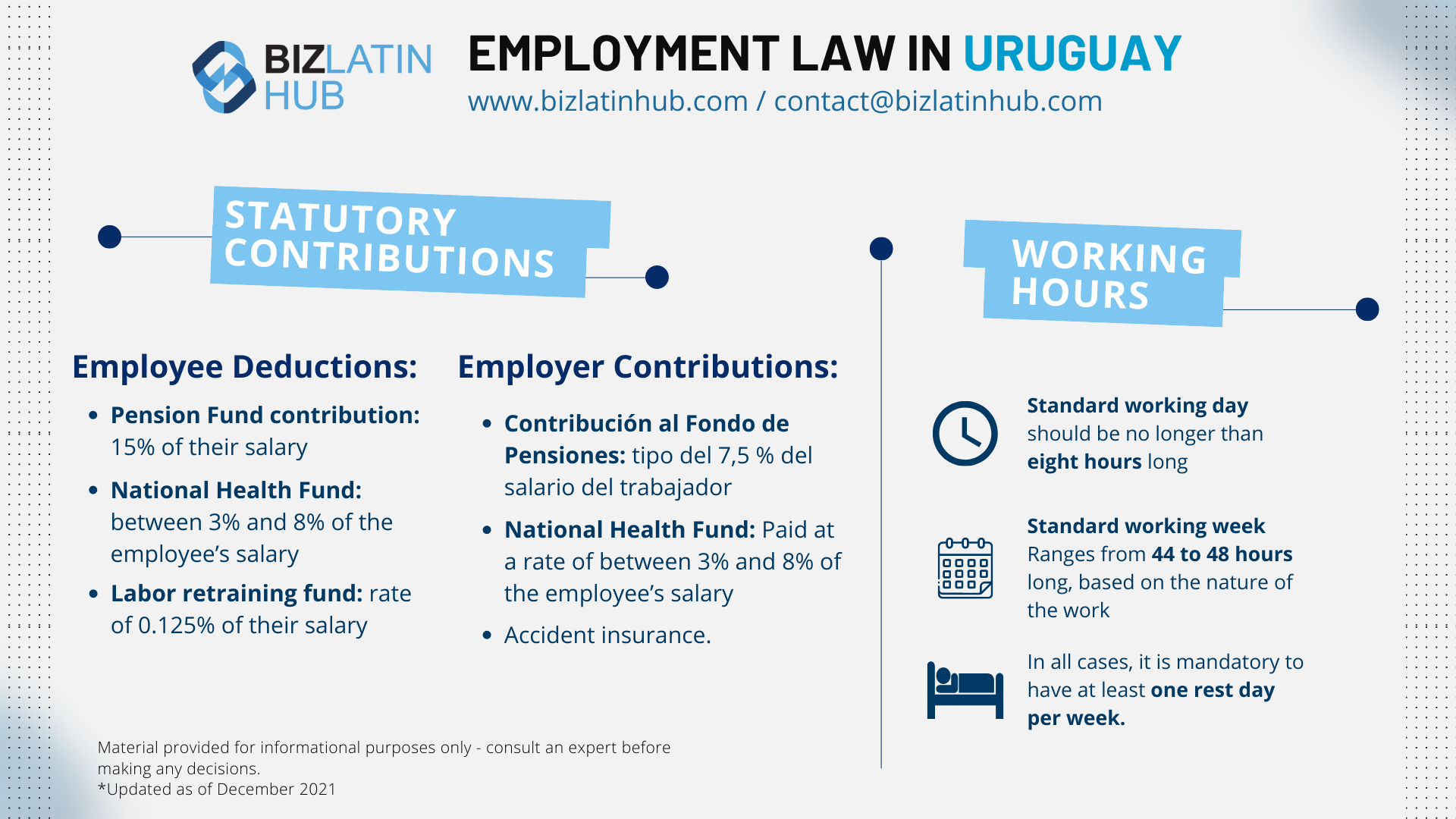

Employers in Uruguay are responsible for calculating and withholding income tax from employees’ wages and making those payments to the relevant authorities, as well as additional contributions to other government agencies.

In Uruguay, there are minimum wages for workers that are adjusted regularly. In 2024, it is UYU$22,268 per month (approximately USD$500 at the date of publication).

The standard workday is eight hours long, with a maximum of 48 hours per week for industrial workers and 44 hours for commercial workers. Law 12.590 states that “all workers hired by individuals or private companies of any nature are entitled to an annual paid leave for at least twenty days.”

In addition, all dependent workers are entitled to what is commonly known as the ‘thirteenth salary.’ This is a twice-per-year bonus common to many countries in Latin America that corresponds to one average month’s salary, paid in two installments in June and in December.

Keep in mind that if the termination of an employment contract is due to the voluntary resignation of the employee, the employer will have to pay the following:

- Salary: the employee must receive the salary corresponding to the days worked in the month in which they resigned

- Bonus: the employee must receive the bonus generated in the last December-May or June-November semester prior to the resignation date

- Leave not taken: The employee must be paid for the leave not taken up to the date of resignation

What Happens if a Company Fails to Comply With Regulations?

On a monthly basis, the employer must liquidate the items to be paid to the employee and make the corresponding payments to social security through the sending of payroll. There are fines in case of failure to comply with these legal obligations, based on the ‘re-adjustable units’ (unidades reajustables — UR) a unit of measurement based on the country’s national salary index. Those include:

- 0.1 URs per undeclared worker the first time of failure to comply

- 0.5 UR per undeclared worker the second time of failure to comply

Another sanction for not adhering to proper payroll practices is established in Law 18.752, which indicates that the omission of the payment of labor credits will automatically generate a fine of 10% on the amount of the credit owed by the employer.

FAQs on payroll outsourcing in Uruguay

No, traditional payroll outsourcing in Uruguay will not handle this, solely focusing on managing payments. A Professional Employer Organization (PEO) will be necessary for managing recruitment.

Reduced administration: By outsourcing payroll in Uruguay, your company’s administrative burden will be reduced as you or your team will not have to manage employees’ benefits deductions, hiring, and dismissals. In addition, you will not have to stay aware of changes in labor regulations, which are not uncommon in the South American nation.

Good standing: Fines imposed by Uruguayan authorities for errors, omissions, or late payment of payroll taxes can put your reputation — or worse, your business operations — at risk. An experienced payroll provider will guarantee your company’s good health by fully complying with all corporate requirements.

Expert advice: By outsourcing payroll in Uruguay, you will be able to rely on ongoing legal advice and the business wisdom comes with having significant experience in the local market. Payroll outsourcing companies usually have a team of experts who handle various areas of human resources and payroll.

Latest software: By hiring a reliable company experienced in managing payroll, you should be able to count on them using the latest human resources management software, guaranteeing the proper, efficient administration of your staff.

In 2024, it is UYU$22,268, equivalent to roughly USD$500 at current exchange rates.

The standard workday is eight hours long, with a maximum of 48 hours per week for industrial workers and 44 hours for commercial workers.

This is a twice-per-year bonus common to many countries in Latin America that corresponds to one average month’s salary, paid in two installments in June and in December.

There are fines in case of failure to comply with legal obligations, based on the ‘re-adjustable units’ (unidades reajustables — UR) a unit of measurement based on the country’s national salary index.

Biz Latin Hub can provide payroll outsourcing in Uruguay

At Biz Latin Hub, our team of multilingual specialists is equipped to deliver excellence and help you manage employee payroll to ensure the success of your commercial operations in Uruguay. With our full portfolio of hiring and international PEO services, we can be your single point of contact to incorporate your business in Latin America and the Caribbean.

Reach out to us now to receive personalized assistance.

Learn more about our team and expert authors.