Choosing payroll outsourcing in Peru is a wise decision for those looking to enter the market without having to deal with the administrative tasks associated with hiring and maintaining qualified local staff.

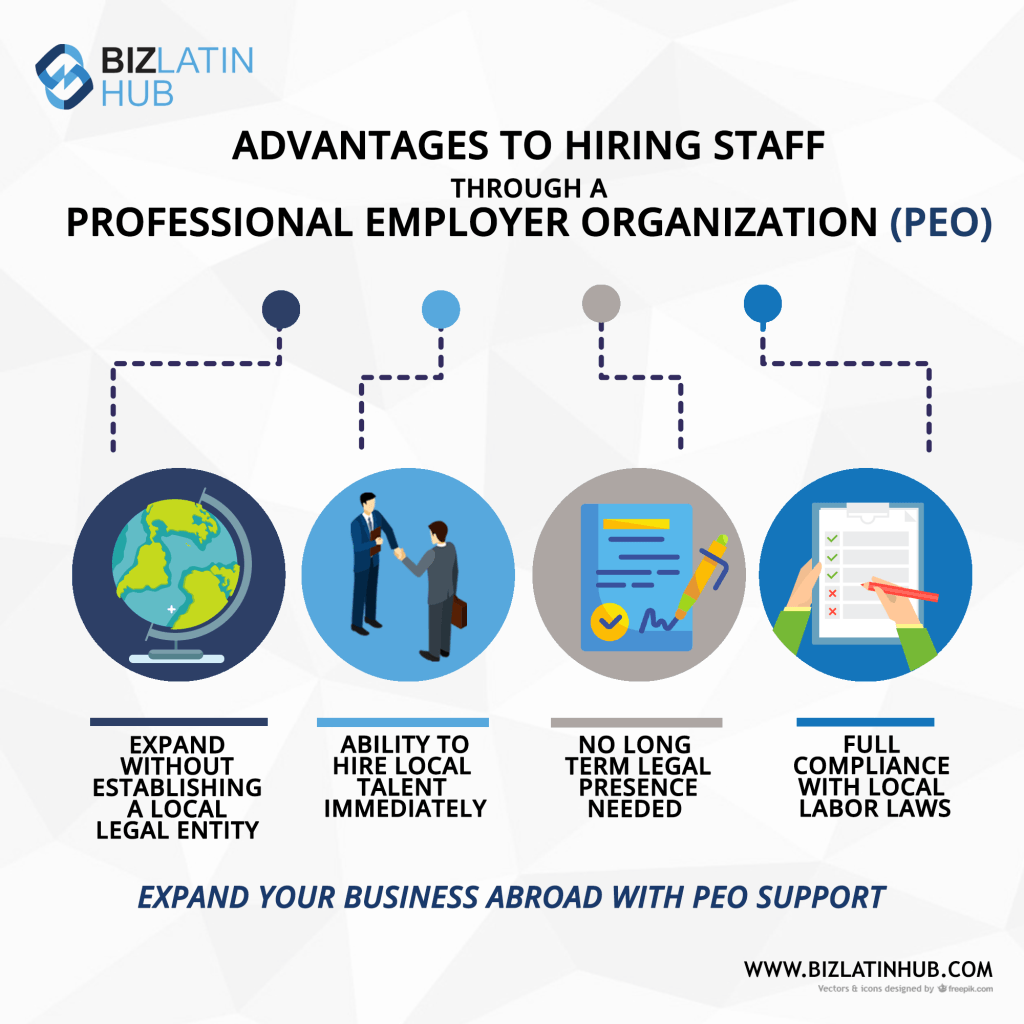

Also known as a Professional Employer Organization (PEO) or Employer of Record (EOR), a payroll outsourcing company will hire staff on your behalf and manage their financial records, guaranteeing full compliance with labor regulations and helping you meet all corporate requirements when doing business in Peru, without having to incorporate a local entity.

Peru has the sixth-largest economy in Latin America by gross domestic product (GDP), which reached $226.8 billion (all figures in USD) in 2019. The country has had one of the fastest-growing markets in the region over recent years, registering foreign direct investment (FDI) inflows of $8.9 billion in 2019. The Pacific coastal nation has also enjoyed decades of political stability and low inflation rates, which have helped it to become one of the top destinations for foreign investment in Latin America.

Peru is a founding member of the Pacific Alliance, a political and economic bloc that also includes Chile, Colombia, and Mexico. In addition, the Andean country has reached multiple free trade agreements (FTAs) with developed economies in North America, Europe, and Asia, managing to maintain an investment-friendly environment that benefits local and foreign companies operating in the country.

During the last 20 years, Peru has seen an exponential increase in the export of local agricultural products such as fruits and vegetables, which has contributed to reducing the poverty rate among rural communities from 80 percent in 2004 to 36 percent in 2018. Some of Peru’s top imports include precious metals, hydrocarbons, machinery, and vehicles, with the country’s most important export destinations including China, India, Japan, South Korea, and the United States.

If you are considering entering the Peruvian market, read on to understand how payroll outsourcing in Peru could benefit your business venture, or go ahead and reach out to us now to discuss your business options.

Understanding payroll outsourcing in Peru

As well as acting as the official employer in the eyes of local authorities, a payroll outsourcing service provider will manage on-boarding and off-boarding, as well as the drawing up of legal documents related to your overseas staff.

Some of the main tasks a payroll outsourcing company will be in charge of include:

- Making payments and completing tax procedures in accordance with local law

- Carrying out regular payroll and budget calculations

- Managing, registering, and updating information related to contracts and salaries

- Printing and delivery of pay stubs

- Making direct deposits of wages and benefits

- Preparing of management reports

Choosing payroll outsourcing: advantages

Some of the main benefits of choosing payroll outsourcing in Peru include:

Reduced administration: By outsourcing payroll in Peru, your paperwork related to your overseas staff will amount to signing off on agreements and processes with the PEO, rather than the complex administrative task of managing payroll.

Legal assistance: If you work with a payroll outsourcing company, you will be working with a company with local corporate and labor law experts on staff, giving you access to valuable legal advice.

Profitability: While your provider of payroll outsourcing in Peru will charge you a service fee, that will be significantly offset by the savings made from avoiding entity registration and other market entry costs.

Local network: Hiring staff in Peru could be a challenging task for a foreign company unfamiliar with the market or the local official languages. But a PEO in Peru will have an established recruitment network and extensive experience finding qualified personnel, promising a faster and process when seeking the right staff.

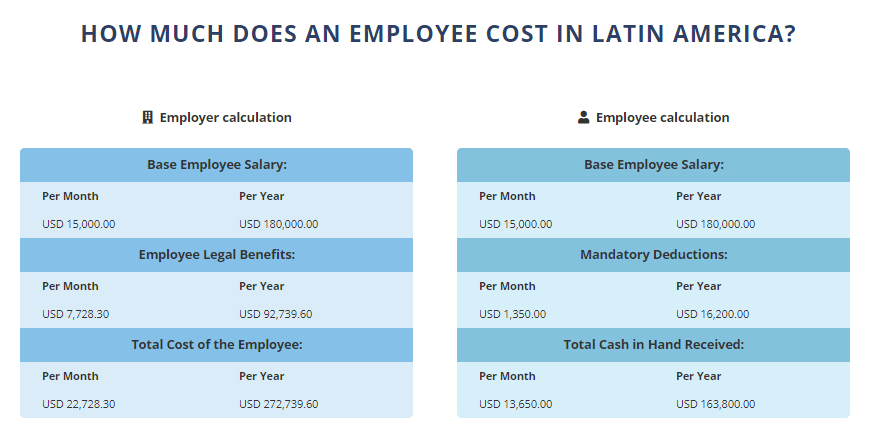

Using a payroll calculator to calculate the costs of hiring in Peru

If you want to get an idea of the costs involved in payroll outsourcing in Peru, it is worth using a payroll calculator, which will give you an opportunity to compare costs to other possible options for operating in the market, as well as to other potential markets.

Visit our PEO services page and scroll down to access the Biz Latin Hub payroll calculator, which will allow you to make calculations based on:

- The country where you want to hire employees

- The currency you wish to use

- The expected salary for a given employee

Please note that a payroll calculator should only be taken as a very good indication of the costs you can expect to incur, with actual costs based on more complex calculations.

Biz Latin Hub can help you hire and manage overseas staff

At Biz Latin Hub, we have broad experience supporting foreign companies with high-quality payroll outsourcing services in Peru. Our multilingual team of experienced accountants and legal experts is equipped to help you comply with local labor regulations, ensuring the longevity of your company. With our full suite of market entry, commercial representation, and back-office services, we can be your single point of contact to expand your business in Peru and other 15 countries across Latin America and the Caribbean.

Contact us know to learn more about our tailored services or to get a free quote.

Learn more about our team and expert authors.