Payroll outsourcing in the Dominican Republic could be a good option for anyone doing business in the market. It involves contracting a third-party provider to oversee administration and compliance matters related to paying employees after you incorporate a company in the Dominican Republic. That means your provider will manage timely payments and guarantee that relevant local legislation is properly adhered to.

Key takeaways

| Reduced administration | A third party will manage payroll outsourcing in the Dominican Republic |

| Compliance | No worries about legal problems |

| Reputation | Payroll outsourcing in the Dominican Republic will keep both authorities and employees happy |

| Bottom line | Cost savings can be achieved |

| Timely payments | A third party will make sure everyone is paid on time |

Benefits of payroll outsourcing in the Dominican Republic

When you choose payroll outsourcing in the Dominican Republic, you enjoy the following benefits:

- Reduced administration: The obvious benefit of payroll outsourcing in the Dominican Republic is the elimination of a large and complicated administrative burden involved in overseeing the payment of staff.

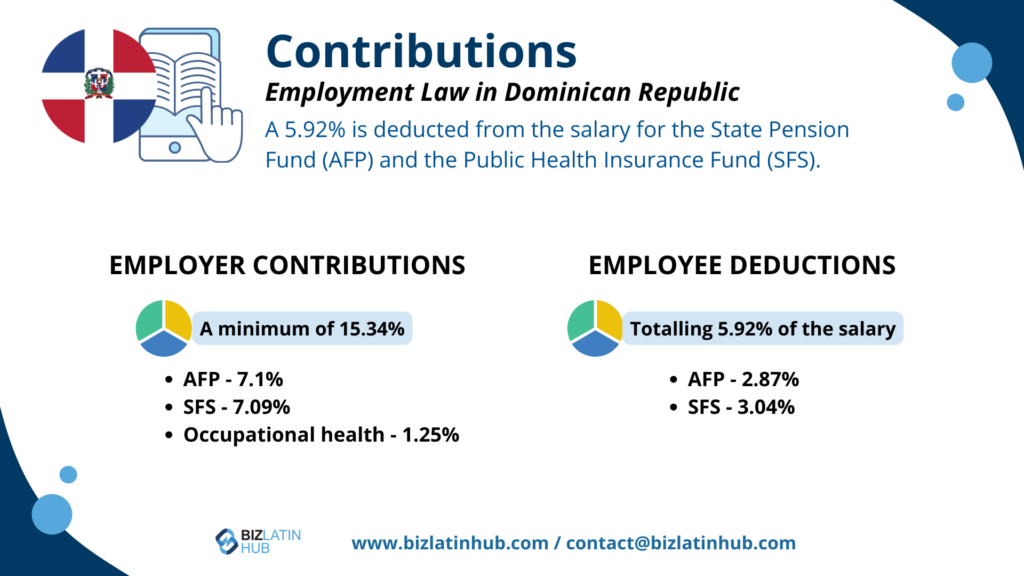

While outsourcing will obviously come with a fee, you will benefit from having a more streamlined core staff, as you will not need to employ people engaged in managing your payroll. - Guaranteed compliance: By outsourcing your payroll, you hand over responsibility to the third-party provider for complying with all aspects of corporate, employment, and labor law as related to your employees.

That means that you will be able to count on their understanding of the local regulatory regime and experience in the market to avoid legal inconveniences of financial penalties for non-compliance. - Good standing: Guaranteed compliance and the avoidance of sanctions means that you will be able to maintain your good standing in the eyes of the local authorities.

That can be crucial to the health of your business, helping you to make valuable connections and allowing you to build a strong reputation in the local business community. - Cost efficiency: While contracting someone for payroll outsourcing in the Dominican Republic will come with a fee, that can often work out to be more cost efficient than operating your own payroll.

Because when you outsource, you have greater scope for rapidly scaling up or down your payroll operations as requirements, while avoiding the need to go through the onboarding or offboarding of staff.

Dominican Republic an attractive destination for investment

The Dominican Republic has attracted increasing amounts of foreign direct investment (FDI) since the country began adopting measures to open up the economy and attract investment in the mid-1990s.

That has seen FDI increase more than ten-fold between 1994 and 2019 — a period which also saw FDI more than double as a percentage of gross domestic product (GDP), as international investors took a growing interest in the economy.

That still places the Dominican Republic as an upper-middle income nation by standards set out by the World Bank, and represents a more than eight-fold increase since 1990.

Among a number of significant draws for investors, the country boasts an extensive network of free trade zones, which provide enticing tax incentives and are home to close to 700 companies country-wide.

Many of those are involved in manufacturing key export goods, such as clothes, medical equipment, and electrical machinery. Others are home to the country’s growing tech and call center industries, which offer significant opportunities to investors.

The Dominican Republic is also a major producer of agricultural goods such as tobacco, fruits, and nuts, while gold is the country’s number one export product — with the value of those exports leaping 80% earlier this year.

Regardless of which sector you are engaged in, your business could benefit from payroll outsourcing in the Dominican Republic.

FAQs on payroll outsourcing in Dominican Republic

How does payroll outsource help with compliance in Dominican Republic?

Payroll outsourcing in Dominican Republic can significantly aid compliance by ensuring that businesses adhere to local laws and regulations. Here’s how:

- Legal expertise: Outsourcing providers offer access to local experts well versed in local labor laws, tax regulations and reporting requirements. They guide companies through the complexities of these regulations.

- Calculation accuracy: Outsourcing ensures accurate calculation of wages, salaries and benefits, mitigating the risk of inaccuracies or non-compliance with regulations.

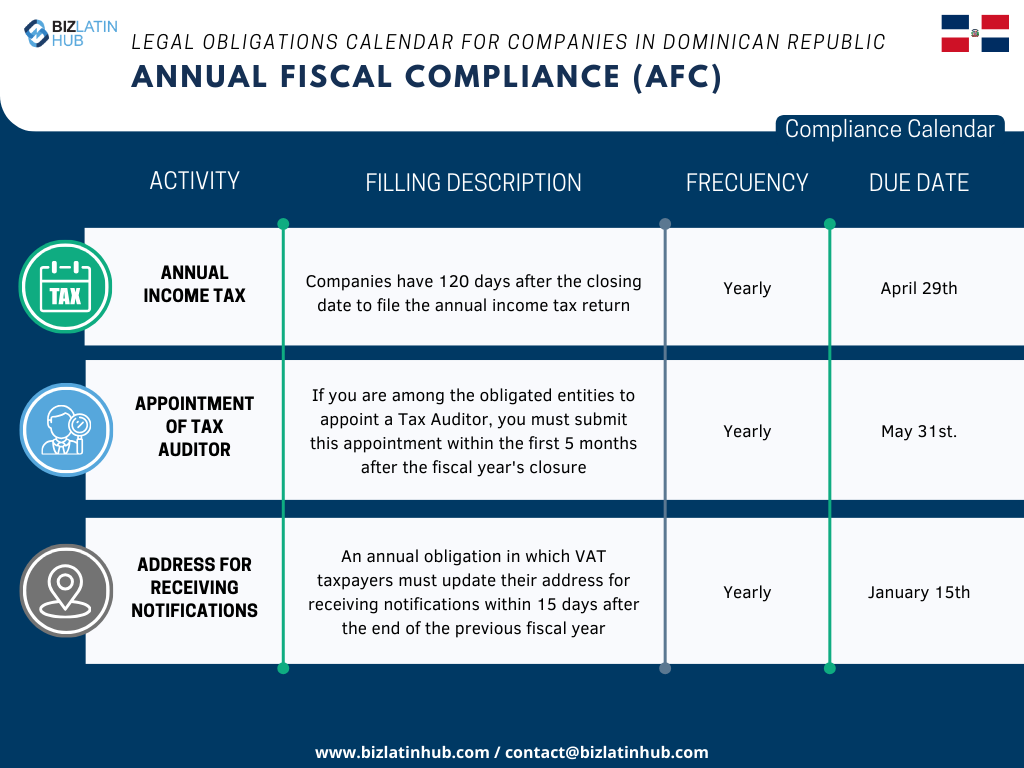

- Timely disbursements: Service providers manage salary disbursements, tax returns and social security contributions in a timely manner, avoiding potential penalties.

- Policy compliance: They help formulate comprehensive policies on leave, compensation and other payroll issues, ensuring regulatory compliance.

Can payroll outsourcing save costs for businesses in Dominican Republic?

Yes, although outsourcing incurs costs, it can be more cost-effective than maintaining an in-house payroll team. Savings can include reduced recruitment, training and operating costs.

How can businesses ensure data security when outsourcing payroll in the Dominican Republic?

To ensure data security when outsourcing payroll in Dominican Republic, follow these guidelines:

- Opt for trusted providers: Choose trusted outsourcing companies that are recognized for their strict security measures.

- Use secure systems: Ensure that vendors employ secure systems to manage sensitive employee data, thus reducing the risk of a breach.

- Establish confidentiality agreements: Establish explicit confidentiality agreements with the outsourcing partner to safeguard confidential information.

- Conduct routine audits: Periodically review data processing processes through audits to detect and rectify vulnerabilities.

- Adhere to regulatory standards: Ensure strict compliance with the country’s data protection laws to maintain legal obligations.

Biz Latin Hub offers payroll outsourcing in the Dominican Republic

At Biz Latin Hub, we support investors and companies doing business in Latin America and the Caribbean with a comprehensive portfolio of back-office services that includes accounting & taxation, company formation, legal services, hiring & PEO, and visa processing.

With teams in place in countries around the region, we also specialize in multi-jurisdiction market entry.

Contact us today to find out more about how we can support you with payroll outsourcing in the Dominican Republic, or any other service you may need.

Or read about our team and expert authors.