As the eighth largest economy in Latin America, investing in Ecuador allows businesses to share in steady economic growth. Its government is open to foreign investment, and knowledgeable local legal and financial experts help to simplify the company formation process.

It’s important to know your remuneration obligations as a company in Ecuador. Read on to learn how to pay your employees and stay compliant with financial regulations.

Employment Law Ecuador – Get the paperwork done properly

Ecuador’s legal and financial regulations may be complex for some foreigners and can change frequently. Seeking reliable, qualified legal assistance for this process is important in ensuring your company stays compliant and follows due process.

The Ecuador Ministry of Labor (Ministerio del Trabajo) supplies a standard format for employee contracts. While companies may write their own contracts individually, all contracts must be uploaded to the Labor Ministry’s website.

Contracts for employees include a probation period of three months. During this probation period, employers can terminate the contract without severance. Companies can offer short-term contracts up to six months, as well. However, be aware that employers must pay people on these contracts an additional 35% of the agreed salary.

On the other hand, foreign employees need to obtain a work visa in order to work in Ecuador for three months or more.

Setting up payroll with your RUC

Your company needs to obtain an Ecuadorian Tax Identification Number (known as RUC or Registro Único de Contribuyentes) in order to set up payroll. You’ll then need to upload employee information into systems governed by the Labor Ministry and Social Security. This includes contracts and can be done via the respective institutions’ websites. Your tax ID or RUC is key to gaining access to these systems.

Paying your staff

Common business practice in Ecuador is to pay employees twice a month, though this isn’t compulsory. The minimum wage in Ecuador is US$ 394,00 a month.

Ecuador’s working week is 40 hours over the five weekdays. Overtime rates apply for those working over 40 hours per week. Overtime rates are dictated by employee’s after-hours schedules. The rates range from a 25-100% increase in wage based on these schedules and depending on particular cases.

Employers must pay reserved funds to employees after their completion of the first year of employment. This should be paid at a rate of 8.33% of the gross monthly salary. The employee may choose to receive monthly payments of the reserved fund or accumulate it in Social Security.

Long-service employees (employed for more than 20 years) are also entitled to a private retirement pension.

Some companies also choose to offer private medical insurance benefits. This is not mandatory.

Tax requirements

Income tax rates are scaled up to 35%. People earning under USD $8,570 are exempt from Income Tax. People working in Ecuador for less than six months are considered non-residents, and therefore pay a flat Income Tax rate of 22%.

Employers are responsible for calculating the income tax to be deducted from employees’ pay. Companies withhold the income tax, which needs to be deducted from employee wages on a monthly basis. Employers must pay this monthly amount to the Ecuadorian tax authority, “Servicio de Rentas Internas”. The tax year runs from 1 January to 31 December.

Companies also contribute to social security at a monthly rate of 11.15%. Employee contributions are at a rate of 9.45%. Total monthly contributions equal 21.60%.

At the end of each tax year, employers must complete and submit an income tax form, known as Form 107. This demonstrates proof of employers’ withholdings of Income Tax.

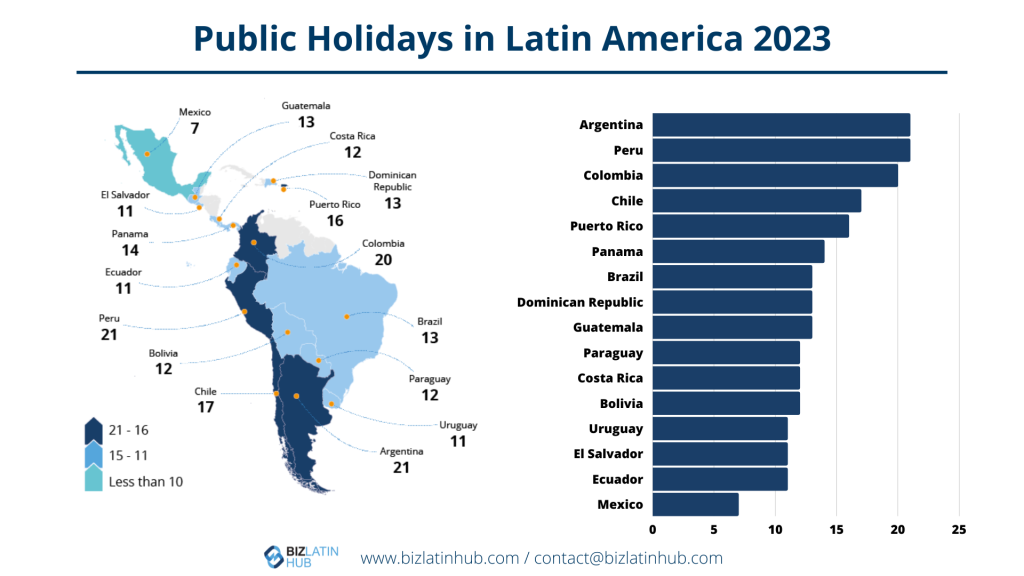

Annual leave (including rest days) is legally set at 15 days after one year of employment. After five years of employment, employees are entitled to one extra day per year up to an additional 15 days. Ecuador also observes 12 national holidays.

Employees are entitled to sick leave of up to two months at 50% of their salary. Employers must certify sick leave of less than three days with the social security medical centre. Sick leave beyond the first two months is usually paid by social security, as long as the employee is registered with the social security office.

Employers must offer up to 12 weeks paid maternity leave. Employers must pay 25% of the person’s salary during this time. The other 75% is paid by social security. Mothers are also entitled to nine months of shortened work days (six hours as opposed to the full eight). On the other hand, paternity leave has a cap of 10 days.

If a company terminates an employee’s contract while they are pregnant, the employee is entitled to a settlement of 12 salaries additional any other terms of the settlement.

Monthly and annual bonuses (13th and 14th salary)

Staff in Ecuador are entitled to two extra bonuses, known as the 13th and 14th salaries.

The 13th salary is an annual bonus companies pay their staff at the end of each year. The amount should be paid in full by 22 December – although, note that employees can choose to have this bonus paid to in monthly portions. The total of the 13th salary is calculated based on the individual employee’s overtime, bonuses and commissions accumulated throughout the year.

The 14th salary is a bonus equal to the current amount of the legal minimum wage. Depending on the location of the employee’s workplace, the 14th salary should be paid in either March or August of each year.

If employees are not union members, companies are not legally bound to consider particular annual raises or bonuses.

Need assistance? Get in touch with us

Ecuador’s steadily-growing economy makes it an attractive place for establishing yourself and your company. However, its complex legal framework around company formation and financial reporting require careful attention. Consulting an Ecuadorian business expert will ensure your organization remains compliant throughout your setup process.

At Biz Latin Hub, we offer tailored business solutions to foreign investors looking to do business in Latin America. Our Ecuador office is well-equipped with the expertise to support you during the company formation process. Reach out to our team today. We’re dedicated to ensuring you have the best possible start.