Businesses in Paraguay face a unique challenge in navigating corporate compliance. The Paraguayan legal framework, established by laws like Law No. 6480, plays a crucial role in governing corporate entities. This article will delve into the essentials of ensuring that businesses meet compliance requirements through an effective entity health check process.

Understanding the Paraguayan legal framework is essential for compliance. Key laws and regulations, including those on simplified share companies and the register of legal entities, form the backbone of corporate governance. This guide will explore these aspects to help businesses maintain compliance and mitigate financial risks.

Attaining corporate compliance goes beyond legal understanding; it involves adopting effective strategies and leveraging local expertise. The article will cover essential procedures, risk management strategies, and the role of local advisory services. Read on to grasp how corporate compliance can safeguard business reputation and financial health.

Importance of Corporate Compliance in Paraguay

Corporate compliance in Paraguay is vital. Strong economic growth makes Paraguay attractive for businesses. This increases the need for compliance to manage risks. Corporate secretarial services help in this area by mitigating business compliance risks.

In the 1990s, Paraguay faced financial challenges. It made fiscal adjustments in the early 2000s. These changes underscored the need for effective compliance frameworks.

Here is a list of reasons why corporate compliance is essential in Paraguay:

- Economic Growth: Paraguay has a consistent growth rate of 4.5%, as noted by the World Bank.

- Investment Attraction: Compliance ensures a stable environment for investment.

- Risk Management: It reduces potential risks and reputational damage.

- Adaptability: Businesses must adapt to changing regulatory requirements.

Compliance professionals and teams play a key role. They conduct risk assessments to understand legal compliance needs. These efforts ensure financial stability and a healthy risk profile for businesses. Adapting to government agency guidelines and international organizations is crucial. Maintaining compliance helps sustain Paraguay’s progress and supports its economic transformations.

Overview of Paraguay’s Legal Framework

Paraguay’s legal structure focuses on maintaining financial stability and transparency. The framework is shaped by laws that regulate financial institutions and ensure organizational transparency. It encompasses regulations for insolvency, bank recovery, and legal entity registration. These laws aim to ensure economic stability and compliance with international standards. Within this framework, the Banco Central del Paraguay (BCP) plays a significant role in managing distressed financial situations to secure economic resilience. Moreover, recent laws promote transparency in legal entities, with a focus on registering and governing the administration and control of companies. This includes mandates on providing current details concerning shareholders and individuals exerting control over businesses.

Administrative Register of Legal Entities

Paraguay has taken steps to enhance transparency through the Administrative Register of Legal Entities. This initiative was established under Law 6446/2019 and further regulated by Decree 3241. This register requires entities such as companies, associations, and foundations to disclose key details about their administration and control. Managed by the Autoridad de Aplicación, a body under the Ministry of Finance, the register ensures that entities update their ownership information regularly. This move promotes legal compliance and aligns with global trends towards greater corporate transparency. Companies must provide detailed information to stay compliant, ensuring that the country’s business environment remains open and accountable.

Ultimate Beneficial Owners

Identifying Ultimate Beneficial Owners is a crucial part of Paraguay’s compliance strategy. The law, established under Law 6446/2019 and regulated by Decree 3241, requires detailed reporting from entities operating in Paraguay. The Ministry of Finance oversees this process through its newly established agency. This rule enforces the disclosure obligations on all companies, associations, and legal persons. Financial institutions play a key role by identifying these beneficial owners in their Know Your Business processes. This helps prevent illegal activities and associations with sanctioned individuals. By focusing on beneficial ownership, Paraguay aligns with international financial regulations, enhancing its reputation as a transparent and investor-friendly nation.

Paraguayan Entity Health Check Essentials

Paraguayan entity health checks play a vital role in ensuring compliance for businesses. Independent auditors with local expertise conduct thorough reviews. They examine a company’s legal and accounting records. These checks aim to assess a company’s compliance ‘health’ to mitigate risks of penalties. Auditors delve into various aspects like financial transactions, meeting minutes, and licensing agreements. The objective is to identify any non-compliance. Addressing potential legal or fiscal issues early on helps avoid fines or reputational damage. These checks focus on a company’s fiscal and legal conditions. They provide insight into any outlying requirements that must be addressed. This ensures continued compliance and business integrity.

Key Compliance Audits and Their Benefits

Compliance audits offer numerous benefits to companies. They enable businesses to verify conditions in business relationships. This is crucial for safeguarding against risks. Entity health checks highlight local fiscal and legal requirement faults. Identifying approaching deadlines minimizes financial penalties risk. Branch offices also benefit, ensuring adherence to compliance regulations. Non-compliance can adversely affect the organization. Startup companies find assistance in navigating distinct corporate laws. Compliance services aid in maintaining legal standing globally. They ensure efficient management of statutory registers and filings. By engaging in compliance audits, businesses protect their reputation and legal status.

Fiscal Audits: Reducing Financial Risks

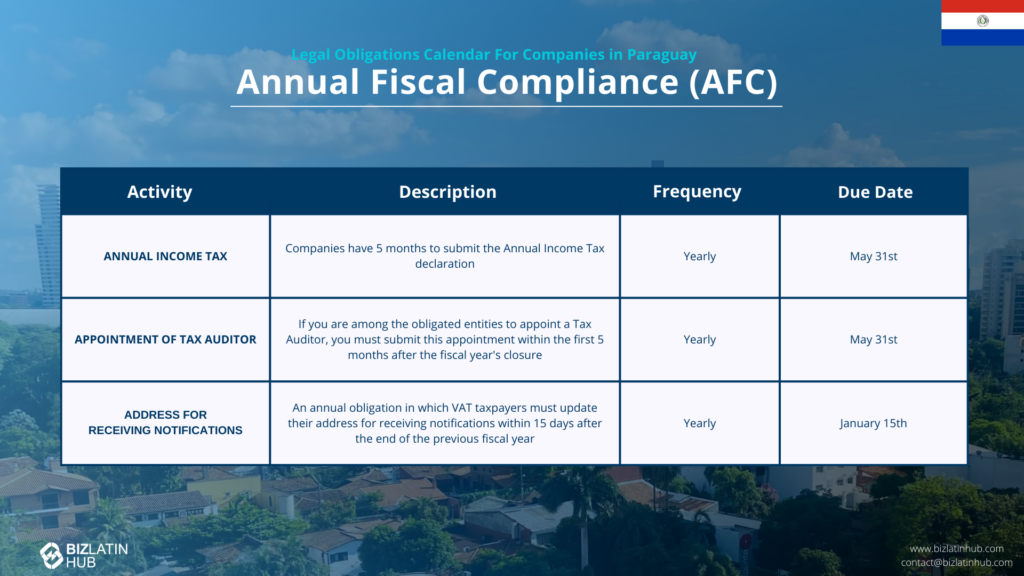

Fiscal audits are crucial for managing financial risks in Paraguay. These audits review a company’s tax obligations. Ensuring accuracy in annual and monthly tax declarations is the goal. Detecting unnoticed issues during fiscal audits is vital. It helps avoid complex situations with authorities. Fiscal audits can reveal mistakes in tax declarations. This can lead to overpaying or underpaying taxes. Many companies outsource these audits to corporate secretarial service providers. Holding a CCT – Tax Compliance Certificate is important. It is crucial for processes in both private and public spheres. Conducting fiscal audits is an essential practice for financial stability.

Compliance Audits: Safeguarding Reputation

Compliance audits serve as a protective shield for businesses. They guard against financial penalties and reputational damage. Operating in new regions presents compliance challenges. Non-compliance can lead to serious penalties. These range from warnings to fines, and even imprisonment. Such outcomes can damage an institution’s reputation severely. Entity health checks through local compliance audits help maintain reputations. This is vital, especially in regions like Latin America. Periodic health checks ensure adherence to local laws and regulations. Small and medium-sized companies benefit from compliance audits. They protect reputation without needing full-time compliance teams. By offering a view of a company’s local standing, audits provide peace of mind.

Understanding Local Regulations

In Paraguay, businesses must navigate a web of regulatory obligations to ensure compliance. These obligations cover both general and industry-specific regulations. Financial compliance audits help businesses meet these standards, ensuring operations align with both internal and external guidelines. In the banking sector, compliance is crucial. Banks must adhere to capital adequacy and liquidity requirements, set by Law No 861/96 and the Central Bank of Paraguay (BCP). The Superintendency of Banks oversees the capital adequacy ratio. It requires banks to balance their capital against risk-weighted assets. Entity health checks assess compliance with local laws, mitigating risks like financial loss or reputational damage. In Latin America, non-compliance can result in serious penalties, including fines, reputational harm, or even imprisonment.

Paraguay Regulatory Landscape

Paraguay’s regulatory framework focuses on transparency and accountability for legal entities. The Administrative Register of Legal Entities and Ultimate Beneficial Owners, established by Law 6446/2019, targets Paraguayan legal entities. This law, regulated under Decree 3241, requires companies to disclose detailed information about shareholders and managing personnel. This information is managed by an agency within the Ministry of Finance. Companies with foreign capital must keep updated records on shares, capital quotas, and local powers. Law No 861/96, a key piece of regulation, governs bank insolvency. It gives the Central Bank of Paraguay the authority to intervene when necessary. Paraguay’s commitment to mitigating business compliance risks makes it an appealing environment for investors.

Key Regulations for Corporate Governance

Corporate governance in Paraguay follows strict standards, especially in financial institutions. Resolution No 16, Act 04, dated 20 January 2022, sets these standards. It mandates that board members be qualified, understand their mission, and act with independent judgment. Directors must grasp the financial and commercial activities planned by the institution. This requires governance experience and independence from conflicting interests. Organizational structures must clearly define decision-making processes and guidance for avoiding influence. This clarity helps institutions comply with governance standards and maintain operational integrity. Decisions by directors must be free from external pressures that could create conflicts of interest. This protects the institution’s reputation and ensures decisions align with regulatory requirements.

Role of Corporate Secretarial Services

Corporate secretarial services in Paraguay are vital for managing business compliance risks. These services help businesses follow Paraguay’s corporate regulations. They are especially useful to startups during their initial phase. Secretarial services perform entity health checks. These checks ensure branch offices meet local regulations. This prevents financial penalties. Services also provide tools to track compliance, utilizing dashboards and analytics for effective data management. Thus, outsourcing corporate secretarial tasks improves legal compliance and reduces business risks.

Importance of Administrative Requirements

Administrative requirements play a key role in maintaining corporate compliance. They involve processes like data validation and matching with statutory records. This helps prevent material issues. These requirements are crucial during key business events, such as incorporation or dissolution. By implementing corporate health checks, businesses can address compliance lapses. This reduces the risk of financial penalties and reputational harm. Regular adherence to administrative protocols ensures companies meet their obligations. Operating in regions with distinct legal systems demands thorough compliance to avoid non-compliance issues.

Maintaining Effective Record-Keeping

Effective record-keeping is essential under multiple regulations. The EU-General Data Protection Regulation (GDPR) mandates data protection measures for EU individuals’ information. The Sarbanes-Oxley Act (SOX) requires public companies to securely store electronic financial records. This includes monitoring and auditing activities. The Payment Card Industry Data Security Standard (PCI DSS) demands tracking of cardholder account activities to protect sensitive data. Also, U.S. persons offering services under Cuba sanctions must preserve travel licenses as per OFAC. Similarly, banks under NY Department of Financial Services follow 23 NYCRR 500 regulation. They annually certify their adherence to risk management programs. These measures ensure proper compliance record maintenance across multiple sectors.

Procedures for Conducting Entity Health Checks

Entity health checks are essential for businesses operating in Paraguay. These checks assess a company’s compliance with local government regulations. Ensuring compliance helps mitigate financial and reputational risks. They provide a comprehensive overview of a company’s fiscal and legal adherence. Health checks identify any faults or impending deadlines, keeping companies aligned with requirements. Regular health checks in Paraguay maintain a business’s standing with government agencies. This practice safeguards against sanctions and legal complications. Companies can outsource these checks to local experts, enhancing adherence to local laws. Timely preparation and filing of tax declarations are a crucial part of the health check process. Maintaining regulatory compliance helps uphold a company’s reputation.

Step-by-Step Health Check Process

Entity health checks, also called corporate health checks, are detailed reviews of a company’s operations. Independent auditors with local expertise conduct these checks. They examine legal and accounting records, such as financial transactions and meeting minutes. The objective is to assess compliance with legal and fiscal obligations.

Compliance specialists play a crucial role in this process. They identify potential non-compliance issues, which helps prevent fines or penalties. This proactive approach protects the company’s reputation and financial status. The checks address both fiscal and legal conditions, providing a thorough compliance overview.

Through detailed analysis and reporting, health checks detect and rectify breaches. Compliance, governance, and control issues receive attention. This careful examination ensures that companies maintain a robust compliance status.

Implementing Best Practices for Compliance

Implementing compliance best practices involves clear communication. Companies must inform customers about U.S. sanctions compliance obligations. Customers should agree in writing not to violate OFAC sanctions. This agreement is essential in industries like banking and securities. Due diligence is a key best practice here.

Firms engage in thorough examinations, using questionnaires and certifications. This helps identify and manage relationships with customers linked to sanctioned parties. Companies conduct enhanced due diligence for high-risk customers. This may involve restrictions on certain products or services.

Regular entity health checks are another best practice. They help firms stay compliant with local regulations, reducing financial and reputational risks. Multinational companies often have teams devoted to compliance. These teams conduct regular checks to avoid major non-compliance-related losses. Small to medium-sized enterprises also benefit from annual health checks. Regular reviews ensure adherence to regulations and favorable outcomes.

Risk Management Strategies

Risk management is crucial for organizations to maintain stability and avoid unnecessary threats. A risk-based approach helps in making compliance more predictable. Companies should focus on sanctions compliance programs. These programs help guard against risks linked to regulatory breaches. Transaction screening is vital. It helps identify problematic payments and avoid penalties. Implementing real-time screening data is important. This helps manage changing sanctions and ensures compliance.

Identifying and Mitigating Compliance Risks

Companies face many compliance risks. Associating with the wrong partners can lead to trouble. Risk and compliance checks help. They identify the strengths and weaknesses of business partners. Sanctions compliance programs are key. They need to include both customer and transaction screening. This helps identify payments or connections with targeted individuals. Companies should be aware of economic sanctions. Effective compliance strategies can prevent significant penalties.

Utilizing Advisory Services for Compliance

Advisory services offer great benefits for businesses. They guide companies through complex sanctions regulations. By using these services, companies can stay informed about changes in rules and compliance requirements. This helps in managing risk exposure better. Advisory services offer legal opinions. They ensure that financial transactions comply with sanctions laws. Regular compliance checks help avoid financial and reputational risks. Working with local advisors ensures that companies meet both local and international standards. This collaboration enhances risk management and compliance efforts.

The Role of Local Advisory Services

Local advisory services in Paraguay are vital for businesses seeking compliance. These services help companies meet both internal and external standards. Experienced advisors assist with compliance audits and identify potential issues. This ensures that businesses operate smoothly and avoid regulatory pitfalls. Local advisory services provide guidance on international taxation, helping businesses minimize costs and grow. Companies like Biz Latin Hub offer expert legal and business advice. With decades of experience, they help businesses understand Paraguayan laws and regulations.

Choosing Trusted Local Partners

Partnering with trusted local firms is essential for business success in Paraguay. Such partnerships ensure companies meet local and international requirements. Reliable partners enhance risk management by ensuring adherence to regulations. This helps businesses prevent penalties and sanctions, safeguarding operations. Expert local partners provide corporate secretarial services, guiding businesses through tax regulations and the business culture. By handling compliance tasks, these partners allow executives to focus on core business strategies. Trusted partners are instrumental in avoiding complications during business expansions in Paraguay.

Leveraging Local Expertise for Success

Collaborating with local experts in Paraguay is key to a successful business expansion. Local corporate secretarial services ensure compliance with laws and regulations. These professionals manage risks by maintaining legal and corporate obligations. Partnering with local experts helps companies understand complex tax systems and business customs. This local knowledge is crucial in avoiding financial penalties due to non-compliance. By leveraging local expertise, businesses can focus on strategic growth plans. This approach leads to smoother operations and long-term success in the Paraguayan market.