It is essential for foreign companies and to thoroughly research their chosen Latin American country before setting up in it. Rushing into incorporation or setting up an office without due diligence can result in your company being taxed at high rates, including Value Added Tax (VAT) in Latin America. Understanding the nuances of VAT in Latin America is crucial to ensuring compliance with local regulations.

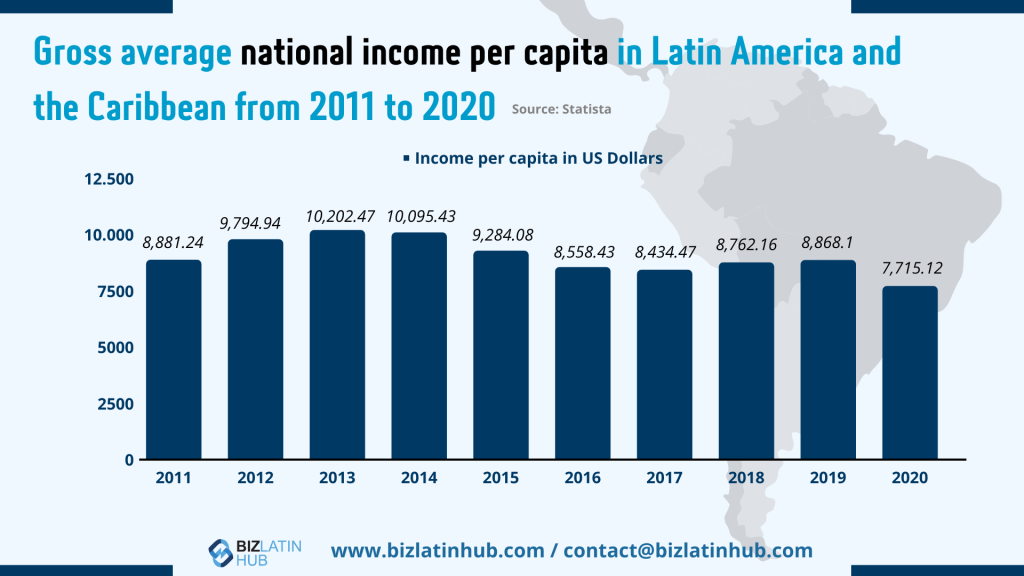

Benjamin Franklin once said that nothing is certain in life except death and taxes. The phrase may have been first uttered by one of the authors of the US Constitution, but nowhere is it truer than in Latin America. And unlike the United States (with comparatively low rates), Value Added Tax (VAT) in Latin America accounts for a significant amount of the taxes that governments in the region collect.

With some exceptions, the Value Added Tax (VAT) in Latin America has been steadily increasing over the past 30 years. VAT is the largest source of tax revenue on average in Latin America and the Caribbean (LAC), accounting for 27.7 percent of total tax revenue in 2019, according to the Organization for Economic Co-operation and Development (OECD).

Over the last three years (2019-2021), the estimated tax collection efficiency for VAT in the analyzed Latin American and Caribbean (LAC) countries is 55.3%, with the tax gap split into 18.6% attributed to the policy gap generated by tax expenditures and 26% to the inefficiency or non-compliance gap.

Top 10 countries with the highest VAT revenues in Latin America

The following is a list of nations with the highest percentages of overall tax take coming from Value Added Tax in Latin America, as of 2019 (the year for which the latest figures are available):

- Chile – 39.9%

- Guatemala – 38.8%

- Peru – 38.5%

- El Salvador – 37.5%

- Paraguay – 35.7%

- Dominican Republic – 34.7%

- Honduras – 31.8%

- Ecuador – 30.3%

- Colombia – 29.6%

- Belize – 29.3%

Regional average – 27.7%

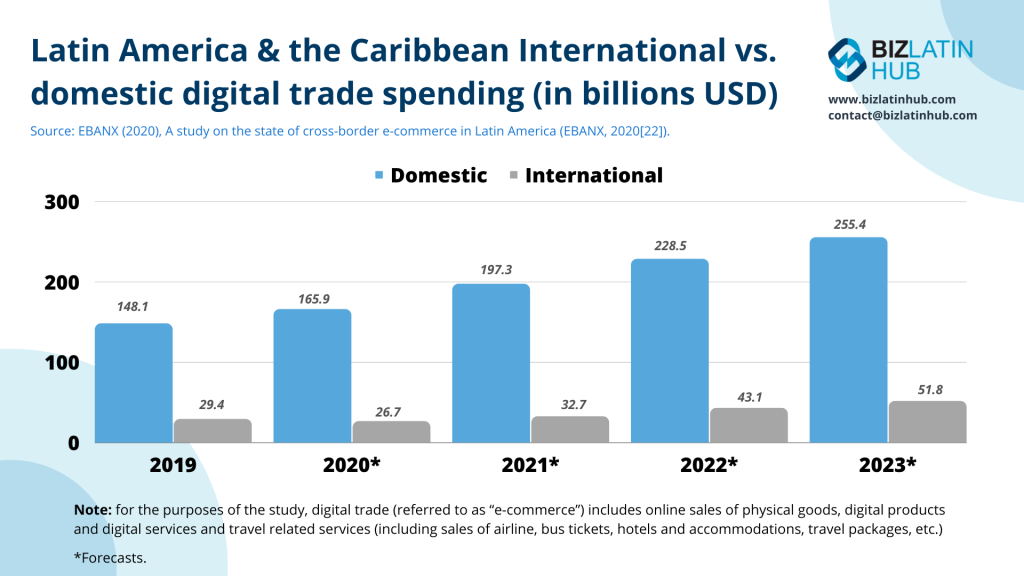

During the Covid-19 pandemic and the lockdowns that followed, online shopping, e-commerce, and other digital commercial activity skyrocketed in Latin America. Retail e-commerce sales shot up 36.7 percent in 2020, representing higher growth than any other region in the world at the time.

A year later, a wide-ranging study was jointly released by the OECD, the World Bank, the Inter-American Development Bank (IDB) and an organization representing regional tax authorities. Entitled the ‘VAT Digital Toolkit for Latin America and the Caribbean’, the study recommended that LAC governments reform their tax laws to apply VAT to all e-retail purchases/e-commerce sales.

“Latin America and the Caribbean could increase tax collection by USD$3 billion by applying the value-added tax to e-commerce, according to estimates from the IDB, one of the institutions involved in the development of this toolkit,” the IDB stated in June 2021.

“With regard to Value Added Tax in Latin America, “the main VAT challenges relate to the strong growth in online sales of services and digital products to private consumers (such as ‘apps’, music and movie streaming, gaming, ride-hailing, etc.) and to the exponential growth in online sales of low-value imported goods, often by foreign sellers, on which VAT is not collected effectively under existing rules,” the organization added.

Many nations in the region heeded the Toolkit’s recommendations, and as a result, Latin America now leads the world in taxing digital services.

Value Added Tax levied on digital commerce in Latin America

What follows are the percentages of VAT in Latin America levied on digital goods and services by country:

- Uruguay – 22%

- Argentina – 21%

- Chile – 19%

- Colombia – 19%

- Peru – 18%

- Honduras – 15%

- Mexico – 16%

- Bolivia – 13%

- Costa Rica – 13%

- El Salvador – 13%

- Ecuador – 12%

- Guatemala – 12%

- Panama – 10%

- Paraguay – 10%

While a more robust VAT regime in Latin America is good for governments’ tax revenues, it is a costly nuisance for businesses in the region – especially for small- and medium-sized enterprises (SMEs). Any kind of tax hike means the cost of doing business goes up, and as that cost is typically passed onto the consumer, it means that the cost of many goods and services goes up too.

Companies looking to avoid paying business- and consumer-unfriendly Value Added Tax in Latin America (as well as other taxes) should look into the various Free-Trade Zones (FTZs) that dot the region. They are designed to attract foreign direct investment by providing businesses large and small with tax exemptions on corporate taxes, capital gains tax, import duties and VAT, among others.

VAT in Latin America: Top 10 countries offering FTZ tax exemptions

What follows is a list of Latin American countries that have active FTZs in place, where foreign businesses enjoy many tax exemptions (including Value Added Tax in Latin America). Brazil tops the list, but will be enacting major change from 2026.

- Brazil.

- Chile.

- Colombia.

- Costa Rica.

- Dominican Republic.

- Ecuador.

- El Salvador.

- Guatemala.

- Honduras.

- Mexico.

FAQs on VAT in Latin America

Generally, yes, but it varies from place to place. There are some exceptions in certain industries and certain countries, so be sure to double check with a trusted local specialist.

The top five are:

Uruguay – 22%

Argentina – 21%

Chile – 19%

Colombia – 19%

Peru – 18%

Although our guide above gives you the basis for understanding VAT in Latin AMerica, we always recommend that you talk to one of our dedicated local specialists who can advise you on specific details relevant to your precise business. This especially applies to exemptions.

This depends on where you are used to. However, there is a broadly similar business culture throughout Latin America to what you might expect in the USA, Europe or Canada. Again, do make sure to consult a local specialist for precise and tailored advice, as while VAT exceptions are similar across juristictions there will be differences in the details.

Generally, yes. Most legal structures in Latin America come with built in liability protection, meaning that you are generally limited to the value of your investment as long as you are compliant.

Biz Latin Hub can help you with VAT in Latin America.

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in 18 countries in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about VAT in Latin America, our portfolio of services includes hiring & PEO accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding talent, or otherwise do business in Latin America and the Caribbean.

If this article about VAT in Latin America was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.