Technology is a tool with increasingly growing uses in society as well as in the workplace. Even the most traditional primary sectors such as agriculture and mining have found ways to incorporate technology to significantly improve efficiency. Financial services and banking is one industry that has evolved, possibly the most drastically, having changed the very fabric of the commodity it deals in – money.

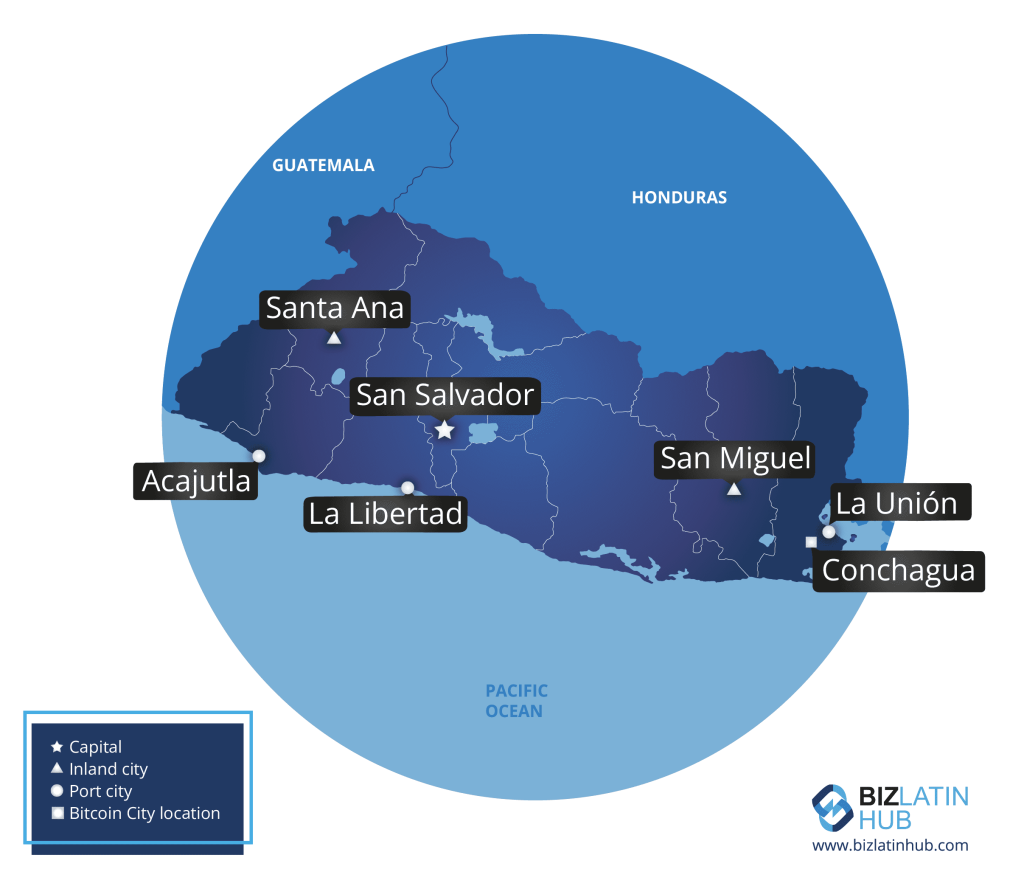

To keep up with the rapid advancement of technologies, governments are having to legislate at an unprecedented pace. With the goal to advance with their financial technology industry, El Salvador is undergoing major changes to its regulations and processes to align them with their resident technology and Fintech businesses. Outlined below is a detailed overview of the fintech industry in El Salvador, and with it, a comprehensive catalogue of the opportunities available to foreign investors.

What is Fintech?

As the world so rapidly changes, much due to the technology revolution, new business opportunities arise. Many of these opportunities lie within the bracket of financial technology. By incorporating technology into finance and banking, the market becomes more secure, more convenient, easier for customers to use whilst at the same time promoting a more transparent financial framework. Within the sector of fintech comes a whole host of different markets: the credit industry, online currency exchanges, online payment providers, digital banking and of course the lively cryptocurrency market.

Fintech companies demonstrate that there is a better method of managing money, in a more agile, comfortable and transparent way. Its strength is that it offers a quick solution, without the implementation and use of resources and money. Fintech also simplifies banking and finance, making the industry more inclusive and digestible.

These companies having the most success within the market are focusing their efforts on commercial activities such as large banking transactions, personal finance management, investment consulting platforms, and investment marketing.

Fintechs in Latin America and El Salvador

The Fintech wave is constantly growing, especially in the Latin American region – Argentina and Chile are two world leaders in the industry. However, though just the start of Central America’s emergence onto the market, countries such as El Salvador and Costa Rica are showing promising results. Investors are just becoming aware of Central America’s presence in the market and initial reports are positive. Costa Rica has 9 Fintech Startups, Panama with 6, Guatemala with 4, El Salvador has 3 and finally, Honduras and Nicaragua register one in each country.

Fintech firms have emerged in Central America out of necessity – to make payments, execute transactions, manage finances, and consult online in a simpler way. And although the types of services being provided seem to be limited to big banks, other non-banking companies are able act on these services too so long as they’re compliant.

The Salvadorian fintech “YoVendoRecarga”, arose as a result of the needs among Salvadorans to have a more efficient method of topping up their sim card balance. Federico Barillas, co-founder, and director of innovation at “Global Pay Solutions”, explains that this Salvadoran Fintech was designed to make owning a mobile phone an easier user experience using an easily-accessible tool, in this case, a smartphone. In addition, GlobalPay also has a web platform to receive payments and top-ups for Salvadorans abroad.

These Fintechs are working together with the four operators of the Salvadoran network (Tigo, Claro, Telefonica, Digicel) and is contributing not only to their own success but also that of the mobile networks. This demonstrates that by no means is fintech a stand-alone industry; it can perform a supporting role to almost any traditional industry.

With the simple use of an application, internet connection, and a payment card, Salvadorans can remain connected to cell phone data at all times. This is just one simple example of how technology innovation has enabled citizens to avoid going to their network provider’s shop every time they have to top-up their cell phones.

Future for El Salvador in the fintech industry

The Fintech industry is gaining ground as increasingly more companies and people carry out their transactions online, a trend that can be seen throughout Latin America; countries such as Mexico, Brazil, and Colombia lead the way in promoting the Fintech industry.

“In Latin America, new companies are emerging based on financial technologies. Virtual banks no longer require branches; but instead, from their virtual pages on the internet, you can subscribe to a savings account. In addition, new forms of payment are emerging, not necessarily from a physical credit or debit card, but from electronic purses ” said Oscar Cabrera, president of the Central Reserve Bank (BCR).

El Salvador, though not falling behind, is working alongside its resident fintech businesses in order to create a legal framework to adopt the industry into. As it currently stands, there is little/no regulation.

Given the growing number of fintech businesses and the expectation that the industry will continue to grow in El Salvador, work is being done with the BCR to create a regulatory framework. By evaluating the performance of the current fintech companies and assimilating the risks of the industry, the BCR is confident that they can come up with a regulatory framework that will encourage business whilst maintaining order and fairness.

The lack of a regulatory framework, if nothing else, demonstrates the newness of the industry within El Salvador. If that doesn’t spell opportunity, what does?

Invest in El Salvador’s most recent market boom

El Salvador is not only an exciting destination for business, but the nation has undergone massive improvements to its economic stability and legal fortitude, consequently reducing volatility on foreign investments. Fintech is the most recent update to El Salvador’s range of startup sectors. By gaining the first-mover advantage, your business can thrive in the expanse of market space available.

Biz Latin Hub specializes in assisting market entry to foreign in-coming businesses, providing a range of services from legal and accountancy to company incorporation and professional employment services. Get in touch with us today here at Biz Latin Hub to kick-off your Central American venture.

Learn more about our team and expert authors.