Choosing to open a corporate bank account in Panama can provide you with the financial infrastructure to support your business objectives and drive success in the region. Additionally, Panama is one of the best locations to incorporate a company as a means of protecting assets from government agencies. Biz Latin Hub provides expert assistance with our full suite of back-office services, ensuring a smooth entry into the Panamanian market.

Key takeaways on a corporate bank account in Panama

| Which are the best banks to open a corporate bank account in Panama? | Banco General. BAC International Bank. Banistmo. Credicorp Bank. Banco Aliado. Banco Nacional de Panama. Citibank. Banco Davivienda. Santander. BPR Bank. Scotiabank. BBVA Panama. Inteligo Bank. |

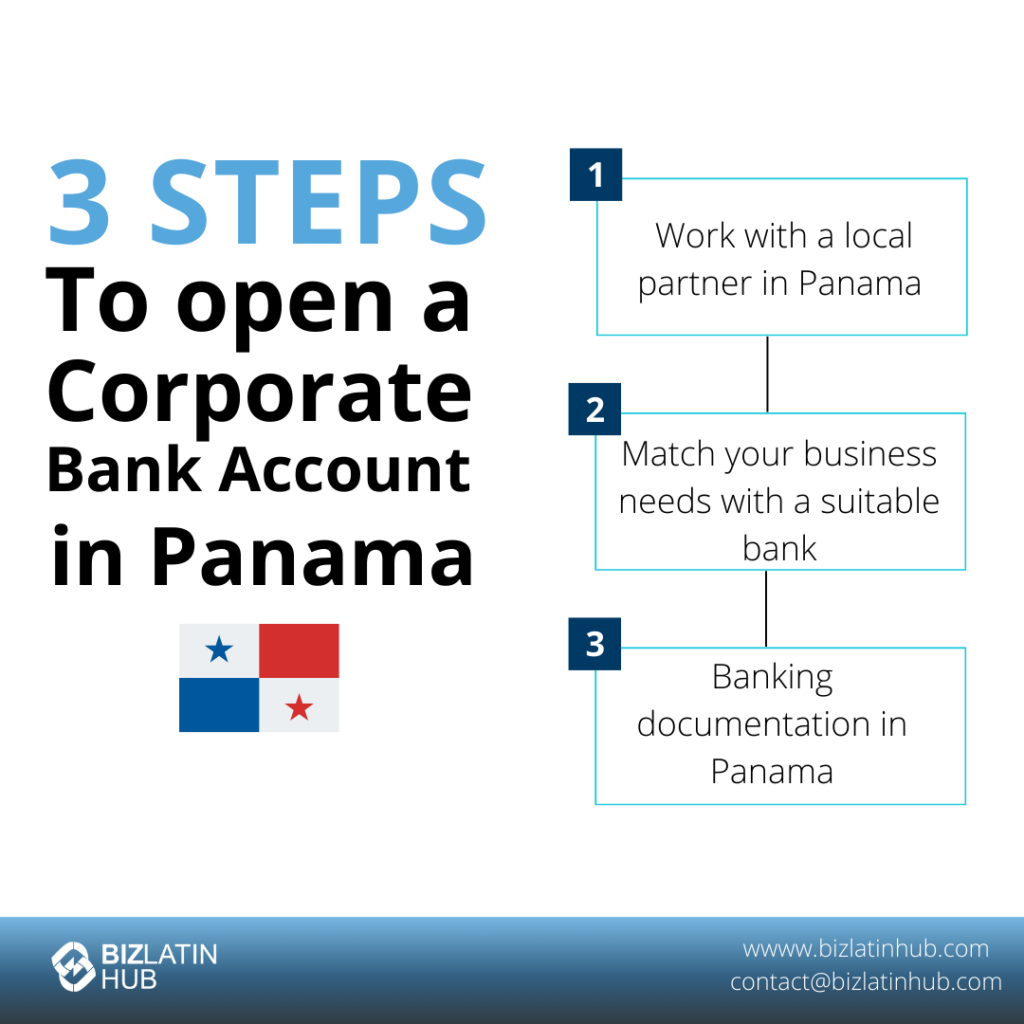

| The three step process to open a corporate bank account in Panama: | Step 1: Work with a local partner in Panama. Step 2: Match your business needs with a suitable bank. Step 3: Banking documentation in Panama. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| What documents are necessary when opening a corporate bank account in Panama? | Copy of the articles of incorporation of the company. Certificate of good standing for the company. Commercial license (where applicable). Bank reference letter. If the company doesn’t have a bank reference letter, the shareholders of the company will need to provide it. Evidence of income can be proven with a copy of the income tax declaration of the shareholders. Passport copy of all shareholders and members of the company. |

Open a Corporate Bank Account in Panama in 3 Key Steps

It is well known that in order to set up a business you will need a corporate bank account and Panama is no exception. However, the process is not as difficult as you may think, especially working with a specialist such as Biz Latin Hub.

- Step 1: Work with a local partner in Panama.

- Step 2: Match your business needs with a suitable bank.

- Step 3: Banking documentation in Panama.

Step 1: Work with a local partner in Panama

If you are looking for partners to work with as you begin the bank opening process, law firms or consultants will be your best options. Although opening a corporate bank account in Panama is relatively simple, there are some factors that could make the process more difficult if not taken into account, such as cultural and language barriers. For this reason, it is important to work with a local partner who can provide support throughout the entire process.

Step 2: Match your business needs with a suitable bank

Depending on the activities of the company, some banks are more flexible than others when it comes to opening investment accounts, flexible payment methods, international transfers, etc. Make sure you choose the bank that best fits your business needs for your corporate bank account in Panama.

Step 3: Banking documentation in Panama

Banks need proof that you are eligible to open a bank account and this applies to both personal and corporate accounts in Panama. Once you have gotten the necessary documents together (i.e valid passport, financial statements, bank and commercial references), the process for opening a bank account in Panama is relatively straightforward: filling out the paperwork and presenting the documentation to the bank.

In Panama, all documentation must be apostilled to comply with the bank’s requirements. Once all the requested paperwork and documents have been checked and approved, the bank will send a notification of the account opening.

Bank Options in Panama

Panama has a number of banking providers that offer good services to foreign companies. The best choice for your company will depend on your business goals and which bank’s services align with them best. The options for a corporate bank account in Panama are mainly with:

- Banco General.

- BAC International Bank.

- Banistmo.

- Credicorp Bank.

- Banco Aliado.

- Banco Nacional de Panama.

- Citibank.

- Banco Davivienda.

- Santander.

- BPR Bank.

- Scotiabank.

- BBVA Panama.

- Inteligo Bank.

Our Recommendation: Banco Aliado, Banistmo or Credicorp Bank have the best options for opening a corporate bank account in Panama.

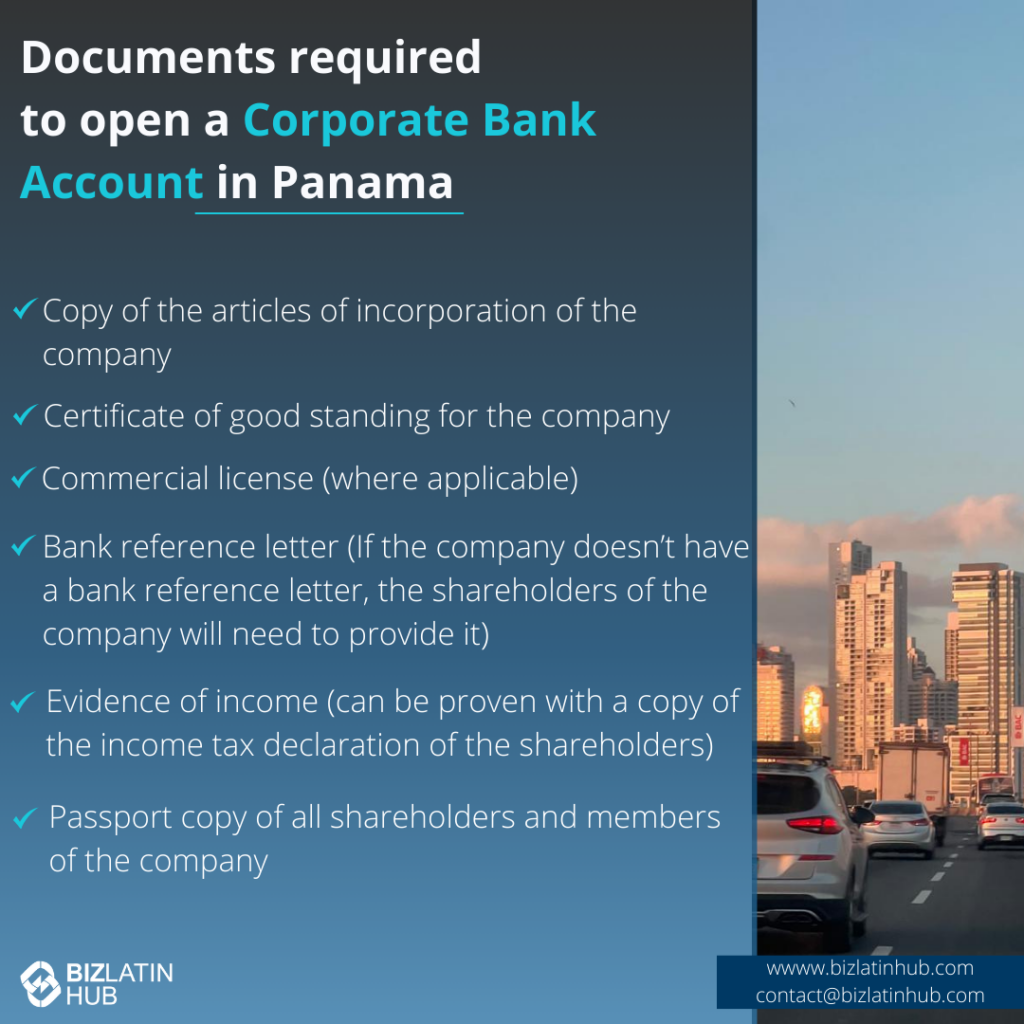

What Documentation is Required for a Corporate Bank Account in Panama?

Depending on the bank you choose to open an account with, the list of documents you will be asked to provide will vary. The following is not an exhaustive list but it outlines the main documents that are required to open the company bank account in Panama:

- Copy of the articles of incorporation of the company.

- Certificate of good standing for the company.

- Commercial license (where applicable).

- Bank reference letter. If the company doesn’t have a bank reference letter, the shareholders of the company will need to provide it.

- Evidence of income can be proven with a copy of the income tax declaration of the shareholders.

- Passport copy of all shareholders and members of the company.

FAQs on Bank Accounts in Panama

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Panama:

Can I open a corporate bank account online in Panama?

No. You can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA). However, the original bank application forms will need to be sent to Panama.

What documents do I need to open a company bank account in Panama?

The following documents are required to open the company bank account:

- Copy of the articles of incorporation of the company.

- Certificate of good standing for the company.

- Commercial license (where applicable).

- Bank reference letter. If the company doesn’t have a bank reference letter, the shareholders of the company will need to provide it.

- Evidence of income can be proven with a copy of the income tax declaration of the shareholders. Passport copy of all shareholders and members of the company.

Who can have access to a company bank account?

Any member of the company that is authorized by company shareholders can have access to the bank account.

What is the best bank in Panama for foreign companies?

We recommend the following banks for foreign companies: Banco Aliado, Credicorp Bank, or Banistmo.

Why do companies open bank accounts in Panama?

Companies choose to open bank accounts in Panama due to economic and political stability, the ability to hold currency in US dollars, the territorial taxation system, and banking privacy.

Does Panama have bank secrecy?

Yes. Law N° 23 of April 27th, 2015, which regulates money laundering prevention measures, states that the information obtained by a financial entity and the unit of financial analysis must be kept strictly confidential and may only be provided to third parties by order of the competent judicial authority.

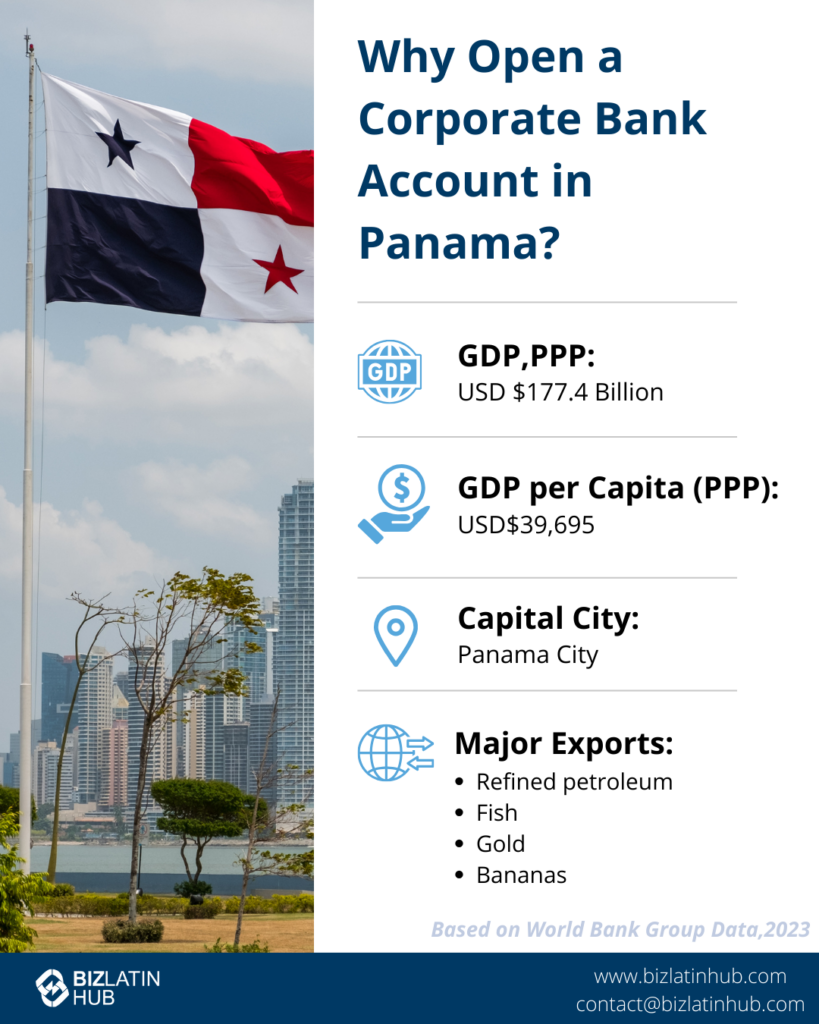

Why Open a Corporate Bank Account in Panama?

Panama is one of the fastest growing economies in Latin America, which continues to offer a favorable environment for investors. Despite global challenges, Panama’s economy has remained resilient. In 2023, Panama’s GDP grew by 7.5%, exceeding expectations for the third consecutive year. There’s never been a better time to open a corporate bank account in Panama and start doing business.

Opening a bank account in Panama is a critical step for investors, offering streamlined access to one of Latin America’s most dynamic financial hubs. With its U.S. dollar-based economy, Panama eliminates currency exchange risks, ensuring smooth transactions for foreign investors. The country’s banking sector is highly stable and internationally connected, providing secure and efficient financial services for managing investments in areas like real estate, logistics, and renewable energy

Investors can benefit from Panama’s privacy-focused banking laws and territorial tax system, which exempts foreign-sourced income from local taxation. This combination of stability, efficiency, and strategic advantages makes a Panamanian bank account a foundational asset for successful investment ventures.

Biz Latin Hub can help you set up a corporate bank account in Panama

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to open a corporate bank account in Panama, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about how to open a corporate bank account in Panama was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.