Setting up a bank account in Ecuador is essential to make financial transactions hassle free, ensuring you can manage your operational expenses, pay salaries and comply with local taxes on time. With business-friendly policies when you incorporate a business in Ecuador, your corporate bank account in Ecuador is an essential step in this process. Ecuador offers business-friendly policies and access to USD-denominated banking. Understanding documentation and compliance is key for foreign investors.

Key takeaways on setting up a bank account in Ecuador

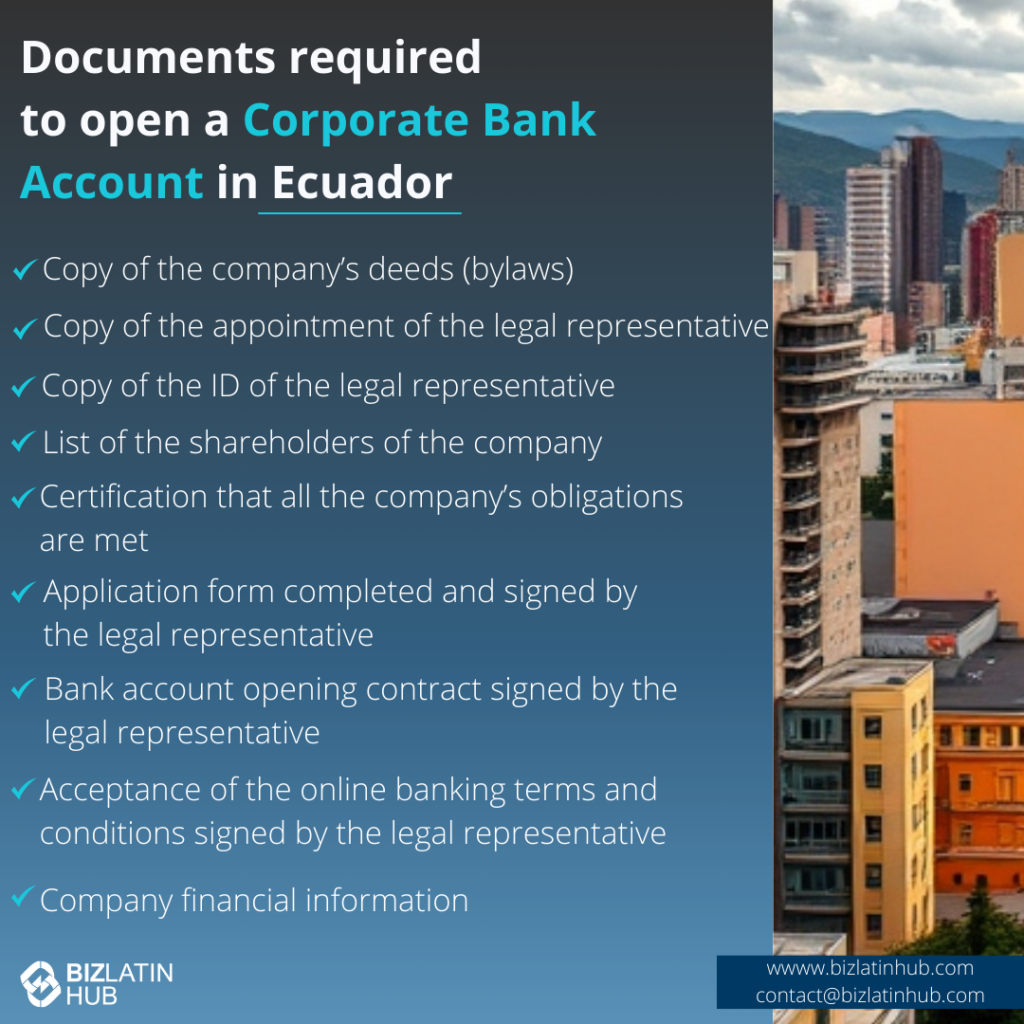

| What documents are necessary when opening a corporate bank account in Ecuador? | Copy of the company’s deeds (bylaws). Copy of the appointment of the legal representative. Copy of the ID of the legal representative. List of the shareholders of the company. Certification that all the company’s obligations are met. Application form completed and signed by the legal representative. Bank account opening contract signed by the legal representative. Acceptance of the online banking terms and conditions signed by the legal representative. Company financial information. |

| Which banks are best when setting up a corporate bank account in Ecuador? | Banco Produbanco. Banco Pichincha. Banco de Guayaquil. Banco del Austro. |

| The four step process to open a corporate bank account in Ecuador: | Step 1 – Choose your provider. Step 2 – Choose a bank account type. Step 3 – Fulfill requirements. Step 4 – Activate your account. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

Process to Open a Business Account

To open a corporate bank account in Ecuador you must follow these 4 steps:

- Step 1 – Choose your provider.

- Step 2 – Choose a bank account type.

- Step 3 – Fulfill requirements.

- Step 4 – Activate your account.

1. Choose your provider

The first step you should take is to determine which bank you want to open an account with. We strongly recommend that you review all the available options. This will help you choose the bank that best suits your company’s business needs.

2. Choose bank account type

Then, you will need to decide which kind of bank account you want to open. You may choose a savings or a checking account. Normally, if it is the first bank account of a new company, the company will only be allowed to open a savings account and not a checking account. This is due to the fact that a checking account requires a good credit record, which a newly formed company will not have. A checking account can be granted to a new company if the legal representative has a good credit history and banking record. However, this depends exclusively on the bank.

3. Fulfill requirements

Once you have decided which bank you will work with, and the type of account you want to open, you will have to hand over all the required documents as dictated by that particular bank.

4. Activate your account

Once you have fulfilled all the requirements, the account number will be granted. Then, the initial deposit must be made in order to activate the account. Depending on the bank, the initial deposit required to open a corporate bank account can vary from USD$30 to USD$2,000. With the account fully activated, the bank will help you create a username and password for the online banking system. Depending on the bank, once you have fulfilled their requirements, opening a bank account can take as little as 2 to 5 labor days.

Once you have completed the four steps outlined above, you are ready to begin using your company bank account. This is the last step in company incorporation. Your business is now ready to begin commercial operations and take advantage of all the business opportunities available in Ecuador!

Best Banks in Ecuador for Corporate Banking

Each of these banks has its own strengths and services designed to support international businesses. It is recommended that you explore each bank’s specific offerings, fees and requirements to determine which one best suits your company’s needs in Ecuador. Some of the more popular banks in Ecuador are the following:

1. Banco Produbanco.

2. Banco Pichincha.

3. Banco de Guayaquil.

4. Banco del Austro.

Unlike in other countries, it is rather easy to open a corporate bank account in Ecuador. If your company is newly formed, you may encounter some bank account limitations. However, after a certain period of time, once you have proven that the company is fully functional and that business transactions are being made, these limitations will be withdrawn.

Banco Pichincha, Banco Guayaquil, and Produbanco are preferred options. Most banks request in-person application as part of tax and accounting requirements in Ecuador.

Recommendation: We advise you to research each bank’s specific offerings and requirements to find the one that best suits your company’s needs.

Comparison Table:

| Feature | Ecuador | Colombia | Peru |

| Minimum Deposit | $500 | $300–$1,000 | $500 |

| Account Opening Time | 2–4 weeks | 2–3 weeks | 2–3 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Rare | Rare |

Required Documents for Foreign Companies

The most difficult part of opening a company account in Ecuador is putting together all the required documents. To formally request the opening of an account, you will be asked to hand over a number of financial and legal documents for the company. This may include the company constitution, RUC (tax ID), legal representative ID, shareholder documents, proof of address, and a business activity plan.

Each bank has its own policies, and may have different requirements for customers seeking to open a corporate bank account. The documentation requested varies bank-to-bank and all are regulated by the Superintendencia de Bancos. Foreign UBOs must complete full KYC, including affidavits, source of funds, and corporate declarations. But almost every bank will ask for and/or require the following:

- Copy of the company’s deeds (bylaws).

- Copy of the appointment of the legal representative, normally the General Manager, duly registered in the Mercantile Registry.

- Copy of the ID of the legal representative.

- List of the shareholders of the company.

- Certification that all the company’s obligations are met, granted by the Superintendencia de Compañías.

- Application form completed and signed by the legal representative.

- Bank account opening contract signed by the legal representative.

- Acceptance of the online banking terms and conditions signed by the legal representative.

- Company financial information.

The Ecuadorian government has put some policies in place in order to avoid money laundry practices. Therefore, depending on the activity of the company, the signing of some additional forms might be necessary. This may include forms like “Know your Client”, which provide more detailed information on the company, its shareholders, and/or business activities.

Additional FAQs About Business Banking in Ecuador

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Ecuador:

Most banks in Ecuador do not allow opening an account entirely online for companies. Often, the legal representative of the company must attend in person to sign certain documents and forms.

Once the company has been established, the following documents must be presented to your local bank:

1. Company Bylaws.

2. Appointment of Legal Representative.

3. Legal Representative ID.

4. Certification of Legal Existence.

5. Invoice or receipt of water or electricity service.

6. RUC (Tax ID).

Initially, only the legal representative. Subsequently, all the people designated by the legal representative.

The options are as follows:

1. Banco Produbanco.

2. Banco Pichincha.

3. Banco de Guayaquil.

4. Banco del Austro.

All types of companies must open a bank account in the name of the company to conduct business transactions and deposit the legal minimum incorporation capital. The bank account will also be used by the company to pay salaries to its employees and to carry out all transactions related to its commercial activity.

Yes. All financial entities maintain bank secrecy. This implies the secrecy of all deposits and transactions of any nature received by a private or public bank, and prohibits these entities from providing information related to any financial operation if the information is not delivered to the bank account owner, or whoever has been expressly authorized by them.

Yes, provided it has a registered RUC, local representative, and all corporate documentation in Spanish and notarized if required.

Yes. Most accounts are in USD, the official currency, though other currencies may be available on request.

Yes. All companies must have a local legal representative to interact with tax and banking authorities.

2 to 4 weeks depending on bank verification and completeness of documents.

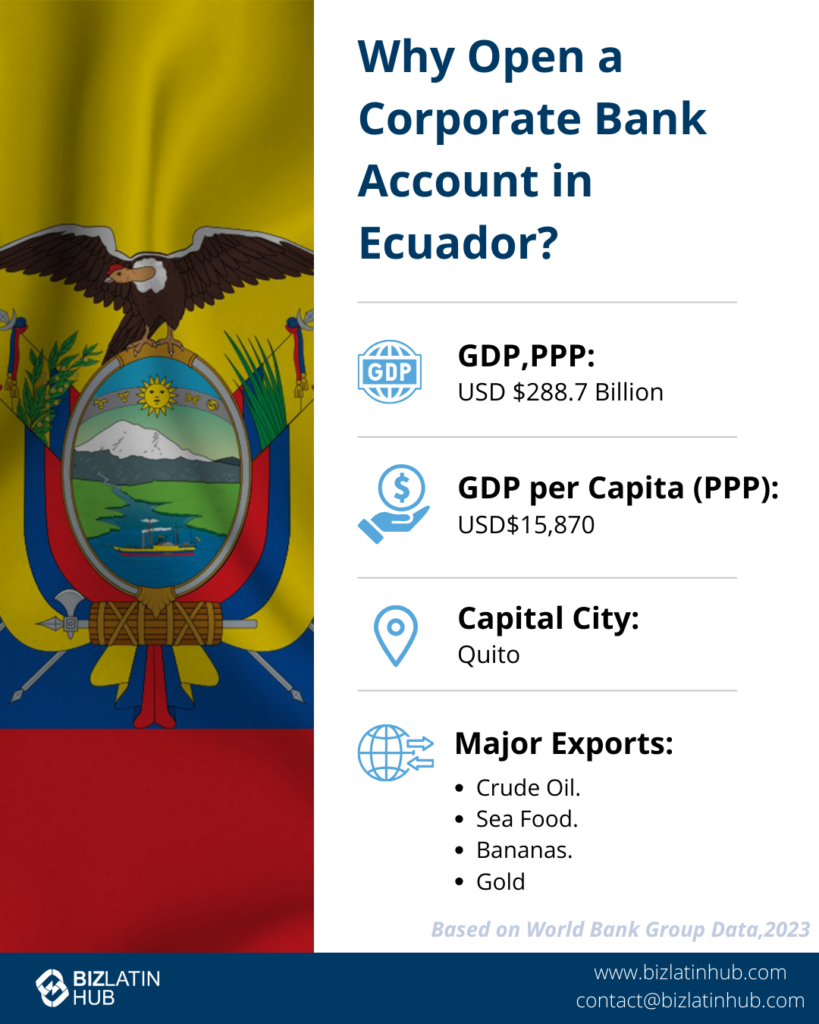

Why Open a Business Account in Ecuador?

Opening a bank account in Ecuador is a crucial step for investors, providing easy access to a dollarized economy and diverse opportunities. It streamlines transactions in U.S. dollars, avoids currency exchange complexities, and ensures compliance with Ecuador’s financial regulations, enabling smooth investments in sectors like agriculture, energy, and tourism.

A local account also boosts credibility with Ecuadorian businesses and authorities and offers tailored financial products and services. It allows investors to effectively navigate the regulatory environment, adapt to market conditions, and capitalize on Ecuador’s growing economic opportunities, ensuring a solid base for success.

Biz Latin Hub can help you open a corporate bank account in Ecuador

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of how to open a corporate bank account in Ecuador, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about opening a corporate bank account in Ecuador was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.