Find out about the new legal entity in Paraguay – the EAS, or Simplified Shares Company – and what this entity can offer business owners entering the market.

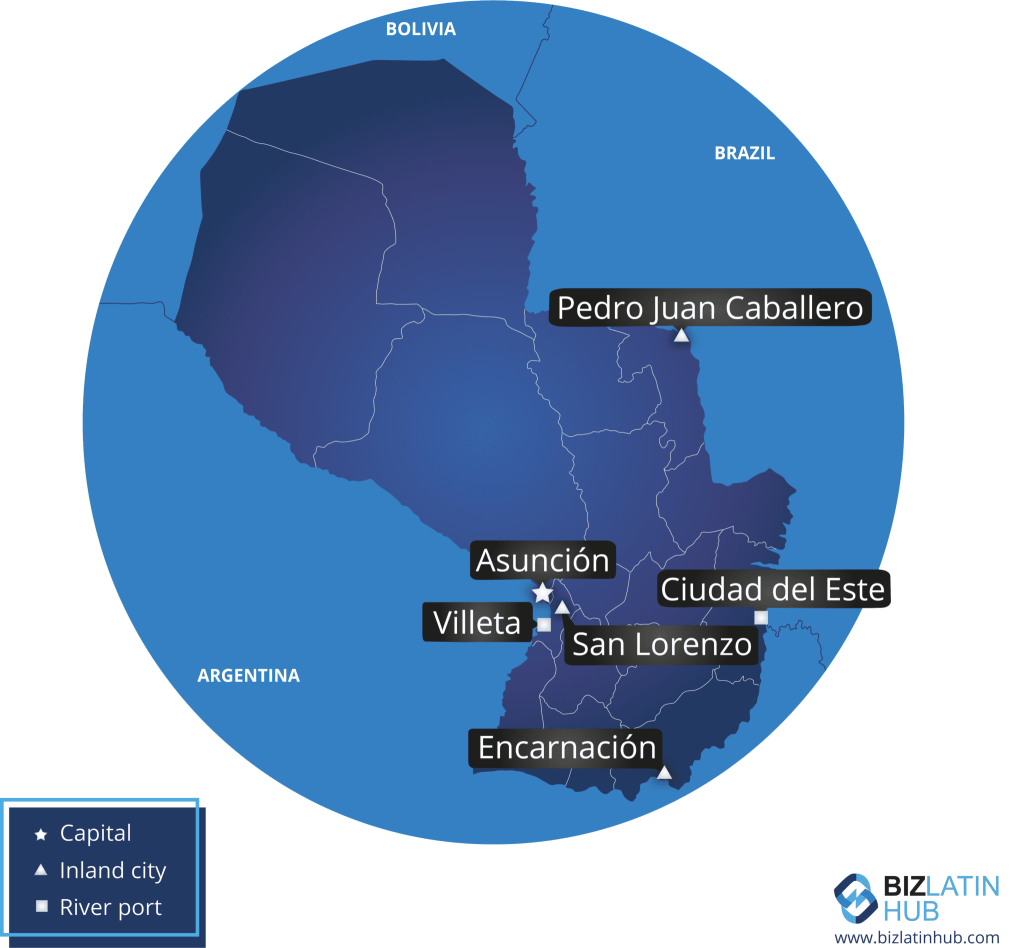

Paraguay is one of the most underrated jurisdictions in Latin America for doing business. The country has demonstrated astonishing annual rates of economic growth, averaging around 4% between 2015-2017 and increasingly diversifying market opportunities, including blossoming agricultural, service and mining sectors. Although it is enticing, it can be difficult to do business in a country where one does not fully understand local law and regulations.

With the purpose of encouraging entrepreneurs to enter the market, and reduce bureaucracy, the Paraguayan government has encouraged simplification in the creation of legal entities.

Recently, Paraguay introduced the Empresa por Acciones Simplificadas (EAS), otherwise known as a Simplified Shares Company entity for business. While the law establishig this entity has yet to fully enter into force, this move to open the business environment in Paraguay is promising for foreign executives looking to expand into the country.

The Empresas por Acciones Simplificadas (EAS) in Paraguay was established through Law No. 6480/2020 and is an excellent tool for business development in Paraguay.

As a Simplified Shares Company, the entity’s main characteristics and innovations to benefit business include:

1. Requirements to incorporate an EAS in Paraguay

An EAS in Paraguay can be incorporated by one or more physical or legal persons. It is the first corporate type legal entity in Paraguay that can be incorporated with a single partner.

In all cases, a legal representative must be appointed.

Business owners can incorporate their EAS in Paraguay by a contract or unilateral act that consists of either:

- Public Deed or;

- Private instrument with signature certification by a notary public or the registry official of the office before which the registration is made.

In the event that the constitutive act provides assets that are required for the transfer of public deed, this formality must be completed in order to incorporate and register the EAS in Paraguay.

Required documentation to incorporate the Simplified Shares Company (EAS) in Paraguay

The constitutive act of the company, without prejudice to the clauses that the members of the EAS decide to include, must indicate the:

- Name, identity document and address of the members of the company.

- Name of the legal entity followed by the words “Empresa por Acciones Simplificadas” or its initials (EAS).

- Main address of the company.

- Purpose of the company.

- Duration of the company, which will be understood to be indefinite in the event that the constitutive act does not contain a provision in this regard.

- Share capital, the issued, the subscribed and the integrated, the class, number and nominal value of the shares and the form and terms in which they must be integrated.

- Rules according to which the profits and the share of each member in them and the losses must be distributed.

- Organization of the administration, of the meetings of members of the company and, where appropriate, of the inspection.

2. Registration

The application for registration must be entered solely and exclusively through the Unified System for Opening and Closing Companies (Sistema Unificado de Apertura y Cierre de Empresas, or SUACE).

Executives must register the statutes of the EAS (drafted in accordance with the law), as well as any amendments to the statutes and their liquidation with the Ministry of Finance. The newly registered legal entity in Paraguay will the be communicated to the General Directorate of the Public Records, or Dirección General de los Registros Públicos.

Unlike other companies, the EAS acquires its legal personality once registered in the dependencies of the Ministry of Finance and not in the Public registries; therefore, the processing time is faster and businesses can start operations more quickly.

The Simplified Shares Company in Paraguay will always be of a commercial nature and will be governed by the tax regulations applicable to the nature of their activities.

Note: A one-person EAS cannot constitute or participate in another one-person EAS in Paraguay.

The capital for an EAS in Paraguay will be divided into shares that must be registered, endorsable or not, ordinary or preferred or with special voting rights. The subscription and integration of capital may be carried out under conditions, proportions and terms different from those provided for in the regulations contemplated in the Civil Code for corporations. In no case may the term for the integration of shares exceed 2 years.

The responsibility of the members of the EAS legal entity will be limited to the amount of the contributions made by them to the company.

4. Administration and inspection

The Law recognizes two mandatory governing bodies for this new legal entity in Paraguay:

- The meeting of EAS members (with equal powers of the Ordinary and Extraordinary Assemblies of Public Limited Companies), and

- The legal representative.

There is no obligation to have neither an administrative body (similar to a board of directors) nor an inspection body (such as the Trustee or the Supervisory Board).

The meetings of EAS members must be called in writing to the members’ addresses 5 working days before the meeting date. There is no obligation to publish this notification in public newspapers. The meetings of the members of the EAS and the management body (if applicable) can be held remotely and recorded in minutes with the signature of a single member.

The liability of the administrators and legal representatives will be regulated by the rules that govern the administrators of Public Limited Companies in the Civil Code.

5. Accounting compliance

The EAS legal entity in Paraguay must keep accounting and company books.

However, the dependency of the Ministry of Finance may regulate and implement mechanisms to supply the use of said books by digital means.

The EAS must keep the following corporate and accounting records:

- Minutes book of the governing body

- Share registration book

- Minutes book of the administrative body

- Daily book

- Inventory book.

They must also present their financial statements in accordance with current regulations.

6. Simplification of bank procedures

Financial institutions must provide mechanisms that enable the EAS in Paraguay to open an account within a maximum period yet to be established by regulation. The intention is to offer executives a faster incorporation process for the EAS in Paraguay and minimum wait time to begin operations.

In all matters not contemplated in this Law, the rules provided for corporations in the Civil Code, with its modifications and regulations, will be applied in a supplementary manner.

Note: Some legal aspects yet to be defined

As a newly established legal entity, some regulatory requirements for the EAS in Paraguay are still pending. Once the publications of the regulatory resolutions are published, the law will be in full force.

Incorporate your new legal entity in Paraguay and protect it from non-compliance and other potential risks by seeking out a trusted team of legal and accounting specialists for support. Engage with a local multilingual team experienced in conducting thorough checks on company and employment circumstances in Paraguay, so you can make informed decisions about your business venture.

At Biz Latin Hub, our team of bilingual professionals in Paraguay has the knowledge and experience in incorporating your new company and ensure it is compliant with local law while it makes new connections in Paraguay. Our legal, accounting, and payroll specialists support new market entrants and existing companies looking to acquire new businesses or hire new staff.

Contact us now to incorporate your Simplified Shares Company in Paraguay.

Learn more about our team and expert authors.