Nearshoring in Latin America and the Caribbean could increase exports of goods and services from the region by up to US $78 billion, with Central American and Caribbean economies particular beneficiaries, according to projections made by the Inter-American Development Bank (IDB).

The automotive, textile, pharmaceutical, and renewable energy industries stand to benefit significantly, IDB President Mauricio Claver-Carone reportedly said during an event held on the sidelines of the 2022 Summit of the Americas, being staged in Los Angeles between June 6 and June 10.

“Growing environmental concerns, coupled with the health crisis and Russia’s recent war in Ukraine, have created a context where the region can contribute to the global economy and the fight against inflation through increased participation in global supply chains in a sustainable and equitable manner” Claver-Carone was quoted as saying in an IDB press release.

SEE ALSO: A PEO in Latin America offers rapid international expansion

The $78 billion figure is made up of an estimated $64 billion in goods and $14 billion in services, with the IDB analysis suggesting that Mexico stands to be a particularly big winner, with a potential increase in exports of goods totalling over $35 billion – or 55% of the total regional increase.

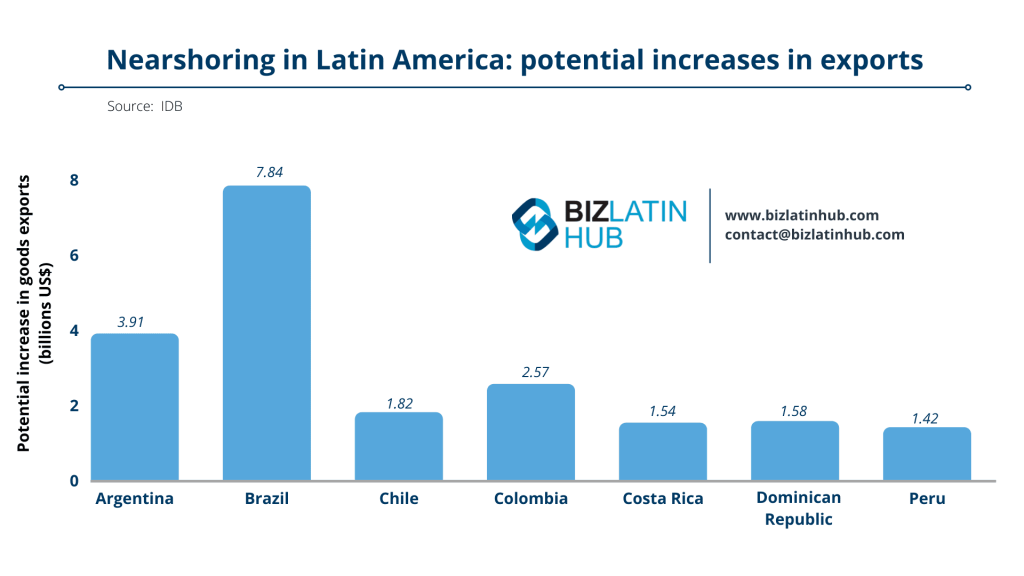

Nearshoring in Latin America: greatest export increases in larger economies

While Mexico is the standout beneficiary based on the IDB projections, other major economies from the region are set to see the greatest increases in goods exports by total value.

They include Argentina ($3.91 billion), Brazil ($7.84 billion), and Colombia ($2.57 billion). Chile, Costa Rica, and the Dominican Republic, meanwhile, each stand to see exports of goods potentially rise by more than $1.5 billion.

The IDB analysis of nearshoring in Latin America includes likely short-term gains in exports to both the United States and rest of Latin America, as well as “medium-term opportunities.”

The report was provided to high ranking officials and business executives from around the Americas, as the IDB sought to highlight the potential for nearshoring to plug gaps in markets and supply chains at a time of considerable upheaval for international commerce.

SEE ALSO: 4 back office services in Mexico ideal for outsourcing

According to Claver-Carone, nearshoring promises to be a major part of regional economic recovery in the face of disruptions caused by the COVID-19 pandemic and ongoing conflict in Europe.

“This meeting is a demonstration that leaders from both the public and private sectors can put aside their differences to find ways to generate the jobs and well-being our people crave, and trade is one of the primary vehicles for accelerating our prosperity” he was quoted as saying.

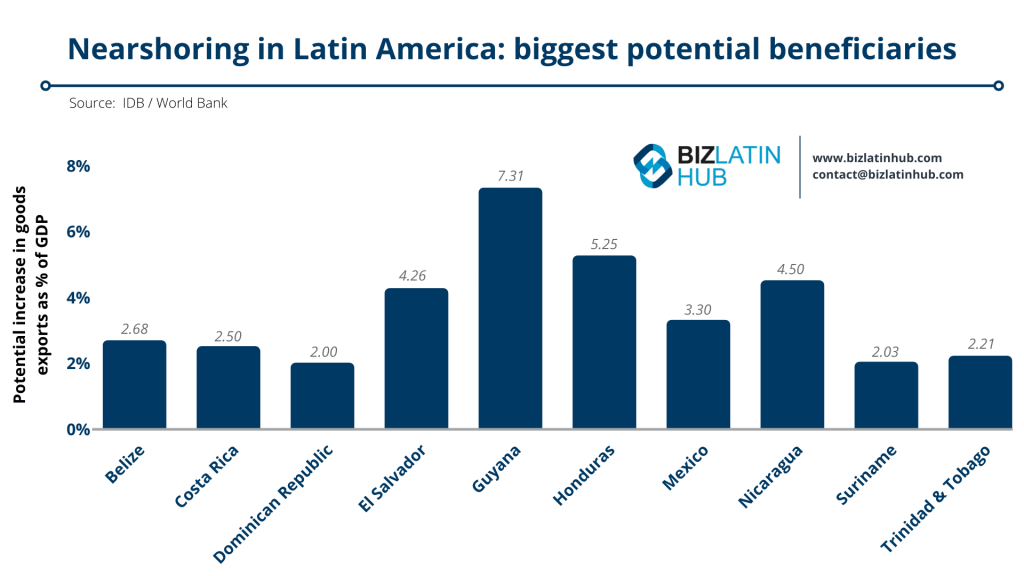

Central American and Caribbean economies to see biggest boosts

While the larger economies of Latin America stand to see the greatest increases in exports by total value, an analysis of the IDB projections compared to the GDPs of each country reveals that it is actually Central American and Caribbean countries that stand to see their economies boosted most.

Beyond Mexico, for which the projected total increase in goods exports represents 3.3% of the country’s GDP, the total potential increases seen in the other five of the six largest economies in the region represent no more than 1% of GDP.

Those include Argentina (1%), Colombia (0.95%), Chile (0.72%), Peru (0.7%), and Brazil (0.54%), based on the latest GDP (2020) figures published by the World Bank.

Among the ten countries that stand to see the biggest increases in exports as a percentage of GDP, all except Mexico are Central American or Caribbean countries.

The countries that stand to see the biggest increases in exports of goods as a percentage of GDP include Guyana (7.31%), Honduras (5.25%), Nicaragua (4.5%), and El Salvador (4.26%).

SEE ALSO: Register a company in Honduras: a 6-step guide

Meanwhile, all of the top ten countries can expect to see increases in exports of goods total at least 2% of GDP – double the highest rate seen among major economies other than Mexico.

Nearshoring in Latin America: a growing trend with ready support

Nearshoring to Latin America has increased significantly over recent years, as growing costs associated with manufacturing in China have made the region increasingly attractive to not only US and Canadian companies, but also European firms.

That interest has surged in recent years, amid rising tensions between China and the United States since the mid 2010s, followed by major disruptions caused to international trade in the context of the COVID-19 pandemic – which swept the world during 2020.

More recently, Russia’s decision to invade Ukraine in early-2022 has caused yet more turmoil to the global economy and exposed vulnerabilities related to the reliance on goods and resources coming from afar.

SEE ALSO: Nearshoring in Colombia: investment passes $1bn in 2 yrs

Months before Russia invaded Ukraine in late-February, the IDB had implemented a program to encourage and assist companies to nearshore their value chains from Asia to Latin America.

Speaking in January, Claver-Carone announced that the IDB was offering funding based on the needs of individual companies, which could cover the likes of relocation, operations, or other aspects of the process.

He also emphasized that the initiative was not only aimed at North America and Latin American companies, but at countries from elsewhere that sought to benefit from relocating production and other facilities to Latin America and the Caribbean.

“I am not [just] talking about nearshoring, thinking only of the United States, but also of Spain. If there are Spanish companies that have invested their value chain in China or other Asian countries and want to transfer that chain to Latin America, the IDB will finance it. I believe that Europeans are beginning to see this as an opportunity,” he told Spanish newspaper El Mundo at the time.

Biz Latin Hub can assist you doing business in Latin America & the Caribbean

At Biz Latin Hub, we provide integrated market entry and back office support to investors throughout Latin America and the Caribbean, with offices in more than a dozen countries around the region and trusted partners in many more.

That unrivaled reach means we are ideally places to support multi-jurisdiction market entries and cross-border operations.

Our portfolio of services includes company formation, accounting & taxation, legal services, bank account opening, and hiring & PEO.

Contact us today to find out more about how we can support you.

If you found this article on nearshoring in Latin America of interest, check out the rest of our coverage from across the region. Or read about our team and expert authors.