Ecuador presents significant business opportunities for foreign investors, but selecting the appropriate legal structure is critical to entering the market successfully. From simplified corporations (SAS) to traditional structures like SRL and SA, this guide helps you understand the main company types in Ecuador and how to register a company in Ecuador with confidence.

Key Takeaways

| Common legal entity types in Ecuador | Soceidad por Acciones Simplificada S.A.S. (Simplified Joint Stock Companies). Compania Anónima S.A. (Corporation). Compania De Economía Mixta C.E.M.I.X. (Mixed Economy Company). Compania De Responsabilidad Limitada Cía. Ltda. (Limited Liability Company). Compania en Nombre Colectivo C.N.C.O.L. (General Partnership). Compania En Comandita Simple Y Dividida Por Acciones C.C.S.D.A. (Limited Partnership). Sucursal (Foreign Branch). |

| What is the most common Ecuadorian types of companies? | The two main company types in Ecuador are the oceidad por Acciones Simplificada (S.A.S.) and Compania De Responsabilidad Limitada (Cía. Ltda.). Both behave similarly to an LLC in the US offering limited liabilits and additional benefits. |

| What are the primary considerations when choosing a business entity in Ecuador? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

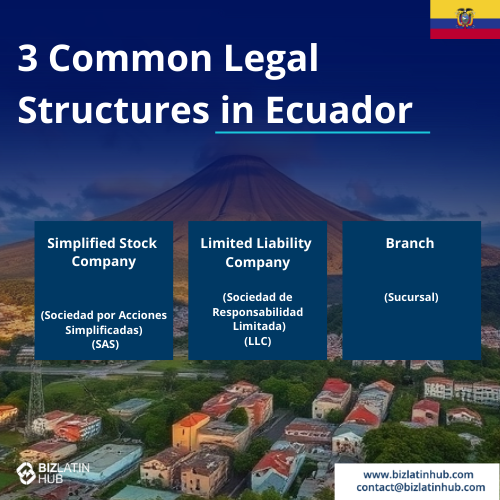

Overview of Legal Structures in Ecuador

Ecuadorian Company Law (La Ley de Companias del Ecuador) recognizes 5 different types of companies that can be established in the country. Each one serves a distinct purpose and will satisfy different objectives. It is therefore very important that companies properly consider each structure and the relevant benefits that they provide. They are:

- Soceidad por Acciones Simplificada S.A.S. (Simplified Joint Stock Companies

- Compania Anónima S.A. (Corporation).

- Compania De Economía Mixta C.E.M.I.X. (Mixed Economy Company).

- Compania De Responsabilidad Limitada Cía. Ltda. (Limited Liability Company L.L.C.).

- Compania en Nombre Colectivo C.N.C.O.L. (General Partnership).

- Compania En Comandita Simple Y Dividida Por Acciones C.C.S.D.A. (Limited Partnership).

All these legal entities must have a company legal representative and a legal/fiscal address in Ecuador. They also must make monthly and annual tax declarations to the local tax authorities.

Comparison Table: Key Legal Entity Types in Ecuador

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SAS | Startups and SMEs | 1+ | Limited to capital | Yes | Corporate tax applies |

| SRL | Small partnerships or family businesses | 2–15 | Limited to capital | Yes | Corporate tax applies |

| SA | Public companies or external investors | 2+ | Limited to capital | Yes | Corporate tax applies |

| Branch | Foreign companies operating in Ecuador | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a local entity |

Keep reading if you are interested in doing business in Ecuador and need to find out about the different types of companies available.

1. Sociedad por Acciones Simplificada (SAS)

The Sociedad por Acciones Simplificada (S.A.S.) is a modern and flexible corporate structure introduced to streamline the process of starting and running a business in Ecuador. It behaves in a a similar way to a US Limitied Liability Company LLC, offering similiar benefits. It is particularly well-suited for startups, small businesses, and growing enterprises because of its minimal formalities, lack of minimum capital requirements, and straightforward registration process. The S.A.S. is known for its adaptability, as it allows shareholders to define the internal rules and management structure through its bylaws, giving them control over how the business operates.

This structure provides shareholders with limited liability protection, ensuring their personal assets are safeguarded from the company’s debts and obligations. The S.A.S. has gained popularity in Ecuador due to its simplicity and versatility, as it allows single or multiple shareholders, including foreign investors, to establish a company.

- Shareholders: A S.A.S. can be formed by one or more shareholders, either individuals or legal entities, with no maximum limit. Foreign shareholders are allowed.

- Management: The management structure is defined in the company’s bylaws. A legal representative must be appointed, who can be an Ecuadorian citizen or a foreigner with residency in Ecuador.

- Capital Contributions: There is no minimum capital requirement. Contributions can be made in cash, goods, or services, which must be formally valued if non-monetary.

- Transfer of Shares: Shareholders have the flexibility to transfer shares unless otherwise restricted by the bylaws. The transfer process must be documented and registered with the Mercantile Registry.

- Fiscal Address: The company must register a fiscal address with the Ecuadorian Tax Authority (SRI).

2. Sociedad Anónima (SA)

The Compañía Anónima (S.A.) is one of the most established and widely used corporate structures in Ecuador, primarily designed for medium to large enterprises. This traditional business structure is ideal for companies seeking to raise substantial capital, attract investors, or operate in industries requiring a high level of trust and credibility.

The S.A. structure provides limited liability protection to its shareholders, meaning their risk is limited to the value of their shares. This feature makes it a popular choice for businesses with significant investment needs or those planning to operate in international markets. Additionally, its governance model, which typically includes a board of directors, ensures professional and structured management, making it suitable for complex operations.

While the incorporation process for an S.A. involves more formalities than other structures, such as the S.A.S., it is well-suited for businesses that require greater shareholder flexibility and access to external capital.

- Shareholders: At least two shareholders are required, and there is no maximum limit. Both individuals and legal entities, whether national or foreign, can participate.

- Management: The company is managed by a board of directors and legal representatives, whose roles are established in the bylaws.

- Capital Contributions: A minimum capital requirement exists, and contributions can be in cash or kind, which must be officially valued.

- Shares: Shares will always be nominative and can be ordinary or preference shares. Ordinary shares only offer the fundamental role of a share, as found in the relevant legislation, whilst preference shares cannot be put up to vote but can have special rights in terms of dividend payments and in the case of company liquidation.

- Transfer of Shares: Shares are transferable unless restricted by the bylaws, making this structure ideal for attracting investment. Transfers must be registered with the Mercantile Registry.

- Fiscal Address: A fiscal address must be registered with the Tax Authority (SRI).

- Administration:

- a) The General Assembly of Shareholders is the main body of the company.

- b) These companies must have a General Manager and a President who will have the role of legal, judicial, and extrajudicial representation, this can either be a shared or sole responsibility.

3. Compania de Economia Mixta (C.E.M.I.X.) – Mixed Economy Company

The Compañía de Economía Mixta (C.E.M.I.X.) is a unique corporate structure that brings together public and private sector entities to pursue projects of mutual interest. This hybrid model is often used for ventures that involve public infrastructure, utilities, or services where private expertise and capital are essential, but public oversight and involvement are also required.

The C.E.M.I.X. allows both public institutions and private investors to become shareholders, each contributing resources, expertise, or funding toward a common objective. It is governed by bylaws that outline the specific roles and responsibilities of each stakeholder, ensuring that the interests of all parties are balanced.

This structure is particularly beneficial for public-private partnerships (PPPs), as it combines the efficiency and innovation of private companies with the regulatory framework and public interest focus of government entities. The C.E.M.I.X. is designed to address national priorities while fostering economic development.

- Shareholders: A mix of private investors and public entities. The minimum number of shareholders is generally two.

- Management: The management structure is defined in the bylaws and may include representation from both public and private stakeholders.

- Capital Contributions: Capital contributions can come from public or private sources. Contributions must comply with valuation requirements if they are non-monetary.

- Transfer of Shares: Share transfers must be approved by all stakeholders and follow the specific provisions outlined in the bylaws.

- Fiscal Address: The company must register a fiscal address with the Tax Authority (SRI).

4. Sociedad de Responsabilidad Limitada (SRL)

The Compañía de Responsabilidad Limitada (SRL or Cía. Ltda.) is one of the most commonly used business structures in Ecuador, particularly for small and medium-sized enterprises (SMEs) and family-owned businesses. It provides a balance between simplicity in operation and robust liability protection for its partners, making it an attractive option for entrepreneurs who want to limit personal risk.

In a Cía. Ltda., the partners’ liability is limited to the amount of their contributions, ensuring that personal assets are not at risk in the event of business debts or liabilities. This structure is known for its flexibility and straightforward management, with decisions made collectively by the partners or their appointed administrators.

The Cía. Ltda. is well-suited for businesses that value privacy and close control over ownership, as shares (referred to as “quotas”) cannot be freely transferred without the consent of the other partners. Its relatively straightforward registration process and suitability for various industries make it a popular choice for entrepreneurs.

- Shareholders: Requires a minimum of two and a maximum of 15 partners, who can be individuals or legal entities, including foreign ones.

- Management: Managed by one or more administrators appointed by the partners, whose roles are outlined in the bylaws.

- Capital Contributions: Contributions are divided into quotas, which must be paid in full at the time of incorporation. Quotas are not freely transferable and require partner approval.

- Transfer of Shares: Transfers are subject to restrictions, often requiring the consent of existing partners. Transfers must be registered with the Mercantile Registry.

- Fiscal Address: A fiscal address must be registered with the Tax Authority (SRI).

LLCs can have the following corporate objectives: civil and commercial or sales services. They cannot operate as banks or insurance companies.

- Partners: These companies must have a minimum of 2 partners and can have up to, but not exceeding 15.

- Capital: The minimum capital required to start an LLC is USD$400. The money is divided into installments and at least 50% must be paid upon forming the entity, with the rest needing to be paid in the following 12 months.

- Administration: These companies must have a General Manager and a President who will have the role of legal, judicial, and extrajudicial representation, this can either be a shared or sole responsibility.

5. Compania en Nombre Colectivo (C.N.C.O.L.) – General Partnership

The Compañía en Nombre Colectivo (C.N.C.O.L.) is a traditional business structure based on mutual trust among its partners. It is typically chosen by small groups of individuals who want to operate a business together and are willing to share unlimited liability for the company’s obligations.

Unlike other corporate structures, the partners in a C.N.C.O.L. are personally liable for the debts of the company, which means their personal assets can be used to satisfy business obligations. This characteristic makes it a high-risk structure, but it is still widely used for businesses where personal relationships and trust are critical, such as professional firms, family businesses, or partnerships in specialized industries.

The C.N.C.O.L. is relatively easy to set up and manage, as it does not require complex governance structures. However, the unlimited liability and shared responsibility for management decisions necessitate careful planning and clear agreements among the partners.

- Shareholders: Requires at least two partners, who can be individuals or legal entities.

- Management: All partners participate in management unless otherwise specified in the partnership agreement.

- Capital Contributions: Partners contribute to the partnership’s capital in cash, goods, or services. Non-monetary contributions must be officially valued.

- Transfer of Shares: Transfer of ownership is typically restricted and requires unanimous partner approval.

- Fiscal Address: The company must register a fiscal address with the Tax Authority (SRI).

6. Compania en Comandita Simple y Dividida por Acciones (C.C.S.D.A.) – Limited Partnership

The Compañía en Comandita (C.C.S.D.A.) is a partnership structure designed to accommodate both active managers and passive investors. It is particularly useful for businesses that require operational expertise from general partners while allowing limited partners to contribute capital without participating in day-to-day management.

In this structure, there are two types of partners: general partners, who manage the business and have unlimited liability, and limited partners, whose liability is restricted to the amount of their contributions. This dual structure makes it an attractive option for projects requiring both financial backing and active management.

The C.C.S.D.A. is commonly used in industries where investors want to minimize their involvement in operations but still benefit from the business’s success. Its formalities, such as registering partnership agreements and contributions, ensure clarity and protection for all parties involved.

- Shareholders: Requires at least two partners: one general partner and one limited partner. Both individuals and legal entities are allowed.

- Management: Managed by the general partners, while limited partners do not participate in daily management.

- Capital Contributions: Limited partners contribute capital, which can be in cash, goods, or services. General partners often provide expertise or management.

- Transfer of Shares: Limited partners can transfer their shares following the provisions in the partnership agreement. Transfers must be registered with the Mercantile Registry.

- Fiscal Address: A fiscal address must be registered with the Tax Authority (SRI).

Our recommendation: The S.A.S. is suitable for small to medium-sized enterprises and foreign businesses seeking to establish a presence in the country. This structure provides liability protection for its members while offering flexibility in management and ownership.

7. Branch of a Foreign Company

A Sucursal (branch) is an extension of a foreign or domestic company that wishes to establish a presence in Ecuador without creating a separate legal entity. This structure is particularly suitable for businesses looking to expand their operations internationally or regionally while maintaining centralized control from the parent company.

A branch operates under the legal identity of the parent company, meaning it does not have its own legal personality. However, it must comply with Ecuadorian regulations and register with the local authorities, including the Mercantile Registry and the Tax Authority (SRI). The parent company is fully liable for the branch’s obligations and debts, which simplifies the management structure but increases the parent company’s exposure.

Branches are commonly used by multinational corporations, service providers, or export-import companies seeking to establish a foothold in Ecuador. While a Sucursal is not required to have its own capital, it must maintain a fiscal address and appoint a legal representative in Ecuador to oversee compliance and operations. This structure allows foreign companies to operate efficiently in Ecuador while leveraging the resources and support of their headquarters.

Who Should Choose Which Entity in Ecuador?

SAS – Sociedad por Acciones Simplificada

Who should choose this: Ideal for new businesses and foreign investors looking for fast setup, simplified governance, and flexibility.

SRL – Sociedad de Responsabilidad Limitada

Who should choose this: Perfect for closely held partnerships or family-run businesses, offering limited liability and simple management.

SA – Sociedad Anónima

Who should choose this: Suitable for larger companies planning to raise capital, issue shares, or bring in institutional investors.

Branch

Who should choose this: Foreign corporations that wish to operate directly in Ecuador without forming a new local entity.

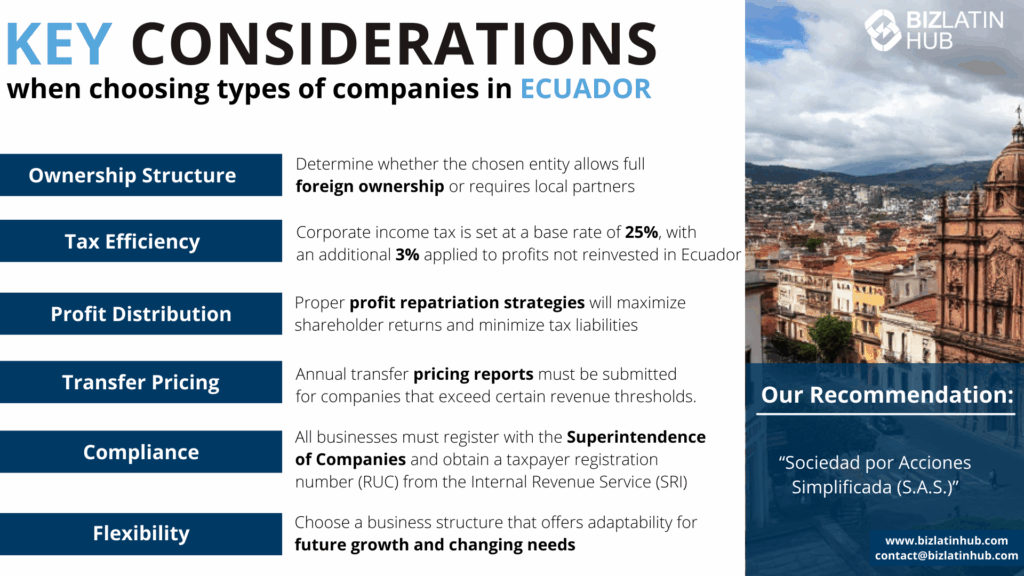

Choosing the Right Legal Structure in Ecuador

Ownership Structure

Evaluate whether the selected business structure permits full foreign ownership. In Ecuador, most industries allow 100% foreign ownership, although certain strategic sectors, such as natural resources, hydrocarbons, and telecommunications, may involve government oversight or special regulations. Understanding these restrictions will ensure your business is compliant and aligned with Ecuador’s legal requirements.

Tax Efficiency

Analyze the implications of Ecuador’s tax system on your business operations. Corporate income tax is set at a base rate of 25%, with an additional 3% surtax applied to profits not reinvested in Ecuador. The VAT rate is 12%, applied to most goods and services. Companies operating in Ecuador may benefit from tax incentives in sectors such as renewable energy, technology, or under the Special Economic Development Zones (ZEDE), which offer exemptions on income tax, VAT, and import duties for export-oriented or innovative businesses. Strategic tax planning is essential to optimize profitability and ensure compliance.

Profit Distribution

Consider the taxation of profit distribution. Dividends paid to non-resident shareholders are subject to a withholding tax of 10%. Ecuador has tax treaties with countries like Spain, Mexico, and Switzerland, which can help reduce withholding rates through double taxation agreements. Proper profit repatriation strategies will maximize shareholder returns and minimize tax liabilities while ensuring compliance with Ecuadorian tax regulations.

Transfer Pricing

Comply with Ecuador’s transfer pricing regulations for transactions between related parties. Businesses engaging in cross-border transactions for goods, services, intellectual property, or intercompany financing must document and justify these transactions to reflect arm’s-length market values. Annual transfer pricing reports must be submitted for companies that exceed certain revenue thresholds. Non-compliance could result in penalties or increased audit scrutiny, making accurate documentation critical.

Compliance

Prepare for Ecuador’s extensive compliance obligations. All businesses must register with the Superintendence of Companies and obtain a taxpayer registration number (RUC) from the Internal Revenue Service (SRI). Companies must file monthly VAT returns and annual income tax declarations. Financial reporting must adhere to International Financial Reporting Standards (IFRS). Additionally, labor regulations require compliance with social security contributions and annual profit-sharing obligations, where 15% of a company’s profits must be distributed to employees. Meeting these compliance requirements is vital for maintaining good standing and avoiding legal or financial penalties.

Flexibility

Select a business structure that offers the right balance of adaptability and legal protection for your operations. In Ecuador, the two most common legal entities are:

- Compañía de Responsabilidad Limitada (Cía. Ltda.): Ideal for smaller businesses or those with fewer shareholders (up to 15). It offers limited liability, and decision-making is managed directly by shareholders.

- Compañía Anónima (S.A.): Better suited for larger businesses or those seeking to raise capital through private or public investments. This structure allows for greater flexibility in ownership transfer but requires at least two shareholders to establish.

- Simplified Stock Corporation (SAS): A newer and highly flexible option, the SAS allows for sole ownership, simpler incorporation, and greater adaptability for capital increases or shareholder changes.

Creating an Online Company in Ecuador

Simplified companies do not exist in Ecuador as they do in other countries (such as Colombia or Argentina). However, using the Company Superintendence service, you can create a company online. This is a very easy, quick, and cost-effective way to form either Joint-Stock Corporations or LLCs. If choosing to use this online service, you must choose one social objective and a maximum of 5 complimentary activities as listed in the International Standard Industrial Classification (ISIC).

The Company Law includes information on the company, the partner and shareholder rights and obligations and the methods and deadlines for the Board, the statutes that you receive through this online process are very simple. The statutes can be reformed if the General Assembly permits it by following an established and straightforward legal process.

Steps to Incorporate a Company in Ecuador

These are the 5 steps that describe the process to set up a business in Ecuador. The process should take from 2-4 weeks if all the documentation is in order and there are no bureaucratic delays.

- Step 1: Grant power of attorney to the legal representative.

- Step 2: Reserve the company name and complete documentation.

- Step 3: Submit all the enabling documents to the authorities.

- Step 4: Send the deeds and documents to the Commercial Registry.

- Step 5: The tax authority will grant the company its tax identification number.

Compliance Tip:

All companies must register with the Superintendencia de Compañías, obtain an RUC (tax ID) from the SRI, and comply with social security (IESS) and labor registration requirements if hiring staff.

Common Pitfalls When Choosing a Legal Entity in Ecuador

- Choosing an SA when SAS would offer more flexibility and lower cost

- Failing to appoint a resident legal representative

- Underestimating mandatory compliance with IESS and SRI

- Using a branch without understanding full parent liability

- Not translating and apostilling foreign documentation correctly

Partnering with Biz Latin Hub for Company Formation in Ecuador

Ecuador is eager to attract more and more foreign investment to its shores. There is an almost infinite number of opportunities in Ecuador, and this is one of the most exciting periods in Ecuador’s recent history.

If you are interested in making the most of the enormous benefits that investing and forming a company in Ecuador can bring, don’t hesitate to contact us. The Biz Latin Hub team is experienced in assisting clients in starting their business ventures in Ecuador and across the Latin American region by providing an extensive and multi-lingual suite of back-office services.

FAQs: Legal Entities in Ecuador

1. Can a foreigner register a company in Ecuador?

Yes, foreign nationals can register companies in Ecuador. The process involves fulfilling certain requirements and may require partnering with local individuals or entities in certain cases.

2. What type of legal entity is an SAS (Sociedad por Acciones Simplificada) in Ecuador?

An SAS, or Simplified Shares Company, is a legal entity in Ecuador that offers a streamlined process for incorporation, increased flexibility in management, and reduced administrative burden compared to traditional corporate structures.

3. How do I create an LLC in Ecuador?

To create an LLC (Limited Liability Company) in Ecuador, individuals or entities must follow the legal procedures outlined by the Superintendencia de Compañías, Valores y Seguros (Superintendency of Companies, Securities, and Insurance).

4. What is an LLC in Ecuador?

An LLC, or Limited Liability Company, is a legal entity in Ecuador that combines the limited liability protection of a corporation with the operational flexibility of a partnership. Members of an LLC are shielded from personal liability for the company’s debts and obligations.

5. What is the business structure of a Simplified Shares Company (S.A.S) in Ecuador?

The Simplified Shares Company (S.A.S) in Ecuador offers a combination of speed, flexibility, and investor-friendly features that make it a suitable choice for both local and foreign businesses. This structure allows for simplified administration, limited liability protection, and efficient management, making it an attractive option for entrepreneurs seeking to establish a presence in Ecuador.

6. What is the most flexible company structure in Ecuador?

The SAS is the most flexible and widely used structure for startups and foreign investors. It allows single-shareholder incorporation and offers simplified governance with minimal formalities.

7. Can foreigners fully own companies in Ecuador?

Yes. There are no restrictions on foreign ownership. Foreigners can own 100% of any legal entity, including SAS, SRL, SA, or branches.

8. What is the difference between SAS and SA in Ecuador?

SAS is more modern and allows simpler incorporation and internal management. SA is more traditional, requires a board of directors, and is better for larger operations or public investment.

9. How long does incorporation take?

On average, it takes 2–4 weeks depending on the company type and the completeness of submitted documentation.

10. What tax and reporting obligations apply?

Companies must file monthly VAT and payroll taxes, and annual income tax returns with the SRI. Accounting records and annual shareholder meeting minutes must be maintained.

11. Do branches have different tax treatment?

No. Branches are treated as resident taxpayers and must comply with the same corporate tax and regulatory obligations as Ecuadorian entities.

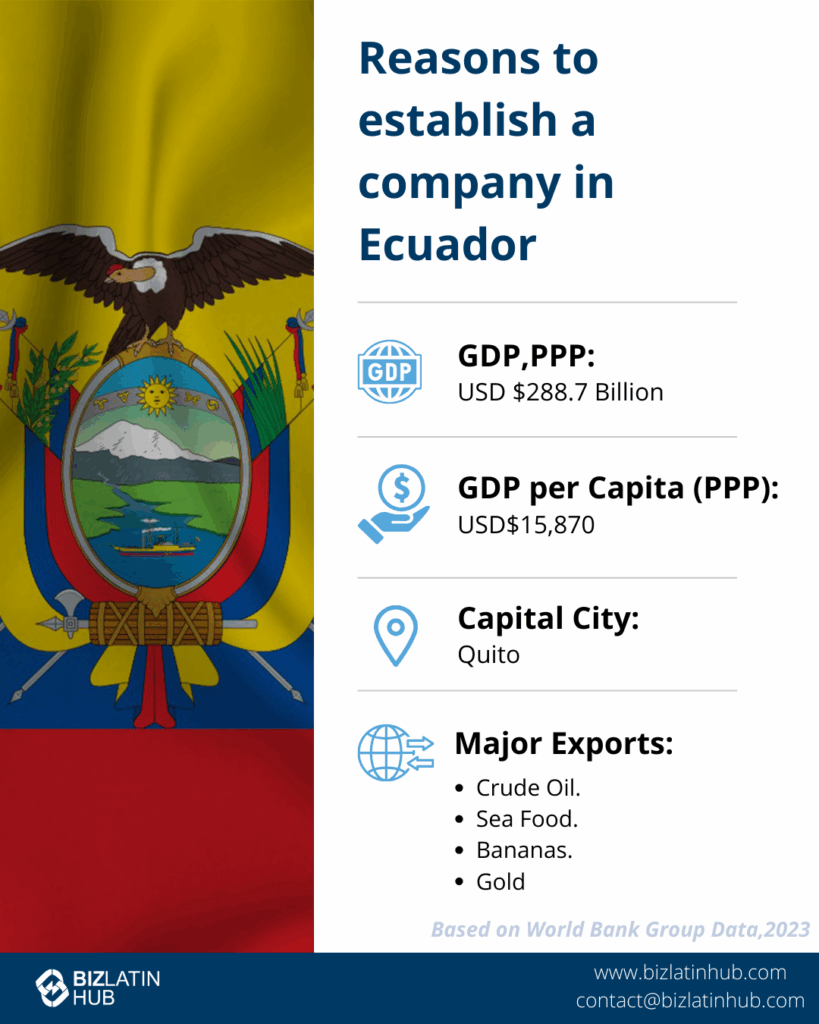

Why Choose to Invest in Ecuador?

The Ecuadorian government’s proactive stance to attract foreign investment is underscored by recent legislative initiatives, which reflect a welcoming environment for international entrepreneurs. Numerous factors underpin Ecuador’s current economic boom. In particular, the stability of the national currency, the U.S. dollar, along with its abundant natural resources, reinforce Ecuador’s status as a business-friendly destination. Delve into Ecuador’s various types of companies to discern the optimal corporate structure to suit your investment objectives. Whether considering a Sociedad Anónima (SA), a Sociedad de Responsabilidad Limitada (SRL), or other entity models, our experience in company formation allows you to navigate Ecuador’s business landscape with confidence and clarity.