When contemplating business ventures in Panama, you may wish to consider LLC formation in Panama. The process of forming an LLC in Panama is characterized by its simplicity and flexibility, distinguishing it from other methods of establishing legal entities in the Central American nation. This simplified approach to starting up makes it exceptionally attractive among investors looking to navigate the Panamanian business landscape efficiently.

The Panamanian economy is strong and continuing to increase, with 2.5% growth predicted by the end of 2024. This makes it a good time to think about LLC formation in Panama. With a growing middle class and a business-friendly economy, there are plenty of opportunities in many different fields.

Panama has an advantageous geographical location, connecting South and Central America, while being home to the famed Panama Canal. This makes it a hub for global trade and is yet another reason that investors are looking at LLC formation in Panama. Some of the country’s main export commodities include refined petroleum, coal tar oil, newly built ships, and gold.

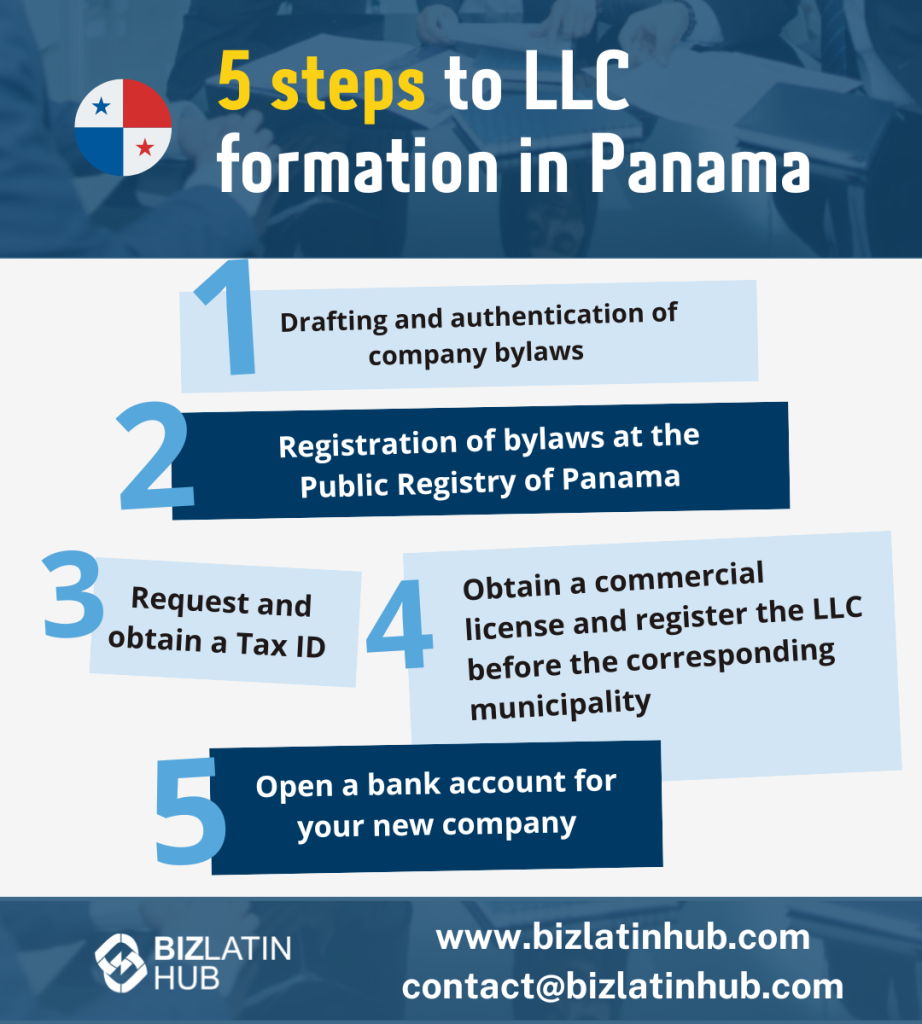

5 Key Steps to LLC Formation in Panama

The 5 key steps to LLC formation in Panama are:

- Step 1 – Drafting and authentication of company bylaws.

- Step 2 – Registration of bylaws at the Public Registry of Panama.

- Step 3 – Request and obtain a Tax ID.

- Step 4 – Obtain a commercial license and register the LLC before the corresponding municipality.

- Step 5 – Open a bank account for your new company.

Step 1: Drafting and authentication of company bylaws

The first step is to write the LLC’s bylaws in accordance with local corporate legislation. Thus, it is strongly recommended to engage with a local provider for the required assistance in drafting the bylaws. Once this step is completed, you will need to authenticate the company bylaws before a notary public.

Step 2: Registration of bylaws at the Public Registry of Panama

The statutes of the LLC must be authenticated with the Public Registry of Panama. This public institution is in charge of checking that the statutes of the company comply with all requirements established by Panamanian legislation. If the statutes are approved, the LLC will be considered a legal entity registered in and governed by the laws of Panama.

Step 3: Request and obtain a Tax ID

To continue with the process of LLC formation in Panama, you must request and obtain a tax identification number for the company. The tax identification number in Panama is known as the ‘Single Taxpayer Registry’ (Registro Único de Contribuyente — RUC) is obtained by registering the company with the General Directorate of Income (DGI). Tax obligations will depend on the nature of the commercial activities to be developed and where they are carried out. Note that income from foreign business activities will not be taxed in Panama.

Step 4: Obtain a commercial license and register the LLC before the corresponding municipality

The commercial license must be requested from the Ministry of Commerce and Industries and the DGI. It is necessary to specify the commercial activity of the LLC and the city where it will operate. After obtaining the business license, you must also register the LLC in the corresponding municipality, based on the district where your business is located.

For companies located in the district of Panama, the company is automatically registered in the municipality after obtaining the business license. For other districts, you may need to submit business-related information in person.

Step 5: Open a bank account for your new company

To open an LLC bank account, which will be crucial to managing your business and meeting accounting requirements in Panama, the following documents must be presented:

- Copy of passport or ID of all shareholders.

- Utility bill to verify shareholder’s residence addresses.

- Bank reference letter in favor of shareholders.

- Proof of income or copy of income tax return, financial statements, or employment reference letter.

- Annual projection of the expenses and income of the LLC in Panama.

LLC formation in Panama: what is an LLC company?

What are the main requirements to form an LLC?

According to Law N° 4 of 2009, the following are the main requirements for LLC formation in Panama:

- Two or more shareholders are required, who can be natural or legal persons

- All shareholders must confirm their identification and legal addresses

- The legal address of the LLC and the corporate purpose of the company must be specified

- An administrator, a legal representative, and a director must be appointed

- An attorney representing the company must be appointed

FAQs About LLC Formation in Panama

1. What is an LLC in Panama?

A Panama LLC, or Limited Liability Company, is a type of business entity that combines the limited liability protection of a corporation with the flexible management structure of a partnership. It is a popular choice for entrepreneurs and businesses looking to establish a presence in Panama due to its favorable business environment and simplified procedures.

2. How long does it take to incorporate an LLC in Panama?

The incorporation of an LLC in Panama usually takes between 2 to 4 weeks, depending on several factors such as the complexity of the application and regulatory processing times.

3. Can foreigners own an LLC in Panama?

Yes, foreigners can own and operate an LLC in Panama without any restrictions. Panama welcomes foreign investment and offers a business environment conducive to international entrepreneurs.

4. What requirements are there for the formation of an LLC in Panama?

According to Law N° 4 of 2009, the following are the main requirements for LLC formation in Panama:

- Two or more shareholders are required, who can be natural or legal persons.

- All shareholders must confirm their identification and legal addresses.

- The legal address of the LLC and the corporate purpose of the company must be specified.

- An administrator, a legal representative, and a director must be appointed.

- An attorney representing the company must be appointed.

5. Is it necessary to have a physical office in Panama for the formation of an LLC?

While having a physical office in Panama is not mandatory, you may need a registered agent with a local address to represent your LLC for official correspondence and legal purposes.

Biz Latin Hub can help you with LLC formation in Panama

At Biz Latin Hub, our team of experienced company formation agents is equipped to help you enter the Panamanian market and take advantage of the country’s business opportunities. With our complete portfolio of corporate legal, accounting, and back-office services, our multilingual team is equipped to deliver excellence and ensure the success of your LLC formation process in Panama.

Get in touch with us today for personalized assistance.

Learn more about our team and expert authors.