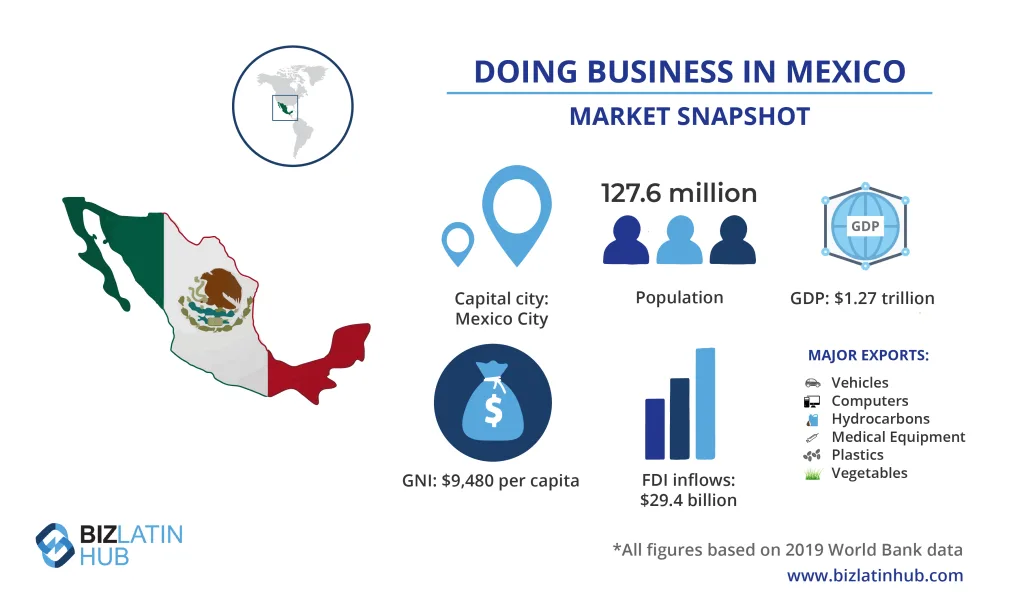

First of all, Mexico has some key industries that contribute significantly to the economy and the current GDP growth of almost 2.3%. The most important ones are on the one hand the Mexican automotive industry, being responsible for the assembly, R&D, and production of components of cars. Apart from the ‘Big Three’, consisting of Chrysler, Ford and General Motors, luxury car companies, such as BMW and Mercedes Benz have established their plants in the country. Other important industries are the Maquiladora industry, which is manufacturing plants converting imported raw materials into final good, the food industry, the electronics sector, and the oil industry. Additionally, those mentioned sectors play a major role in foreign trade, making Mexico an international trade key player.

This small economic overview illustrates perfectly why more and more international businesses are interested in establishing a presence in Mexico. If you interested to do so, you have to be certain about the type of legal entity to form. In Mexico, the 3 most common entity types are the Stock Corporation (Sociedad Anónima de Capital Variable – S.A. de C.V.), the Simplified Shares Company (Sociedad por Acciones Simplificada – S.A.S.) and the Limited Liability Company (Sociedad de Responsibilidad Limitada de Capital Variable – S de R.L. de C.V.).

Read One to learn the Key information of creating a Limited Liability Company (LLC) in Mexico, or go ahead and reach out to us now

Corporate Requirements in Mexico – Summary of a Mexican Limited Liability Company

The Mexican LLC is similar to a US Limited Liability Company, whereby the shareholders are only liable up to the value of their respective capital contributions. Moreover, shareholders’ contributions can only be capital in the form of money or assets. The Mexican LLC has a mandatory structure of two corporate sections: the general partners meeting that is equivalent to a shareholders meeting and the administrative body, which is run either by a sole manager or a board of managers. You can also appoint a supervisory body to oversee the two sections, but this is not mandatory.

A popular advantage of the S. de R.L. de C.V. is that when a company pays its dividends to a shareholder or foreign company, it may apply a tax advantage in the US, whereby it can choose to apply the provision known as “Check the Box“, which allows American companies to deduct the loss of subsidiary companies abroad, provided that both subsidiary and shareholder companies are of similar category (LLC).

The downside of this entity type is that it is limited to 50 shareholders and shares cannot be bought and/or sold without the agreement of all shareholders.

Legal Requirements to setup a Limited Liability Company in Mexico

In order to set up a Limited Liability Company in Mexico, several requisites need to be complied with. In the following, we will outline the most important ones:

- Company Name: To incorporate a company in Mexico a unique company name must be registered.

- Purpose of the Company: The shareholders must state the commercial activities of the company within the bylaws.

- Minimum Share Capital: According to the Mexican Law, there is no established minimum or maximum share capital, however, the amount must be specified in the company bylaws and in Mexican pesos.

- Shareholders: A minimum of two shareholders are required, and they can be either legal entities and/or private individuals. Please note that there are no restrictions about the ownership percentages and (99%)/(1%) is permissible by law.

The company’s shareholders need to present the following documentation as part of the company incorporation process:

- For Individuals: Name, date of birth, telephone number, marital status, place of birth, profession/employment, address, Tax identification number, e-mail address.

- For Entities: Incorporation deed, Certificate of Incumbency, Certificate of Directors and general KYC of its legal representatives/ director as listed in the Process to Incorporate a Mexican Subsidiary document.

- Board of Directors or Sole-Administrator: A sole-administrator or board of directors must be appointed within the company bylaws, as well as any further alternate legal representatives.

- Appointment of a Fiscal Auditor: Formal auditing is required IF the client service company is a Mexican Public Company OR IF the company has a annual revenue of more then 100,000,000 Mexican Pesos (approx. USD$5,000,000) OR if the company has more then 300 Employees.

- Fiscal Address: The company must be registered to an official office address within Mexico in order to be able to have official communications and to pay all the necessary taxes to the Mexican tax authority.

Legal Requirements to Maintain a Limited Liability Company in Mexico

After establishing the Mexican Limited Liability Company, several additional requirements come up that need to be respected. We clarify the most important ones below:

Annual economic reports.

Annual economic reports must be submitted, provided that during one year the company has had an increase of one MXN$110 million in any of the following accounts (either initial or final):

- Total assets,

- Total liabilities,

- Income (in the country and abroad), or

- Expenses (in the country and abroad).

If this amount has not been exceeded, there will not be an obligation to present this report.

Quarterly economic reports.

Quarterly economic reports should only be submitted in the case of changes in

- Name, denomination or company name,

- Economic activity,

- Fiscal domicile,

- The share capital and/or share structure that implies a change in the participation of natural or legal persons of a nationality other than Mexico and foreign entities without legal personality, or

- The capital for a greater amount, in absolute value, to twenty million pesos. If this amount has not been exceeded, there is no obligation to submit this report

Presentation of taxes.

VAT and Income Tax declarations are required to be filed on a monthly basis in Mexico, and an annual tax return must be filed at the end of the fiscal year (Mexican fiscal year is January to December).

Maintain corporation variations book.

The Corporation variations book is where the record of increases and reductions of the share capital are kept.

Maintain a shareholders register.

This book is used to detail the shareholders of the company.

Annual partners meeting.

This meeting is required by law to be held in Mexico. However, the partners can send proxy letters to a legal representative to represent them in the meeting and afterwards send the minutes for their approval.

Maintain records in both English and Spanish.

Required by law to be drafted in Spanish, as public notaries require an official translation when documents are presented in another language.

Preparation of ownership certificates should the client undergo changes in capital.

Corporate certificates need to be issued in Spanish as required by law.

Biz Latin Hub can help you to establish a Limited Liability Company in Mexico

At Biz Latin Hub, our multilingual team of company formation agents is equipped to help you successfully establish a Limited Liability Company in Mexico in the shortest time possible. With our full suite of back-office support offerings, accounting, legal, and HR services, we can be your single point of contact to support your market entry and ongoing operations in Mexico, as well as the other 15 countries in Latin America and the Caribbean where we are present.

Contact us now to find out how our services can help your specific needs.

Learn more about our team and expert authors.