Argentinian cryptocurrency exchange Lemon Cash has escaped some of the oversight of the South American country’s fiscal authorities by delegating custody of the cryptocurrency it holds to a company based in El Salvador, where Bitcoin became legal tender in September.

According to Criptomonedas.com, a cryptocurrency-focused online news publication, Lemon Cash made the announcement to its customers via an email. The message reportedly said that Lemon Cash had delegated custody of crypto to El Salvador-based company Lanin Pay, but that the move would have no effect on the platform or its customers.

“None of these changes impact how you use Lemon Cash every day. Your operations will not be affected in any way and you will be able to continue operating with pesos and cryptocurrencies with total normality,“ the email reportedly said.

SEE ALSO: Hire Reliable Corporate Legal Counsel in El Salvador

However, it will effectively mean that Lemon Cash is no longer obliged to inform Argentina’s fiscal authority, the Federal Administration of Public Revenue (AFIP), about the cryptocurrency holdings of its customers — something Lemon Cash CCO Borja Martel Seward confirmed via Twitter.

The AFIP will still have oversight over transactions involving debit cards and using Argentinian pesos, however any transaction that only uses cryptocurrency, as we holdings of the likes of Bitcoin and Ethereum will be outside of its purview.

Lemon Cash is not the first cryptocurrency exchange in Argentina to make such a move in order to avoid oversight, with Buenbit highlighting in its terms and conditions that it delegates custody of crypto assets to a company in the United Kingdom, thus enjoying the same benefit.

Is use of El Salvador by Lemon Cash a sign of things to come?

Since El Salvador’s National Assembly passed the country’s so-called Bitcoin Law in early June, the country’s maverick President Nabil Bukele — whose New Ideas party controls the legislature — has been on an intense public relations drive to promote the use of the cryptocurrency, which became legal tender in early September.

The adoption of Bitcoin has raised significant regulatory conerns from the international community, and the move by Lemon Cash to use El Salvador to escape AFIP oversight will only add to those concerns.

Last month, Bukule announced the creation of ‘Bitcoin City’ — a project he reportedly hopes will convert El Salvador into the Wall Street of the 21st Century.

The facility will be based in the eastern municipality of Conchagua, where a nearby volcano is intended to provide geothermal energy for Bitcoin mining — a process involving the use of high-powered computers to solve of complex mathematical formulas that demands large amounts of electrcity.

“This is a totally ecological city that works and is energized by a volcano,” Bukele reportedly said while announcing the project at the end of an event called Bitcoin Week, which drew large numbers of cryptocurrency traders from overseas.

Bitcoin City will reportedly be built using funds generated through cryptocurrency bonds, and will be free of income, property, and capital gains taxes, with resident businesses only subject to value-added tax (VAT).

That has drawn criticism from Leonor Selva, the president of El Salvador’s National Association of Private Enterprise (ANEP), who has questioned what value the project will bring to the country if the foreign companies tempted to relocate are enjoying tax breaks that most local businesses and people will never enjoy.

“If [foreign investors] are not going to pay any taxes, what is the benefit and the contribution to the country that [Bitcoin City] will generate?” Selva was reported as saying by local news outlet El Diario de Hoy.

That is just the latest criticism of El Salvador’s move to legalize Bitcoin, which saw Fitch Ratings highlight serious concerns about the increased financial and regulatory risk associated with cryptocurrency, which the move by Lemon Cash to escape oversight will only exacerbate.

The law has also drawn widespread protests in the country, as well as raising concern among the business communities of neighboring Guatemala and Honduras, which are key trading partners of El Salvador. It has also drawn attention away from the significant opportunities on offer in more traditional investments.

With Lemon Cash now using the country to avoid having to report cryptocurrency assets to authorities in its home country, the question will be whether other crypto exchanges seek similar moves.

That would raise major concerns among the financial services community, with a senior Bank of England policymaker recently warning that the failure to tighly regulate and control cryptocurrency could trigger a global financial meltdown akin to that seen in 2008.

Biz Latin Hub can help you doing business in El Salvador

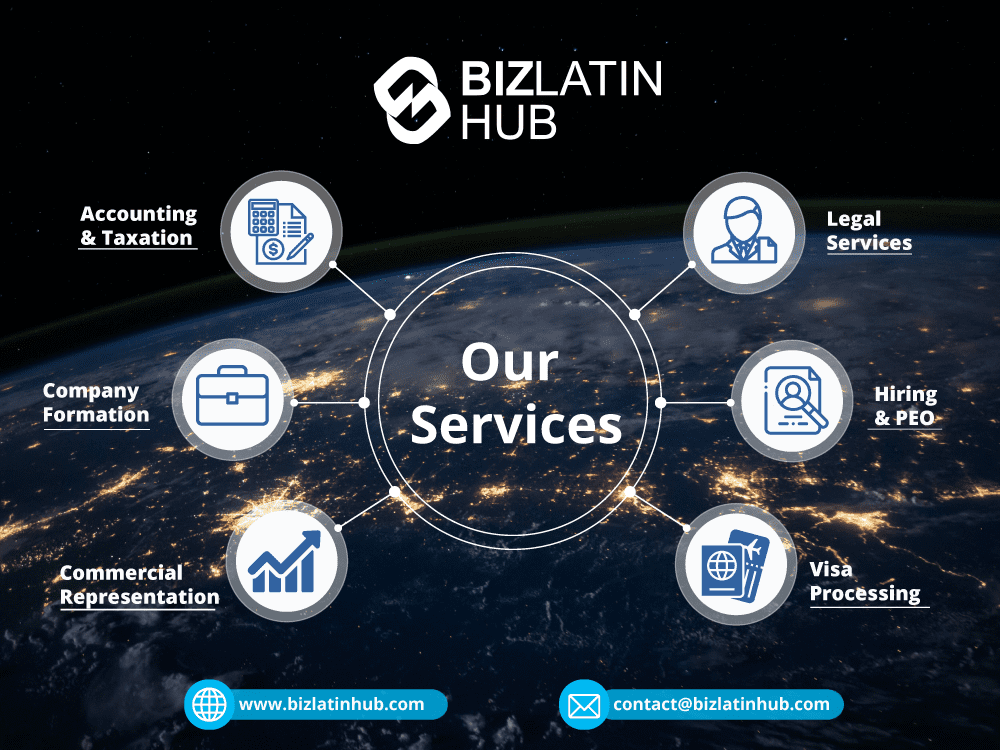

At Biz Latin Hub, we provide tailored packages of back-office services to suit the needs of every one of our clients, who range from individual entrepreneurs entering Latin America and the Caribbean for the first time to major corporations that are well-established in the region.

Our comprehensive portfolio of professional solutions includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, among others.

We have locally-based teams in 16 markets around Latin America and the Caribbean, and trusted partners who extend our reach to almost every corner of the region, meaning we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

If you are interested in entering the market or looking for an outsourcing provider in El Salvador, rather than planning a move similar to Lemon Cash, contact us today to find out more about how we can support you

Or read about our team and expert authors.