Argentina is one of South America’s largest economies and a key regional hub for foreign business. However, selecting the correct legal entity is critical for compliance, liability, and operational flexibility. Whether you’re a startup or a multinational expanding into the region, this guide explains the main company types in Argentina — including SRL, SA, SAS, and branch offices — and how to choose the most suitable for your business goals and company incorporation in Argentina.

Key Takeaways

| What are the common legal entity types in Argentina? | Corporation (Sociedad Anónima – ‘S.A’). Limited Liability Company (Sociedad de Responsabilidad Limitada – ‘SRL’). Simplified Shares Company (Sociedad por Acciones Simplificadas – ‘S.A.S’). Branch Office. |

| What is the most common Argentinian business entity? | The most frequently incorporated legal entity in Argentina is the Sociedad de Responsabilidad Limitada (SRL). |

| What are the primary considerations when choosing a business entity in Argentina? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

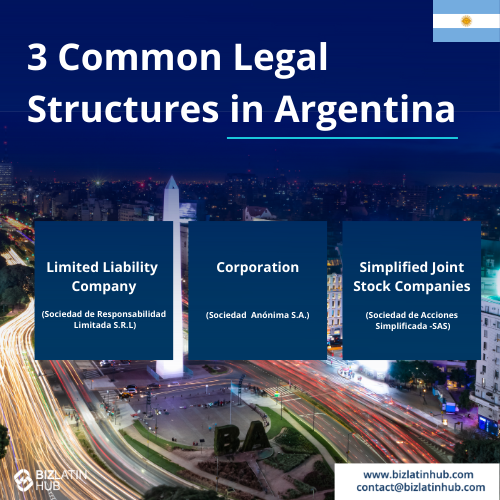

3 Types of Legal Structures in Argentina

The most common types of legal structures in Argentina are:

- Corporation (Sociedad Anónima – ‘S.A.’).

- Limited Liability Company (Sociedad de Responsabilidad Limitada – ‘S.R.L’).

- Simplified Shares Company (Sociedad por Acciones Simplificadas – ‘S.A.S’).

Comparison Table: Key Legal Entity Types in Argentina

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SAS | Startups and entrepreneurs | 1+ | Limited to capital | Yes | Corporate tax applies |

| SRL | Small partnerships or family businesses | 2–50 | Limited to capital | Yes | Corporate tax applies |

| SA | Public or large companies | 2+ | Limited to capital | Yes | Corporate tax applies |

| Branch | Foreign companies expanding into Argentina | 1 (foreign HQ) | Parent company liable | Yes | Treated as a local taxpayer |

1. Sociedad Anónima (SA)

Who should choose this: Recommended for companies that plan to issue shares, raise investment capital, or enter highly regulated industries.

The first type of legal structure in Argentina is a corporation, which requires a minimum of two shareholders. It is not important whether they are local or foreign. A corporation requires a minimum investment of AR$100,000, with a proportion of the company shares of at least 10% (max 90%).

The Corporation must also have a board of directors of which the majority must reside in Argentina and hold annual shareholders’ meetings in order to assess the financial situation of the company.

2. Sociedad de Responsabilidad Limitada (SRL)

Who should choose this: Great for SMEs with multiple partners who want to limit liability while avoiding the complexity of an SA.

An additional legal structure in Argentina is an SRL. An SRL can be formed with a minimum of two partners and a maximum of 50. The SRL requires minimum capital commensurate with the activity to be performed by the company, which is to be divided into stocks. This structure must be administered by a manager residing in Argentina. Similar to a corporation, a SRL must also assess annual statements through a yearly partner’s meeting.

3. Sociedad por Acciones Simplificada (SAS)

Who should choose this: Ideal for startups and foreign investors looking for fast setup, single-shareholder capability, and flexible governance.

The Argentine S.A.S was created in 2017 in order to simplify the process of establishing a legal entity in Argentina. This type of legal structure has the following advantages:

- Able to have a single shareholder (natural or legal person)

- Low minimum capital (twice the minimum wage)

- Quick formation time (the legal entity can be approved in 24 hours)

This new type of legal entity has been a key factor in the increased commercial interest in Argentina over the past year. Combined with investor-friendly reforms, Argentina is opening its doors to foreign participation, and the economy is feeling the benefits of this.

Our recommendation: The Simplified Joint Stock Company (S.A.S.) offers a combination of speed, flexibility and investor-friendly features that make it a suitable option for foreign companies wishing to establish a presence in Argentina.

Branch of a Foreign Company

Who should choose this: Suitable for multinational companies that want a legal presence in Argentina but prefer to keep full control from abroad.

Installing a branch in Argentina is an attractive alternative option for companies who have headquarters in a foreign country. In order to install the branch, proof of the existence of the office overseas must be provided to local authorities. It suits already well-established companies looking to build on existing brand awareness.

The branch will have to prove the following conditions:

- A representative in the country where the company is being established.

- Carry out business in line with partnership purposes.

- Have own accounting and submit annually its balance sheet to the controlling authority.

This article will provide you with the most commonly used types of legal entities in Argentina

How to Choose the Right Legal Structure in Argentina

The key considerations when deciding on the best entity type in Argentina are the following:

Ownership Structure

Determine whether the chosen entity allows full foreign ownership or requires local partners, as this depends on the sector in Argentina. Certain sectors, such as energy, media, or agriculture, may impose restrictions on foreign investment. Understanding these restrictions helps align your business structure with local laws, ensuring compliance and operational stability.

Tax Efficiency

Analyze Argentina’s corporate tax rate, which is 35%, and the VAT rate of 21%. Explore opportunities to reduce tax burdens by qualifying for incentives, such as those available in certain regional development areas. Effective tax planning helps optimize profitability while maintaining compliance with Argentine tax laws.

Profit Distribution

Consider the impact of Argentina’s taxation system on profit distribution. Corporate tax at 35% applies to company profits, and dividend taxes range between 7% and 35%, depending on the type of shareholders. Plan repatriation strategies, as double taxation treaties with some countries may offer tax relief. A well-defined repatriation strategy ensures efficient profit distribution while minimizing tax impacts.

Transfer Pricing

Comply with Argentina’s transfer pricing regulations, which require companies to document and justify cross-border transactions between related parties. These transactions must reflect market values. This is particularly relevant for businesses engaged in import/export activities, intellectual property licensing, or intercompany loans. Prepare annual transfer pricing documentation to demonstrate compliance.

Compliance

Argentina has stringent compliance requirements. Companies must follow International Financial Reporting Standards (IFRS) for financial reporting. Annual tax filings are required, and companies above certain revenue or asset thresholds must undergo statutory audits. Meeting these compliance obligations is necessary to maintain legal status and avoid penalties.

Flexibility

Choose a business structure that provides flexibility for future needs. For example, the simplified joint-stock company (S.A.S.) offers ease of ownership changes, capital increases, and operational restructuring. This flexibility is important in Argentina’s changing regulatory and economic environment, where businesses may need to adjust their operations or models quickly.

Note: Our recommendation based on experience would in most cases to incorporate a “Sociedad de Responsabilidad Limitada” (S.R.L), which is similar to a US Limited Liability Company (LLC).

Steps to Incorporate a Company in Argentina

Follow these eight steps to complete company incorporation in Argentina:

- Step 1: Draft the POA’s to obtain shareholders’ Tax ID.

- Step 2: Draft POAs to incorporate the company.

- Step 3: Draft your Company Bylaws.

- Step 4: Registration in the Public Commercial Registry.

- Step 5: Obtaining the registration certificate.

- Step 6: Registration with the Tax Authority (AFIP).

- Step 7: Opening a bank account.

- Step 8: Register the Company Books.

Compliance Tip:

All legal entities must register with the Inspección General de Justicia (IGJ) or local registry, obtain a tax identification number (CUIT) from AFIP, and enroll for local labor and social security contributions (ANSES, ART, and health plans).

Common Pitfalls When Choosing a Legal Entity in Argentina

- Confusing SAS with SRL — SAS allows more flexibility but is not yet accepted for all sectors

- Underestimating compliance obligations for SAs (e.g. publishing financials, board oversight)

- Choosing a branch without understanding full liability implications for the parent company

- Failing to appoint a legal representative with a local Argentine tax ID

- Delays in document legalizations or translations for foreign shareholders

Partnering with Biz Latin Hub for Company Formation in Argentina

Whichever of the types of legal structures in Argentina you choose, setting up a business can be a challenge. That-s why its best done with an expert. Ideally, work with a local partner who knows both the county and the region.

Get in contact with Biz Latin Hub – our team of local experts and professionals can support you and your business venture in Argentina with our services ranging from legal and commercial representation to market entry. Feel free to contact us now for personalized information.

FAQs: Legal Entities in Argentina

1. Can a foreigner register a company in Argentina?

Yes, foreign nationals can register a company in Argentina. However, they may need to fulfill certain requirements and follow specific procedures outlined by Argentine law. It’s advisable to seek legal counsel to ensure compliance with regulations.

2. What type of legal entity is recommended in Argentina?

The recommended legal entity in Argentina often depends on various factors such as the nature of the business, liability considerations, and tax implications. Common options include Sociedad Anónima (S.A.), Sociedad de Responsabilidad Limitada (S.R.L.), and the Simplified Shares Company (S.A.S).

3. How do I create a legal entity in Argentina?

To create a legal entity in Argentina, individuals or entities must follow the registration procedures outlined by the Argentine government. This typically involves preparing the necessary documentation, filing with the appropriate authorities, and obtaining approval.

4. What is an LLC in Argentina?

In Argentina, an LLC (Limited Liability Company) is known as Sociedad de Responsabilidad Limitada (S.R.L.). This legal structure combines limited liability with operational flexibility, making it a popular choice for small to medium-sized businesses.

An example of an LLC in Argentina could be a small technology consulting firm formed by a group of software engineers. The liability of each member is limited to their respective capital contributions, protecting their personal assets from the debts and legal liabilities of the company. This structure gives them flexibility in management and taxation, while providing protection against individual financial risks.

5. What is the most commonly used legal entity in Argentina?

The Sociedad por Acciones Simplificada (SAS) is increasingly the most popular due to its flexibility, single-shareholder allowance, and streamlined incorporation. However, in some industries or provinces, it may not be accepted, making SRL or SA more suitable.

6. What’s the main difference between SAS and SRL?

SAS is faster to incorporate, can be created by a single shareholder, and offers more operational flexibility. SRL is more traditional and may be better recognized by financial institutions and government tenders.

7. How long does it take to incorporate a company in Argentina?

It generally takes between 3–6 weeks, depending on the structure, shareholder documentation, and whether the foreign investors have local representation.

8. What tax obligations do companies in Argentina face?

Companies must file monthly VAT returns, pay income tax (currently 35% on net profits), and enroll employees in labor risk and pension plans. Annual financial statements must be submitted to AFIP.

9. Is a branch treated differently for taxes?

No. A branch of a foreign company is taxed the same as a local company in Argentina, but the parent company assumes full liability for its obligations.

10. Can I convert my company from SAS to SRL or SA later?

Yes, but it requires legal restructuring and court authorization. It’s best to choose the correct structure from the beginning to avoid delays and added legal costs.

Why engage in Business in Argentina?

Argentina, as the third-largest economy in Latin America, teems with enticing business prospects. Boasting a GDP of USD$632.77 billion, the Argentine economy stands robust and ripe for investment. Moreover, the presence of established legal structures in the country influence the various types of legal structures in Argentina.

Legal entities in Argentina, such as Sociedad Anónima (SA) and Sociedad de Responsabilidad Limitada (SRL), offer flexibility and liability protection, enhancing the appeal for entrepreneurs. These legal entities in Argentina facilitate efficient operations and compliance with local regulations. The government’s commitment to economic reforms further bolsters the business environment, attracting foreign direct investment.

Argentina’s skilled workforce, rich natural resources, and diverse industries create a robust market for goods and services. Legal structures in Argentina provide a framework for foreign entities to engage in partnerships with local companies, fostering innovation and collaboration.

The country’s strategic location and membership in the Mercosur trade bloc enhance its access to regional markets. Legal structures in Argentina also allow for easy repatriation of profits and capital. With a growing tech sector and emerging opportunities in renewable energy, foreign investors find Argentina’s business landscape promising.