Hiring employees in Australia requires compliance with the Fair Work Act and National Employment Standards (NES). This 2025 guide outlines employment contracts, minimum entitlements, termination laws, and employer responsibilities when operating in Australia. This is key when expanding into the Australian market.

Key Takeaways

| What are the working hours mandated by employment law in Australia? | Local labor law sets a maximum work schedule of 38 hours per week, not including overtime. |

| What is the Australian Minimum Wage? | The current standard minimum wage as of July 2024 is AUS$24.10 |

| Types of Employment Contracts in Australia | Permanent (full-time or part time) Casual Fixed-term Seasonal Piecework |

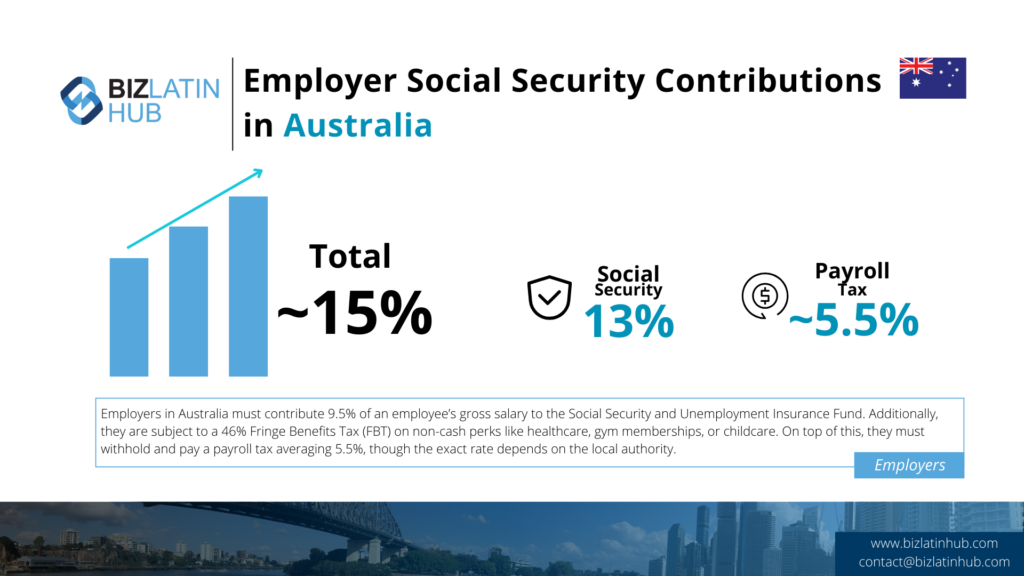

| What percentage of an employee’s salary is contributed to social security in Australia? | Employers must pay into the Social Security and Unemployment Insurance Fund at a rate of 9.5% of an employees’ gross salary. Employers are also expected to withhold payroll tax that is due on all employees’ wages, which averages at around 5.5%. |

| What role do trade unions play? | Trade Unions play a big part in labor laws, both when hiring employees in Australia and for ongoing compliancy |

Overview of Australian Labor Law and the Fair Work Act

The labor laws in Australia, as outlined in the Fair Work Act 2009, ensure that Australian workers have certain fundamental rights. These include a minimum wage, paid leave periods, compensation when necessary, and safe working conditions. Additionally, it is specified that employees should not exceed 38 working hours per week.

The Fair Work Act of 2009 (FW Act) is the general basis for all Australia’s established employment law, as well as work, health and safety, and non-discriminatory regulations. The act creates a council, the Fair Work Commission (FWC), which oversees employment regulations, awards, and enterprise agreements.

On an annual basis, the FWC reviews minimum wage requirements for the country. Most recently, in July 2024, the commission deemed the minimum hourly wage in Australia would be AU$24.10. However, there are also certain industry awards and registered agreements that may contradict this, as well as reduced rates for trainees and so on. Make sure to consult a specialist to make sure you are in compliance with the law.

Additionally, the FW Act states that employment contracts need not be in writing to make them official. Oral contracts suffice and hold up as legitimate. Once employment at an establishment begins, businesses are required to distribute a copy of the National Employment Standards to their new employees. These standards are covered in detail below.

The basics of employment law in Australia are based on the National Employment Standards (NES). This document outlines ten minimum employee entitlements in the workforce which employers must comply with. These minimum requirements are as follows:

- maximum 38-hour work week for full-time employees

- employees who have worked for a company for 12 months or more may request flexible working hours if they meet one of the six categories

- employees are entitled to 12 months of unpaid parental leave and may request an additional 12 months of leave

- full-time employees are entitled to annual, paid leave

- entitled to personal/carer’s leave, compassionate leave, and unpaid family and domestic violence leave

- granted paid leave for jury duty and unpaid leave for voluntary emergency management activities

- paid leave for public holidays

- long service leave

- up to 5 weeks notice of termination and up to 16 weeks redundancy pay

- Fair Work Information Statement

If a company does not comply with these standards, monetary damages may be awarded to employees, as well as possible legal repercussions enforced upon the business.

Types of Employment Contracts in Australia

There are various types of employment contract in the country, all of which are designed for different types of workers. These encompass standard permanent contracts, casual work, fixed-term contracts and piecework. All these ways of hiring employees in Australia are covered by the NES and some modify the basic law.

Permanent (full-time and part-time)

Either for full-time or part-time work, these are standard for most employees. The exact working hours and conditions will be specified by the contract as long as they comply with the NES. Casual employees are also found, who do not have to give notice before termination but will not receive paid leave or redundancy pay. If they start having a fixed schedule they must be offered a full contract within a year.

Fixed-term and probationary contracts

These are especially common for things like construction work. As the work period is known in advance, redundancy and notice periods are absent from these contracts, although the worker will receive benefits pro rata for the term they serve. Maximum term contracts also exist, which allow for more flexibility in working time but reintroduce the need for notice periods.

Casual employment

These are most commonly found in tourism and agriculture, owing to pronounced high seasons in both. Seasonal contracts are similar to fixed-term or casual ones but avoid the need to offer a permanent contract later. Piecework, meanwhile, involves payment in accordance with production levels.

Employer Obligations and Payroll Requirements

When taking on employees in Australia, you must be aware of the financial responsibilities of doing so and factor this into operating costs. Employers must pay into the Social Security and Unemployment Insurance Fund at a rate of 9.5% of an employees’ gross salary, whether setting up as a Sole Trader or a Trust.

There is also an eye-watering 46% tax on fringe benefits provided to workers, whether that be healthcare, gym membership, or childcare. On top of that, employers are expected to withhold payroll tax that is due on all employees’ wages, which averages at around 5.5% depending on the local authority you operate within.

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Contracts | Provide written contract compliant with NES | Clear employment terms and protections |

| Minimum Standards | Follow NES: 38-hour week, paid leave, public holidays | Legal entitlement to minimum benefits |

| Superannuation | Pay 11% super to employee fund | Retirement contributions from employer |

| Fair Dismissal | Follow proper procedures under Fair Work Act | Protection from unfair dismissal |

| Leave | Annual, sick, and parental leave as per NES | Paid time off and entitlements |

Trade Unions in Australia

Much like labor culture in New Zealand, unions in Australia play a crucial role in the employment sector. The organization serves as a representative of the employee during disputes with their employer. Moreover, unions can serve as a bargaining tool during negotiations between employees and employers. Because of their vast involvement in the job market, it is important that businesses recognize and work with trade unions and their employees.

Under the FW Act, unions have a variety of rights within the workplace. These rights include, but are not limited to:

- Representation of a member/potential member in legal proceedings

- Entering a workplace to inspect safety standards, given they have proper permits and governmental approval

- Investigating a suspected breach in health or safety protocol

- Require employers to provide them with relevant documentation and/or records

- Entering the workplace to speak with employees

Overall, unions in Australia exercise a fair share of power in the workplace and in regards to employment law. The activity levels of the unions in this country are comparatively higher than most other countries, so it is important to be aware of the rights and roles they play in employment.

FAQs about hiring employees in Australia

In our experience, these are the common questions that our potential clients often have.

The labor laws in Australia, as outlined in the Fair Work Act 2009, ensure that Australian workers have certain fundamental rights. These include a minimum wage, paid leave periods, compensation when necessary, and safe working conditions. Additionally, it is specified that employees should not exceed 38 working hours per week.

Employers in Australia have a legal obligation to ensure a safe working environment for their employees. They are also required to have workers’ compensation insurance in case of any workplace accidents. The Australian Government oversees this system, and there are also state and territory laws that regulate workers’ compensation.

Employees in Australia work up to 38 hours a week, which is equivalent to seven and a half hours per day.

The current national minimum wage in Australia is $24.10 per hour. Casual employees who are covered by the National Minimum Wage are also entitled to receive at least a 25% casual loading.

Employees are entitled to receive 150% of the minimum hourly rate for the first 2 hours of overtime worked from Monday to Saturday and 200% of the minimum hourly rate for any additional hours. On Sundays, employees are paid 200% of the minimum hourly rate for all hours worked.

Terminations must follow Fair Work guidelines, including notice periods, valid reason, and procedural fairness to avoid unfair dismissal claims.

To terminate an employee in Australia, employers must provide written notice of the day of termination. The notice period varies based on the length of service and enterprise agreements. The requirements for termination are as follows:

– Employees with less than one year of service are entitled to one week’s notice.

– Employees with more than one but less than three years of service are entitled to two weeks’ notice.

Alternatively, employers can choose to pay employees in lieu of notice, and this payment must include superannuation. It is important to note that immediate termination is only allowed for serious misconduct, which is defined as conduct that damages the trust between the employer and employee. Employers must also have a valid reason for dismissing an employee, such as poor performance or conduct.

When an employee quits in Australia, their final termination pay should be paid within seven days. This payment should include any outstanding salary up to the termination date, accrued but untaken annual leave, and if applicable, long service leave entitlements. Additionally, the employee should receive payment in respect of their notice period if it is being paid in lieu.

Employment is governed by the Fair Work Act 2009, which includes the National Employment Standards (NES) that apply to most employees.

While not mandatory by law, written contracts are strongly recommended to clearly define conditions and protect both parties.

As of July 2025, the national minimum wage is AUD $24.10 per hour (subject to Fair Work Commission updates). Industry awards may set higher rates.

Employers must contribute 11% of an employee’s ordinary time earnings to a registered superannuation fund.

Yes, by working with a Professional Employer Organization (PEO) or Employer of Record (EOR). Otherwise, a registered local entity is required.

How well motivated are Australian workers?

In general, these rules and regulations create a workplace environment where employees can feel safe and valued. According to Curtin University’s research report on Australia’s employee happiness in the workplace, over 40% of employees reported being very satisfied with their job. Comparatively speaking, this is a very high and favorable percentage.

Satisfied employees are typically more productive and profitable at work than unsatisfied ones. Employers stand to benefit from the implementation of these laws and the involvement of labor unions. Complying with the minimum standards is expected, but going beyond these and treating employees favorably could reap more benefits for the employer. Overall, abiding by employment law creates a safe and healthy work environment, but going above these expectations will pay off even more.

Biz Latin Hub can help with hiring employees in Australia

Entering the Australian market presents businesses with a host of opportunities. Inevitably, growing business may need to consider hiring employees. The Australian labor market and its rules can be complicated to navigate. When starting your move to into markets ‘down under,’ contact Biz Latin Hub for all your commercial representation and back office needs

Biz Latin Hub’s award for Business Excellence by the Australian-Latin America Business Council demonstrates the support we receive from Australian institutions to connect businesses and support start-ups in the region.

Reach out to us for assistance in navigating Latin American and Oceanian markets.