Whether you are already doing business in the Panamanian market, or are planning to launch there, you must learn how to adhere to corporate compliance in Panama. As with other countries, this is something that is taken very seriously indeed in order to stay in line with international standards and accounting norms. If you want to register a company in Panama, we can help you get started. However, you will need to understand corporate compliance in Panama to avoid ending up on the wrong side of the law or facing sanctions. The Dirección General de Ingresos (DGI) oversees tax compliance, while the Public Registry handles commercial registrations in Panama.

Key Takeaways On Corporate Legal Compliance in Panama

| Is a physical address in Panama necessary for doing business? | Yes, a registered office address or local fiscal address is required for all entities in Panama for the receipt of legal correspondence and governmental visits. |

| What are the annual entity fiscal compliance requirements? | Companies in Panama have 5 months to submit their annual income tax declaration which should be done by the deadline of May 31st. |

| What are the annual Entity Legal Compliance Requirements? | The due date for companies to execute their annual legal entity renewal in Panama is June 30th or January 15th of every calendar year. This depends on the semester in which the company was incorporated. Legal entities in Panama have the option to celebrate an annual shareholder meeting that approves the financial statements of the company. It is not mandatory, but it is good practice. |

| What common statutory appointments do companies make in Panama? | – A resident agent must be appointed who will be personally liable for the company’s compliance. – Three directors who can be nationals or foreigners. – Three dignitaries (President, Secretary, and Treasurer) as a requirement. – Legal representative. |

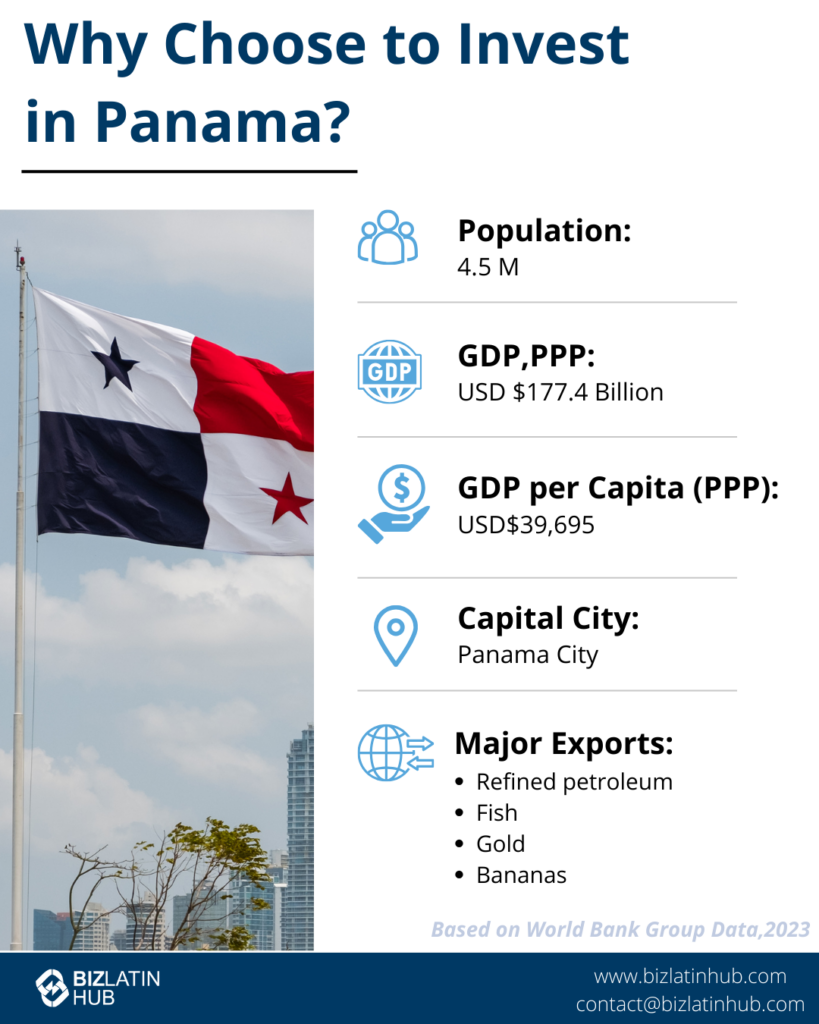

| Why Choose to Invest in Panama? | The country is emerging as a regional hotspot for commercial activity and foreign business. It offers famously competitive conditions for company formation, making it a leader in Central America for investment and economic growth. |

Overview of Corporate Compliance in Panama

There are different types of legal entities that you can incorporate in Panama. In many cases, the most convenient options for foreign multinationals is a corporation (Sociedad Anónima in Spanish) or limited liability company or LLC (Sociedad de Responsabilidad Limitada). These types of entities can be incorporated with just one shareholder. They allow 100% foreign ownership from either a natural person or a legal entity (an individual or another company).

Both a corporation and a limited liability company can be incorporated within a week. Furthermore, Panama offers an express registration process that allows incorporation to be completed within one business day. Companies must provide their resident agent with all necessary information to identify the ultimate beneficial owner (UBO) of the entity. Non-compliance can lead to significant penalties.

What’s the difference between a corporation and a limited liability company in Panama?

The main difference between these two entities is that in a limited liability company, the shareholder needs to be registered with the local public registry institution (Registro Público de Panamá).

For a corporation, the shareholder’s information remains private with the owners, resident agent, the Superintendence of Non-Financial Subjects and the bank (if you open a corporate bank account).

When establishing a company, it is important that every foreign investor knows what the minimum corporate requirements are in order to comply with Panamanian law.

According to Panamanian legislation, every legal entity or company must have a legal representative. This person is appointed to act as the face of the company and represent it in all legal matters. The legal representative is granted legal powers to make certain decisions on behalf of the company.

In Panama, a legal representative can be a foreigner or a Panamanian national, without any restrictions. Make sure that the person you appoint as your legal representative has an in-depth understanding of the local laws and the penalties that might apply if the company doesn’t comply with its corporate obligations. The resident agent must be a local attorney or law firm and is responsible for the company’s compliance with UBO and AML regulations.

What responsibilities does a legal representative have?

A legal representative must fulfill the following roles and responsibilities in Panama:

- Sign formal documents on behalf of the company

- Open corporate bank accounts with the permission of the shareholder or beneficiary of the company

- Sign employment, sales, and lease contracts

- Represent the company in application processes for local permits or registrations such as a commercial license (Aviso de Operación) with the Ministry of Commerce

Register a fiscal address for corporate compliance in Panama

As soon as the company is incorporated at the public registry, it must be registered at the National Tax Authority (Dirección General de Ingresos). The company is obligated to declare its monthly/annual taxes to the National Tax Authority (depending on whether the company has local operations).

You will need to fulfill the annual renewal payment for the company registration. Upon company registration, every legal entity must supply a fiscal address. This address is used to receive correspondence and formal notices from government authorities and financial institutions.

What are my tax responsibilities in Panama?

Your company will need to make monthly or annual tax declarations, depending on whether your company has commercial activities inside the country. This obligation may apply differently to companies located in a free trade zone, that develop an incentive activity like tourism or agriculture, or have a Multinational Company Headquarters License (Licencia de Sede de Empresa Multinacional).

Annual income tax declarations are due by May 31st. Companies conducting activity inside the country need to file an annual income tax declaration by March 31st of every year. An extension to April 30th can be requested.

Panama allows an entity to be registered without monthly or annual tax declarations as long as no commercial operations take place and no incomes are paid. This allows you to incorporate an entity today, not have to worry about tax declarations, and on a later date, when you are ready to start operating, modify the tax declaration obligations.

Since it is dependent on the type of commercial activities, it is important to individually determine which obligations your company has with the national authorities. Companies that are not aware of their annual obligations may end up paying more taxes than is necessary or making fraudulent tax declarations by mistake. Partnering with an experienced local accounting consultant in Panama will ensure you avoid any issues with your tax declarations.

Unless the company is operating under a recognized special tax incentive, companies with local and commercial operations in Panama will need to report monthly tax declarations to the national tax authorities. One example of this is the VAT (Value Added Tax) known better in Panama as ITBMS (Impuesto sobre la transferencia de bienes corporales muebles y la prestación de servicios). This tax is mandatory when annual income exceeds USD$36,000 or depending on the economic activity. According to the Panamanian fiscal code, in the article 1057-V, the VAT or ITBMS report must be filed and paid by the 15th day of each month.

Companies that have operations in Panama will also need to apply for commercial license (Aviso de Operación) and pay an annual tax of 2% over the accountable capital of the company, with a minimum payment of USD$100 and a maximum payment of USD$60,000. Additionally, companies must be aware of additional municipality taxes.

Is there a difference in compliance for onshore and offshore companies in Panama?

Companies with operations within Panamanian territory (onshore) have more corporate compliance obligations than those operating outside of the territory (offshore). Companies conducting activity inside of the country need to file an annual income tax declaration by March 31st of every year. You can request to extend this period to April 30th. It is not necessary to file income tax returns for offshore companies with assets exclusively outside of Panama.

If you operate a corporate bank account and receive any kind of income throughout the year, the company will need accounting registries. This is mandatory for offshore and onshore companies that are established in Panama.

Penalties for Non-Compliance in Panama

Non-compliance with corporate legal obligations in Panama can result in significant legal and operational consequences. Common penalties include:

- Suspension of Tax Identification Number (RUC): Businesses cannot operate legally if their RUC is suspended.

- Fines from Regulatory Authorities: The DGI may impose fines for late or incorrect filings.

- Legal Actions Against Administrators: Company administrators may face personal liability for non-compliance, leading to legal actions and potential disqualification from holding management positions.

- Restriction on Business Operations: Companies failing to comply with regulations may face restrictions on their business activities.

- Negative Impact on Creditworthiness: Non-compliance can adversely affect the company’s credit rating, making it difficult to secure financing or conduct business with partners.

FAQs on Corporate Compliance in Panama

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Panama

The following are the most common statutory appointments for Panamanian legal entities:

– A resident agent must be appointed who will be personally liable for the company’s compliance with Ultimate Beneficial Owner (UBO) and Anti-Money Laundering (AML) regulation. The appointee must be a local attorney or a law firm.

– Three directors who can be nationals or foreigners.

– Three dignitaries (President, Secretary, and Treasurer) as a requirement. The dignitaries can be the same three persons appointed as directors.

– Legal representative. The roles and responsibilities of this statutory appointment were already discussed above. It is very common for the president of the entity to also be the legal representative.

Yes, a registered office address or local fiscal address is required for all entities in Panama for the receipt of legal correspondence and governmental visits.

Companies in Panama have 5 months to submit their annual income tax declaration which should be done by the deadline of May 31st.

Legal entities in Panama have the option to celebrate an annual shareholder meeting that approves the financial statements of the company. It is not mandatory, but it is good practice.

The due date for companies to execute their annual legal entity renewal in Panama is June 30th or January 15th of every calendar year. This depends on the semester in which the company was incorporated.

Companies must maintain a registered office address, submit annual income tax declarations by May 31st, execute annual legal entity renewals by June 30th or January 15th (depending on the incorporation semester), and appoint a resident agent, three directors, and three dignitaries (President, Secretary, and Treasurer).

Companies must submit annual income tax declarations within five months of the fiscal year-end, with a deadline of May 31st. Companies conducting activity inside the country need to file an annual income tax declaration by March 31st of every year. An extension to April 30th can be requested.

A resident agent, who must be a local attorney or law firm, is responsible for the company’s compliance with Ultimate Beneficial Owner (UBO) and Anti-Money Laundering (AML) regulations. They are personally liable for the company’s compliance.

Companies must provide their resident agent with all necessary information to identify the beneficial owner of the entity. The resident agent is then obligated to include this information in the Beneficial Owners Register, managed by the Superintendency of Non-Financial Subjects. Non-compliance can lead to significant penalties, including fines up to USD $5,000 per legal entity not registered, with additional daily fines if not corrected.

Non-compliance can result in penalties, including fines, suspension of the company’s tax identification number, and potential legal actions against the company’s administrators. The company may also be unable to initiate legal processes, conduct business, or dispose of assets.

Why invest in Panama?

Panama’s stable political environment, high levels of prosperity, relatively low levels of crime, and famed offshore banking system make it a highly popular destination for investors and corporations doing business in the region. Those assets come with prime logistics.

Panama City is a major flight hub, with the capital’s Tocumen International Airport having direct flights to various major cities in Europe and throughout the Americas. The presence of the Panama Canal makes the country a critical hub for trade and commerce, with approximately 14,000 ships passing through the waterway each year. It is crucial to the economy, accounting for approximately 6% of gross domestic product (GDP).

Another factor that makes the country attractive to investors is that it is one of Latin America’s dollarized economies. This results in a greater degree of currency stability in Panama than in some other markets. This means that the country attracts more FDI than its Central American neighbors.

Biz Latin Hub can help you with corporate compliance in Panama

With an infinite amount of business opportunities available in Panama, it is not surprising that keen investors are looking towards Panama as great location to start developing their businesses.

It’s crucial to know how and when to file your monthly or annual taxes to avoid any kind of penalties with the national authorities. For this reason and more, working with a trusted local legal and accounting firm can ensure that your company remains compliant when operating in Panama.

At Biz Latin Hub, our team of local and expatriate professionals offer vital guidance and support to help companies meet their obligations for corporate compliance in Panama. Our accounting and legal experts are equipped to deliver high-quality, personalized market entry and back-office services to suit your needs.

Contact here at Biz Latin Hub to see how team Biz Latin Hub can support your business in Panama and Latin America.

Learn more about our team and expert authors, and how our specialist services can guide you through the company formation process in Panama.