Corporate Entity Regulatory Compliance in Brazil aims to foster economic growth, protect workers, and ensure a competitive business environment. Understanding these regulations is essential for registering a business in Brazil while avoiding penalties. Biz Latin Hub, can simplify compliance with out full suite of back-office services can cover all of your needs under one services agreement. With tailored support, you can streamline operations and focus on growth in one of Latin America’s most dynamic markets.

Key Takeaways On Corporate Entity Regulatory Compliance in Brazil

| Fiscal Address Requirements: | A registered local fiscal address is required for all entities in Brazil for the receipt of legal correspondence and governmental visits. |

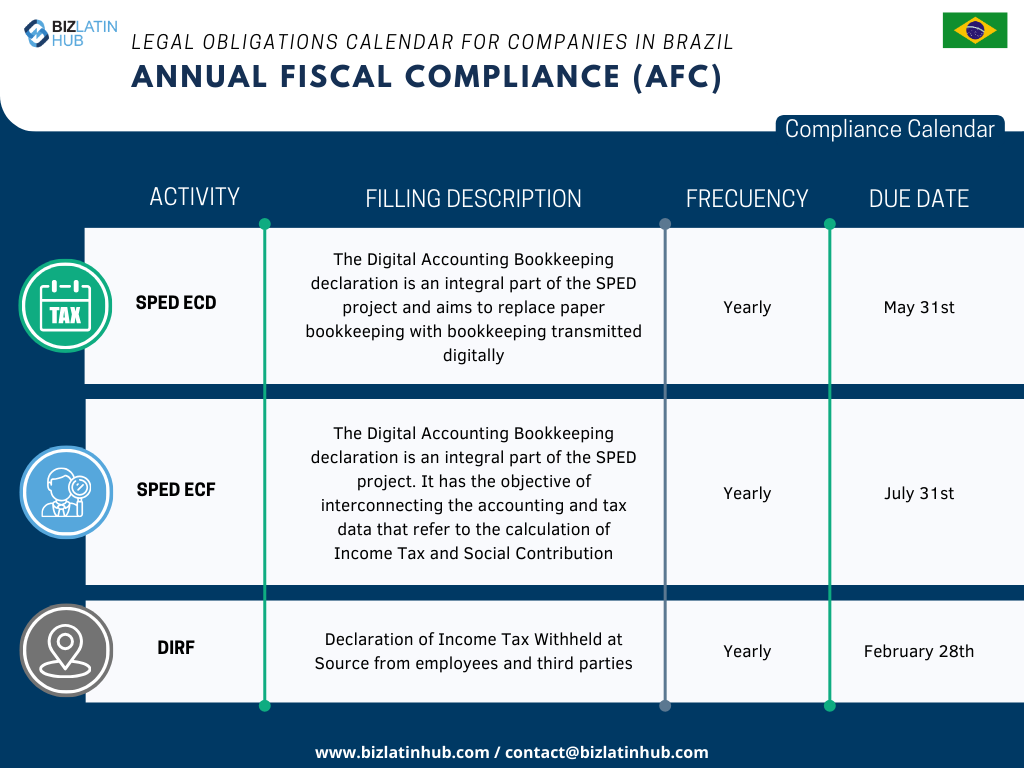

| What Are The Steps For Annual Entity Fiscal Compliance? | SPED EDC SPED ECF DIRF |

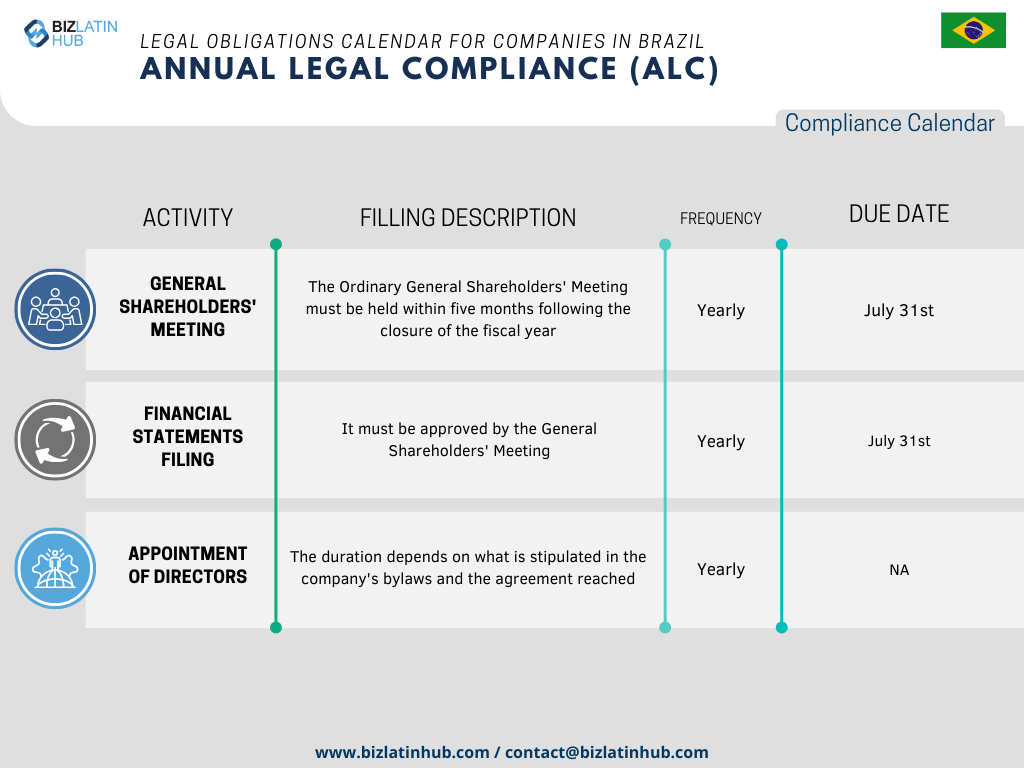

| What Are The Steps For Annual Entity Legal Compliance? | General Shareholders Meeting Financial Statements Filing Appointment of Directors |

| Why Invest in Brazil? | Brazil continues to lead as Latin America’s largest economy, with growing sectors in agriculture, energy, technology, and manufacturing. |

Overview of corporate compliance in Brazil

Any company in Brazil, regardless of legal entity type, must comply with a series of regulatory obligations over the calendar year. Fulfilling your corporate compliance requirements in a timely manner will help your company manage risk, and avoid liabilities.

Below, we outline the main compliance rules applicable to Brazil’s Limited Liability Company (LLC) structure, known as the Sociedade Limitada.

1. Corporate obligations for a Brazilian LLC

If your Limited Liability Company (LLC) in Brazil has a foreign shareholder, it is mandatory to register the capital invested by that shareholder. You must register this capital before the system of the Brazilian Central Bank (Banco Central do Brasil).

To complete this requirement, you must provide information on the shareholder, disclose the amount invested in the Brazilian LLC, and hand over supporting documents illustrating the company’s operations.

In addition, you must file minutes of the LLC’s shareholder meeting/s by April 30th every year. The minutes should include the following:

- Review of the management accounts

- The company balance sheet plus economic performance

- Information on designated administrators, where applicable

- Decisions on any other matter included on the agenda

You must ensure that all books are updated to reflect the company’s current situation. Please note that part of managing the accounting books must be done online.

Note: Companies that possess more than 240 million Brazilian reais in assets or have a gross revenue over 300 million Brazilian reais, must publish their financial statements (i.e. balance sheet, statement of retained earnings or accumulated losses, income statement for the year, and cash flow statement) publicly.

By-laws requirements

- Personal identification information for each shareholder, including nationality, marital status, profession, ID document, address, and CPF number (Brazilian tax identification number, which must be obtained by a foreign partner).

- Definition of the company’s business purpose, which must be in accordance with Brazil’s CNAE system, where each business activity has a corresponding descriptive code.

- Information on the company’s capital and each shareholder’s quota. Must include the value of a quota as well as the percentages applied to each owner.

- Information on the company’s representative/administrator, who must be a Brazilian citizen or a foreigner with permanent resident status. Foreign shareholders who do not have permanent resident status cannot be administrators.

Requirements for administrators and representatives

- Foreign shareholders must be enrolled in the Brazilian Federal Revenue’s taxpayers’ registry. For that purpose, they must appoint an individual resident in Brazil with powers to represent them before the aforementioned authority and to manage their assets in Brazil. This process can be initiated online but must be completed within 90 days of the initial filing.

- It is also important to bear in mind that in case the relevant shareholders and/or managers are not residents in Brazil and do not intend to become residents, certain actions must be completed in advance. This includes appointing an attorney in Brazil to represent any non-resident individuals for corporate and tax purposes.

2. Taxes and fiscal obligations

Brazil, throughout its republican history, has battled to find the best way to optimize its tax system.

The Brazilian tax system is regulated by the constitution and other state and municipal laws. Each tax authority administers specific regulations. As part of corporate compliance in Brazil, each company must pay taxes to the federal, state, and municipal tax authorities.

There are different types of taxes and, consequently, there are different types of tax returns.

The main federal taxes applicable to an LLC in Brazil are:

- IPI: Taxes Over Industrialized Products

- IOF: Financial Transactions Tax

- IRPJ: Corporate Income Tax

- CSLL: Social Contribution to Net Income

- COFINS: Contribution for Social Security Financing

- PIS: Social Integration Program.

For the main federal tax returns, a Limited Liability Company in Brazil must comply with the following:

- DCTF: Federal Tax Debt Statement

- EFD Contribuições: Digital Tax Bookkeeping Contributions

- ECD: Digital Accounting Bookkeeping

- ECF: Fiscal Accounting Bookkeeping

- DIRF: Withholding Income Tax Statement.

Brazil has a complex taxation system. If we consider state and municipal tax returns on top of those listed above, the list of accounting compliance requirements for companies in Brazil can be extensive.

Recent governments have passed tax reforms with the aim of simplifying this system but they have been only partially effective. Only experienced accountants have the necessary expertise to handle corporate taxation obligations.

Using an experienced local accounting and taxation specialist is the best way to fully meet corporate compliance requirements in Brazil and protect your company from non-compliance issues.

3. Labor and social security obligations

As with taxation, labor compliance requirements can also be complex in Brazil.

Fortunately, the government has recently passed reforms on labor regulations and social security. Since 2017, labor legislation has become more flexible, and the government and labor courts now enforce legal certainty for new hires.

To ensure compliance with corporate requirements in Brazil, companies must take note of the following obligations regarding labor:

- Paid vacation: 30 days of paid vacation for every 1 year of work

- Vacation allowance: one-third salary allowance on vacation salary amount (salary x 0.333)

- Annual bonus: paid before December 20th

- Contribution to social security: Paid over the total salary amount (8% to 27.6%)

- Deposit guarantee fund (FGTS): Paid over the total salary amount (8%)

Note: Every employer must enroll its employees in the INSS (National Social Insurance Institution or Instituto Nacional do Seguro Social).

Keep Tabs on Due Dates

Following in our expericence, if you move forward with company formation in Brazil, to avoid the incidence of fines or other penalties, make sure you meet all corporate compliance requirements in Brazil with the following in mind:

- Compliance with local rules on tax incidence

- Understand how to accurately calculate the contributions owed

- Due dates for payments and filing statements

It’s important to engage with a trusted provider who has comprehensive knowledge of corporate compliance in Brazil, to ensure your company operates in accordance with local law and doesn’t miss deadlines. That way, company executives are free to focus on business growth and development.

FAQs on entity legal compliance in Brazil

Based on our extensive experience these are the common questions and doubts of our clients on corporate legal compliance in Brazil:

The following are the most common statutory appointments for Brazilian legal entities:

– An appointed local director, who will be personally liable, both legally and financially, for the good operation and standing of the company. This person can either be a local national or a foreigner with residency in Brazil.

– A certified local accountant (CPA) registered with the authorities on behalf of the company.

– A shareholder’s legal representative for each foreign shareholder. This person can either be a local national or a foreigner with residency in Brazil.

Yes, a registered local fiscal address is required for all entities in Brazil for the receipt of legal correspondence and governmental visits.

In the case of both the SPED ECD and the SPED ECF, the Digital Accounting Bookkeeping declaration is an integral part of the SPED project. However, in the case of the SPED ECD, this aims to replace paper bookkeeping with bookkeeping transmitted digitally and, in the case of the SPED ECF, this has the objective of interconnecting the accounting and tax data that refer to the calculation of Income Tax and Social Contribution.

DIRF refers to the Declaration of Income Tax Withheld at Source from employees and third parties which occurs yearly and whose deadline for submission is February 28th.

The Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year and the deadline of this meeting is July 31st.

Yes it is mandatory to register the capital invested by that shareholder before the system of the Brazilian Central Bank (Banco Central do Brasil).

it is mandatory to register the capital invested by that shareholder. You must register this capital before the system of the Brazilian Central Bank (Banco Central do Brasil).https://www.bcb.gov.br/en

Why Invest in Brazil?

Brazil offers a dynamic economy with diverse sectors, including agriculture, energy, technology, and manufacturing. It is a leading global exporter of commodities like soybeans, coffee, and iron ore, which ensures sustained demand. A growing middle class fuels consumption and presents opportunities in retail, real estate, and financial services.

The government has implemented reforms to attract foreign investment, such as reducing bureaucratic barriers and improving infrastructure. Brazil’s recent focus on renewable energy projects, including solar and wind, aligns with global sustainability goals. Investors benefit from robust returns in both traditional and emerging markets.

The countires membership in Mercosur also enhances regional trade opportunities, while free trade agreements increase competitiveness. The nation’s large, skilled workforce supports business operations across industries.

Biz Latin Hub can help you with corporate compliance requirements in Brazil

At Biz Latin Hub, our team of local and expatriate professionals in Brazil routinely support foreign entrepreneurs entering the market and doing business in full compliance with local law.

We offer a full suite of market entry and back-office support for expanding multinationals in Brazil and the wider Latin American region, making us your single point of contact for full legal and accounting services. This includes company formation, corporate compliance, legal representation, accounting, hiring, visa processing, due diligence, and other business solutions.

Contact us now to make the most of our market leading services, and get a customized quote from our team.

Learn more about our team of specialists and expert authors.