Choosing the right business entity is crucial for entrepreneurs aiming to establish a foothold in Jamaica. Each type comes with unique tax implications and legal requirements, which significantly influence business operations and profitability. This guide provides a clear insight into the different business entity types available in Jamaica and their respective legal and tax considerations.

Available Business Entity Types in Jamaica

Jamaica offers multiple business structures that cater to different investment needs and operational goals:

Limited Liability Company (LLC)

A Limited Liability Company in Jamaica offers flexibility and liability protection. Governed by the Companies Act of 2004, an LLC shields members from personal financial risk, ensuring personal assets are protected from business debts. This structure is particularly attractive to small and medium enterprises. LLCs can be fully foreign-owned, which encourages international investment. Members have the advantage of choosing their tax structure, with LLCs in unregulated industries benefiting from a lower corporate tax rate of 25%.

Public Limited Company (PLC)

Public Limited Companies can publicly offer shares and are often listed on the Jamaica Stock Exchange. A PLC must have at least three directors and one shareholder. Large companies favor this structure due to the limited liability of shareholders, who are responsible only for their share capital. Forming a PLC requires detailed submissions to the Companies Office of Jamaica, including a prospectus. Once established, a PLC must appoint an auditor and provide audited financial statements annually.

Sole Proprietorship

This is one of the simplest forms of business entities in Jamaica, owned and operated by a single individual who has full control and is entitled to all profits. Setting up this entity is straightforward and cost-effective, with few regulatory hurdles. However, the owner bears all financial risks, as there is no legal distinction between the owner and the business.

Partnerships

Partnerships involve collaboration between two or more individuals or entities. In Jamaica, partnerships allow for shared management and profit distribution. Partners can negotiate different arrangements regarding liability and profit sharing. Some partnerships include limited liability partners, while others feature silent partners who invest but do not participate in daily operations.

Branches of Foreign Companies

Branches operate as extensions of their parent companies and must appoint local representatives to manage legal matters. They must register with the Companies Office of Jamaica. The foreign parent holds full liability for branch debts and obligations. Establishing a branch requires at least US$1 in paid-up capital and allows foreign companies to expand without creating separate legal entities.

Subsidiaries of Foreign Firms

Subsidiaries in Jamaica operate like domestic companies. Foreign firms can establish subsidiaries without special nationality constraints, as Jamaica imposes few restrictions on foreign ownership. This facilitates the movement of capital and dividends. The legal requirements for subsidiaries fall under the Companies Act, offering foreign firms operational control while benefiting from local business advantages.

Legal Requirements for Business Entities

Registration Procedures

Registering a business in Jamaica is a streamlined process, typically completed in 3-5 business days. The Companies Act, including its 2018 amendment, governs this process. Jamaica permits 100% foreign ownership for both legal and natural persons. Businesses can register as private or public limited companies, or as sole proprietorships.

Required Documentation

Incorporating a company in Jamaica begins with reserving a company name. Entrepreneurs then prepare the necessary incorporation documents and submit a registration application. Required documents include:

- Articles of Incorporation

- Beneficial Owners information using BOR Form A and/or B

- At least one director, one shareholder, and a company secretary

- Minimum paid-up share capital of US$1

Compliance and Reporting Obligations

Companies in Jamaica must file annual returns and financial statements with the Companies Office of Jamaica. Overseas companies must submit annual balance sheets, profit and loss accounts, and statements showing assets in Jamaica. LLCs and PLCs must appoint a registered auditor for annual audits. Foreign branches must appoint a resident agent or representative with a general power of attorney.

Licenses and Permits

After receiving a Taxpayer Registration Number (TRN), businesses must obtain necessary industry-specific licenses and permits. Professional fields may require validated certifications. Non-CARICOM nationals need work permits unless they can prove Jamaican citizenship. Companies typically acquire these permits after opening a corporate bank account.

Tax Considerations for Different Entities

Jamaica’s tax system includes several important components that businesses must understand:

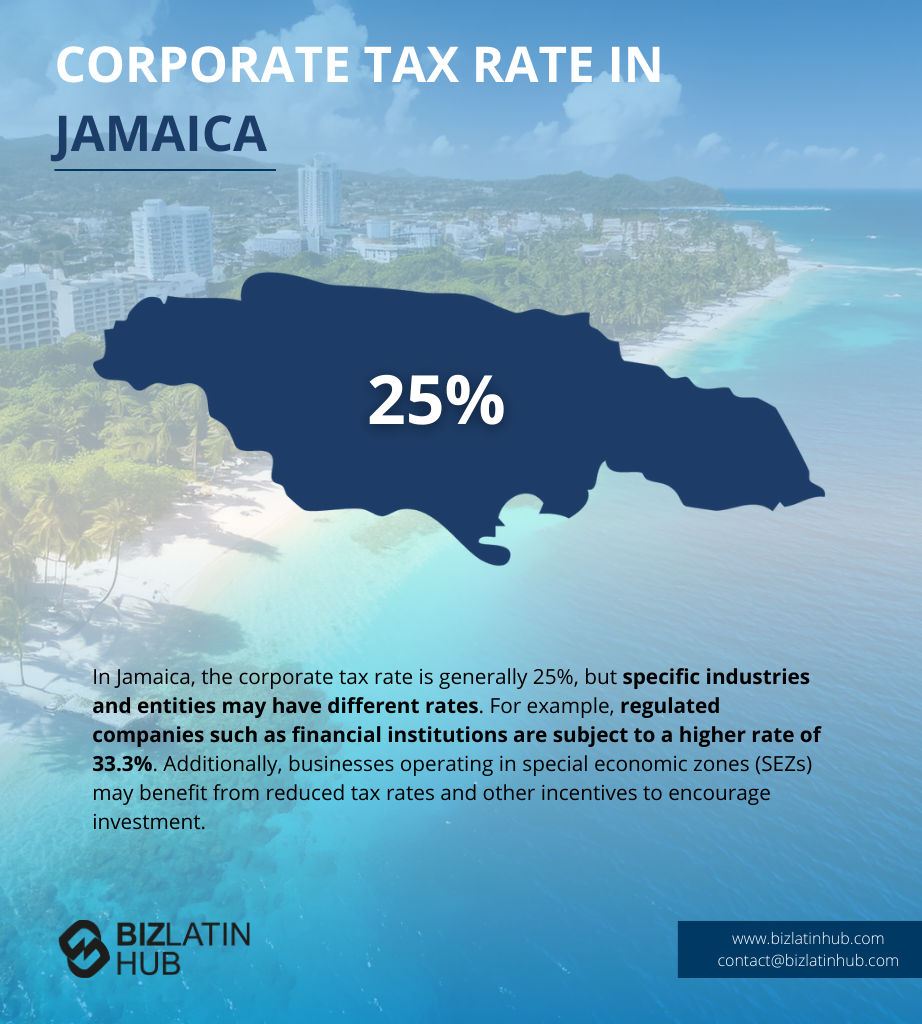

Corporate Income Tax

The general corporate tax rate is 33%, but LLCs in unregulated industries benefit from a reduced rate of 25%. All corporate entities must possess a tax registration certificate and appoint a registered local auditor. Annual audits and financial statement submissions are mandatory for compliance.

Payroll Taxes

Employers must deduct Pay-As-You-Earn (PAYE) Income Tax from employee salaries at a rate of 25% for amounts up to JMD 6 million yearly and 30% for earnings above that threshold. Additional deductions include:

- Education tax: 3.50% from employers, 2.25% from employees

- National Insurance Scheme (NIS): 3% from both employers and employees on gross emoluments capped at JMD 5 million per year

These taxes must be remitted within 14 days after the end of each pay period.

Property and Transfer Taxes

Property taxes in Jamaica are based on the unimproved value of the property, with rates varying between 0.50% and 0.90%. Transfer taxes apply to land, building, securities, and share transfers at 2% of the market value. Listed securities on the Jamaica Stock Exchange are exempt from transfer taxes and stamp duties. A tax refund is available if transfer tax exceeds 37.5% of capital gains from selling property or shares.

Special Consumption Tax (SCT)

Jamaica imposes Special Consumption Tax on specific products including alcohol, tobacco, petroleum products, and certain luxury items. This excise tax varies by product category and supports government revenue while regulating consumption of these goods. Businesses importing or manufacturing SCT-applicable products must register with the tax authorities and submit regular filings.

Withholding Taxes

Jamaica applies withholding taxes to payments made to non-residents, including dividends, interest, and royalties. These rates may be reduced under applicable double taxation agreements that Jamaica maintains with countries including Canada, USA, UK, Germany, and Sweden. Businesses making payments to non-residents must verify the applicable withholding rate and ensure proper tax compliance.

Regulatory Environment for Foreign Investments

Regulatory Framework

The Companies Act of 2004 and its 2018 amendment form the primary regulatory framework for business operations in Jamaica. The Companies Office of Jamaica (COJ) handles registration of all business entities. Companies must also comply with tax laws, health and safety regulations, environmental considerations, and employment standards.

Investment Incentives and Strategic Advantages

Jamaica offers significant advantages to foreign investors:

- Free movement of capital, profits, and dividends

- No restrictions on borrowing in local or foreign currencies

- Strategic location within a four-hour flight radius of 500 million people

- Two international airports facilitating global connectivity

- Double taxation agreements with major economies including Canada, USA, UK, and Sweden

- Well-developed infrastructure including highways, seaports, and telecommunications

Steps to Setting Up a Business in Jamaica

Market Research and Feasibility

Before establishing a business in Jamaica, conducting thorough market research is essential. Companies can establish representative offices to understand the local market before committing to full operations. These offices help assess the business environment and identify potential opportunities.

Legal and Financial Advising

Legal advisors help companies navigate the incorporation process, obtain necessary registrations, and ensure compliance with Jamaican tax and regulatory requirements. They also assist with drafting employee contracts and policies and obtaining work permits for non-resident business activities.

Entity Formation Process

The business formation process typically takes 3-10 days depending on the entity type. The Electronic Business Registration Platform (eBRF) facilitates many business registrations. Public Registrar records display the names of directors but not shareholders, offering some privacy protections.

Banking and Financial System

Jamaica’s banking system includes commercial banks, credit unions, and building societies that handle financial transactions. The national currency is the Jamaican dollar, though many businesses also operate in US dollars. Foreign-owned companies face no special requirements for directors or shareholders, supporting Jamaica’s mixed free-market system of private businesses and state enterprises.

With its favorable business environment, strategic location, and diverse entity options, Jamaica offers attractive opportunities for entrepreneurs and investors. Understanding the legal and tax implications of each business structure is essential for making informed decisions and establishing successful operations in this Caribbean nation.