When doing business abroad, it is important to comply with local invoicing requirements in order to avoid penalties or administrative inconveniences that would be detrimental to your business. The following article highlights some of the key considerations related to invoicing requirements for a foreign company in Chile — one of Latin America’s most highly-developed and prosperous nations, and a popular destination for foreign investment.

Having pioneered economic liberalization policies during the late-1970s and 1980s, Chile emerged as a global leader in promoting free trade, and experienced a period of rapid social and economic development, thanks to institutions like the World Bank. Now a modern nation, invoicing requirements for a foreign company in Chile laregly follow international standards.

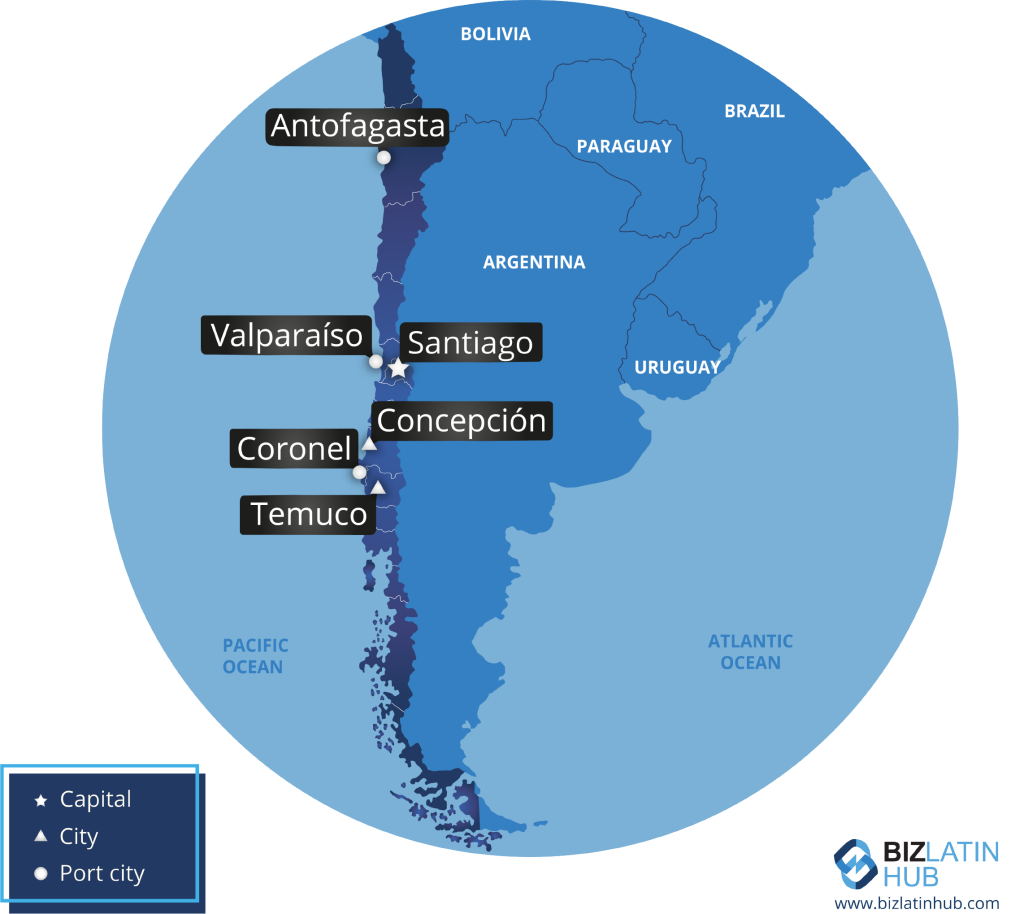

Whether you are considering doing business or have already established your operations in the country, read on to learn about invoicing requirements for a foreign company in Chile, or go ahead and reach out to us now to discuss your business options. With a dedicated office in Santiago, we know the country and region inside out and our array of back office services can help you with any business needs, including company formation in Chile.

Invoicing requirements in Chile: when to issue an invoice?

An invoice in Chile describes an agreement for goods or services provided by an individual or firm to a client, and is an important element of record keeping for tax and accounting purposes.

Invoicing requirements in Chile dictate that all companies legally operating in Chile are able to issue an invoice when selling a product or service. Likewise, any organization developing commercial transactions with another organization or service provider must always issue an invoice.

Note that companies in certain sectors that deal with high volumes of overseas clients — such as the tourism sector — have the options of issuing electronic invoices, also known as ‘export invoices’, to clients who do not have a domicile or residence in the country. This process is carried out online and is supervised by the Chilean Internal Revenue Service (SII).

What should an invoice issued to a foreign company contain?

In order to comply with invoicing requirements for a foreign company in Chile, legal entities operating in the country must issue include the following information:

- Economic activity of the issuer and receiver of the invoice, as registered with the SII

- Physical address, telephone number, and email of the issuer

- Identification number of the person/firm who issues the invoice

- Unique Taxpayer Identification Number (RUT in Spanish) of the issuer and receiver of the invoice. In the event that the issuer is foreign, a default number is assigned

- Invoice number in sequential order

- Invoice issuance date expressed in “day/month/year” format

- Description of the service or good purchased, detailing the quantity per unit

- Price and value of the service or good acquired, indicating the amount of value-added tax (VAT) to be applied

Note that as established by invoicing requirements for a foreign company in Chile, any invoice issued to a foreign person or organization must always include VAT. This tax applies to all products sold in the country, regardless of whether the purchase is made in Chile or abroad.

FAQs on invoicing requirements for a foreign company in Chile

In order to comply with invoicing requirements in Chile, legal entities operating in the country must issue include the following information:

Economic activity of the issuer and receiver of the invoice, as registered with the SII

Physical address, telephone number, and email of the issuer

Identification number of the person/firm who issues the invoice

Unique Taxpayer Identification Number (RUT in Spanish) of the issuer and receiver of the invoice. In the event that the issuer is foreign, a default number is assigned

Invoice number in sequential order

Invoice issuance date expressed in “day/month/year” format

Description of the service or good purchased, detailing the quantity per unit

Price and value of the service or good acquired, indicating the amount of value-added tax (VAT) to be applied

Any organization developing commercial transactions with another organization or service provider must always issue an invoice.

Invoicing requirements for a foreign company in Chile dictate that all companies legally operating in Chile are able to issue an invoice when selling a product or service.

If the company has a permanent legal presence, anyone legally authorised to sign documents on behalf of that company will be able to issue an invoice. Where the company does not have a legal entity constituted in Chile, but instead has an appointed legal representative in the country, that representative can manage invoices on the company’s behalf.

Invoices indicate outstanding payment due for goods or services, and represent a type of legal protection to both parties involved in a business transaction, promising the client the service and the contractor their payment.

Biz Latin Hub can help with invoicing requirements for a foreign company in Chile

At Biz Latin Hub, our multilingual team of accounting and taxation specialists is equipped to help you navigate all manner of corporate regulations, including understanding invoicing requirements for a foreign company in Chile.

With our full suite of legal, HR, commercial representation, and tax advisory services, we can be your single point of contact to ensure the success of your commercial operations in Chile, as well as any of the other 15 countries across Latin America and the Caribbean where we are present.

Contact us now for personalized assistance.

Learn more about our team and expert authors.