If you are doing business in the Bolivian market, understanding invoicing requirements for a foreign company in Bolivia will be important. Because failure to invoice according to local regulations and norms could result in legal inconveniences or financial penalties that will be detrimental to the smooth running of your business.

Invoices provide a detailed record of transactions undertaken for your business, and are an indispensable resource for accountancy matters. They also offer a level of legal protection to both parties involved in the transaction, demonstrating the provider’s commitment to offer up a particular good or service, as well as the recipient’s commitment to pay for it once provided as agreed.

For anyone looking to register a company in Bolivia, while you will likely have a local partner assisting you with legal and accounting matters, it is worthwhile having an understanding of invoicing requirements for a foreign company in Bolivia.

That’s why it makes sense to partner with a local specialist such as Biz Latin Hub. With a network of 18 dedicated local offices around Latin America and the Caribbean, we can help you with invoicing requirements for a foreign company in Bolivia or elsewhere in the region. Not only that, but our array of back office services can make sure your day-to-day operations are fully compliant and allow you to focus on building your business.

Invoicing requirements for a foreign company in Bolivia: essential considerations

One of the most fundamental invoicing requirements for a foreign company in Bolivia is to have a legal entity established in the country in the first place.

That means that the company formation process has been completed, and that the entity has a registered address, as well as being registered with the national tax authority, which has issued the entity with a tax identification number, or NIT. This information must be included on an invoice.

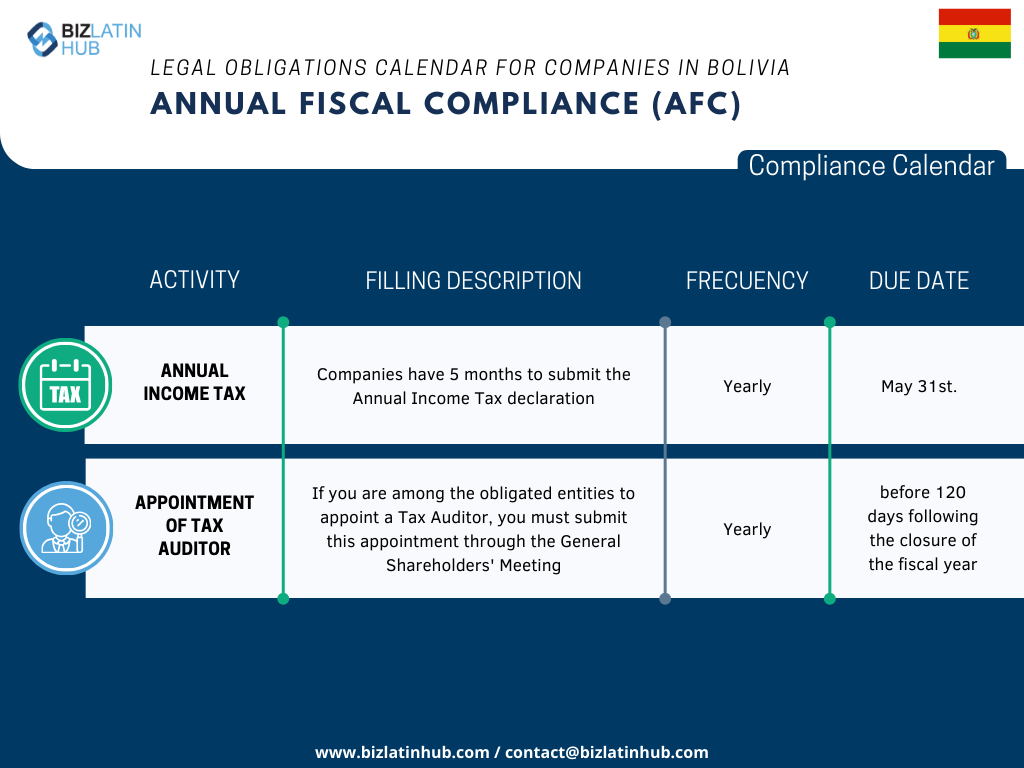

By law, all invoices and related documents must be stored for a period of at least eight years, and in some situations they must be stored for ten years. They must also be stored in a manner that makes them easily accessible to relevant parties, including the tax authorities.

In Bolivia, the standard rate of value-added tax (VAT) is 13%. VAT is applied to the likes of sales of goods, provision of services and imports of goods. Exports are generally exempt from VAT.

Invoicing requirements for a foreign company in Bolivia: electronic invoicing

Currently, Bolivia operates an optional electronic invoicing system, known as its virtual invoicing system, or SFV. This system has been reintroduced after being curtailed prior to the global pandemic sweeping the globe in early 2020.

While electronic invoicing remains optional, it is widely expected to be made compulsory. One of the key advantages of electronic invoicing is the ease with which you can store them, guaranteeing compliance with the law on keeping invoices.

In order to issue electronic invoices, you must apply for a permit, as well as use designated software endorsed by the national tax authority.

FAQs on invoicing requirements for a foreign company in Bolivia

One of the most fundamental invoicing requirements for a foreign company in Bolivia is to have a legal entity established in the country in the first place.

That means that the company formation process has been completed, and that the entity has a registered address, as well as being registered with the national tax authority, which has issued the entity with a tax identification number, or NIT. This information must be included on an invoice.

By law, all invoices and related documents must be stored for a period of at least eight years, and in some situations they must be stored for ten years. They must also be stored in a manner that makes them easily accessible to relevant parties, including the tax authorities.

This identifies you to the tax authorities, which have issued the entity with a tax identification number, or NIT. This information must be included on an invoice.

If the company has a permanent legal presence, anyone legally authorised to sign documents on behalf of that company will be able to issue an invoice. Where the company does not have a legal entity constituted in Bolivia, but instead has an appointed legal representative in the country, that representative can manage invoices on the company’s behalf. In order to issue electronic invoices, you must apply for a permit, as well as use designated software endorsed by the national tax authority.

Invoices provide a detailed record of transactions undertaken for your business, and are an indispensable resource for accountancy matters. They also offer a level of legal protection to both parties involved in the transaction, demonstrating the provider’s commitment to offer up a particular good or service, as well as the recipient’s commitment to pay for it once provided as agreed.

Biz Latin Hub can assist you with invoicing requirements for a foreign company in Bolivia

At Biz Latin Hub, our team of corporate support experts has the experience and expertise to help you deal with invoicing requirements for a foreign company in Bolivia, or any of the other 17 markets in Latin America and the Caribbean where we have teams in place.

With our complete portfolio of back office solutions, including accounting & taxation, company formation, legal, recruitment, and visa processing services, we can be your single point of contact for entering and operating in the region.

Reach out to us now for more information on how we can support your business.

Learn more about our team and expert authors.