Investor confidence in Brazil has hit its highest level since June 2013, in a clear sign of the country’s economic reactivation following the turmoil of the global pandemic that will be welcomed by investors interested in doing business in Brazil.

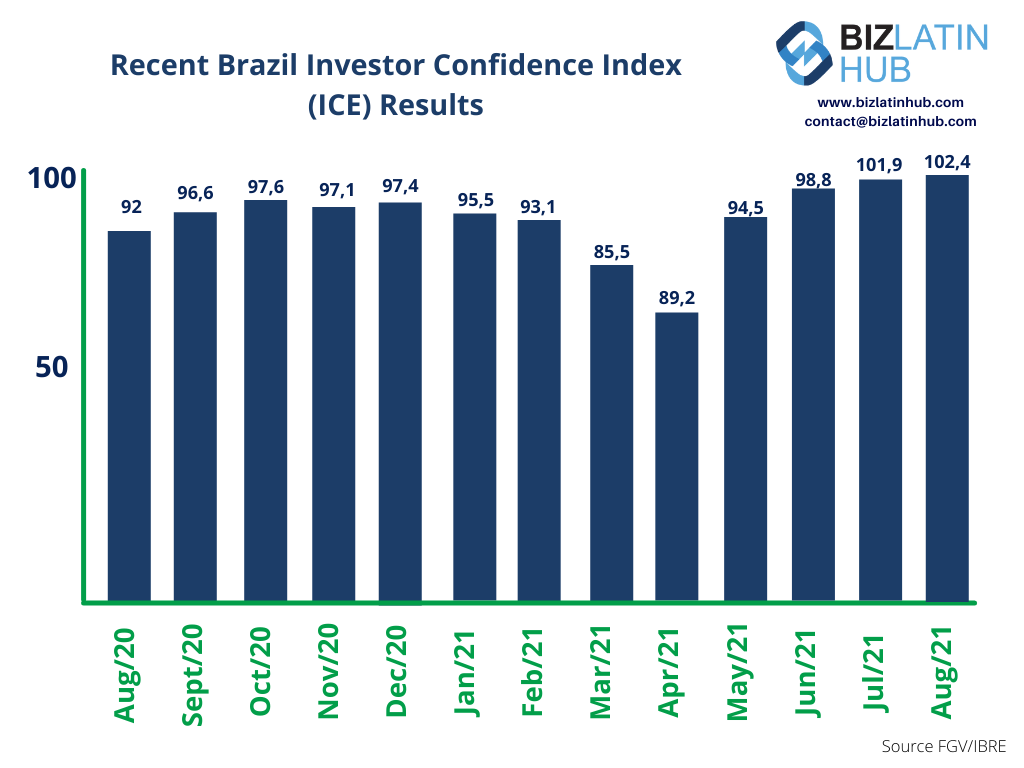

According to data released by the Getulio Vargas Foundation (FGV), an economic institute, Brazil saw its Business Confidence Index (ICE) rise 0.5 points in August to hit 102.4 points — the highest score the Index has registered since June 2013.

FGV assesses ICE on a 100-point ‘neutrality scale,’ whereby scores over 100 demonstrate significant confidence. The latest result marks the fifth consecutive month in which investor confidence has grown, rising from 85.5 in March and first breaching the 100-point benchmark in July.

“The result suggests that economic activity continues to accelerate in the third quarter,” Aloisio Campelo Jr, FGV’s statistics superintendent, was reported as saying.

However, Campelo did highlight that while the results demonstrate the ongoing growth of investor confidence in Brazil, they did represent a slight dampening on the strong improvement from the previous month.

FGV calculates ICE based on 49 economic sub-sectors, drawn from the four key sectors of industry, services, commerce, and construction. Notably, investor confidence was reported to have grown in relation to 26 of them, when it had grown in relation to 36 in July.

According to the study, it was significant growth in the construction and services industries that were responsible for the uptick in investor confidence.

Growth in investor confidence in Brazil an encouraging sign of recovery

The news that investor confidence in Brazil has hit an eight-year high offers an encouraging sign of recovery from the economic ructions of the COVID-19 pandemic that have affected all of Latin America, along with most of the world.

Known as ‘the Giant of South America,’ Brazil is the largest economy in Latin America and eighth-largest in the world, registering a gross domestic product (GDP) of $1.84 trillion in 2019 (all figures in USD).

That same year, the country’s gross national income (GNI) was $9,130 per capita — a figure that placed Brazil as a prosperous upper-middle income nation by standards established by the World Bank.

The country is famously a major source of agricultural and primary goods, which help to make it a major trade hub. Some of Brazil’s most significant export products include coffee, soybeans, and timber, with Argentina, Chile, China, the Netherlands, and the United States among their most important trading partners.

Brazil is also a founding member of the Southern Common Market (Mercosur) — a 30-year old regional economic association that also includes Argentina, Paraguay, and Uruguay. Bolivia is currently awaiting formal membership to the bloc.

With a population of over 211 million, and a fast-growing middle class, Brazil has a growing and increasingly well-recognized professional services industry, especially concentrated in major urban centers such as Sao Paulo and Rio de Janeiro.

All of this contributes to the country being a popular destination for investment, with foreign direct investment (FDI) in 2019 standing at $69.2 billion — the fourth-highest inflow registered globally.

With investor confidence in Brazil continuing to grow, the country can expect to see inflows rise again, as the economy finds its feet in the wake of the global health crisis.

Biz Latin Hub can assist you doing business in Brazil

Investor confidence in Brazil is growing and at Biz Latin Hub we have a multilingual team of corporate support specialists available to provide the integrated back-office services you need to take advantage of opportunities in the market. Whether you want help with market entry or ongoing operations, our comprehensive portfolio of services — including company formation, accounting & taxation, legal , recruiting, and due diligence — means we can provide a tailored package suited to your needs.

Contact us today to discuss how we can support you in Brazil, or any of the other 17 markets around Latin America and the Caribbean where we have local teams in place.

Or read about our team and expert authors.