A scheme led by banks seeks to encourage more people to invest in Costa Rica by offering credit to companies focused on sustainable development and the green economy.

At least 13 financial institutions have signed up to the ‘Green Protocol’, which sees them offering loans to small- and medium-sized enterprises (SMEs) with an environmental focus, as well as projects related to the likes of environmental management, sustainable housing, and eco-friendly transport.

The project was launched by Costa Rica’s Chamber of Banks and Financial Institutions, with the intention of bolstering the country’s green economy, as well as public awareness of environmental protection.

It is also intended to promote a better future for the local population, via “the creation of sustainable products that allow a better quality of life for people”, according to Annabelle Ortega, executive director of the Chamber.

SEE ALSO: Key Requirements for Starting a Business in Costa Rica

The scheme will see financial institutions seek to support companies and organizations promoting the likes of water and energy efficiency, renewable energy, green tech, and the reduction of carbon emissions.

The scheme is just one example of efforts being made to encourage people to invest in Costa Rica, where authorities are seeking to promote foreign direct investment (FDI) and relocation to the Central American country by foreign workers in order to help it overcome the economic ructions of the COVID-19 pandemic.

In August, that saw the government announce an initiative to ease investment in Costa Rica by slashing taxes and lowering the investment threshold for foreigners to gain residency.

That saw the minimum investment needed to receive residency cut from $200,000 to $150,000, including through property purchase, with those taking up the scheme gaining a ten-year residence permit (all figures in USD).

The same month, the government also implemented a new law seeking to attract digital nomads into moving to Costa Rica by offering a renewable one-year visa with generous tax incentives and provisions to facilitate relocation.

Successful applicants for the new ‘remote services provider’ visa will enjoy full income tax exemption for the duration of the visa, which they will be able to renew as long as they spend a minimum of 180 days in the country during the first year.

Schemes make investment more enticing

Funding for green business, tax breaks, and the ease of migration all add up to give foreign investors and workers even more reason to invest in Costa Rica — which has long been a highly popular destination for investors, retirees, and holidaymakers from outside of Latin America.

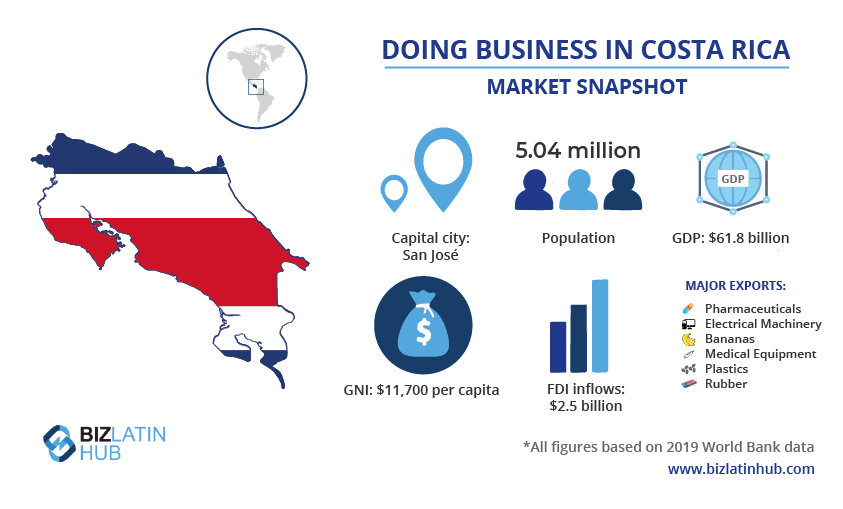

That is in part because the country boasts a stable economy, with high levels of prosperity and low violent crime levels. In 2019 alone, more than $2.5 billion of FDI entered the country.

While, like most economies around the world, Costa Rica suffered during the global health crisis, its economy is due to grow this year.

A report issued in late-August saw the UN’s Economic Commission for Latin America and the Caribbean (ECLAC) upgrade its growth prediction for the country, with gross domestic product (GDP) now expected to increase by 3.9% in 2021.

Meanwhile, earlier this year, Costa Rica was accepted as the 38th member of the Organisation for Economic Co-operation and Development (OECD) — demonstrating a level of compliance with international norms that promotes investor confidence.

For those looking to invest in Costa Rica, other significant pull factors include the fact that it has the second-highest level of English proficiency in the region, as well as a growing tech ecosystem.

Biz Latin Hub can help you invest in Costa Rica

At Biz Latin Hub, our team of multilingual company formation specialists has the experience and expertise to help you invest in Costa Rica. With our comprehensive portfolio of back-office solutions, including legal services, accounting & taxation, and recruitment services, we can be your single point of contact for entering and doing business in Costa Rica, or any of the other 17 markets around Latin America and the Caribbean where we work with investors.

Contact us today to discuss how we can support you.

Or read about our team and expert authors.