Engaging with a reliable international tax accountant in Brazil when doing business in the country will improve your profitability and help you maintain your company’s good standing in the eyes of local authorities. Because an experienced tax accountant will have a deep understanding of accounting requirements in Brazil, so will be able to identify possible tax planning options as yet not exploited, while undertaking all administrative and statutory responsibilities in a timely and accurate manner, meaning your business should run profitably and smoothly, while avoiding any regulatory inconveniences.

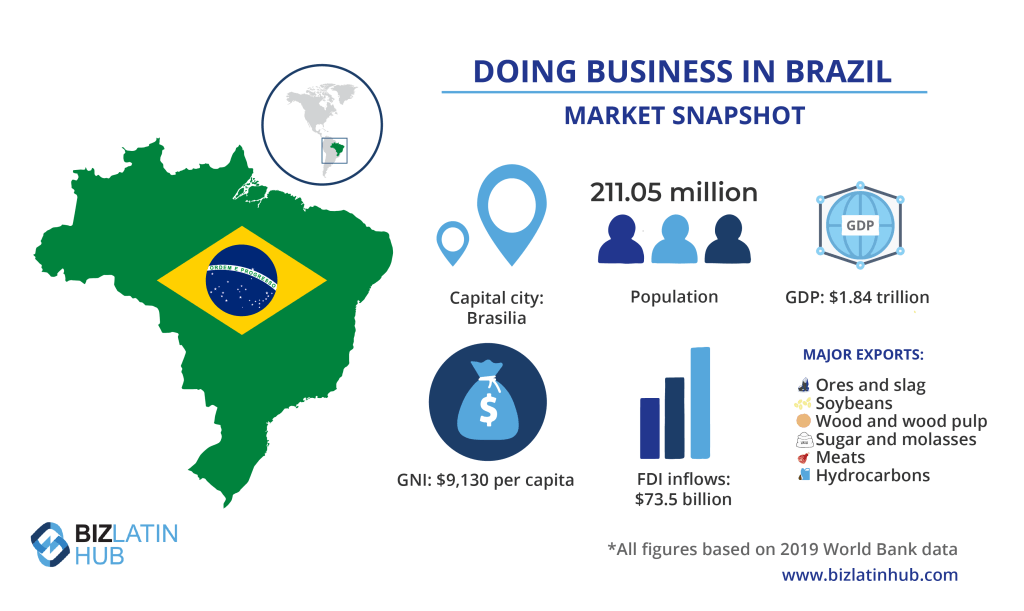

Sometimes referred to as the ‘the Giant of South America,’ Brazil is Latin America’s largest economy by gross domestic product (GDP). It is also the 8th-largest economy in the world, in 2019 recording a GDP of $1.84 trillion (all figures in USD) and a gross national income (GNI) of $9,130 per capita, the latter making Brazil an upper-middle income nation according to international standards. While the Brazilian economy has been battered by the COVID-19 pandemic, it is expected to return to 3% growth in 2021.

Brazil is a major destination for foreign direct investment (FDI), with the $75 billion of inflows in 2019 making it the fourth-largest recipient of FDI globally. That interest is partly fueled by the sheer size of Brazil’s market, with a population of over 211 million people, a ready supply of skilled employees, and a rapidly growing middle class.

Sharing borders with every country in South America other than Chile and Ecuador, Brazil is a global trade advocate and active member of the Southern Common Market (Mercosur), along with Argentina, Chile, Paraguay and Uruguay. Brazil has strong commercial relations with key global players, including China, the United States, and the European Union.

Some of Brazil’s prime export commodities include ores and slag, soybeans, timber and related product, coffee, sugarcane, fruit, beef and chicken, and crude petroleum. Its main export destinations include Argentina, Chile, China, the Netherlands, and the United States.

Whether you are thinking of incorporating a company in this South American powerhouse, or have already established a legal entity in the country, read on to understand what an international tax accountant in Brazil can do for you and what some of the main taxes are that they will help you with. Or go ahead a contact us now to discuss your business options.

What can an international tax accountant in Brazil do for you?

An international tax accountant in Brazil will provide you with specialist advice on local tax regulations and corporate accounting obligations required to form and run a company in the country, ensuring its good standing with Brazilian authorities.

As such, an experienced tax accountant is able to help you fill and submit federal and state tax documents, such as income tax returns — a task demanding fluent Portuguese that can be difficult for anyone unfamiliar with local accounting regulations and norms.

In addition, an international tax accountant will be experienced at tax planning, so will be able to help you and your accounting team design a strategic approach that better helps you reach your financial objectives and maximize your chances of commercial success.

So not only will your international tax accountant in Brazil prevent you from incurring fines or unnecessary expenses, they might also be able to significantly reduce your normal costs.

What are the main Brazilian taxes for business?

Some of the main taxes that an international tax accountant in Brazil will be able to help you with include:

Income tax: calculated based on the profit reported by the company. Income tax is set at 15% on all monthly net profits up to 20,000 Brazilian reais (approximately $3,715). For profits that exceed that threshold, an additional 10% tax is added. Note that income tax is not imposed on dividends paid to shareholders of a company, however, the Brazilian government is working on a tax reform that may change that in the future.

Export tax: applied to merchandise that leaves national territory. In accordance with Decree-law 1.578/77, the tax calculation is based on the price of that product abroad, under conditions of free competition in the international market.

Import Tax: is levied on the import of foreign goods. It is calculated based on the value of the product and the rate indicated in the Common External Tariff (Tarifa Externa Comum) directory.

Tax on financial operations: is applied to currency exchange transactions and is collected by organizations authorized by the government to carry out currency exchanges in Brazil. Foreign exchange operations to pay for imported goods must take this tax into account.

Importing to Brazil with the help of a tax accountant: key considerations

In Brazil it is possible to secure an unlimited license to import products, however being granted such a license will depend on the financial capacity of your company. To obtain this license, the minimum capital of your company must be approximately $150,000.

An international tax accountant in Brazil will be able to look into your finances, consider possible financial planning opportunities available to you, and offer you advice on how eligible you will be for such a license, or what you would need to do to be eligible.

Regardless of the scale of your import/export operations, your international tax accountant in Brazil will also be able to handle a great deal of the legal-administrative burden and provide expert support for the likes of transfer pricing and reclaiming taxes.

Biz Latin Hub can be your international tax accountant in Brazil

At Biz Latin Hub, our team of multilingual business support specialists has extensive experience providing accounting and taxation services in Brazil. With our full suite of market entry services, we can be your single point of contact to do business in any of the 16 countries across Latin America and the Caribbean, also offering reliable legal, HR, and immigration support, as well as commercial and legal representation wherever needed.

Reach out to us now to see how we can help you doing business in Brazil.

Learn more about our team and expert authors.