As the second-largest country in Latin America, it presents an attractive business investment opportunity, even if inflation in Argentina is something some people worry about. Foreign investors are particularly interested in its natural resources like mining, agribusiness, renewable energy, plus oil and gas production.

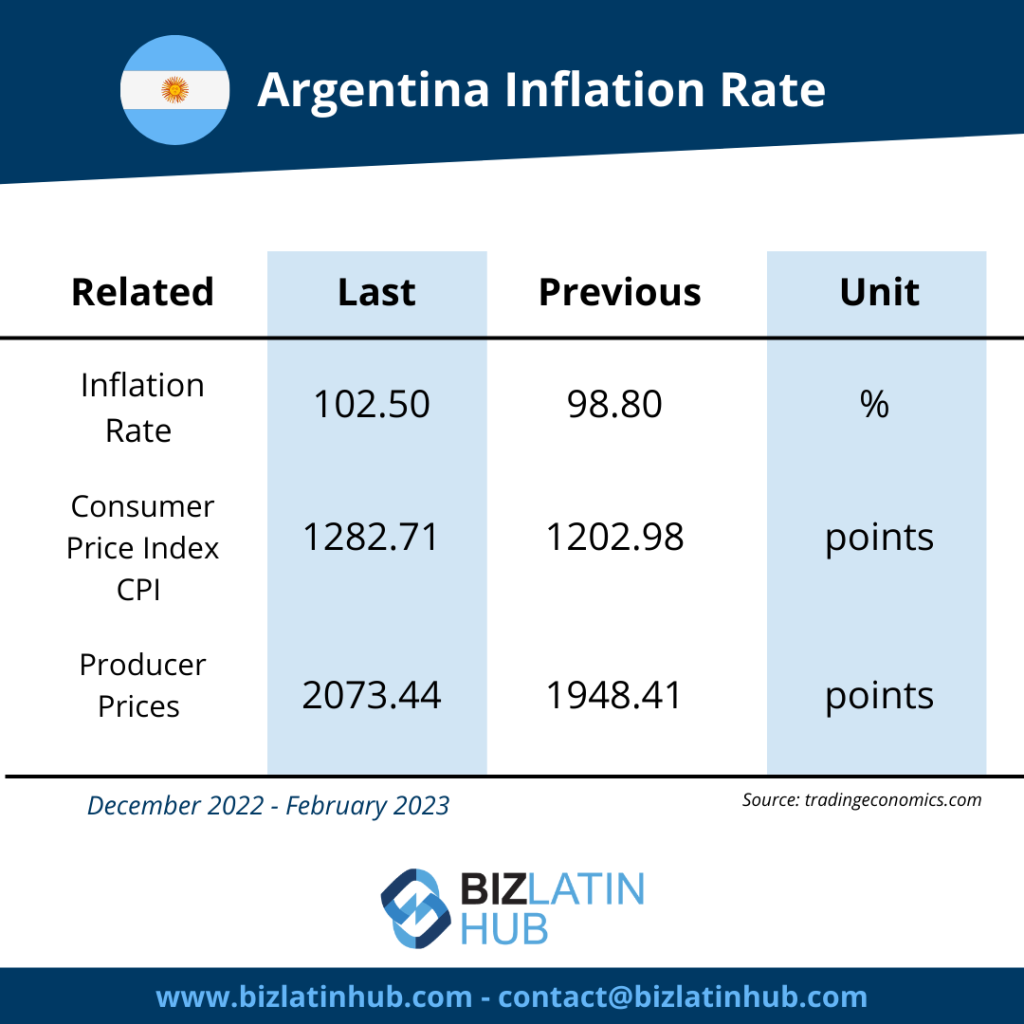

It boasts a highly skilled workforce, a well-educated middle class, and a thriving entrepreneurial community that could facilitate exponential growth if consistently managed. However, the continued escalation of inflation in Argentina poses significant challenges for businesses. Its inflation rate is back over 100 percent for the first time in 30 years. This soaring inflation rate is second only to Venezuela in Latin America.

This article will examine the reasons behind the soaring inflation rates in Argentina and the consequent impact on conducting business within the nation.

We will also explain why partnering with a local expert can help deal with this issue and with other legal services in Argentina.

Why is inflation in Argentina a problem?

Argentina has a long history of economic turmoil. According to the World Bank, Argentina has spent more time in recession than almost any other country.

In the past 50 years, it has experienced three hyperinflations in 1975, 1989, and 1990. The currency crisis in 2018 led to the peso losing half of its value against the US dollar. In 2019, new president Alberto Fernandez tried to fix this problem by selling off government bonds and printing money to finance salary programs and cash payments during the pandemic.

Which only helped to boost the already sky-high inflation rate. Argentina has yet to recover from the economic crisis in 2018. Inflation rates have been consistently over 50 percent annually since then, with a peak of 103 percent in February.

Today, nearly 40 percent of Argentinians live in poverty. Efforts to curb inflation have been a longstanding priority for the Argentinian government, but internal divisions have hindered the country’s economic policy.

How inflation in Argentina affects business:

- Declining value of salary

- Government price limits

- Import restrictions

- Supply shortages

- Higher costs

- Ability to plan ahead

Despite the economy bouncing back from the pandemic, Argentina is teetering on the brink of another recession. Economists are projecting GDP to drop three percent in 2023.

The surging inflation in Argentina is a massive challenge for businesses to overcome. Here are six significant issues that companies encounter in the present economic conditions of Argentina.

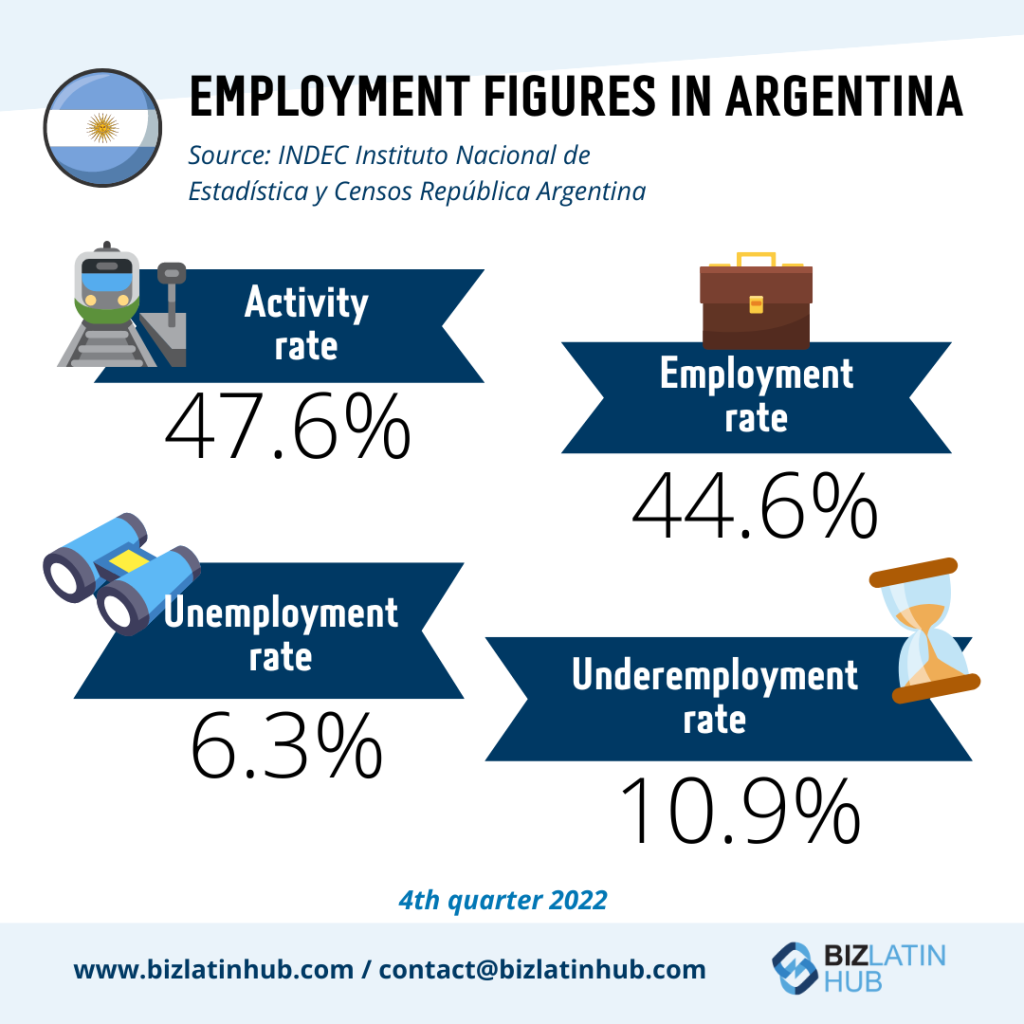

- Declining salary value: While Argentinians have become accustomed to rapidly changing inflation, the current situation is concerning. Inflation in Argentina, which has reached triple-digit figures, is swiftly diminishing the value of people’s earnings, leading to a decline in their purchasing power and consumer expenditure.

Declining salary value: While Argentinians have become accustomed to rapidly changing inflation, the current situation is concerning. Inflation in Argentina, which has reached triple-digit figures, is swiftly diminishing the value of people’s earnings, leading to a decline in their purchasing power and consumer expenditure. - Government price limits: Businesses in Argentina are dealing with multiple factors concerning inflation. To stay afloat, some businesses are raising their prices, while a recent government policy is limiting the pricing of specific commodities for others.

- Import restrictions: The government has enacted import restrictions to protect its dwindling foreign currency reserves. Which has led to a fear of future shortages in imported goods and services.

- Supply shortages: Suppliers of construction materials are facing a scarcity of resources. They can’t provide quotes for more than a few days due to the surging inflation rate. The government’s current strategy of restricting imports is compounding this issue.

- Higher costs: Argentinian companies are facing ongoing increases in production expenses resulting from scarce raw materials or elevated energy costs. Therefore, they have no choice but to pass on these costs to their consumers by raising prices.

- Ability to plan ahead: The uncertain fluctuations of inflation in Argentina make it extremely difficult to make long-term plans for the future. The unpredictability of pricing over the next six months will disrupt companies’ budgets.

Positive signs for the future

It’s not all doom and gloom for the Argentine economy. Argentina is once again attracting investor interest, as evidenced by the remarkable gains in the stock market.

Most Argentine stocks have surged by over 100 percent in the last six months when measured in US dollars.

The government reached an agreement with the IMF regarding a restructured loan arrangement and is also striving to create a more business-friendly environment.

According to the World Bank, Argentina’s GDP is projected to expand by two percent in 2023.

Team up with a specialist in inflation in Argentina

Engaging a team of local business experts can be an excellent strategy to overcome your initial hurdles if you plan to launch a business in Argentina. As you have just read, dealing with inflation in Argentina can be very complex.

An experienced employer of record (EOR) or corporate legal service can help your business stay compliant and avoid costly mistakes with inflation in Argentina.

Biz Latin Hub: Your go-to Argentina business experts

Our team at Biz Latin Hub specializes in tailoring services to meet your Argentinian business needs.

We provide a comprehensive range of accounting, back-office and legal solutions enabling us to serve as your primary contact point, helping simplify and speed up your entry into the Argentine market.

Talk to our local experts today about how to combat inflation in Argentina, company formation, and how to best enter this LATAM market.

If you found this article interesting, be sure to explore the rest of our coverage of the region. Additionally, you can learn more about our team and expert authors here.