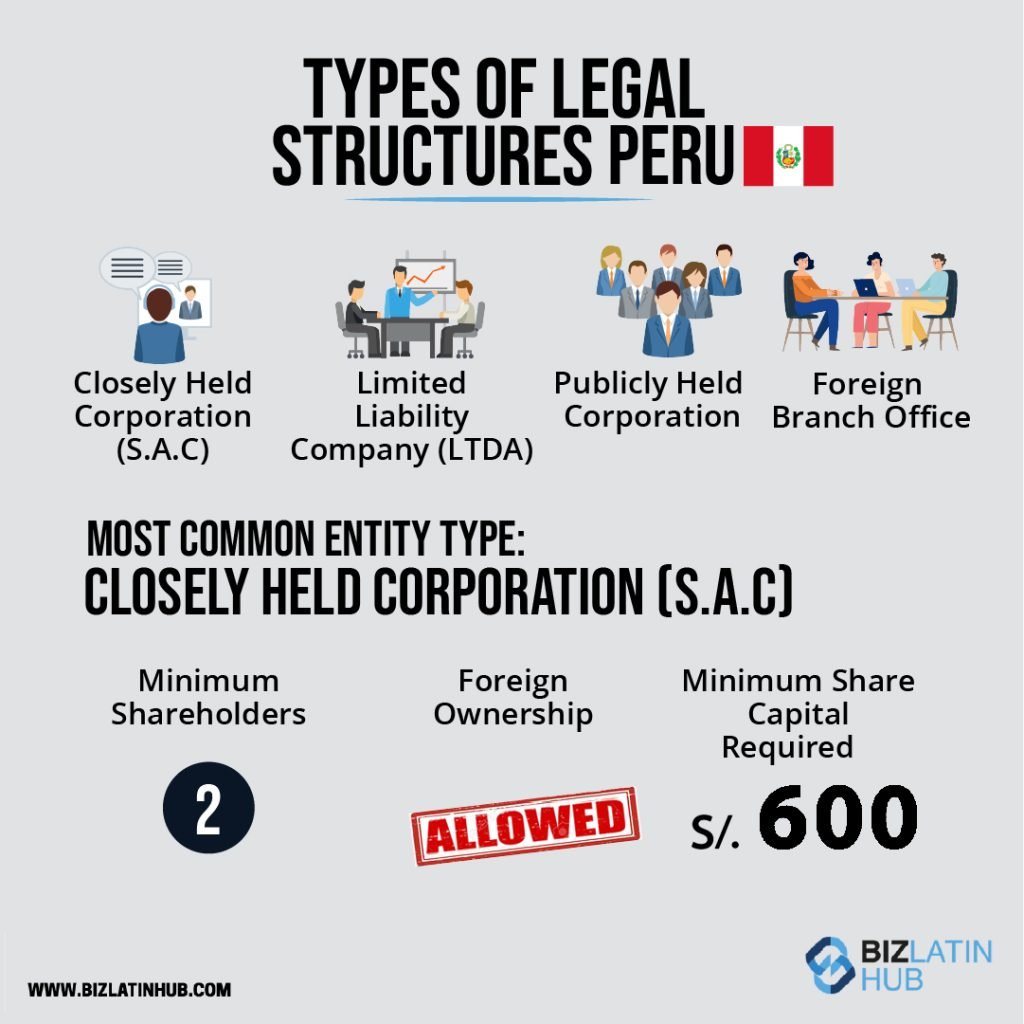

While there are a variety of corporate structures available in the country, the Sociedad Anónima Cerrada, commonly known as a SAC, is a popular option. The flexibility and advantages offered by a closely held corporation in Peru make it an attractive option for both local entrepreneurs and foreign investors seeking to incorporate a company in Peru.

The country continues to stand out as a leader in Latin America in terms of attractiveness to foreign investors. It’s not hard to see why – it has abundant natural resources, a multitude of strategic regional trade agreements and a progressively educated workforce. Government policies also encourage and support foreign companies operating within Peru’s borders. All of these are great reasons to consider a closely held corporation in Peru.

See below some interesting facts about the Peruvian business environment:

- Over 90% of Peru’s exports are covered by regional trade agreements.

- Peruvian financial institutes allow companies to open bank accounts in US dollars.

- The commission to encourage, support and facilitate trade and tourism in Peru – Comisión de Promoción del Perú para la Exportación y el Turismo (PROMPERÚ).

- Peru is a nation rich in natural resources, namely copper, silver, gold, petroleum, iron ore, coal, phosphate, and potash.

Biz Latin hub can help you establish a closely held corporation in Peru, or any other legal entity of your choice. We are experts in Latin America and the Caribbean and know all about incorporation procedures and how to do business. Our array of local back office services is also available to ensure that you concentrate on the thing you do best – running your business.

7 Steps to form a closely held corporation in Peru

These are the 7 steps to incorporate a closely-held corporation in Peru:

- Step 1 – Create the company bylaws.

- Step 2 – Register the company with the Superintendency of Public Registries.

- Step 3 – Obtain a taxpayer ID number.

- Step 4 – Legalize company accounting books.

- Step 5 – Obtain a municipal license.

- Step 6 – Open a corporate bank account.

- Step 7 – Deposit the required capital to activate the corporate bank account.

Company requirements

All SAC have some corporate requirements which must be met:

- Register at least two shareholders – 99% and 1% shareholder ownership is OK.

- Appoint a Company Legal Representative – This individual has to be a Peruvian national or a foreigner with the right to live and work in Peru.

- Have a registered fiscal/legal company address – Which must be located in Peru.

- File monthly and annual tax declarations – With the national tax authority, The Superintendencia Nacional de Aduanas y de Administración Tributaria (SUNAT).

The company incorporation should be completed in four to seven weeks following the final submission of the required paperwork to the local government authority. To complete this process, it is best to partner with a local law firm who can guide you through the entire process, ensuring all documentation is filled correctly.

To complete the company incorporation, the following information/documentation is typically needed:

- If you are outside Peru, a local company can prepare a Power of Attorney (POA) that authorizes it to constitute a company locally. This POA has to have the signatures legalized, has to be apostilled in the nearest Peruvian consulate and officially translated by a certified translator.

- 3 names for your company in order of priority.

- Identification of the two company shareholders.

- Company Legal Representative naming.

- Identification of company share capital – a SAC has a minimum share capital of PEN$1,000.

- Details of the commercial activities that the company will undertake.

- Registered address of the company.

FAQs Closely Held Corporation (SAC) Company Incorporation

1. Can foreign investors incorporate an S.A.C. in Peru?

Yes, foreign investors can establish an S.A.C. in Peru by appointing a legal representative and fulfilling the required documentation and regulatory formalities.

2. What is the minimum capital requirement for incorporating an S.A.C. in Peru?

The minimum capital requirement for an S.A.C. in Peru is 1000 Peruvian sols, equivalent to approximately $280 USD.

3. How long does the incorporation process typically take in Peru?

4. Are there any restrictions on the business activities of an S.A.C. in Peru?

5. Can an S.A.C. be converted into a different corporate structure in the future?

Need Local Support?

Peru offers investors an attractive marketplace to operate, with a broad range of opportunities across the board. With the right local support, a Peruvian market entry is a strategic step in your company’s global expansion. Additionally, setting-up operations in Peru will give you access to other key players in the Latin American region.

That could be a closely held corporation in Peru, or any one of the other legal entities available in the country. We are happy to advise you on the best fit for your particular situation.

If you are unsure of the next steps in your expansion into Peru or are looking for personalized information, reach out to our Country Manager at Biz Latin Hub Peru. Our bi-lingual team in Lima are ready to support you and your business.