Understand the importance of an entity health check and corporate due diligence in Bolivia to secure your business and manage risk. It is an attractive country for executives looking to expand, but conducting proper legal due diligence after company formation in Bolivia is crucial before establishing operations. Local and strict regulations require thorough Bolivia compliance checks and entity verification. This guide explains why a proactive compliance audit is critical and details the primary areas of review needed to ensure a company operates in accordance with Bolivian law.

Key takeaways on an entity health check in Bolivia

| What is a corporate entity health check? | An entity health check is a detailed diagnostic of a company’s statutory records and filings. |

| Which authorities will a health check look at? | It verifies compliance with the Tax Service (SIN) and Fundempresa. |

| What are the key areas reviewed for a Bolivian company? | Legal and fiscal compliance, although AML, labor registration and so on are also common. |

| Why is a health check a vital part of risk management? | It is part of due diligence for acquisitions and also allows you to resolve problems before the authorities get involved. |

The Importance of a Corporate Health Check in Bolivia

An entity health check is a detailed diagnostic of a company’s statutory records and filings. Its purpose is to identify and rectify any compliance issues, such as an un-updated Commerce Registry or missed social security payments, before they result in significant penalties or operational disruptions.

Main Areas of a Bolivian Entity Health Check

Legal and fiscal obligations are the most important aspects to check in a company established in Bolivia. These provide essential information about a company’s status. Likewise, the audit will conclude if the business obligations are according to local laws. There are multiple kinds of audits involved in an entity health check in Bolivia, these include:

Expert Tip: The Mandatory Annual Commerce Registry Update

From our experience, the single most common compliance failure in Bolivia is missing the mandatory annual update of the Commerce Registry (Matrícula de Comercio), which is managed by Fundempresa. This is not just a fee payment; it requires the submission of a statutory declaration and updated financial information.

The deadline is tied to the company’s fiscal year-end. Failure to complete this update results in the company losing its good standing, which can freeze bank accounts and prevent legal operations. Verifying the status of the annual Matrícula update is the most critical first step of any health check.

1. Corporate Compliance with Fundempresa

This audit verifies that the company’s annual Commerce Registry update (Matrícula de Comercio) has been completed and that all corporate information is correct on the public record.

Legal auditing

The moment a company is constituted in Bolivia, it must fully comply with all legal obligations. Some of these obligations are:

- Registry of Commerce: Companies must have a trade registry number to operate with legal domicile in Bolivia.

- Company books: Once a company is constituted, company books must register all the important resolutions of shareholder meetings or Board of Directors meetings.

- License to operate: The municipality will grant the company a license according to the business activity registered at the Registry of Commerce. To maintain the license validity, the company must pay an annual payment.

- Bank accounts: The bank account registers the company’s money movements as proof of good administration. Bank accounts are vital in case of a tax audit.

- Trade registration update: Companies must update their trade registration with documentation that proves their existence and compliance with local corporate obligations. This documentation must be submitted every year.

- Labour obligations: If a company has employees, the entity health check in Bolivia verifies the company’s legal compliance with the Ministry of Labor, Health Insurance Office and Pension Fund Office.

2. Tax Compliance with the SIN

This involves a review of all monthly VAT declarations and the annual corporate income tax (IUE) return to confirm they were filed correctly and on time.

Once obtaining a trade registry number, the next step is to get a tax ID. The most important fiscal activities audited by an entity health check in Bolivia are:

- Tax ID: This document needs to register the main activities of the company. The date of registration will determine the company’s tax obligations.

- Monthly Tax returns: Tax returns are declared according to the tax calendar established by the tax office each year. The last digit of the tax ID is used to verify if tax returns are declared properly and before the due date.

- Financial statements and annual balance: Each year, the tax office establishes the deadline to file the financial statements and annual balances. These documents determine if a company needs to pay the Corporate Profit Tax. Paying taxes on time is crucial to avoid unnecessary expensive fines.

Companies can choose to conduct both kinds of audits (legal and fiscal) or to hire a third-party to determine if obligations in a specific field are fulfilled correctly.

3. Labor and Social Security Compliance

This review checks that the company is correctly registered as an employer with the Ministry of Labor and that all monthly contributions to the relevant pension (AFP) and health (CNS) funds have been paid.

4. Financial and Accounting Records

This check ensures that the company is maintaining proper accounting books in Spanish and that they provide adequate support for all tax filings and financial statements.

5. Anti-Money Laundering and Financial Crime Prevention Auditing

Entity health checks in Bolivia must include verification of anti-money laundering (AML) compliance under Bolivia’s Financial Services Law No. 393. Companies operating in Bolivia face strict regulatory requirements for financial crime prevention and must maintain proper documentation to avoid penalties from the Unidad de Investigaciones Financieras (UIF).

Key AML compliance areas verified during an entity health check include:

- Customer due diligence procedures: Verification that proper know-your-customer (KYC) protocols are documented and implemented for all business partners and clients

- Politically exposed persons screening: Review of PEPs identification and enhanced due diligence procedures for high-risk business relationships

- Suspicious transaction reporting: Assessment of internal systems for detecting and reporting unusual financial activity to Bolivian authorities

- Transaction monitoring systems: Evaluation of controls for cross-border transactions and international business activities

- Risk assessment protocols: Review of money laundering and terrorist financing risk assessments tailored to the company’s specific business operations

Why Due Diligence in Bolivia is Critical for Foreign Investors

Bolivia entity verification goes beyond simple compliance—it’s about understanding the unique regulatory landscape. Key aspects of corporate due diligence in Bolivia include:

- Regulatory complexity: Bolivia’s legal framework combines civil law traditions with unique local requirements

- Tax implications: Understanding Bolivia’s dual taxation system (national and municipal levels)

- Labor regulations: Strict employment laws requiring careful Bolivia compliance checks

- Currency controls: Regulations on foreign exchange that impact international transactions

- Documentation requirements: All corporate documents must be in Spanish and properly notarized

How does an entity health check work?

An entity health check is an audit carried out by a third-party to verify its local corporate compliance. An entity health check in Bolivia involves the verification that company administrators and employees are fulfilling legal and fiscal obligations.

Some benefits to hiring a third-party for an entity health check in Bolivia

Hiring qualified professionals for entity health checks in Bolivia provides comprehensive risk assessment and regulatory compliance verification beyond basic legal and fiscal auditing.

Enhanced Due Diligence Capabilities

Professional auditors conduct thorough legal due diligence including corporate governance verification, review of board resolutions, and assessment of corporate secretarial compliance. Financial due diligence encompasses detailed analysis of balance sheets, internal control systems, and fiscal obligations to tax authorities including the Servicio de Impuestos Nacionales.

Risk Management and Control Environment Assessment

Professional entity health checks include comprehensive business risk assessment covering operational, financial, and regulatory compliance risks. Auditors evaluate the company’s control environment to ensure proper segregation of duties, authorization processes, and corporate data management systems.

Regulatory Compliance Framework Verification

For companies in regulated sectors, professional auditors verify compliance with sector-specific requirements including permits from the Hydrocarbon National Agency for natural gas operations, registrations with the Ministry of Labor for employment compliance, and adherence to international standards for foreign-invested companies.

Transaction Risk Mitigation

Professional auditors assess transaction monitoring systems and cross-border business compliance to reduce transaction risks and ensure proper documentation for international business activities.

Given all of the above, it is strongly recommended to hire a third party to conduct an entity health check in Bolivia at least once a year. This is the best way to know the company’s status and act as quickly as possible if administration modifications are needed to avoid financial and reputational risk. Hiring a third-party allows a company to better prepare for unwanted contingencies.

Practical Recommendations from Local Experts for Bolivia Compliance Checks

1. Critical Bolivian Deadlines to Remember:

- Tax returns: Monthly by the 15th-21st (depending on NIT ending digit)

- Annual financial statements: March 31st for most companies

- Municipal license renewal: January 31st annually

- Labor registration updates: Within 5 days of any employee changes

2. Bolivia-Specific Compliance Tips:

- Document authentication: All foreign documents require apostille and official translation

- Digital compliance: Bolivia is transitioning to digital filing—register for AGETIC digital certificates early

- Labor inspections: Maintain physical employee files as digital records aren’t always accepted

- Banking relationships: Establish accounts with at least two banks to ensure operational continuity

3. Red Flags in Bolivia Entity Verification:

- Inconsistent NIT (tax ID) registrations across municipalities

- Delayed UFV (Unidad de Fomento de Vivienda) adjustments in tax payments

- Missing “Libros de Actas” (meeting minutes books) physical stamps

- Unsigned or improperly notarized shareholder resolutions

4. Cost-Saving Strategies:

- Consolidate all compliance checks quarterly to reduce audit costs

- Use Bolivia’s “ventanilla única” (one-stop shop) for multiple registrations

- Maintain a compliance calendar with automatic reminders for all deadlines

- Engage local legal counsel for preventive compliance rather than corrective measures

Entity Health Check Frequency and Ongoing Compliance Management

Regular entity health checks are essential for maintaining corporate compliance in Bolivia’s evolving regulatory landscape. Companies should conduct comprehensive health checks annually, with additional focused reviews when undertaking significant transactions, entering new business partnerships, or expanding operations.

Ongoing Compliance Monitoring

Between formal entity health checks, companies should maintain ongoing compliance monitoring including regular review of corporate documents, financial records tracking, and regulatory requirements updates. This proactive approach helps identify potential compliance issues before they become costly penalties.

Documentation and Record Keeping

Proper documentation from entity health checks serves multiple purposes including preparation for tax authority inspections, due diligence for business partners, and compliance with money laundering prevention requirements. Companies must maintain detailed records of corporate compliance activities as mandated by Bolivian regulatory authorities.

Frequently Asked Questions: Entity Health Check in Bolivia

Why should you get an entity health check?

An entity health check helps executives understand how the business is managed, reduces the risk of penalties and reputational damage, and minimizes transaction risks during audits, sales, or mergers.

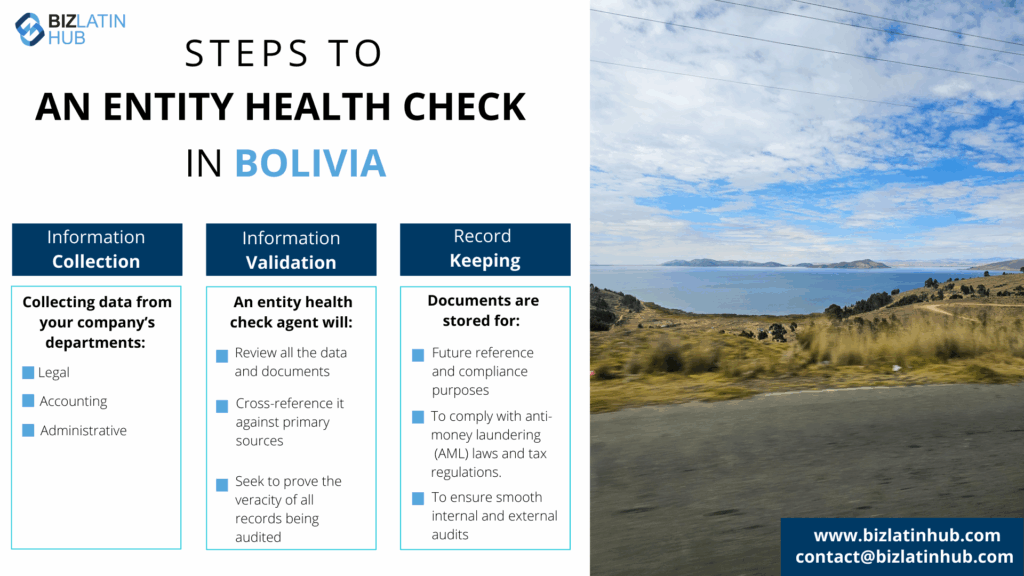

What steps are there to an entity health check?

An entity health check typically involves three key steps: (1) Information collection from legal, accounting, and administrative departments; (2) Information validation through cross-referencing and audit review; and (3) Record keeping to support future audits and legal compliance.

What happens in an entity health check?

An entity health check includes a review of financial and tax records, contracts, social security compliance, certificate renewals, and the preparation of financial statements and balance sheets to assess overall regulatory adherence.

What is Fundempresa?

Fundempresa is the foundation that manages the Commerce Registry of Bolivia. All companies must register with Fundempresa at incorporation and must update their registration annually to remain active.

What is the SIN?

The SIN (Servicio de Impuestos Nacionales) is the National Tax Service, Bolivia’s main tax authority. A health check ensures all filings and payments for income tax and VAT are current with the SIN.

What are the main social security entities?

The main entities are the Pension Fund Administrators (AFPs) and the National Health Fund (Caja Nacional de Salud – CNS). A health check verifies that the company has made all mandatory monthly contributions for its employees to both.

What happens if a company’s Commerce Registry is not updated?

If the annual update is not completed, the company’s registration becomes inactive. This means it is no longer in good standing and cannot legally operate, enter into contracts, or obtain certificates from other government agencies.

How does Bolivia entity verification differ from other Latin American countries?

Bolivia requires more frequent updates to corporate records, maintains strict labor compliance, and still relies on physical documentation, unlike neighboring countries that use digital systems. It also has a dual national and municipal tax structure.

Can foreign companies conduct their own due diligence in Bolivia?

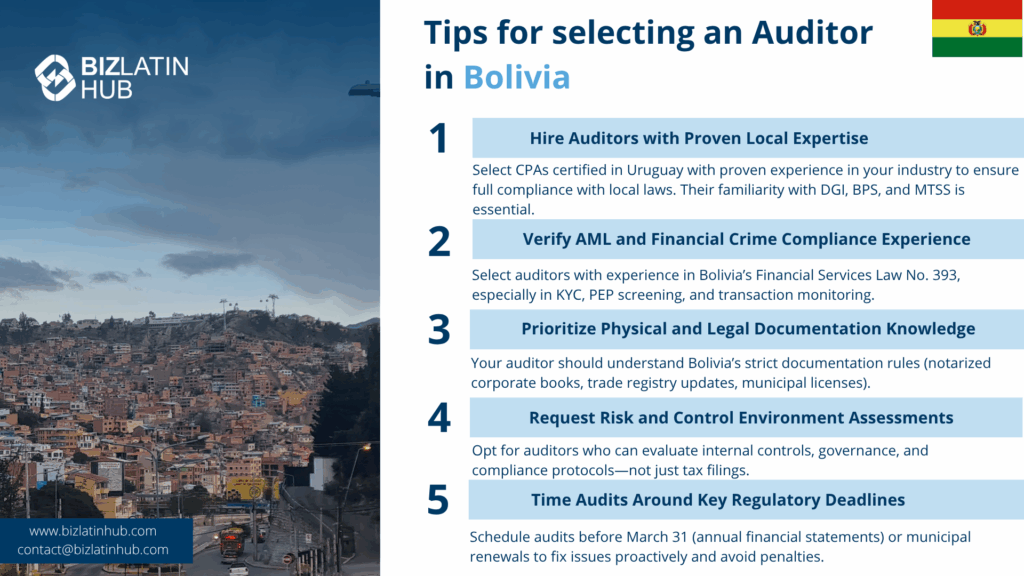

While foreign companies technically can perform their own due diligence in Bolivia, it is strongly discouraged due to language barriers, complex and evolving regulations, and the need for deep local knowledge. Using independent local auditors is recommended.

Conduct a local entity health check in Bolivia with the support of Biz Latin Hub

With offices all over Latin America, Biz Latin Hub has the expertise to offer due diligence services for investors and companies of all sizes. The legal and accounting team in Bolivia can serve your company at any time of the year to ensure your company is ahead of compliance deadlines. Get in touch now with our Bolivian team for further information about how an entity health check in Bolivia is conducted.

Learn more about our team and expert authors.