When a business grows, exporting and importing goods becomes a major part of its business model. Selecting the appropriate country to expand to is key to securing positive returns on investment.

Peru is a consumer market of 32 million people, strategically located in the center of the region, facing the Pacific Ocean. The country holds 20 free trade agreements (FTAs) and has access to dozens of countries through other multilateral alliances and treaties. Having trade deals with the European Union, the UK, China, the US, India, Australia, the South American region and many more countries, has transformed Peru into an attractive point for investment. Peru’s steady economy and international relations make the country a great option to expand business globally.

In this article, we outline the procedures of importing and exporting in Peru.

Private investment driving greater import and export in Peru

Private investment increased in the third quarter of 2019, which is predicted to dynamize the economy.

Peru’s economy has grown at an annual average rate of 5% over the past 20 years and experienced an increase in private investment of 7% in the third quarter of 2019. A growing private investment sector goes to show that investors trust in the Peruvian economy is increasing, as a consequence, 2020’s economic outlook is on the bright side.

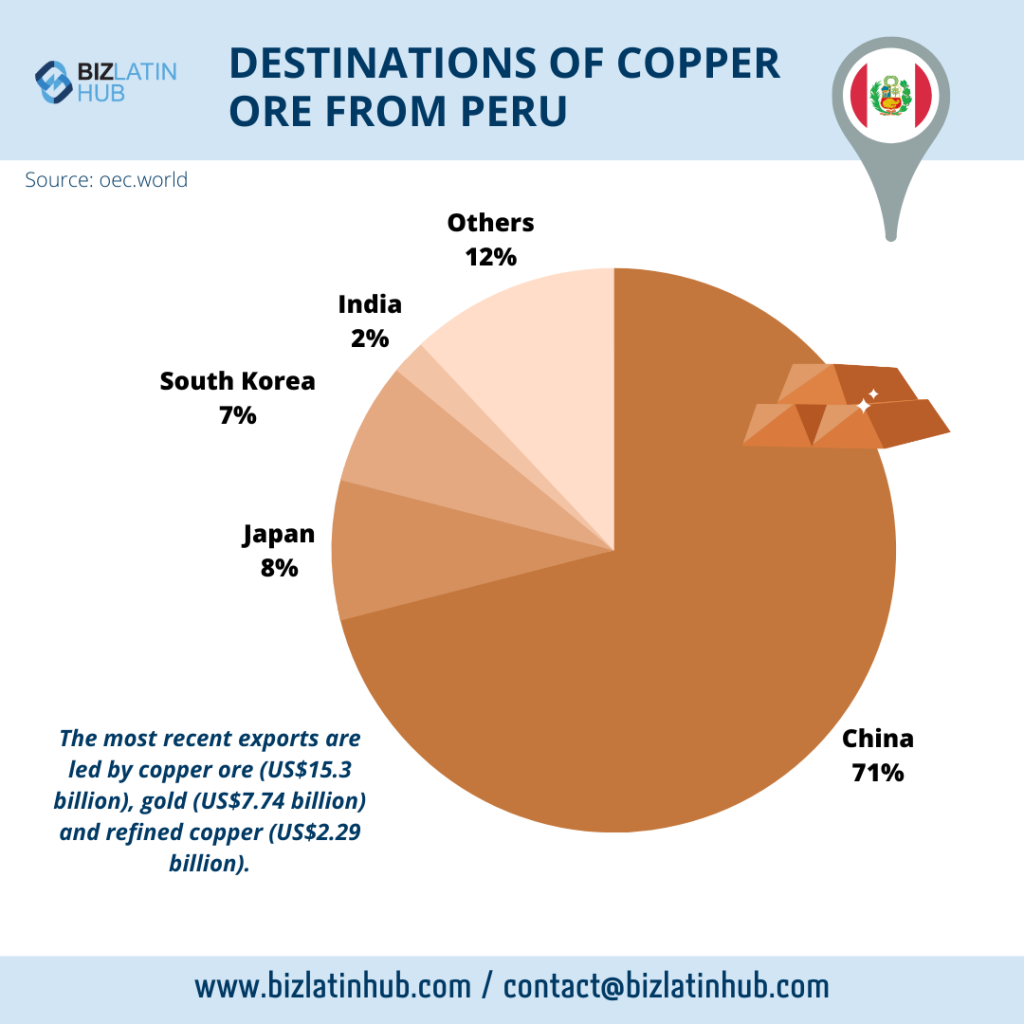

On the international market, Peru has a good reputation for minerals, agriproducts, textiles and more. In July 2019, the export of agricultural goods reached a value of US$550 million, an amount that surpassed last year’s record for the same month by 23%. The increasing demand for blueberries and asparagus contributed greatly to this statistic, with the European Union countries and the US as main buyers.

How to import in Peru

This is the process of buying foreign goods from Peru.

In Peru, the entity that regulates customs is the Superintendence of Customs and Tax Administration (Superintendencia Nacional de Aduanas y de Administración Tributaria, SUNAT). SUNAT is in charge of calculating the value of each merchandise, this valuation is known as the real paid price or price to pay (precio realmente pagado o por pagar, FOB). It excludes international freight, insurance, and other values.

Tax and tariff fees for imports are:

- Ad valorem (value-added) duty: this is a general tariff assigned for all imports, varies between 0%, 6% and 11%.

- Selective consumption tax: applies to certain goods, such as fuel, liquor, cigarettes, used and new cars, drinks, etc.

- General sales tax (GST): 16% and includes custom duties and other taxes.

- Municipal promotion tax: 2%, this tax is levied on import of goods subject to GST.

- Specific duties: applies for specific products, such as rice, sugar, corn, milk, and more.

- Anti-dumping duty: a tariff that applies to certain products that could cause instability to the local industry.

Important: Peru’s trade agreements and certain laws reduce or eliminate tax and tariffs for some goods. For instance, the promotion of the agricultural sector (Law 27360) grants tax benefits that include a reduction of the income tax to 15%, a 20% depreciation rate for investments in hydraulic infrastructure works, and the early recovery of the general sales tax (paid in capital goods, supplies, services and construction contracts).

For business purposes, imports fall under two categories: Simplified Dispatch Import and Definitive Import, also known as Import for Consumption. Let’s begin with the first one.

1. Simplified dispatch import

This type of import applies to merchandise within the range of US$200 and US$2000.

A great advantage of the Simplified dispatch import is that is a digital-friendly process. People who are more comfortable with electronic transactions will benefit from the Easy importing (Importa Fácil) system, which allows all processes to be carried out over the internet.

When using the Easy importing system, importers should just download the Easy importing declaration form from SUNAT’s website, fill it and present it to a bank ( or pay electronically ) to pay for tax and tariff fees. As explained, the digital process is really convenient, but one detail to remember is that merchandise should arrive to the national post (SERPORST). When the merchandise arrives, importers will receive a notification( or could track online) to pay tax and tariff fees and simply pick up their merchandise. All done!

For the ones who prefer a more traditional approach or to pick up their merchandise through other carriers, there is the classic option. When merchandise arrives, importers should fill out a Simplified Import Declaration (Declaración Simplificada de Importación, DSI) form at a customs office. After the document is submitted, the customs officer will send the DSI to SUNAT and an invoice will be open.

Import requirements

- Unique Taxpayer Registration Number (RUC)

- Proof of payment or Sworn declaration of value: Invoice or other documents of equal value issued by the seller.

- Transport document: Bill of lading (maritime transport), Air waybill (air transport) or transport card (land transport)

- Certificate of Origin: These are important as they serve as proof and reference of location, which is used to gain access to FTAs.

Now, for the people interested in importing for a higher value than US$2000, let’s talk about Definitive imports.

2. Definitive imports

Meant for merchandise with a FOB value higher than US$2000. This type of import will require the support of a customs agent.

When submitting documents at a customs office, the requirements are the same as for the Simplified dispatch import, the only difference is two more documents. The additional documents to submit are the document of control (used to supervise) and the Andean declaration on the imported goods. For early or express delivery, the importer should submit an extra document, which is the special authorization of the primary zone.

Now that you have all documents, the process begins. First, a customs agent will prepare the customs declaration of merchandise (Declaración Aduanera de Mercancías, DAM) and submit it for the purpose of obtaining a numbering to your declaration.

If everything worked smoothly, an invoice to pay for tariff and tax fees will be open. After paying, SUNAT enters the procedure. Since all merchandise should follow a control process, SUNAT will classify your merchandise into 3 categories for regulation purposes, the category that you receive will be your channel of control. After your declaration of merchandise and all your documents have been reviewed a last in-person control of your merchandise may take place. If everything is in order, the importer will receive a lift order and should be able to pick up her merchandise without any problem. Merchandise successfully imported!

For specification on types of merchandise and trade agreements, contact a local trade lawyer to help you out.

How to export goods from Peru

Some investors might be wondering about how to both import and export in Peru. In this section, we will explain the process of taking merchandise from Peru and sending it abroad. This guideline will explain how to import from Peru, parting from the Peruvian perspective and a lot of valuable information is detailed in a simple manner.

From the Peru-location perspective: Exporting from Peru is much simpler than importing. First of all, exports are not taxed. Additionally, there are four categories for exports: Simplified dispatch export, Express delivery, Postal shipment, and Definitive exports.

Generally, merchandise for commercial purposes falls under the Simplified dispatch exports and Definitive exports categories. So, we will focus on explaining these ones.

Requisites

- Unique Taxpayer Registration Number (RUC)

- Proof of payment or Sworn declaration of value: Payment Invoice.

- Transportation document: Bill of lading (maritime transport), Air waybill (air transport) or transport card (land transport)

- Certificate of Origin: These are important as they serve as proof and reference to benefit from trade agreements.

- Document of control: used to regulate merchandise.

Let’s talk about the first type of exports.

1. Simplified Dispatch Export

Merchandise with a FOB value smaller than US$ 5000 or with non-commercial purposes that don’t exceed US$ 1000 fall under this category. To begin the process, the customs officer will help you with the generation of the Simplified Dispatch form digitally. After the submission takes place, your merchandise will enter a temporary warehouse(or you could choose to directly transfer your merchandise to the shipping port).

When verifications finalize at the temporary warehouse, your merchandise will be classified into two categories for control purposes, your assigned category is your channel of control. Depending on your category your merchandise may or may not need revision.

If you receive a green pass from the temporary warehouse, your merchandise is ready for shipment!

Don’t forget to regularize your export after the shipment, simply present a copy of your DSE at the customs office of the transportation method you used to deliver your merchandise.

Now, we can continue to explain the second type of export.

2. Definitive Exports

Merchandise that exceeds the FOB limit value of US$ 5000 falls under this category. The required documents are the same as listed above with the addition of a number of customs declaration and a customs agent mandate ( document by which the merchandise owner assigns the dispatch of goods to a customs agent).

The procedure is similar to what was explained for Simplified dispatch exports. It begins with numbering the export declaration (DAM), then the merchandise enters a temporary warehouse for control purposes and it is assigned a channel of control. If all information is processed without an issue, the merchandise revision takes place and your goods are ready to be transferred for shipment.

Again, don’t forget to regularize your exports by submitting a copy of your DAM.

After learning how to import from Peru (from an outsider perspective), some may have further questions, for more specifications on a particular type of merchandise and benefits from FTAs contact a trade lawyer to help you out with due diligence.

Gain access to the Peruvian market

Peru is a country fertile in agricultural goods, rich in soils, open to digitalization and with multiple FTAs and treaties to access international markets. Take advantage of the straightforward import and export procedures and expand your business now.

To help you comply with due diligence, contact our team of trade lawyers who are ready to assist you to grow your business. Get in touch with us here to get started.

Learn more about our team and expert authors, and check out our video on why Peru is a top choice for foreign investment in Latin America.