If you are looking to start an NGO in Chile, you will need to understand the steps involved in the process, as well as the legal services in Chile, and have an idea of your obligations about taxes.

Below, a step-by-step guide on how to start an NGO in Chile is provided, as well as some insight into tax obligations for non-governmental organizations based in the South American country.

Note that, if you are planning to establish an NGO in Chile which is already active in another country, you will need to choose between creating a local subsidiary of that NGO or setting up the entity as a ‘foreign NGO’ in Chile.

The main distinction lies in where the organization will generate its funding, with those receiving donations within Chile obliged to incorporate as a subsidiary. Another factor is the level of risk and liability assumed by the parent entity, which will be higher in the case of setting up a foreign NGO.

Chile is a popular investment destination in Latin America, well-known for its high levels of development, pro-business outlook, and promotion of free trade.

The country has an extensive portfolio of free trade agreements in place with key markets around the region, and is also a founding member of the Pacific Alliance — a ten-year-old economic integration initiative that also includes Colombia, Mexico, and Peru, and to which Ecuador has formally applied to be a member.

In a mark of the Alliance’s interest in forging closer ties with Asia-Pacific countries, in late-2021, Singapore was inaugurated as an associate member, with Australia, Canada, New Zealand, and South Korea mentioned as potential future associate members.

Like in most countries, the COVID-19 pandemic caused considerable economic difficulty in Chile, contributing to a decline in GDP in 2020. However, the World Bank has predicted that Chile will see one of the strongest levels of growth in the region in 2022.

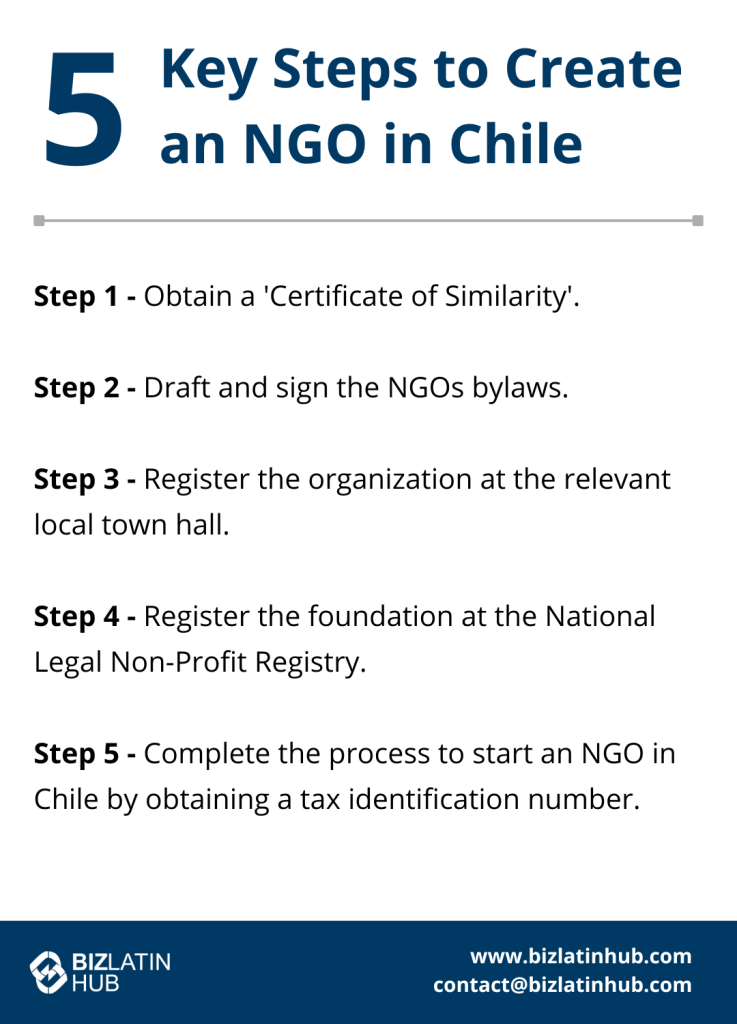

How to start an NGO in Chile: 5 key steps

In terms of economic output, Chile is perhaps best known for its mining sector, with major deposits of copper, gems, and precious metals. It is also a significant producer of farmed products, including the likes of fruits, nuts, timber, and seafood.

While Chile enjoys a high level of development, the country still faces significant social challenges, meaning there is a wide array of work for non-governmental organizations to do.

Because of its strategic location and the high quality of life it can provide to, it is also an ideal headquarters for civil society and non-governmental organizations that will be operating on a regional level.

There are five key steps to follow when you start an NGO in Chile, which are as follows:

- Step 1 – Obtain a ‘Certificate of Similarity’.

- Step 2 – Draft and sign the NGOs bylaws.

- Step 3 – Register the organization at the relevant local town hall.

- Step 4 – Register the foundation at the National Legal Non-Profit Registry.

- Step 5 – Complete the process to start an NGO in Chile by obtaining a tax identification number.

Step 1: Obtain a ‘Certificate of Similarity’

The first step when you start an NGO in Chile is to obtain a “certificate of Similarity (Certificado de Similitud), from the Civil Registry, which essentially clarifies that the name under which your NGO will operate is not already in use in the country.

Step 2: Draft and sign the NGOs bylaws

The bylaws specify the objectives of the NGO and its sources of funding, among other key information.

Step 3: Register the organization at the relevant local town hall

With the bylaws drafted and signed, the next step to start an NGO in Chile is to register the organization at the local town hall of the city where it will be based.

Step 4: Register the foundation at the National Legal Non-Profit Registry

As well as registering the NGO at the local town hall, you will also need to register it with the National Legal Non-Profit Registry, which will certify the organization as being not-for-profit in the eyes of the Chilean government.

Step 5: Complete the process to start an NGO in Chile by obtaining a tax identification number

Like for-profit companies based in the country, any NGO registered in Chile must have a tax identification number (RUT) in order to operate legally. This is done by filing an “initiation of activities” affidavit before local authorities.

Understanding taxes for NGOs incorporated in Chile

If you are planning to start an NGO in Chile, or already operating a non-profit organization there, you will need to have an understanding of your tax burden and obligations.

Like all entities, to operate in Chile, an NGO must be registered at the Single Taxpayer Registry, as well as providing an “initiation of activities” affidavit to authorities.

Under Chilean law, an NGO must also keep up-to-date accounting records, file annual tax returns, and, in some cases, make monthly provisional payments and undertake tax withholding. Your chosen legal firm in Chile will be able to provide comprehensive advice with regards to these legal requirements.

In terms of specific taxes, for NGOs in Chile income tax is only applicable when the organization is engaged in income-generating activities.

An NGO in Chile is also liable for “First Category Tax” (Impuesto de Primera Categoría – IDPC), calculated by deducting costs and expenses related to income generation from the organization’s declared gross income.

While IDPC for NGOs is usually set at a rate of 25%, as part of Chile’s efforts to mitigate the turmoil of the pandemic, it was reduced to 10% for the financial years 2021 to 2023. An NGO in Chile must also pay value-added tax (VAT) on services and goods provided, which is set at a rate of 19%.

Note that any NGO operating in Chile but not resident in the country will be subject to an additional tax of 35% on any income generated within the country.

Where an NGO in Chile can be exempted from paying tax is with regards to Global Complementary Tax, which is levied on owners, partners, and shareholders of a given entity.

Furthermore, an NGO in Chile that carries out charitable, religious, cultural, mutual aid, artistic, non-professional sports activities, or activities that promote community interests, can also apply for an exemption from municipal taxes.

With regards to donations received by an NGO in Chile, their tax exemption is based on the activity the organization engages in. As long as the NGO can be proven to be engaged in religious, educational, scientific, or other charitable activities with a social benefit, donations received will generally be exempted from tax.

Biz Latin Hub can help you start an NGO in Chile

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, meaning we are ideal partners to help you start an NGO in Chile, as well as to assist with its ongoing operations.

As well as in Santiago de Chile, we have offices in 16 other key cities around Latin America and the Caribbean, meaning we are well positioned to support multi-jurisdiction market entries and cross-border operations.

Our portfolio of services includes accounting & taxation, company formation, due diligence, hiring & PEO, and corporate legal services.

Contact us today to find out more about how we can assist you.

Or read about our team and expert authors.