With a strategic position close to the main Latin American markets, together with its growing economy and its welcoming attitude towards international business, increasing numbers of foreign investors are looking into setting up a company in Perú.

The process to set up a company or corporation in Perú takes about four to six weeks. It is required to have at least two shareholders who might be individuals or a legal entity and involves preparing the minutes of incorporation. If you want to set up a company in Perú, it’s crucial to understand the steps involved and the legal requirements. From selecting a business structure to registering with the appropriate authorities, the process of setting up a company in Perú can be navigated efficiently with proper planning and guidance.

Before entering this market, business owners must understand the local regulations of forming a company in Perú. This article outlines the key steps toward incorporating a business successfully.

How to Set Up the Legal Structure for Your Company in Perú?

It is important to choose the appropriate legal structure for your company based on your business goals and requirements. Each type of company has its own set of legal requirements, tax implications, and reporting obligations. It is advisable to consult with a legal advisor or business consultant who is familiar with the local laws and regulations in Perú before making a decision.

- Joint Stock Company – Sociedad Anónima (S.A.) – A Joint Stock Company is a business entity in which ownership is divided into shares of stock that can be bought and sold on the stock market. This type of company is typically used for larger businesses with multiple shareholders.

- Closely Held Company – Sociedad Anónima Cerrada (S.A.C.) – A Closely Held Company is a business entity that is owned by a small group of shareholders, often family members or close associates. This type of company is typically used for smaller businesses where the owners want to maintain control over the company.

- Publicly Held Corporation – Sociedad Anónima Abierta (S.A.A.) – A Publicly Held Corporation is a business entity that is owned by multiple shareholders and whose shares are publicly traded on the stock market. This type of company is typically used for larger businesses that want to raise capital by selling shares to the public.

- Limited Liability Company – Sociedad de Responsabilidad Limitada -(S.R.L.) – A Limited Liability Company is a business entity in which the owners have limited liability for the debts and obligations of the company. This type of company is typically used for smaller businesses where the owners want to protect their personal assets from business liabilities.

When appointing a new legal representative for your company in Perú, it is important to follow the proper legal procedures. A Power of Attorney (POA) must be signed by the current legal representative and legalized by the Ministry of Foreign Affairs. If the POA is written in another language, it must be officially translated into Spanish before it has legal validity.

What are the Minimum Requirements to Incorporate a Limited Company in Perú?

To incorporate a Limited Liability Company (Sociedad Anónima), the minimum requirements typically include:

- Shareholders: A minimum of two shareholders, who can be individuals or legal entities.

- Capital: There is no specific minimum capital requirement, but it must be specified in the company’s bylaws.

- Articles of Incorporation: Draft and notarize the company’s Articles of Incorporation (Escritura Pública), outlining key details such as company name, objectives, address, capital structure, and governing bodies.

- Registered Address: Provide a physical address in Perú where the company will be located.

- Legal Representative: Appoint a legal representative, who can be a Peruvian resident or a foreigner with a valid resident visa.

- Tax ID: Obtain a Tax Identification Number (RUC – Registro Único de Contribuyentes) from the Peruvian tax authorities (SUNAT – Superintendencia Nacional de Aduanas y de Administración Tributaria).

- Publication: Publish a notice of the company’s incorporation in a local newspaper for legal purposes.

- Registration: Register the company with the Public Registry (Registro de Personas Jurídicas) and obtain a registration certificate.

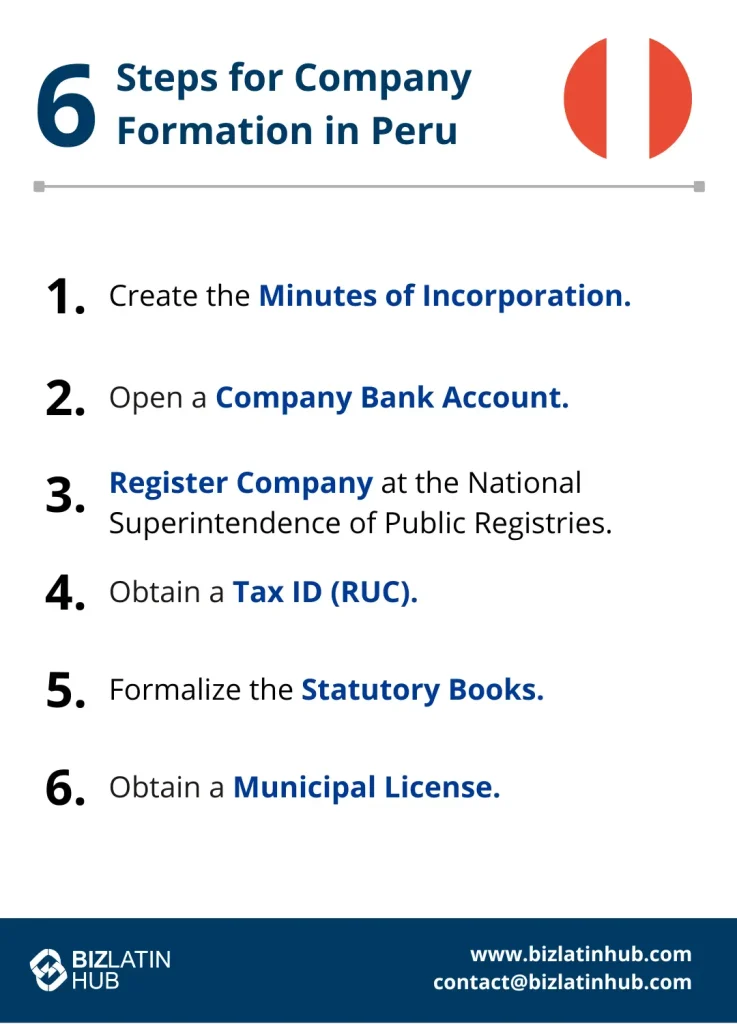

6 Steps to Form a Company in Perú

Here you can follow the 6 steps to form a company in Perú:

- Step 1: Create the Minutes of Incorporation

- Step 2: Open a Company Bank Account

- Step 3: Register Company at the National Superintendence of Public Registries (SUNARP)

- Step 4: Obtain a Tax ID (RUC – Registro Único de Contribuyentes)

- Step 5: Formalize the Statutory Books

- Step 6: Obtain a Municipal License

1. Create the Minutes of Incorporation

This is the incorporation document of your company, which includes:

• Identification of shareholders

• Description of leadership positions

• Company objective(s)

• Bylaws

• Description

Please note that this document must be signed by a lawyer.

2. Open a Company Bank Account

You must choose a bank to open your company’s bank account. It is important to consider that to open an account you usually will have to make a minimum initial deposit amount in the currency of your new account (i.e. USD for a USD account and Soles for an Sol account).

3. Register the Company at the National Superintendence of Public Registries (SUNARP)

The notary public is in charge of converting the minutes into a public deed and preparing your documents for your registration with SUNARP (National Superintendence of Public Registries).

To register with SUNARP you will need:

• Notary Public documents

• SUNARP forms

• Payment for the Rights to Registration

4. Obtain a Tax ID (RUC – Registro Único de Contribuyente)

The Superintendence of Tax Administration (SUNAT) in Perú grants the Taxpayer Identification Number (RUC – Registro Único de Contribuyente).

To request your Tax ID, you will need the following:

• Water or electricity bill that shows the legal address of your company

• RUC Registration form (Provided by SUNAT)

• Testimony of company incorporation, duly registered with SUNARP

• Identification document of your legal representative

• Rental agreement, or ownership title, of the location where the business will operate

5. Formalize the Statutory Books

The following step to form a company in Perú is the legalization of statutory books and accounting records. The following are necessary for this step:

• Books/records to be legalized.

• Copy of RUC form.

• Notary Public’s Offices Rights to Registration Payment.

Authorization of the Payroll Book, granted by the Ministry of Labour and Promotion of Employment:

• Payroll Book authorization application.

• Copy of RUC Certificate.

• Application rights payment.

• Name or Legal name of Employer.

• Company address.

6. Obtain a Municipal License in Perú

To legally operate a business in Perú, you need to acquire a Municipal Operations License. This license is necessary for various types of establishments, including those in the commercial, service, industrial, and professional service sectors. The respective municipality grants this permit. To obtain it, you’ll need a Certificate of Sectorization and Compatibility of Use:

In Perú, the Certificate of Sectorization and Compatibility of Use ensures that your proposed business complies with zoning regulations and land use compatibility at its intended location, ensuring conformity with local laws. This certification process involves submitting the following documents to municipal authorities for their approval:

- A completed application form

- Application Rights Permit

- A map of the area or premises where your company will be located.

- Approval from the National Institute of Civil Defense (Defensa Civil)

This step also involves a safety inspection to ensure your premises meet safety standards. Upon approval, you will receive a Certificate of Safety. Here are the documents required for this process:

- Compliance Certificate (Granted by the Division of Land Registry and Municipal Authorizations).

- A copy of the property title or property ownership extract.

- A request addressed to the mayor.

- Payment of the required fees.

- A map of the area signed by an architect.

- A copy of the RUC certificate.

- A copy of the identification document of the respective party of the legal representative.

- A rental agreement or ownership title of the location where the business will operate.

- If applicable: A copy of the deed of incorporation of the legal person.

- If applicable: A copy of the authorization/certification of the respective sector.

Branch Offices

Branch offices can be freely established by companies that are domiciled or not in Perú. The branch is to be registered in SUNARP’s Register of Legal Entities. Please note that a branch office does not have any legal status independently from its parent company.

The Branch Office’s public deed of incorporation should include, at least:

• Certificate of Good Standing of the parent company, issued by the competent authority in your country of origin

• Copy of the agreement of the creation of the branch by the board members (or the competent body of the parent company) defining capital, activities, purpose, address, legal representative, and its powers granted

• Incumbency certificate

• If Applicable – a copy of bylaws, articles of association, or equivalent in the country of origin

Partnership Agreements

Please note that a partnership agreement does not create a legal entity. It is based on the mutual interest of the parties; a partnership agreement rules the integration and participation of particular businesses and companies which the agreement requires to be in written form.

Joint Venture

In Perú, regulations for joint ventures are not standardized and may vary depending on the industry. Joint ventures allow foreign capital to enter the country by teaming up with local companies and facilitating the use of technology, access to products or services, know-how, and financing of economic activities.

If Applicable – FDI registration

Under legislation, there is an obligation to register foreign investments, which gives the investor the right to transfer monies abroad and use the most favorable exchange rate when conducting an exchange transaction.

Differences Between S.A.C and S.A.A. in Perú

| Aspect | Private Close Corporation (S.A.C) | Public Corporation (S.A.A) |

|---|---|---|

| Shareholders | Minimum: 2, Maximum: 20 | Minimum: 750 |

| Capital Stock | Determined by the contributions of each shareholder. | Over 35% is owned by 175 or more shareholders. |

| Registration | Must register with the Superintendencia del Mercado de Valores (SMV) and adhere to specific legal requirements, including the regular submission of audited financial statements. | Must register with the Superintendencia del Mercado de Valores (SMV) and adhere to specific legal requirements, including the regular submission of audited financial statements. |

| Company Size | More appropriate for smaller companies aiming to retain control over a limited group of shareholders. | Generally better suited for larger companies seeking financing in the securities markets and willing to comply with associated disclosure and regulatory obligations. |

FAQs when forming a company in Perú

In our experience, these are the most common questions our clients have about companies in Perú.

1. Can a foreigner own a business in Perú?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. What is the Peru Company Tax ID (TIN)?

The Peru Company Tax ID is known as RUC (Registro Único de Contribuyentes), which translates in English to Single Taxpayer Registry a unique identification number for tax purposes in Peru.

3. How long does it take to register a company in Perú?

Registering a company in Perú takes 6 weeks.

4. What does an S.A.C. company name mean in Perú?

In Perú, an S.A.C means Sociedad Anónima Cerrada, which is similar to a Private Closed Corporation. This is a legal entity in Perú that mandates a minimum of two and a maximum of 20 shareholders. While a Board of Directors is not obligatory, the corporation must have a General Manager.

5. What does an S.A.A company name mean in Peru?

In Perú, a S.A.A means Sociedad Anonima Abierta, which is similar to a Public Corporation. This type of legal entity is suitable for companies with a considerable number of shareholders. To establish this entity, an initial public offering is required. Specifically, the company needs to have more than 750 shareholders. This structure is designed to accommodate companies with a large and diverse shareholder base.

6. What entity types offer Limited Liability in Perú?

In Perú, both the Sociedad Anónima Abierta (S.A.A.) and the Sociedad Anónima Cerrada (S.A.C.), are limited liability companies.

Do you want to set up a Company or Corporation in Perú?

Once you have your business setup, registered, legal representation, and you have your tax and accounting in order, then you are ready to do business in Perú.

If you have any questions or inquiries about how to set up a company or corporation in Perú, our Peruvian business experts have created a company formation presentation. If you have any more questions about how to incorporate your company in Perú, please do not hesitate to contact us now.

Our Biz Latin Hub team in Perú includes local and expat professionals who have the knowledge and expertise to support you throughout the process.