Colombia is a nation with a long and colourful history that is working its way towards greater stabilization. In recent years, the country has made swift and effective moves in reducing social unrest, economic inequality, and injustice. It’s now one of the strongest-performing economies in the region, building a number of initiatives to attract investment from diverse sources. Incorporating a Non-Government Organization (NGO) in Colombia is part of the spectrum of investments that has great potential due to the country’s high social conscience.

Elements of the social benefit systems remain less entrenched or not as strong as others. However, Colombians, like many Latin American societies, have a strong social conscience with a number of driven supportive charities and NGOs. These organizations have played a significant part in changing the global perception of Colombia over the last 30 years. Without them, minority causes and social injustices would likely be unrepresented.

We explore the commercial support for an NGO in Colombia, working towards increased socioeconomic development, and how foreign investors can set up their own NGO locally.

Setup of an NGO in Colombia – The nature of an NGO

Non-profit/non-governmental organizations are typically set up with task-orientated business models, and run by those who with a common interest seeking to change perception or policy.

Activities of an NGO include providing legal advice, economic funding, and lobbying government for positive change. The emphasis on NGO revenue streams is that funds are raised through donors and put towards the cause at hand. However, the emphasis is on no profit. Typical causes NGOs tend to fight and lobby for generally follow human rights, health, the environment or persecuted groups of people.

Examples of successful NGOs already existing in Colombia are those such as ‘Federación Nacional de Cafeteros de Colombia’ – an organization helping to promote and protect Colombian coffee farmers – or ‘Corporación día de la Niñez’ – one promoting the protection of Colombian children. Generally, only NGOs with ethical and principled causes get tax exceptions and public donations.

Why incorporate an NGO?

NGOs are a great way to support a cause or a group of people you care deeply about without using personal assets. NGOs also provide a community for people to gather around, bringing societies closer together. Employees and Directors of NGOs have both stated that being part of an organization that works to help a cause they care about is rewarding, and provides a sense of self-purpose.

Commercial benefits

Of course, the obvious benefit of an NGO is the help and aid they provide to socioeconomic causes. However, commercially, NGOs have a number of business-friendly regulations. Particularly, an NGO in Colombia is exempt from certain tax regulations. Furthermore, when people declare their taxes for the year, donations to NGOs are tax-deductible, and therefore incentivized by Colombian authorities.

Unlike normal businesses, NGOs tend to enjoy high levels of government exposure gaining access to some of the most powerful individuals in the country. Officials are attracted to being associated with NGOs; departments are drawn to organizations that assist government development objectives. This allows NGOs to lobby powerful institutions extremely efficiently, experiencing high levels of success when it comes to getting results.

Incorporation Process of an NGO in Colombia

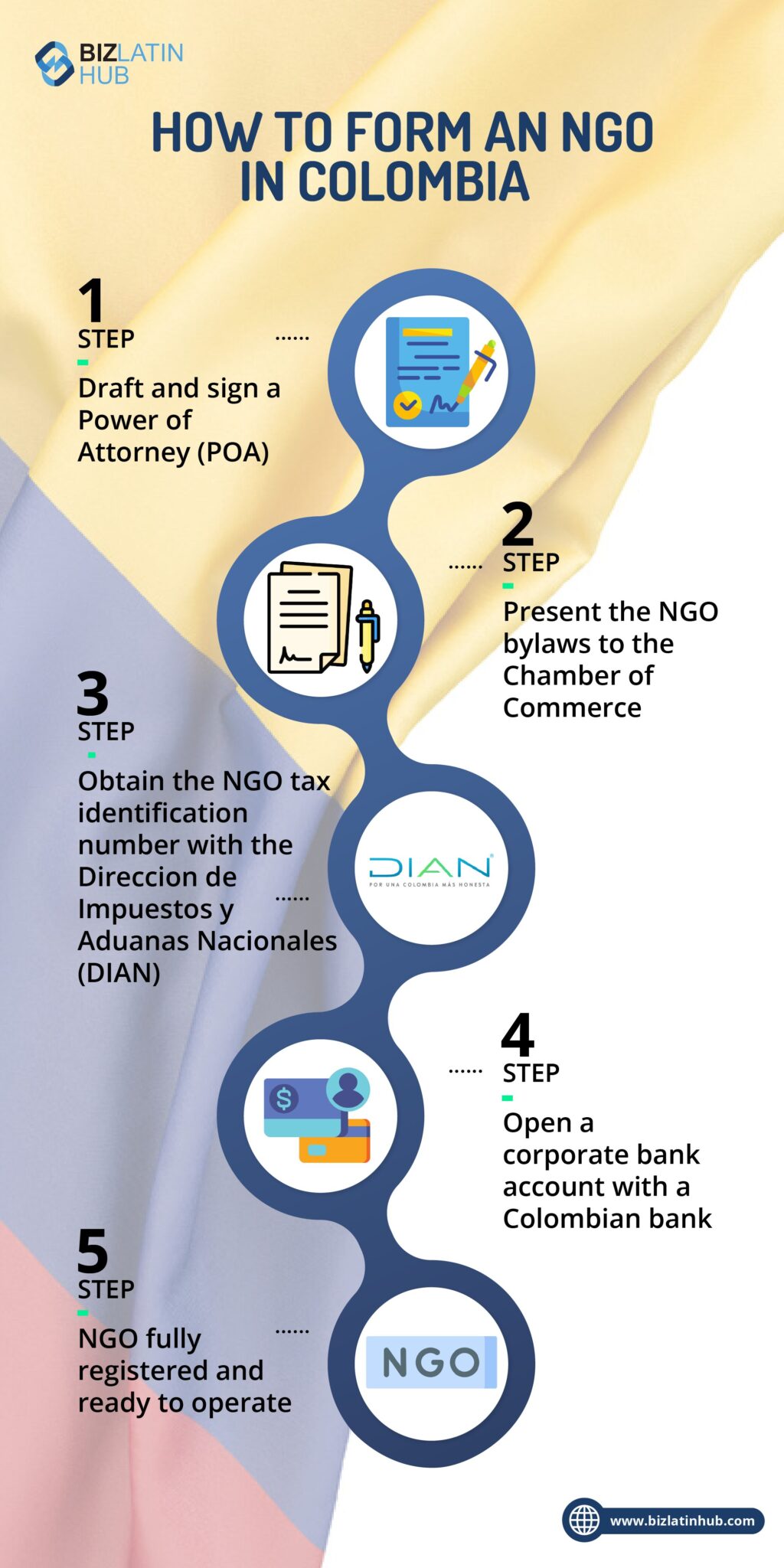

The process of setting up and registering an NGO is more complex than a regular Corporation, Limited Liability Company or Simplified Shares Company. The company formation process also tends to take longer than the usual timeframe of 4-6 weeks, sometimes up to 4-6 months in total.

1. Drafting bylaws with a Power of Attorney

Initially, the process starts like any other with the drafting and signing of a Power of Attorney (POA). Following that is the meeting with the Colombian Chamber of Commerce where the bylaws are presented. Within the statement of purpose and other bylaws, it should be made clear that what is being proposed is an NGO. The model presented to the Chamber of Commerce is similar to a Simplified Shares Company but one without profits. The documents drafted are also slightly different for an NGO.

2. Obtain your tax identification number

The next step after ratification from the Chamber of Commerce is the meeting with the Dirección de Impuestos y Aduanas Nacionales (DIAN). Here, the DIAN present the corporation with its unique tax ID. Following that, are the discussions of tax advantages/exceptions.

The company must submit reasoning to the DIAN as to why their NGO should be offered certain tax exemptions. Examples of adequate reasoning would be if the NGO planned to contribute to society, protect the environment, or support a minority group of people. If the DIAN approves of the cause, the company is fully registered as an NGO. If not, the company is instead registered as a regular Simplified Shares Company (SAS). It is worth noting that NGOs who hire employees will have additional tax obligations to comply with, such as social security contributions.

3. Open a corporate bank account

The next step is to open a corporate bank account. To set up a bank account for an NGO in Colombia, unlike a normal Simplified Shares Company, it is not necessary to deposit an initial capital contribution to activate the account. This arrangement is set up with the bank upon proof of NGO approval from DIAN.

After all of these steps have been completed, the NGO is fully registered and ready to operate.

Requirements to maintain your NGO in Colombia

There are certain corporate compliance requirements NGOs in Colombia must adhere to when operating. This includes those standard requirements of all legal entities in the country, such as:

- Appointing adequate legal representation

- Establishing a fiscal address

- Appointing a Fiscal Auditor

- Opening and maintaining a bank account.

NGOs in Colombia need to file taxes, but for this type of entity a special tax regime applies. If an NGO experiences a surplus, the tax is 20% (instead of 30%), as long as they reimbursed the surplus into the organization. Additionally, depending on the type of NGO, they will be allocated to a specific governmental entity to be supervised. This entity may request additional information from them.

Set up an NGO in Colombia with expert local support.

NGOs provide the lifeblood to underrepresented causes. Setting one up in Colombia does however require navigating a number of corporate and commercial compliance regulations.

Biz Latin Hub has a number of partnerships with NGOs in Latin America through having provided legal and financial services to any NGO, business or branch office seeking market entry.

Reach out to us here at Biz Latin Hub for a personalized consultation today and get your principals put into practice.

Learn more about our team and expert authors.