Opening a corporate bank account in Uruguay is an essential step in building the financial foundation necessary to support your business objectives and drive success in the region. Governmental institutions have consistently promoted foreign investment and it is now considered to be one of the best places to do business in Latin America. Biz Latin Hub provides expert support with our comprehensive back-office services, ensuring a seamless process to register a company in Uruguay and open a corporate bank account, helping you achieve a smooth and successful entry into the Uruguayan market.

Key takeaways on a corporate bank account in Uruguay

| Which are the best banks to open a corporate bank account in Uruguay? | Banco República Oriental del Uruguay (BROU) Banco Bandes Uruguay S.A. Banco Itaú Uruguay S.A. BBVA Uruguay Scotiabank Uruguay S.A. (ex. Nuevo Banco Comercial S.A.) Banco Santander S.A. Banco Bilbao Vizcaya Argentaria Uruguay S.A. HSBC Bank (Uruguay) S.A. Citibank N.A. Sucursal Uruguay |

| The five step process to open a corporate bank account in Uruguay: | Step 1: Find a bank that offers services best-suited to your business goals. Step 2: Decide on the type of bank account your business needs. Step 3: Prepare the required documents. Step 4: Wait for the bank to evaluate your documents and determine if you are eligible for a corporate account. Step 5: Make an initial deposit to activate your account. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| What are the necessary documents when opening a corporate bank account in Uruguay? | Articles of incorporation or association of the company. Proof of registration in the commercial registry. Official journal publications. Final beneficiaries communication for the Central Bank of Uruguay . Proof of registration of the company before the tax and social security authorities (Directorate-General for Taxation and the Social Security Bank). |

Open a corporate bank account in Uruguay in 5 steps

To open a corporate bank account in Uruguay you must follow these 5 steps:

- Step 1: Find a bank that offers services best-suited to your business goals.

- Step 2: Decide on the type of bank account your business needs.

- Step 3: Prepare the required documents.

- Step 4: Wait for the bank to evaluate your documents and determine if you are eligible for a corporate account.

- Step 5: Make an initial deposit to activate your account.

Bank Options in Uruguay

Uruguay offers a variety of banking options tailored to the needs of foreign companies looking to establish a presence in the country. Your ideal choice will depend on factors such as your business objectives and the specific services each bank offers. Here’s a selection of well-regarded banks in Uruguay to help guide your decision-making process:

- Banco República Oriental del Uruguay (BROU)

- Banco Bandes Uruguay S.A.

- Banco Itaú Uruguay S.A.

- BBVA Uruguay

- Scotiabank Uruguay S.A. (ex. Nuevo Banco Comercial S.A.)

- Banco Santander S.A.

- Banco Bilbao Vizcaya Argentaria Uruguay S.A.

- HSBC Bank (Uruguay) S.A.

- Citibank N.A. Sucursal Uruguay

Recommendation: In our experience choosing a bank depends on various factors including the specific needs of the client, the range of services required, the locations of the company’s operations, and more. Some of the most popular banks in Uruguay, counting BROU, are Banco Santander Uruguay, Banco Itaú Uruguay, Scotiabank Uruguay, and BBVA Uruguay.

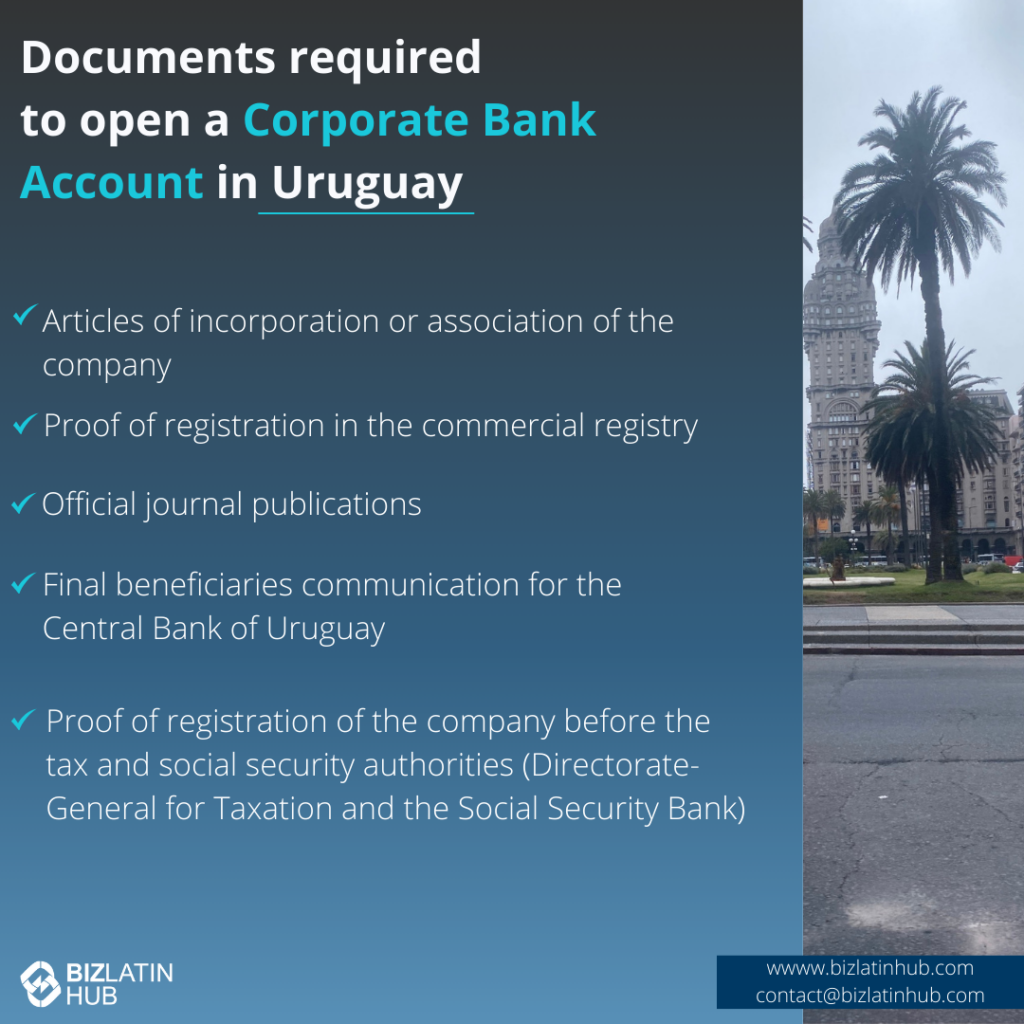

Documents Required to Open a Corporate Bank Account in Uruguay

The Uruguayan financial system is made up of two public banks, nine private banks, and a wide variety of non-banking institutions that have recently consolidated. Each entity will request the documentation it deems relevant for opening a corporate bank account. However, the required documentation is usually the same.

When opening a corporate bank account in Uruguay, most banks will request the following documents:

- Articles of incorporation or association of the company.

- Proof of registration in the commercial registry.

- Official journal publications.

- Final beneficiaries communication for the Central Bank of Uruguay .

- Proof of registration of the company before the tax and social security authorities (Directorate-General for Taxation and the Social Security Bank).

Depending on the activities of the company, banks in Uruguay may request additional documents before opening a corporate bank account.

2 Types of bank account in Uruguay

As there are different types of business bank accounts, you should consider which option is best for your business. The two main types of bank accounts in Uruguay are: checking and savings accounts.

- Checking accounts: Checking accounts are the most popular because they allow unlimited operations. Keep in mind that banks will charge you a small fee every time you use your checking account. Likewise, these accounts allow you to keep checkbooks, valid for making payments.

- Savings accounts: Savings accounts are intended as a safe, month-to-month savings option. The balance of this account can be accessed at any time and can be operated through an ATM network. However, banks charge commissions and maintenance costs for their use.

FAQs on opening a corporate bank account in Uruguay

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Uruguay:

1. Can I open a corporate bank account online in Uruguay?

No. You can open a bank account from abroad with the support of a local lawyer empowered by a special power of attorney. However, there is documentation that must be signed by the shareholders and representatives of the company, and they will need apostille and signature certification, if these people are abroad.

2. What documents do I need to open a corporate bank account in Uruguay?

The following documents are required to open a corporate bank account in Uruguay:

- Copy of the company’s contract or by-laws.

- Approvals and registrations before public bodies (DGI,BPS,DGR).

- Form B communicated to the central bank (shareholding chain).

- Copy of passport of all shareholders and members of the company.

- The bank may request additional information such as a certificate of income of shareholders or similar.

3. Who can have access to a corporate bank account?

Any member of the company who is authorized by the shareholders of the company and has a signature registered with the bank can have access to the bank account.

4. Which is the best bank in Uruguay for foreign companies?

We recommend the following banks for foreign companies: Santander, Itaú or Scotiabank.

5. Why do companies open bank accounts in Uruguay?

Companies choose to open bank accounts in Uruguay because of the economic and political stability, the ability to have the account currency in U.S. dollars and the territorial tax system. However, every company needs a bank account in the country since there are certain payments, such as national contributions, that can only be made from a local account.

6. Does Uruguay have banking secrecy?

Yes, with exceptions.

- Law No. 14.306, of November 29, 1974, art. 47, which establishes the secrecy that the Tax Administration must keep in relation to all administrative or judicial proceedings.

- Law No. 15.322, of September 17, 1982, art. 25 determining the secrecy to be kept by persons engaged in financial intermediation.

- Law No. 16.696, dated March 30, 2002, art. 22 establishing the secrecy to be kept by the BCU when carrying out financial activities.

- Law No. 17,292, dated January 25, 2001, Art. 57, which excludes from banking secrecy everything related to the R.A.V.E., including the information contained in the sworn statements.

- Law No. 17.704, dated October 27, 2003, Art. 12, which establishes that in case of repression of the financing of terrorism, bank secrecy does not apply.

- Law No. 17.861 of December 28, 2004, art. 12, which establishes that in case of repression of organized crime, bank secrecy does not apply.

Why invest in Uruguay?

Expanding to Uruguay offers the advantage of operating in a stable, growing economy. Opening a corporate bank account in Uruguay will allow your company to access the financial market.

Banks offer the option of performing several operations while having a monetary register. Monetary registers are essential to access credits, loans, and other financial services or products.

Once the corporate account has been approved by your chosen financial entity, you will be provided with your online login details, so you can access a wide range of services.

Keep in mind that services offered by financial entities in Uruguay may vary and, depending on the needs of your company, you may prefer to rely on a public or private bank. Also note that most banks will ask you to make an initial deposit.

Biz Latin Hub can help you open a corporate bank account in Uruguay

Doing business in Uruguay and Latin America offers many opportunities for investors. However, local business environments can be somewhat challenging, especially for foreigners. It is important to therefore find a trusted legal provider to support you with your business expansion, including communicating with local authorities to open your corporate bank account.

At Biz Latin Hub, we offer company incorporation services and administrative services for the maintenance of your business, in order to help companies overcome the common problems they face during the initial stages of entering a new market such as opening a corporate bank account.

If you have any questions regarding doing business in Uruguay, please contact us. Contact our team to learn how we can support you and your business in Latin America.

Learn more about our team and expert authors.