To start a business formation process and to ensure financial stability and facilitate smooth international transactions, it is crucial to open a corporate bank account in the Cayman Islands for companies operating in this jurisdiction. To ensure financial stability and seamless international transactions, it is easy to open a corporate bank account in the Cayman Islands, although a lot of documents are required.

Key takeaways to open a corporate bank account in the Cayman Islands

| Necessary documents | A large list, see below for full details. Includes: Personal information for the owner Company records and details Bank references |

| Online opportunity | Usually possible either on website or email |

| Minimum deposit | Yes, varies widely according to bank and account. Starts at around USD$25,000 and goes much higher |

| Access to the account | Can be designated to trusted individuals |

| Banking secrecy | Present in all accounts |

4 Steps to follow to open a bank account in the Cayman Islands

Once you have chosen a provider to bank with, you are ready to begin the process of opening a corporate account. To open a bank account in the Cayman Islands you must follow these steps:

- Gather your documents

- Apply in person or online

- Wait for the bank to verify your documents

- Make a minimum deposit

Below is more information on each of the steps outlined above.

Gather your documents

See below for full details, but be advised that there is an extremely lengthy list of documents you will have to have in order. They are largely fairly straightforward, so should not be a problem but the sheer number ay cause delays. Be aware that any that are not in English will likely have to be translated by an official translator.

Go to the branch in person or online

Most banks in the Cayman Islands are flexible, allowing account formation either over email, online or in person. If you are delegating this to a person other than a director, you will have to provide Power Of Attorney (POA) proof.

Wait for the bank to verify your documents

The bank will go through your documentation to make sure everything is in order. This may take some time, so be prepared to wait and stay attentive in case they have any queries.

Make a minimum deposit

This varies from bank to bank, but is usually around USD$25,000 at entry level, with significantly higher levels for certain endeavours such as finance and wealth management.

Can a Foreigner Open a Bank Account in the Cayman Islands?

Yes, opening a bank account in the Cayman Islands doesn’t require residency or prior visits to the Caribbean Islands. You can open a non-resident corporate account with certain Cayman Islands banks from anywhere, eliminating the need for in-person visits or meetings with bank representatives. Once you establish your corporate account, you’ll gain access to the full spectrum of financial services the bank offers.

What Do You Need to Open a Corporate Bank Account in the Cayman Islands?

To initiate the process of opening a corporate bank account in the Cayman Islands, you will be required to complete a comprehensive application and provide the following information:

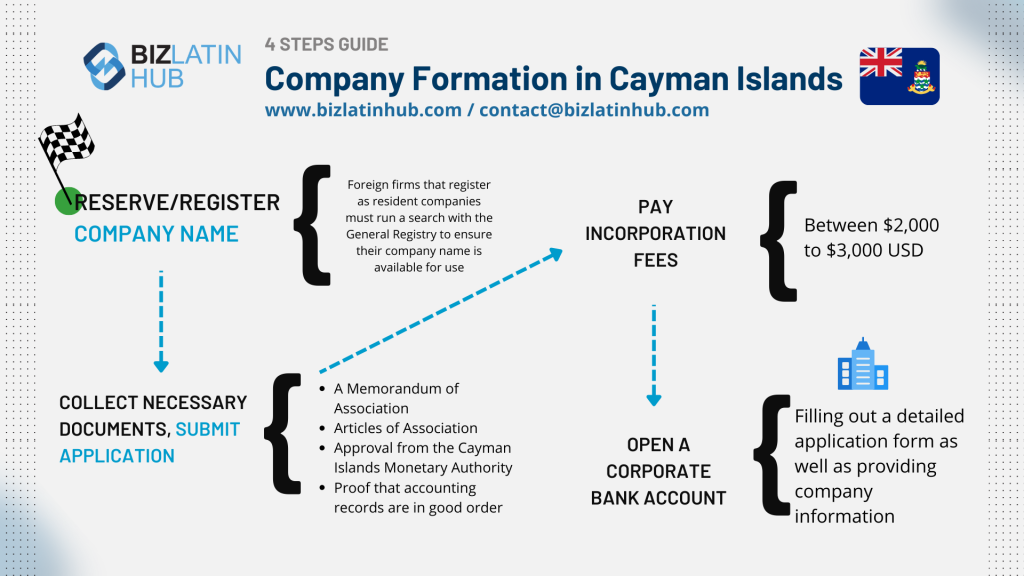

- Full incorporation documentation.

- A written request, drafted on company letterhead, outlining an overview of your business (including clients, staff numbers, and revenue sources) and the purpose of the account.

- Bank references from your current banking institution.

- A Certificate of Incorporation, duly certified by a Notary Public.

- Certified copies of the Articles and Memorandum of Association are also notarized.

- Annual reports, financial statements, auditors’ reports, or a business plan.

- Certificate of Good Standing if your business is older than one year.

- A Register of Members, Officers, and Directors, either certified by the registered office or a Notary Public.

- Identification details for each ultimate beneficial owner, director, and signatory, supported by certified copies of their passports and proof of residential addresses.

- If your business operates within the Cayman Islands, a copy of the current Trade and Business license.

- Professional references from an accounting or law firm and a bank, demonstrating a good relationship spanning over three years.

- Details about the nature and dollar volume of expected transactions, along with the source of funding for initial and subsequent deposits. This information can be provided via a Business Plan for new companies or the latest Financial Statements for established ones.

- A tax declaration form.

- All directors, members, and signatories must supply the necessary information for a personal bank account, including a certified copy of the partnership agreement.

- If there are more than a nominal number of shareholders, the bank will require identification and references for principal shareholders who own 10% or more of the shareholding, as well as directors and officers responsible for account operations.

- For companies incorporated in other countries, notarized documents are necessary to verify the legitimacy of the company.

- Each Cayman bank may have a minimum deposit requirement for opening a business account.

Our recommendation: For precise document requirements tailored to your specific case, it is advisable to consult a local banking expert in the Cayman Islands.

5 Highly Regarded Banks in the Cayman Islands

Customized to suit your company’s specific needs, select banks in the Cayman Islands provide enhanced flexibility for tasks such as setting up investment accounts, accommodating adaptable payment methods, and facilitating international transfers. You should ensure that the bank you choose aligns with your business requirements.

Here are five highly regarded banks in the Cayman Islands:

- Cayman National Bank.

- Cainvest Bank and Trust Limited.

- Merrill Lynch Bank and Trust Company (Cayman) Ltd.

- Fidelity Bank (Cayman) Lrd.

- Alexandria Bancorp Ltd.

- Cayman National Bank: Cayman National Bank, established in 1974 and headquartered in Grand Cayman, offers a wide range of international and domestic financial services, including investment, online banking, administration, management, premier banking, company formation, trust services, and fund management. It manages approximately KYD1.463 trillion in total assets and generated revenue of about KYD46.96 million in the first half of 2018, with a net income of around KYD22.32 million in the same year.

- Cainvest Bank and Trust Limited: Cainvest Bank and Trust Limited, founded in 1994 and holding a Category A banking license, acquired Inter-trust Bank (Cayman) Limited in its inception year and later transformed into Cainvest International Bank Limited. In 2015, it rebranded as Cainvest Bank and Trust Limited, with its headquarters in Georgetown. This bank specializes in investment products and services to institutional clients and high-net-worth individuals.

- Merrill Lynch Bank and Trust Company (Cayman) Ltd.: Merrill Lynch Bank and Trust Company (Cayman) Ltd. holds a Category A license and offers a range of financial products, including client deposits, interbank placements, loans, and forex transactions. In 2017, it reported a net income of approximately KDR 13,243 and total assets of KDR 4.071 million.

- Fidelity Bank (Cayman) Ltd.: Incorporated in 1980 with a Category A license, Fidelity Bank (Cayman) Ltd. provides a comprehensive suite of financial services, including insurance, international and domestic banking. As of the year ended 2017, the bank reported total assets of B$627.770 million.

- Alexandria Bancorp Ltd.: Established in 1990, Alexandria Bancorp Ltd. is a wholly-owned subsidiary of Guardian Capital Group, headquartered in Toronto, Canada. This bank specializes in offering Wealth Management, Private Banking, and Trust and Corporate services, making it one of the prominent foreign banks operating on the island.

Team Up with a Local Expert for a Smoother Process

It is advisable to engage with law firms or consultants when opening a corporate bank account in the Cayman Islands. While the procedure is generally uncomplicated, certain aspects require careful attention, making collaboration with a local partner essential to receive comprehensive support throughout the process.

FAQs on Opening a Corporate Bank Account in the Cayman Islands

Can a foreigner open a bank account in the Cayman Islands?

Yes, opening a bank account in the Cayman Islands doesn’t require residency or prior visits to the Caribbean Islands. You can open a non-resident corporate account with certain Cayman Islands banks from anywhere, eliminating the need for in-person visits or meetings with bank representatives.

What are the main advantages of opening a corporate bank account in the Cayman Islands?

Opening a corporate bank account in the Cayman Islands offers advantages such as taxation, confidentiality and a stable financial environment conducive to business growth.

Are there any minimum deposit requirements for corporate accounts in the Cayman Islands?

Yes, many banks in the Cayman Islands impose minimum deposit requirements for corporate accounts. It is essential to ensure that these requirements are met before beginning the account opening process.

Can I open a Cayman Islands business bank account online?

Yes, it is possible for some banks to open an account online. To do so, the client must issue a broad general power of attorney, and they must always have a Cayman Islands legal representative to be able to manage the duality of management of the bank account.

What documentation is required to open a corporate bank account in the Cayman Islands?

Generally, you will need to submit certified copies of company documents, proof of identity of beneficial owners and directors, and other supporting documents to meet regulatory requirements.

Biz Latin Hub can help you open a corporate bank account in the Cayman Islands

Biz Latin Hub offers comprehensive market entry and back-office solutions across Latin America and the Caribbean, boasting a presence in key cities across the region.

We have also formed reliable partnerships in numerous other markets, positioning us uniquely to assist with multi-jurisdictional market entry and seamless cross-border operations.

As well as knowledge about how to open a corporate bank account in the Cayman Islands, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.