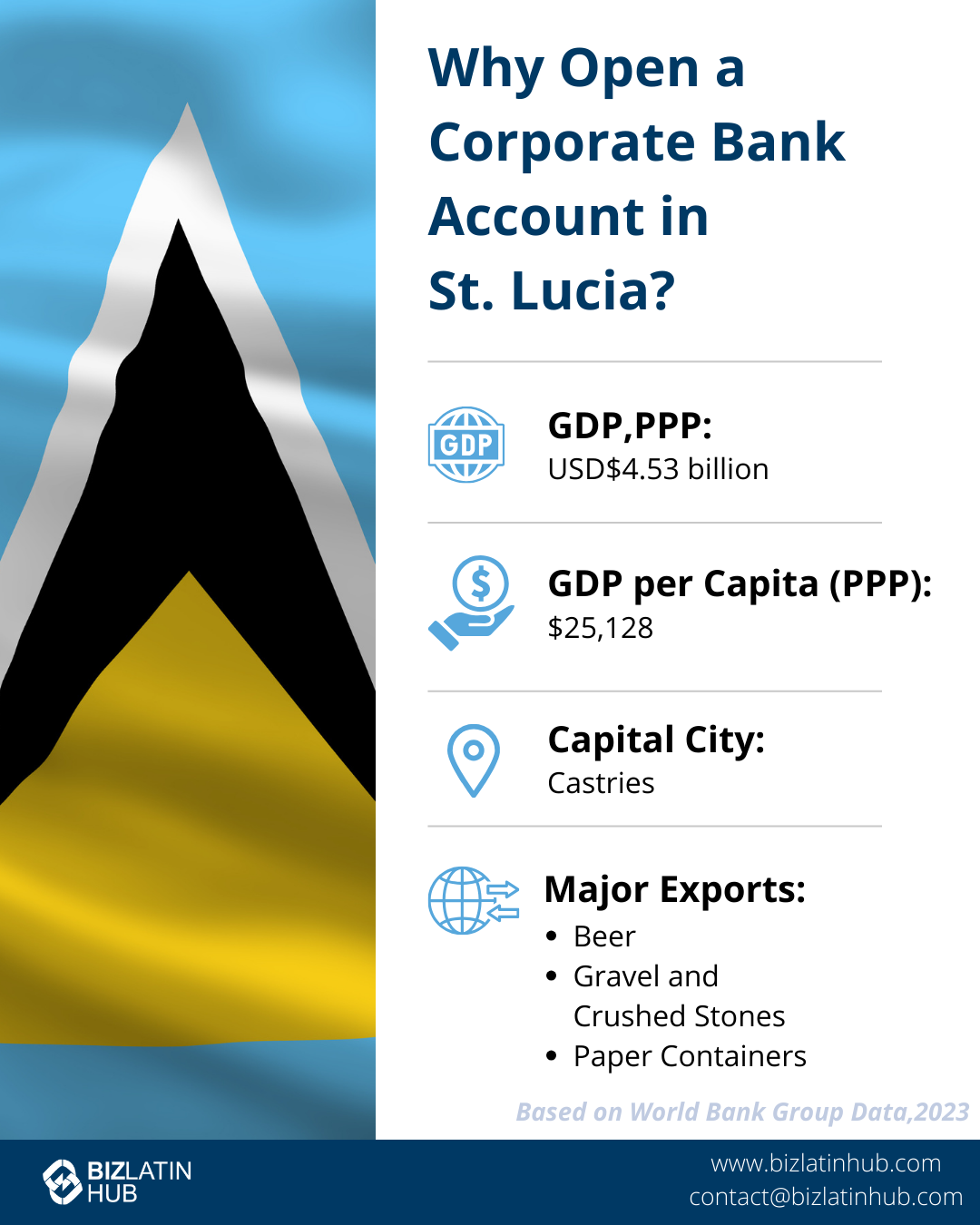

Starting a business venture in Saint Lucia offers an intriguing fusion of Caribbean charm and global business prospects. In this tropical paradise, investors can discover a favorable atmosphere for initiating and growing their businesses in a tax-efficient jurisdiction. To guarantee financial stability and smooth international transactions, opening a corporate bank account in Saint Lucia is essential. Saint Lucia offers a stable banking environment and is a member of the Eastern Caribbean Currency Union, using the Eastern Caribbean Dollar (XCD).

Key takeaways on how to open a corporate bank account in Saint Lucia

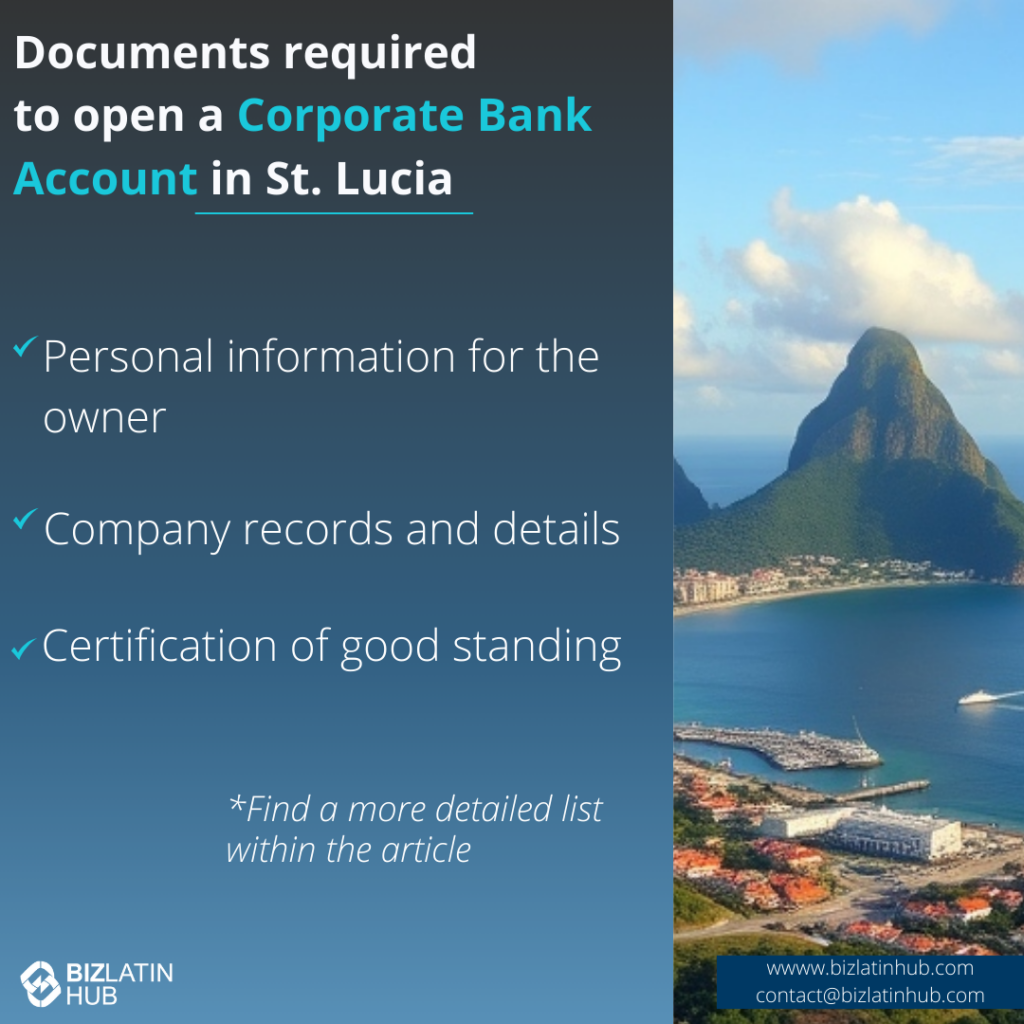

| What are the necessary documents to open a corporate bank account in Saint Lucia? | A large list, see below for full details. Includes: Personal information for the owner Company records and details Certification of good standing |

| Is online corporate banking possible? | Sometimes possible, but usually done in person |

| What is the minimum deposit? | Varies, but approximately USD$5,000 is standard |

| Who can have bank account access? | Can be designated to trusted individuals |

| Does St Lucia have banking secrecy? | Present in all accounts and extremely firm in offshore banking |

Step-by-Step Setup Process

Once you have chosen a provider to bank with, you are ready to begin the process of opening a corporate account. To open a bank account in Saint Lucia you must follow these steps:

- Gather your documents

- Go to a bank branch in person

- Wait for the bank to verify your documents

- Make a minimum deposit, usually around USD$5,000.

Below is more information on each of the steps outlined above.

Gather your documents

See below for full details, but be advised that there is a lengthy list of documents you will have to have in order. They are largely fairly straightforward, so should not be a problem but the sheer number ay cause delays. Be aware that any that are not in English will likely have to be translated by an official translator.

Go to the branch in person

Appointments are not usually made ahead of time, although it is possible. Many banks close early, so make sure you do not go too late. If you cannot go in person yourself, you can delegate this to a legal representative with Power of Attorney (POA).

Wait for the bank to verify your documents

The bank will go through your documentation to make sure everything is in order. This may take some time, so be prepared to wait and stay attentive in case they have any queries.

Make a minimum deposit

This varies from bank to bank, but is usually around USD$5,000.

Can a Foreigner Open a Bank Account in Saint Lucia?

With the right documentation and initial investment, foreign nationals can open a bank account in Saint Lucia. When considering the possibility of opening a bank account in Saint Lucia, it is crucial to enlist the help of international specialists who can expertly guide you through the process.

Corporate Account Requirements for Foreign Businesses

For non-residents seeking to open a bank account in Saint Lucia, the application process requires submitting documentation such as the Certificate of Incorporation, Articles of Association, valid passport, proof of address, bank reference letter, and source of funds declaration.

Regulated by the Eastern Caribbean Central Bank (ECCB) and the Financial Services Regulatory Authority (FSRA). Banks require comprehensive KYC and due diligence documentation as part of tax and accounting requirements in Saint Lucia.

- Identity document: passport, ID card, residence card, or driver’s license.

- Document confirming their registered address: utility bill in the name of the applicant, a letter from the employer confirming the registered residence address of the applicant.

- The charter or memorandum of association.

- The company’s registration certificate with the authorities.

- A certificate of appointment of directors and executive secretary.

- Power of attorney or protocol on the appointment of a responsible person who has the authority to open and manage accounts on behalf of the company.

- Shareholder register; register and resolution on the issue of shares of the company.

- Certificate of Good Standing and the absence of debts.

Work with a Local Expert to Simplify the Process

Collaborating with law firms or consultants is the optimal approach to start the bank opening procedure. While opening a corporate bank account in Saint Lucia is relatively straightforward, certain aspects warrant consideration. Therefore, partnering with a local expert becomes crucial, ensuring comprehensive assistance throughout the process.

Best Banks for International Clients

Banks in Saint Lucia offer customized solutions tailored to your company’s unique requirements, including the establishment of investment accounts, accommodating flexible payment methods, and facilitating international transfers. Common options for international clients include Bank of Saint Lucia, Republic Bank (EC) Limited, and 1st National Bank St. Lucia. It’s important to select a bank that aligns with your business needs.

The following is a list of five well-respected banks in Saint Lucia:

- Bank of Saint Lucia: The Bank of Saint Lucia stands as the largest commercial bank in the nation, established in 2001 through the merger of two prominent banks with a collective history spanning over two decades. With branches strategically located in key areas such as Castries (the capital), Gros Islet, and Vieux Fort in Soufriere, the bank offers extensive accessibility.

- St Lucia Corporative Bank: St Lucia Cooperative Bank, established in 1938, holds the distinction of being the oldest national bank in the country. In 2005, it was renamed the 1st National Bank of St Lucia. Notably, the bank has received prestigious recognition, being awarded the Bank of the Year title by the Financial Times on two occasions. With a total of seven branches nationwide, including around four in the heart of Castries, the bank provides convenient access to its services.

- Hermes Bank: Hermes Bank is highly favored by investors in St Lucia due to its specialized services for foreign clients. Despite having only one branch in the country, the bank caters to both individuals and legal entities. At Hermes Bank, customers can open personal and current accounts, as well as make deposits and term deposits. It’s important to note that the bank does not issue debit or credit cards and lacks ATMs. However, all banking transactions can be conveniently managed through the bank’s online services.

- PROVEN Investments Limited: The leading investment company in the Caribbean. It specializes in offering diverse banking solutions in multiple currencies, catering to global trading, personal investments, and corporate accounts. The company operates under the International Banks Act, Cap. 12.17, as a Class A Bank and is regulated by the Financial Services Regulatory Authority. Their range of products and services includes foreign exchange, transactional banking, eBanking, loans, and more.

- Republic Bank: For 182 years, the Republic Group has consistently experienced financial growth and fostered personal and professional development. It is engaged in a wide range of banking and financial services in the Caribbean, the Group has an extensive global branch network comprising a total of 117 branches, 295 ATMs, and 5,574 employees across the jurisdictions.

Comparison Table:

| Feature | Saint Lucia | Barbados | Trinidad & Tobago |

|---|---|---|---|

| Minimum Deposit | $5,000 | $1,000–$5,000 | $2,000 |

| Account Opening Time | 2–4 weeks | 2–3 weeks | 3–5 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Limited | Rare | Rare |

Additional FAQs About Corporate Banking in Saint Lucia

Based on our extensive experience, these are the common questions and doubts of our clients about opening a company bank account in Saint Lucia:

1. Can I open a corporate bank account online in Saint Lucia?

You can with some banks that operate in the territory, but it is more normal to walk into a bank and talk to a branch representative.

2. What documents do I need to open a company bank account in Saint Lucia?

To open a corporate bank account in Saint Lucia, you will be required to complete a detailed application and provide the following information:

Identity document: passport, ID card, residence card, or driver’s license.

Document confirming their registered address: utility bill in the name of the applicant, a letter from the employer confirming the registered residence address of the applicant.

The charter or memorandum of association.

The company’s registration certificate.

A certificate of appointment of directors and executive secretary.

Power of attorney or protocol on the appointment of a responsible person who has the authority to open and manage accounts on behalf of the company.

Shareholder register; register and resolution on the issue of shares of the company.

Certificate of Good Standing and the absence of debts.

3. Who can have access to a company bank account in Saint Lucia?

Bank account access can usually be granted by the account owner through the virtual platform of the bank with a physical security token device.

4. What is the best bank in St Lucia for foreign companies?

In most cases, we recommend using one of the larger banks which have significant experience with international commerce, provide a broad service offering, and have a large number of branches and ATMs. Bank of Saint Lucia is the leading example of this.

5. Why do companies open bank accounts in Saint Lucia?

A bank account is a must for all companies in Saint Lucia. The bank account will allow you to complete operations, including paying taxes, payroll, local suppliers, and all domestic transactions.

6. Does Saint Lucia have banking secrecy?

Yes, it does. Offshore banking is even more protected.

7. Can a foreign company open a business account in Saint Lucia?

Yes, with proper documentation and compliance with local regulations, foreign companies can open a business bank account in Saint Lucia.

8. How long does onboarding take?

Typically 2 to 4 weeks, depending on the bank and completeness of documentation.

9. Can companies hold USD accounts in Saint Lucia?

Yes, many banks in Saint Lucia offer multi-currency accounts, including USD.

Biz Latin Hub can help you open a corporate bank account in Saint Lucia

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to open a corporate bank account in Saint Lucia, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.