You will need to open a corporate bank account in Puerto Rico as an essential step for companies looking to establish themselves in this vibrant Caribbean territory. It offers a strategic location, favorable tax incentives and a solid business infrastructure, making it an attractive destination for companies looking to expand their operations.

Before you open a corporate bank account in Puerto Rico, companies should be aware of local banking regulations and requirements.

Key takeaways on how to open a corporate bank account in Puerto Rico

| Which banks are the best to open a corporate bank account in Puerto Rico? | Arca International Bank. Banco Popular de Puerto Rico. Banco Santander. Citibank. FirstBank. Oriental Financial Group. Scotiabank of Puerto Rico. |

| The process to open a corporate bank account in Puerto Rico: | Step 1 – Find a bank whose services match your business needs. Step 2 – Prepare the required documentation. Step 3 – Make a minimum deposit into the account. |

| Do all banks have the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| Can you open an account online? | Yes, this is generally possible with most banks and accounts. However, double check with your chosen entity. |

| What are the necessary documents when opening a corporate bank account in Puerto Rico? | Merchant Registration Certificate (SC-2918), issued by the Department of Treasury of Puerto Rico. Evidence of Employers Identification Number (EIN). Valid photo ID issued by the government of Puerto Rico or the United States. Ultimate beneficial owner. Copy of the Articles of Association and Articles of Association or company bylaws. Copy of the certificate of incorporation. Certificate of ‘good standing’. Updated registry of shareholders. Copy of the board resolution appointing the directors and their powers. Board resolution authorizing the opening of an account with the bank. Financial statements. |

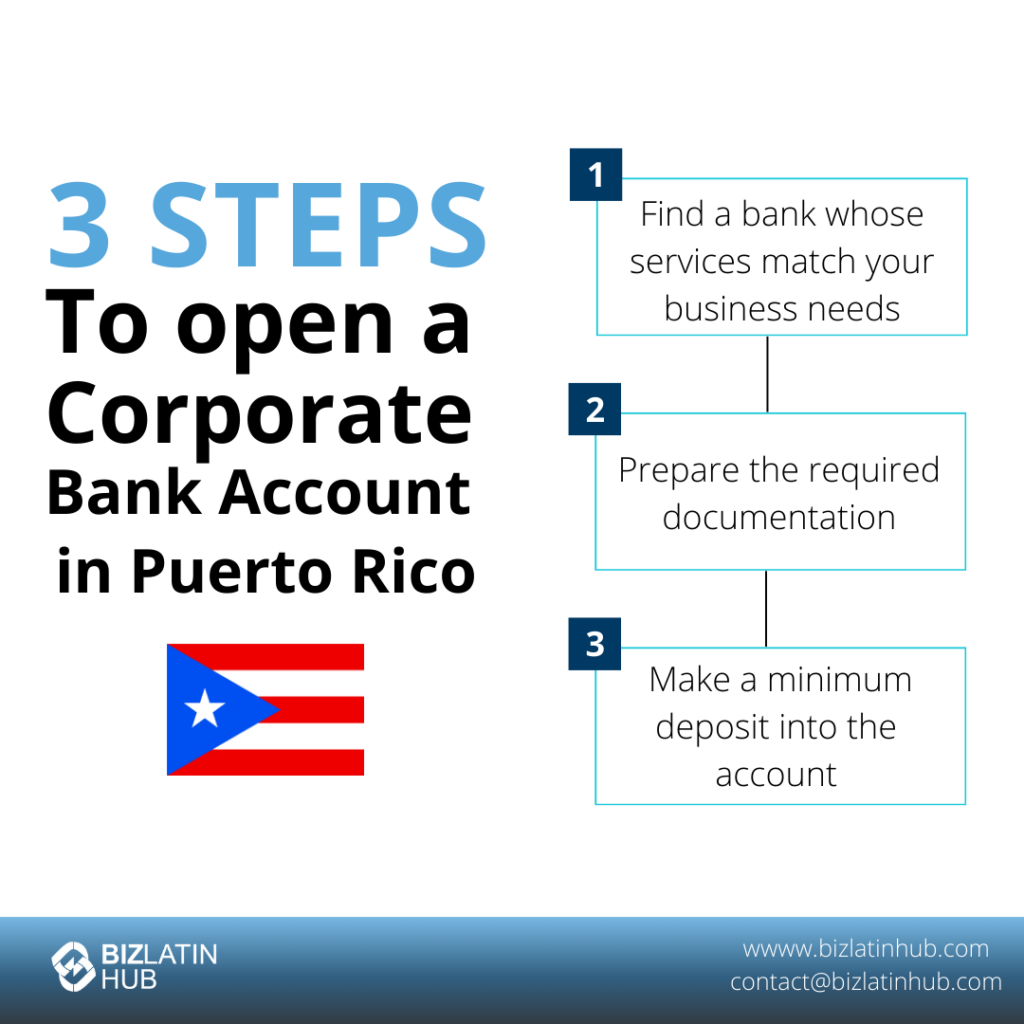

Step-by-Step Bank Account Setup

To open a corporate bank account, you have to follow these 3 steps:

- Step 1 – Find a bank whose services match your business needs.

- Step 2 – Prepare the required documentation.

- Step 3 – Make a minimum deposit into the account.

Once you have completed the three steps above, the bank will evaluate your documents and determine whether you are eligible for a corporate account. The entire process can take up to three weeks. If your application is successful, the bank will provide you with the details needed to activate the online banking system.

To date, there is only one type of corporate bank account that companies can open in Puerto Rico, the resident corporate account.

- Resident corporate account – For local businesses, or for foreign business people who have gone through the long and arduous task of achieving legal residency in Puerto Rico. This account is ideal for foreign companies that have moved their business to the island in order to enjoy the 4-percent fixed corporate tax rate.

The documentation that is required to open a corporate bank account in Puerto Rico varies wildly from one bank to the next, as does the minimum initial deposit.

Many banks do not require minimum deposits to open business bank accounts, while at least one bank on the island insists that new account holders deposit a minimum of USD$100,000.

Top Banks for Corporate Clients in Puerto Rico

In Puerto Rico, it will take some shopping around before you find a bank that meets your business needs. Banco Popular de Puerto Rico, FirstBank, Oriental Bank, Scotiabank of Puerto Rico, and Zenus Bank are commonly used by international clients. What follows are some of the largest and most established local and foreign banks on the island territory:

- Arca International Bank.

- Banco Popular de Puerto Rico.

- Banco Santander.

- Citibank.

- FirstBank.

- Oriental Financial Group.

- Scotiabank of Puerto Rico.

Recommendation: We advise you to research each bank’s specific offerings and requirements to find the one that best suits your company’s needs.

Comparison Table:

| Feature | Puerto Rico | Panama | Belize |

|---|---|---|---|

| Minimum Deposit | Varies | $1,000 | $500 |

| Account Opening Time | 2–4 weeks | 2–3 weeks | 1–2 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Limited | Yes | Yes |

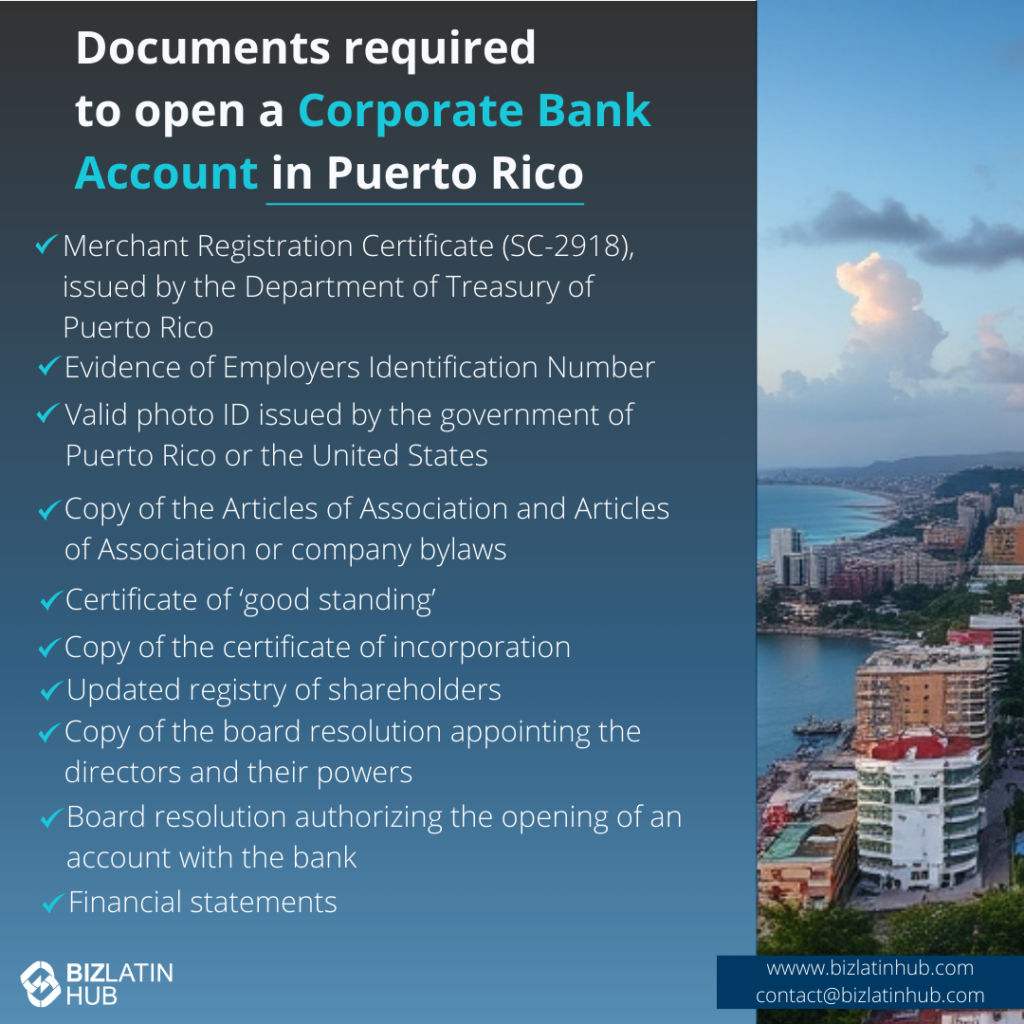

Required Documents for Foreign-Owned Companies

While the Puerto Rican government has for years had a policy in place to attract international business, the island’s banks are not quite on the same page. Most banks on the island require extensive amounts of documentation such as Certificate of Incorporation, Merchant Registration Certificate (SC-2918), Employer Identification Number (EIN), valid photo ID, Articles of Association or company bylaws, Certificate of Good Standing, updated registry of shareholders, board resolution appointing directors and authorizing account opening, and financial statements

Banks often request more documentation than what is required by law, such as certifications from overseas banks or in some cases government bodies. There is also a high level of scrutiny that goes into every new account application, so it’s extremely important that companies consult on-the-ground legal, accounting, and financial expert(s) to ensure that all their documents are in order.

Institutions are regulated under U.S. federal laws, including the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations meaning tax and accounting requirements in Puerto Rico mirror the US. Banks require comprehensive KYC and due diligence documentation. In some cases local experts may act as signatories. The following documents/information are generally required to open the company bank account:

- Merchant Registration Certificate (SC-2918), issued by the Department of Treasury of Puerto Rico.

- Evidence of Employers Identification Number (EIN).

- Valid photo ID issued by the government of Puerto Rico or the United States.

- Ultimate beneficial owner.

- Copy of the Articles of Association and Articles of Association or company bylaws.

- Copy of the certificate of incorporation.

- Certificate of ‘good standing’.

- Updated registry of shareholders.

- Copy of the board resolution appointing the directors and their powers.

- Board resolution authorizing the opening of an account with the bank.

- Financial statements.

Additional FAQs About Puerto Rico Business Banking

Based on our extensive experience, these are the common queries we receive from our clients on opening a company bank account in Puerto Rico:

1. Can I open a corporate bank account online in Puerto Rico?

No. You can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA). However, the original bank application forms will need to be sent to Puerto Rico.

2. What documents do I need to open a company bank account in Puerto Rico?

The following documents are required to open the company bank account:

- Merchant Registration Certificate (SC-2918), issued by the Department of Treasury of Puerto Rico.

- Evidence of Employers Identification Number (EIN).

- Valid photo ID issued by the government of Puerto Rico or the United States.

- Ultimate Beneficial Owner Information (SSN, contact information, etc).

- Copy of the Articles of Association and Articles of Association or company bylaws.

- Copy of the Certificate of Incorporation.

- Certificate of ‘Good Standing’.

- Updated registry of shareholders.

- Copy of the board resolution appointing the directors and their powers.

- Board resolution authorizing the opening of an account with the bank.

3. Who can have access to a company bank account?

Any member of the company that is authorized by company shareholders can have access to the bank account.

4. Why do companies open bank accounts in Puerto Rico?

Companies choose to open bank accounts in Puerto Rico due to the economic and political stability, the ability to hold currency in US Dollars, the national taxation system, and banking privacy.

5. Does Puerto Rico have bank secrecy?

Yes. The Bank Secrecy Act states that the information obtained by a financial entity must be kept strictly confidential and may only be provided to third parties by order of the competent judicial or governmental authority. However, financial institutions must comply with anti-money laundering laws in the United States.

6. Can a foreign company open a business account in Puerto Rico?

Yes, with proper documentation and compliance with local regulations, foreign companies can open a business bank account in Puerto Rico.

7. Which Puerto Rican banks are best for foreign clients?

Banco Popular de Puerto Rico and Zenus Bank are preferred for their international services and experience with foreign clients.

8. How long does onboarding take?

Typically 2 to 4 weeks, depending on the bank and completeness of documentation.

9. Can companies hold USD accounts in Puerto Rico?

Yes, as a U.S. territory, bank accounts in Puerto Rico are denominated in U.S. dollars.

Biz Latin Hub can help you open a corporate bank account in Puerto Rico

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to open a corporate bank account in Puerto Rico, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article on opening a corporate bank account in Puerto Rico was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.