A corporate bank account provides financial stability and facilitates smooth international transactions. Therefore, understanding how to open a corporate bank account in Nicaragua is crucial for building a successful business. Nicaragua’s economy is driven by manufacturing, services, and agriculture, with support from foreign investment.

In 2024, it may make sense open a corporate bank account in Nicaragua, as the country is expected to experience economic growth between 3.5% and 4.5%. Despite the multiple shocks it has faced, the Nicaraguan economy remains resilient thanks to sound macroeconomic policies and multilateral aid. After a very strong rebound in 2021, the economy has continued to grow at a steady pace (about 4% in 2023).

Nicaragua, being an appealing choice for foreign investors, offers access to a variety of reputable banks. This article outlines the steps for opening a corporate bank account in Nicaragua. Biz Latin Hub can help walk you through this process as well as support your business with our array of back office services across Latin America and the Caribbean.

See also: Corporate Bank Account in Costa Rica

Can a foreigner open a bank account in Nicaragua?

Yes, with the necessary paperwork and an initial investment, foreign individuals can open a corporate bank account in Nicaragua. This applies to both residents and non-residents. However, for non-residents the process requires more paperwork and may become complicated. If you are contemplating opening a bank account in Nicaragua, it’s essential to consult international experts who can offer expert assistance every step of the way.

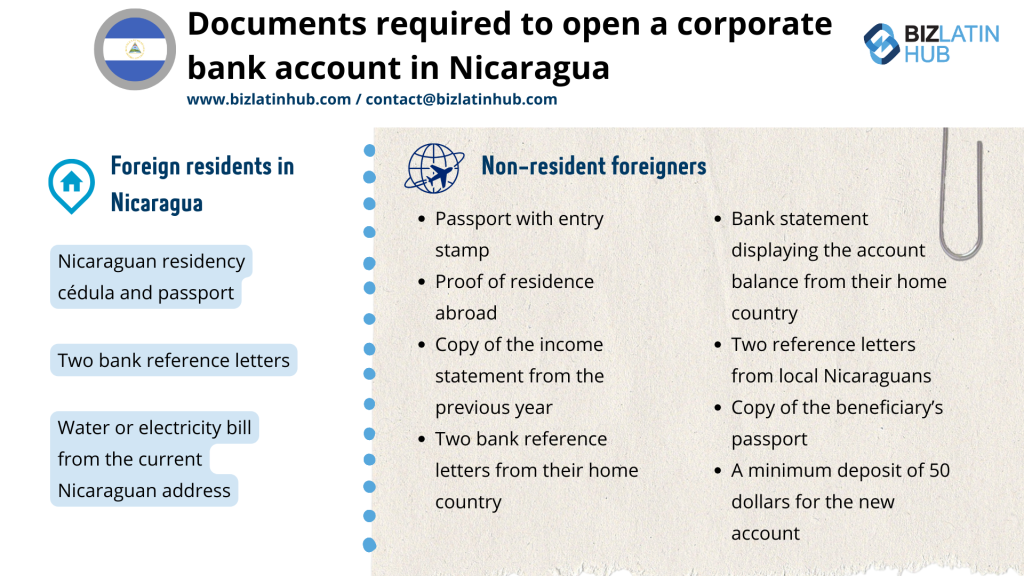

What documents do you need to open a corporate bank account in Nicaragua?

To open a corporate bank account in Nicaragua, you will be required to complete a detailed application and provide the following information:

For foreign residents in Nicaragua, the required documents include:

- Nicaraguan residency cédula and passport.

- Two bank reference letters.

- Water or electricity bill from the current Nicaraguan address.

Non-resident foreigners need to provide:

- Passport with entry stamp.

- Proof of residence abroad (driver’s license, tax return file, etc.).

- Copy of the income statement from the previous year.

- Two bank reference letters from their home country.

- Bank statement displaying the account balance from their home country.

- Two reference letters from Nicaraguan citizens.

- Copy of the beneficiary’s passport.

- A minimum deposit of USD$50 for the new account.

Additionally, some banks may require evidence of a monthly salary. If you are relocating to Nicaragua without a confirmed job, obtaining a reference from your bank in your home country can demonstrate your financial stability and serve as proof of your income source while in Nicaragua, increasing your chances of approval.

3 Simple steps to open a corporate bank account in Nicaragua

To open a corporate bank account in Nicaragua, you must follow these 3 steps:

- Step 1 – Choose the right Nicaraguan bank: Banks in Nicaragua provide customized solutions tailored to meet your company’s specific requirements, be it setting up investment accounts, accommodating flexible payment methods, or facilitating international transfers. Choosing a bank that aligns perfectly with your business needs is of utmost importance.

- Step 2 – Prepare the required documentation: The list above provides information on the documents that most banks will require when opening a corporate bank account. However, the exact list of requirements will depend on the internal policies of your chosen bank.

- Step 3 – Come into agreement with the bank: Once your documents have been validated by the bank and your request for an account has been accepted, the bank will activate your account and provide you with online banking.

What are the best Nicaraguan banks for foreign companies?

To facilitate you in choosing a banking provider, Biz Latin Hub has put together a list of four prominent banks in Nicaragua with experience offering their services to foreign companies:

- Banco de la Producción: The Banco de la Producción, S.A. (Banpro) was founded on November 11th, 1991, to collect deposits from the public and invest them in a wide range of businesses, serving as an agent for the country’s economic development. It has over 3,504 service points spread across the country and offers a wide range of products and services.

- Banco Lafise Bancentro: The Lafise Group was founded in 1895. This Nicaraguan bank is a pioneer in conducting all international operations through the globally recognized SWIFT interbank communication network, ensuring enhanced security.

- Banco Produzcamos: Banco Produzcamos is headquartered in Managua and is well-equipped to fulfill your requirements, whether you are starting a new business or expanding your company’s footprint in Nicaragua.

- BAC Nicaragua: Founded in 1952 in Managua as Banco de América Central, BAC was the forerunner of what is now known as the BAC Credomatic Group (Spanish: Grupo BAC Credomatic). This bank is a leader in using technology to deliver a seamless banking experience for business owners in Nicaragua.

Recommendation: We advise you to research each bank’s specific offerings and requirements to find the one that best suits your company’s needs.

FAQs on banking in Nicaragua

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Nicaragua:

1. Can I open a corporate bank account online in Nicaragua?

No. You can open a bank account from abroad with the support of a local attorney or attorney-in-fact empowered by a special or general power of attorney. However, the application forms and the original Comprehensive Client Profile (PIC) must be sent to Nicaragua to complete the process.

2. What documents do I need to open a corporate bank account in Nicaragua?

The following documents are required to open a corporate bank account in Nicaragua:

- Copy of the company’s constitution and by-laws.

- Copy of the general power of attorney of the legal representative.

- Copy of the identity card of the legal representative.

- Copy of the RUC ID.

- Copy of the Matricula.

- Bank reference letters.

- Copy of the passport of all the shareholders and members of the company.

- An updated financial statement of the company.

3. Who can have access to a corporate bank account in Nicaragua?

Any member of the company who is authorized by the shareholders of the company can have access to the bank account.

4. Which is the best bank in Nicaragua for foreign companies?

We recommend the following banks for foreign companies: Banco de Finanzas (BDF), Lafise Bancentro.

5. Why do companies open bank accounts in Nicaragua?

Companies choose to open bank accounts in Nicaragua because of the economic and political stability, the ability to have the account in U.S. dollars, the national tax system, and banking privacy. In addition, opening a bank account makes it easier to make timely payments from anywhere in the world to suppliers of goods and services, payment to workers, and even payments to state entities, both municipal and national, to settle taxes, fees or rates.

6. Does Nicaragua have banking secrecy?

Yes. Law 561 General Law of Banks, Non-Banking Financial Institutions and Financial Groups, establishes that the information obtained by a financial entity must be kept strictly confidential and can only be provided to third parties by order of the competent judicial authority.

Simplify the Process With Local Professionals

Engaging with legal firms or consultants is the best way to initiate the bank account opening process. Although the process of opening a corporate bank account in Nicaragua is generally uncomplicated, specific aspects require careful attention. That’s why teaming up with a local expert is essential, guaranteeing thorough guidance every step of the way.

Biz Latin Hub can help you open a corporate bank account in Nicaragua

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

Our team has expertise in how to open a corporate bank account in Nicaragua, with legal services, accounting and taxation, hiring, and visa processing available.

We maintain a significant presence in the LATAM region, bolstered by robust partnerships that span the area. This extensive network equips us with many resources to facilitate international projects and expand into new markets across various countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.