New Zealand is an enticing destination for foreign investors and new business ventures. Renowned for its political stability, transparent regulatory environment, and skilled workforce, this island nation offers a secure and supportive backdrop for business owners and investors. Learn how to open a corporate bank account in New Zealand.

Key takeaways to open a corporate bank account in New Zealand

| What are the necessary documents to open a bank account in New Zealand? | Valid proof of identity, usually a government-issued photo ID. Valid proof of address, with traditional banks often requiring a local New Zealand address. Proof of meeting any other eligibility criteria. |

| Can you open a bank account online? | Most banks allow this 100% |

| What is the minimum initial deposit? | Depends on the bank/account type, but usually no minimum |

| Who has access to the account? | Can be designated to trusted individuals |

| Banking secrecy | Present in all accounts |

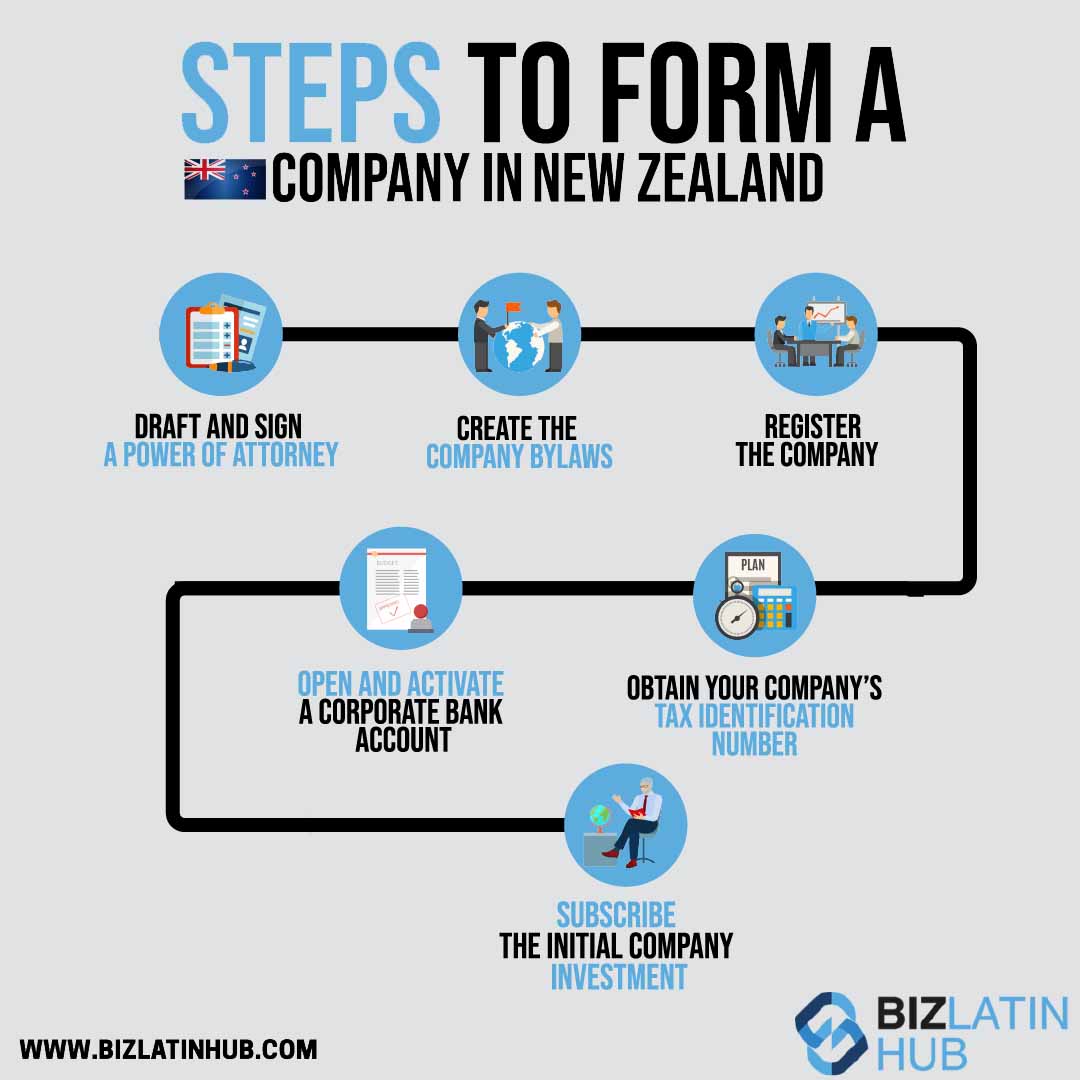

4 Steps to follow to open a bank account in New Zealand

Once you have chosen a provider to bank with, you are ready to begin the process of opening a corporate account. To open a bank account in New Zealand you must follow these steps:

- Gather your documents

- Apply online

- Wait for the bank to verify your documents

- Make a minimum deposit if necessary

Below is more information on each of the steps outlined above.

Gather your documents

This is a relatively straightforward part of opening a corporate bank account in New Zealand. You simply need proof of ID, proof of a (usually) kiwi address and any other documentation the bank requires. The latter depends on your circumstances and/or the specific bank you are using.

Go to the bank website and follow the instructions

Most kiwi banks offer 100% online banking and this is by far the most popular option for most people. The exact system varies by bank, but you will generally go and fill out an automated form with basic information and then upload either scanned or fully digital documents. Note that there are sometimes strict filesize and color rules.. You can still attend a branch if you prefer to.

Wait for the bank to verify your documents

The bank will go through your documentation to make sure everything is in order. This may take some time, so be prepared to wait and stay attentive in case they have any queries. There may also be questions or problems stemming from the upload process if you are opening the account online.

Make a minimum deposit if necessary

This varies depending on both the bank itself and the type of account. However, the general rule is that there is no minimum deposit required.

Can a Foreigner Open a Bank Account in New Zealand?

Depending on your chosen bank, you can apply and open your New Zealand bank account anywhere from 90 to 365 days before you arrive in the country. It’s essential to ensure you possess a valid visa before starting the application process.

What Documents Do You Need to Open a Corporate Bank Account in New Zealand?

The specific requirements for opening a bank account in New Zealand may vary slightly depending on your chosen account type and the financial institution you select. Your circumstances, such as US citizenship or residency, may necessitate additional documentation.

Nevertheless, since all New Zealand banks must adhere to local and global financial regulations, the requisite documents generally remain consistent. To open a bank account, you typically need:

- Valid proof of identity, usually a government-issued photo ID.

- Valid proof of address, with traditional banks often requiring a local New Zealand address.

- Proof of meeting any other eligibility criteria.

Accepted identification documents typically include:

- A valid New Zealand or foreign passport with a visa if you’re not a New Zealand citizen.

- New Zealand refugee or emergency travel documents.

- A full New Zealand driving license.

- New Zealand firearms license.

Accepted proof of address documents often include:

- Recent bank statements showing a New Zealand address (digital statements are typically not accepted).

- Recent New Zealand credit card statements or utility bills.

- Government correspondence containing your name and address.

If you lack the suggested documents, such as a mortgage statement or tenancy agreement contact the bank directly.

Which Bank is Good for a Business Account in New Zealand?

Whether you’re looking to open an investment account, accommodate flexible payment options, or facilitate global money transfers, certain banks in New Zealand offer increased versatility to meet the unique needs of your business. It’s important to choose a bank that aligns seamlessly with your company’s needs.

Here are five esteemed banks in New Zealand:

- Bank of New Zealand: The Bank of New Zealand (BNZ), established in 1861 and is one of the country’s oldest banks, offers specialized services primarily tailored to expatriates in New Zealand. For expatriates seeking investment opportunities, BNZ presents a diverse array of options, such as managed funds accounts and term deposits, making it a top choice among banks for expatriates in New Zealand.

- Kiwibank: With a network encompassing 266 branches and over 250 ATMs nationwide, supported by approximately 2,500 employees, Kiwibank is a notable presence in the country. Kiwibank offers a comprehensive range of retail banking products and services catering to individuals and small to medium-sized enterprises (SMEs). Furthermore, the bank extends its offerings to encompass retail banking products, and agency services for mortgage lending, including investment and fund management solutions.

- ANZ: ANZ is one of the largest banking service providers in New Zealand. ANZ extends a range of valuable services tailored for expatriates, including business banking and insurance. It facilitates a dedicated pathway for new residents planning to relocate to New Zealand. Within 90 days of arrival, individuals can conveniently apply online, selecting from five distinct account types.

- Westpac: Westpac has a rich history of providing services across various sectors, including consumer banking, wealth management, commercial, corporate, institutional banking, investments, and insurance. Established in 1861, the bank boasts a network comprising 163 branches and over 450 ATMs nationwide. Drawing upon its extensive experience working with expatriates, Westpac New Zealand offers a dedicated account known as the Migrant Banking Package. Tailored to meet the diverse needs of expatriates in New Zealand, this account addresses a wide range of banking requirements.

- ASB: ASB allows you to establish a foreign currency account, facilitating seamless financial management between New Zealand and other countries, without incurring any monthly account fees. However, a minimum balance requirement applies when opening a foreign currency account. For example, if you opt for a US dollar (USD) foreign currency account, you’ll need to deposit a minimum balance of USD$5,000.

FAQs on a corporate bank account in New Zealand

Based on our extensive experience, these are the common questions and doubts of our clients about opening a company bank account in New Zealand:

1. Can I open a corporate bank account online in New Zealand?

This is by far the most common way to open a corporate bank account in New Zealand, although it can still be done in person as well.

2. What documents do I need to open a company bank account in New Zealand?

To open a corporate bank account in New Zealand, you will be required to complete a detailed application and provide the following information:

Valid proof of identity, usually a government-issued photo ID.

Valid proof of address, with traditional banks often requiring a local New Zealand address.

Proof of meeting any other eligibility criteria.

3. Who can have access to a company bank account in New Zealand?

Bank account access can usually be granted by the account owner through the virtual platform of the bank with a physical security token device.

4. What is the best bank in New Zealand for foreign companies?

Whether you’re looking to open an investment account, accommodate flexible payment options, or facilitate global money transfers, certain banks in New Zealand offer increased versatility to meet the unique needs of your business. It’s important to choose a bank that aligns seamlessly with your company’s needs.

Bank of New Zealand fits the needs of most businesses.

5. Why do companies open bank accounts in New Zealand?

A bank account is a must for all companies in New Zealand. The bank account will allow you to complete operations, including paying taxes, payroll, local suppliers, and all domestic transactions.

6. Does New Zealand have banking secrecy?

Banks have a legal responsibility under the Privacy Act to preserve confidentiality. However,

Biz Latin Hub can help you open a corporate bank account in New Zealand

Biz Latin Hub offers integrated market entry and back-office services worldwide, including New Zealand.

Our unrivaled reach means we can support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to open a corporate bank account in New Zealand, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent, or otherwise do business in Latin America, the Caribbean, and Oceania.