A company must have a corporate bank account in Jamaica to conduct financial transactions, such as receiving payments and paying suppliers or employees. This is an important step in the process for company formation in Jamaica. Once your bank account has been activated, then the company you have formed can begin commercial operations. Biz Latin Hub can guide you through the process with our comprehensive back-office services, ensuring a soft entry into the Jamaican market.

Key takeaways on a corporate bank account in Jamaica

| Which are the best banks to open a corporate bank account in Jamaica? | National Commercial Bank Jamaica. Scotiabank Jamaica. Jamaica National Bank (JN Bank). CIBC Jamaica. First Global Bank. |

| The six step process to open a corporate bank account in Jamaica: | Step 1 – Choose the Right Bank. Step 2 – Gather Required Documentation. Step 3 – Complete the Bank’s Application Forms. Step 4 – Submit Documentation and Application. Step 5 – Await Verification and Approval. Step 6 – Account Activation. |

| Do all corporate banks follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed requirements. |

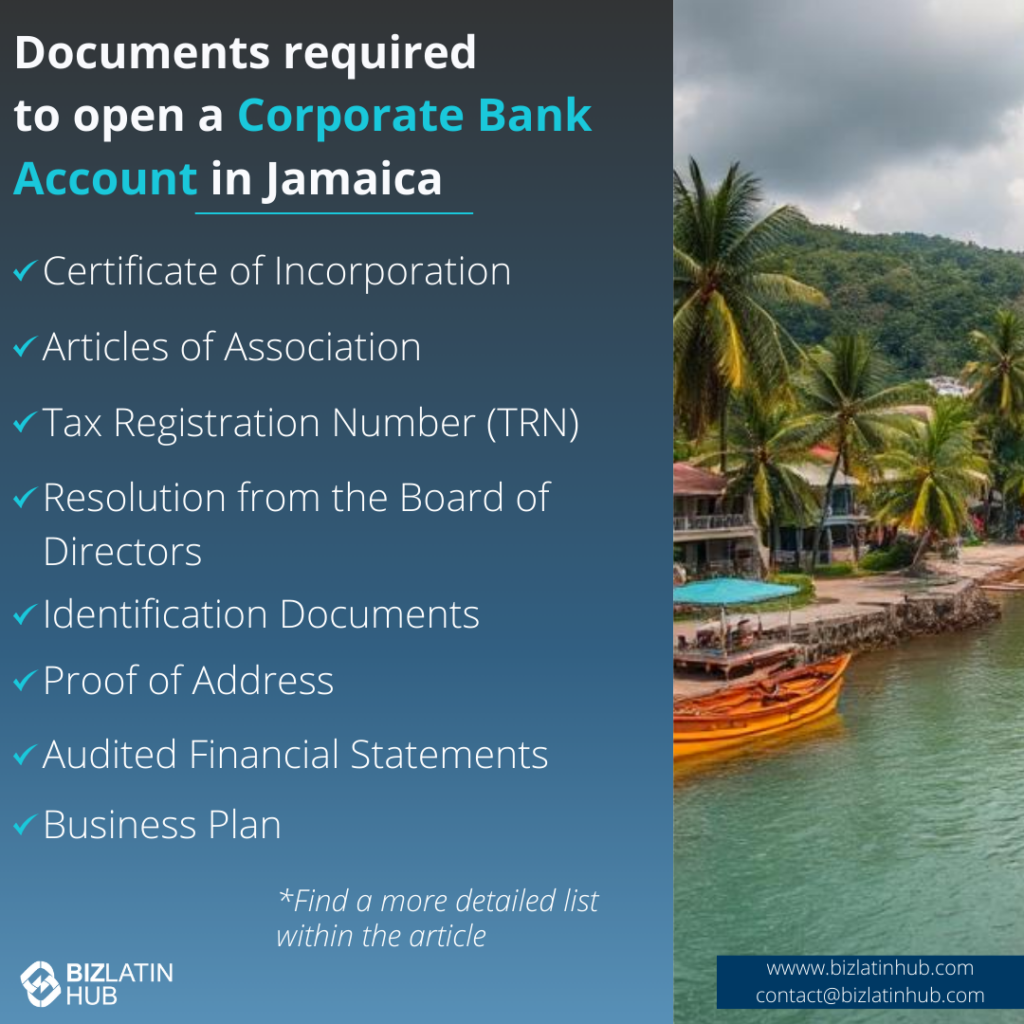

| What documents do you need when opening a corporate bank account in Jamaica? | Certificate of Incorporation. Articles of Association. Tax Registration Number (TRN). Resolution from the Board of Directors. Identification Documents. Proof of Address. Audited Financial Statements. Business Plan. |

6 Step Process to Open a Corporate Bank Account in Jamaica

Opening a corporate bank account in Jamaica involves several steps and requires specific documentation to comply with local regulations and bank policies. Here’s a comprehensive guide to assist you through the process:

- Step 1 – Choose the Right Bank.

- Step 2 – Gather Required Documentation.

- Step 3 – Complete the Bank’s Application Forms.

- Step 4 – Submit Documentation and Application.

- Step 5 – Await Verification and Approval.

- Step 6 – Account Activation.

1. Choose the Right Bank:

It might sound obvious, but in our experience numerous cleints come to Biz Latin Hub without any prior research or awareness of the banking options available in Jamaica. It is essential to research various banks in Jamaica to determine which institution best aligns with your company’s needs. Consider factors such as account features, fees, online banking services, and branch accessibility.

Note: Each bank may have specific policies and requirements, so it’s advisable to contact the bank directly or visit their official website for the most accurate information.

2. Gather Required Documentation:

The specific documents required can vary between banks, but generally you can expect each bank to request for similar information. The requirements are extensive in order to comply with anti-money laundering regulations, therfore, being prepared beforhand and having documents in the correct format will ensure there are no unecessary delays in this process.

For a more detailed list of the required documents please see below.

3. Complete the Bank’s Application Forms:

Obtain and fill out the necessary application forms provided by your chosen bank. These forms typically require information about your business activities, financial details, and the identification of individuals associated with the account.

4. Submit Documentation and Application:

Visit the bank branch to submit your application forms along with the gathered documentation. Ensure that all documents are original or certified copies, as per the bank’s requirements.

5. Await Verification and Approval:

The bank will review your application and documents to verify their authenticity and compliance with regulatory standards. This process may take several days to a few weeks. Be prepared to provide any additional information or clarification if requested by the bank during their review.

6. Account Activation:

Once approved, the bank will notify you of your new corporate account details. You can then deposit funds, order cheque books, and set up online banking services as needed. After this step you are now able to pay employees, invoice and start your commerical activities in Jamaica.

By following these steps and preparing the necessary documentation, you can establish a corporate bank account in Jamaica to support your business operations effectively.

What Documents are Required to Open a Corporate Bank Account in Jamaica?

For non-residents seeking to open a bank account in Jamaica, the application process requires submitting the following documentation:

- Certificate of Incorporation

- Memorandum and Articles of Association (for companies not registered under the Companies Act, 2004)

- Articles of Incorporation (for companies registered under the Companies Act, 2004)

- Company Taxpayer Registration Number (TRN)

- Resolution of the Board of Directors (authorizing the establishment of the business relationship and relevant signing instructions on account)

- Tax Compliance Certification (TCC)

- Valid license for the operation of the business (where applicable)

- List of Authorized Signers/Directors and specimen signatures for each

- TRN-certified copies for all Authorized Signers and Directors

- Copy of Identification for all authorized signers, Directors, and Majority Shareholders

- Proof of Address for the Company, Authorized Signers, Directors, and Majority Shareholders. The Company Secretary may provide a letter, listing the names and addresses of all Directors, Authorized Signers, and Majority Shareholders confirming that they are Directors/Signing Officers/Majority Shareholders of the company and that the necessary paperwork has been filed with the Office of the Registrar of Companies. This letter must be accompanied by a certified copy of Form 23 from the Office of Registrar of Companies confirming the identity of the Company Secretary.

- For Corporate Accounts. Audited financial statement; description and place of the company’s principal line(s) of business; major suppliers; list and names of principal owners; directors; management officers; bankers; customers and bearers; must be submitted.

- Source of Funds Information. A description of the source of funds being used to open the account, as well as the source of future investments or deposits.

Match your business needs with the right Jamaican bank

Customized to suit your company’s needs, specific banks in Jamaica provide enhanced flexibility for activities like setting up investment accounts, accommodating adaptable payment methods, and executing international transfers. The selected bank must align seamlessly with your business requirements and criteria.

Below are five of the most reputable banks in Jamaica:

- National Commercial Bank Jamaica – NCB holds the position of Jamaica’s leading financial services provider, commanding a substantial 40.8% market share in the commercial banking sector. Extending its reach through 36 locations and over 170 ATMs across the island, NCB offers a comprehensive array of financial services.

- Scotiabank Jamaica – Scotiabank Jamaica, a private bank in Jamaica, provides a variety of banking products and services, catering to individuals and businesses. Their offerings include home loans, insurance, and investments. With a network comprising 38 banking and investment branches and 231 Automated Teller Machines (ATMs), Scotiabank Jamaica is an integral part of the Canadian financial group, Scotiabank.

- Jamaica National Bank (JN Bank) – One of Jamaica’s inaugural mutually-owned commercial banks, wholly owned by its savers and borrowers. Rooted in the values and principles of its forerunner, the Jamaica National Building Society, JN Bank draws strength from almost a century and a half of a robust history and legacy. As a member of The Jamaica National Group, it remains dedicated to being the foremost private mortgage provider in Jamaica.

- CIBC Jamaica – CIBC FirstCaribbean holds the position as the largest bank listed regionally in the English and Dutch-speaking Caribbean, catering to over 500,000 accounts across 17 markets. With a presence in 100 branches and offices, the bank provides a comprehensive range of financial services through its Corporate and Investment Banking, Retail and Business Banking, and Wealth Management portfolios.

- First Global Bank – First Global Bank Limited (FGB) stands as a commercial bank under the ownership of GraceKennedy. Throughout its evolution, FGB has earned a reputation for reshaping the banking experience by dedicating itself to delivering cutting-edge financial solutions coupled with the renowned high standard of customer service that characterizes the institution.

Partner with a local expert to simplify the process

Engaging with law firms or consultants is a great approach to start the bank opening procedure. While opening a corporate bank account in Jamaica can be relatively simple, certain aspects warrant consideration. Therefore, working with a local partner becomes crucial, ensuring comprehensive assistance throughout the process.

Can a non-resident open a bank account in Jamaica?

Several banks in Jamaica are open to foreign entities and customers, with English being the main language for communication and documentation, highlighting accessibility for international businesses.

Frequently Asked Questions when Opening a Corporate Bank Account in Jamaica

Based on our extensive experience these are the common questions and doubts from our clients when looking to open a company bank account in Jamaica.

Yes, many Jamaican banks offer online services for opening corporate accounts. Specific procedures may vary, so check with the chosen bank for details.

Generally, you’ll need the Certificate of Incorporation, Articles of Association, TRN, valid IDs, proof of address, and business registration certificate. Requirements may vary, so contact the bank for exact details.

Authorized signatories designated during account opening, such as directors or appointed representatives, have access as outlined in the bank’s agreement.

Options include National Commercial Bank (NCB), Scotiabank, and First Global Bank. Research services, fees, and customer reviews to choose based on business needs.

Reasons include facilitating local transactions, compliance with regulations, accessing diverse financial services, and tapping into regional business opportunities in the Caribbean.

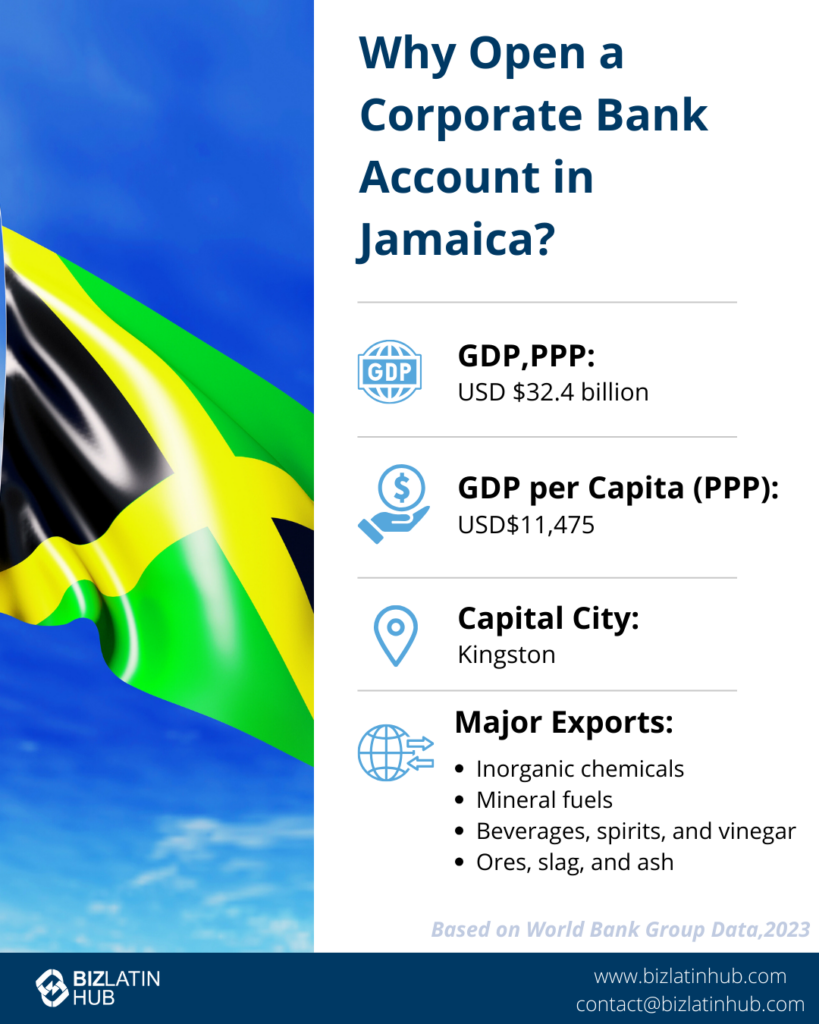

Why open a bank account in Jamaica?

Opening a corporate bank account in Jamaica is a strategic move for businesses looking to establish a strong financial foundation in the Caribbean. As one of the region’s leading financial hubs, Jamaica offers a well-regulated banking sector governed by the Bank of Jamaica, ensuring stability and investor confidence.

A corporate account enhances credibility, making it easier to conduct business transactions with local and international partners while separating personal and business finances for better financial management.

With an increasing focus on digital banking, many Jamaican banks provide secure online banking platforms, facilitating seamless transactions, payroll processing, and foreign exchange services.

Additionally, Jamaica’s growing economy, favorable trade agreements, and strategic location make it an attractive market for entrepreneurs and corporations alike. By leveraging a corporate bank account, businesses can access essential financial services such as business loans, trade financing, and investment opportunities, enabling long-term growth and sustainability.

Biz Latin Hub can help you open a corporate bank account in Jamaica

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to open a corporate bank account in Jamaica, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.

If this article on how to open a corporate bank account in Jamaica was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.