Incorporating a business in Honduras creates numerous opportunities across various industries, from agriculture and agribusiness to renewable energy development. Opening a corporate bank account in Honduras is an important step when building a successful business, and it offers benefits such as financial stability and seamless international transactions. Biz Latin Hub provides expert assistance with our comprehensive back-office services, ensuring your smooth entry into the Honduran Market.

Key takeaways on a corporate bank account in Honduras

| Which are the best banks to set-up a corporate bank account in Honduras? | Banco Fisohsa Banco Atlantida BAC Honduras Banco de Occidente Banco Davivienda |

| The three step process to set-up a corporate bank account in Honduras | Step 1 – Choose a banking provider. Step 2 – Prepare the required documents. Step 3 – Come into agreement with the bank. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| What documents are necessary when opening a corporate bank account in Honduras? | Legal document of the representative and all the people authorized to sign on the account. Document or statutes explaining the goals and objectives of the business. RTN (National Bank Registration). Two bank references. |

How to Open a Corporate Bank Account in Honduras: 3-Step Guide

From experience, partnering with local experts is highly recommended when incorporating a company or opening a corporate bank account in Honduras. The process to open a corporate bank account in Honduras can be summarized into three key steps:

- Step 1 – Choose a banking provider.

- Step 2 – Prepare the required documents.

- Step 3 – Come into agreement with the bank.

Below we outline each step in further detail.

1. Choose a banking provider

The first step in opening a corporate bank account in Honduras is selecting the right banking provider. Honduras has a range of reputable local and international banks, each offering distinct corporate banking services tailored to various business needs. It is necessary to evaluate banks based on factors such as their fees, available services, digital banking options, and the level of customer support provided. Likewise, consider the bank’s reputation and whether it has experience working with international businesses if your company has global operations. Taking the time to research and compare your options ensures the selection of a banking provider that aligns with your business goals and financial requirements.

2. Prepare the Required Documents

Once you’ve chosen a bank, the next step is to gather the necessary documentation. Banks in Honduras typically require a range of documents to comply with local regulations and anti-money laundering laws. These may include your company’s articles of incorporation, proof of registration with the Honduran Chamber of Commerce, tax identification numbers, a list of authorized signatories, and valid identification for company directors or representatives. Some banks may also ask for financial statements or a business plan to better understand your operations. Ensuring that all documents are accurate and up-to-date can streamline the account opening process, so it’s helpful to check with your chosen bank for a specific list of requirements before proceeding.

3. Come in Agreement With the Bank

The final step is to formalize your agreement with the bank. This involves meeting with a bank representative to review the terms and conditions of the corporate account. During this stage, it’s important to discuss the account features, including transaction limits, maintenance fees, and any additional services such as payroll management or foreign currency accounts. If you agree to the bank’s terms, you’ll sign the necessary contracts and provide any final documentation or deposits required to activate the account. Maintaining open communication with the bank throughout this process ensures that you fully understand the corporate account’s functionality and how it will support your business operations. Once everything is finalized, your corporate account will be ready for use.

Which is the Ideal Bank for Your Business Needs in Honduras?

Being an attractive location for foreign investors, Honduras offers a selection of reputable banks. Many banks in Honduras offer customized solutions to meet your company’s unique requirements, including the establishment of investment accounts, accommodating flexible payment methods, and facilitating international transfers. When selecting an option, you should choose the bank that best aligns with your business needs.

The following is a list of five well-respected banks in Honduras:

- Banco Fisohsa: In 1991, driven by the vision and determination of a consortium of entrepreneurs and business leaders, Financiera Comercial Hondureña SA was founded in Honduras. It offers credit, digital, and integrated banking solutions for businesses. This banking institution currently maintains the largest market share in Honduras.

- Banco Atlantida: Banco Atlantida, S.A. was founded in 1913. It is a financial institution that offers commercial banking services to businesses and individuals. It has products such as lines of credit, payroll, credit, managing accounts receivable, savings, and investment products.

- BAC Honduras: BAC Credomatic is a well-established institution with nearly seven decades of experience, catering to a vast clientele of 4.2 million individuals across the region. The organization’s journey started on July 5th, 1952, with the establishment of Bank of America in Nicaragua. By the 1990s, BAC Credomatic had achieved the distinction of becoming the very first financial group with a presence spanning all of Central America.

- Banco de Occidente: Founded on September 1st, 1951, Banco de Occidente stands as one of Honduras’ prominent commercial banks, with its headquarters situated in Santa Rosa de Copan and an extensive network of 9 branches and 170 offices spread across the country.

- Banco Davivienda: Davivienda has a rich history spanning more than half a century. Originally established as Corporación de Ahorro y Vivienda in 1972 in Colombia, Davivienda has been on a robust and consistent growth trajectory since 2005. In 2012, it acquired HSBC operations in Honduras.

Our Recommendation: Banco Ficohsa, Banco Atlántida, BAC Honduras, Banco de Occidente and Banco Davivienda are one of the best options to open a business account in Honduras.

What is required to Open a Corporate Bank Account in Honduras?

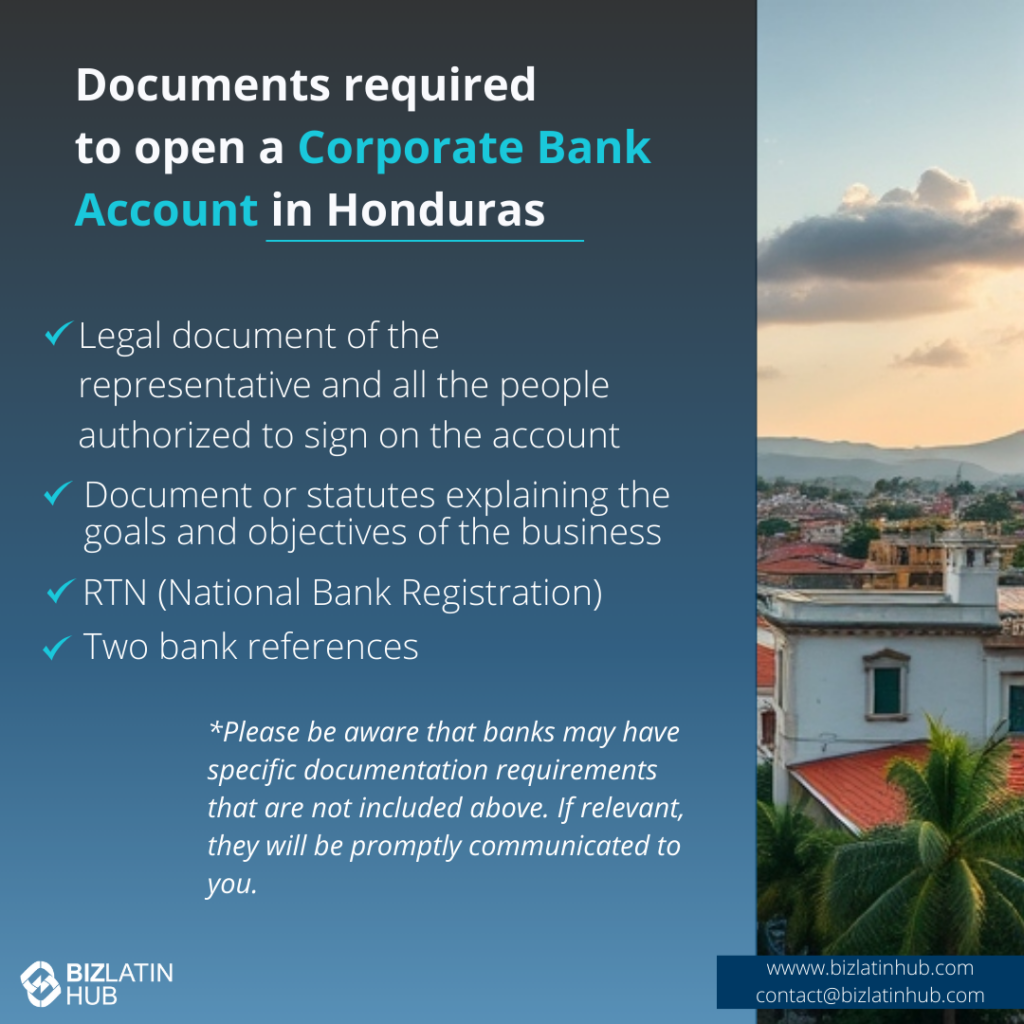

Once you have selected a bank to hold your account, you are ready to request that they open an account for your business. Each bank will have its own requirements dictated by their internal policies. However, the process is generally very similar. For non-residents seeking to open a business bank account in Honduras, the application process usually requires submitting the following documentation:

- Legal document of the representative and all the people authorized to sign on the account.

- Document or statutes explaining the goals and objectives of the business.

- RTN (National Bank Registration).

- Two bank references.

Please be aware that banks may have specific documentation requirements that are not included above. If relevant, they will be promptly communicated to you.

Common Questions on Opening a Corporate Bank Account in Honduras

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Honduras:

1. What type of bank account can I have in Honduras?

You can have either a checking or a savings account.

2. Can a foreigner open a bank account in Honduras?

With the correct documentation and initial investment, foreign nationals can open a bank account in Honduras.

3. What documents do I need to open a company bank account in Honduras?

Legal document of the representative and all the people authorized to sign on the account.

Document or statutes explaining the goals and objectives of the business.

RTN (National Bank Registration).

4. Can I open a corporate bank account in a foreign currency?

You can open a corporate account in either USD or Lempiras.

5. What is the best bank in Honduras for foreign companies?

We recommend Banco Fisohsa, Banco Atlantida, BAC Honduras, Banco de Occidente, and Banco Davivienda.

6. Why do companies open bank accounts in Honduras?

Having a corporate bank account is crucial for business operations and for ensuring compliance with tax regulations.

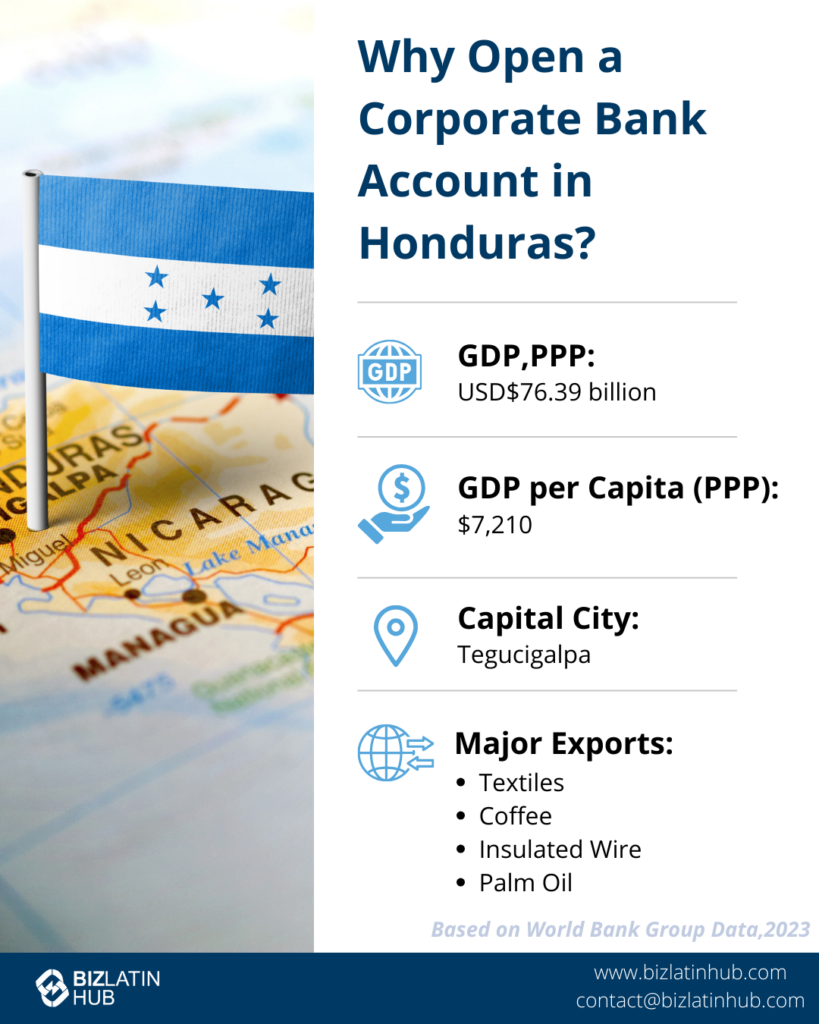

Why Open a Corporate Bank Account in Honduras?

Honduras, a country nestled in the heart of Central America, offers a wealth of opportunities for foreign investors looking to establish and grow their businesses. Its strategic geographic position provides easy access to North and South American markets, making it a gateway for international trade.

Opening a bank account in Honduras is a strategic step for investors, offering streamlined access to its growing economy and key sectors like agriculture, manufacturing, and tourism. A local account simplifies transactions, reduces transfer costs, and ensures compliance with Honduran financial regulations, enabling efficient management of investments.

Honduran banks provide essential services such as multi-currency accounts, online banking, and tailored solutions for international investors. Opening a bank account also enhances credibility with local businesses and authorities, while offering a secure platform to navigate the country’s financial landscape and capitalize on its expanding investment opportunities.

Biz Latin Hub Can Support You in Opening a Corporate Bank Account in Honduras

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about how to open a corporate bank account in Honduras, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or otherwise doing business in Latin America and the Caribbean.