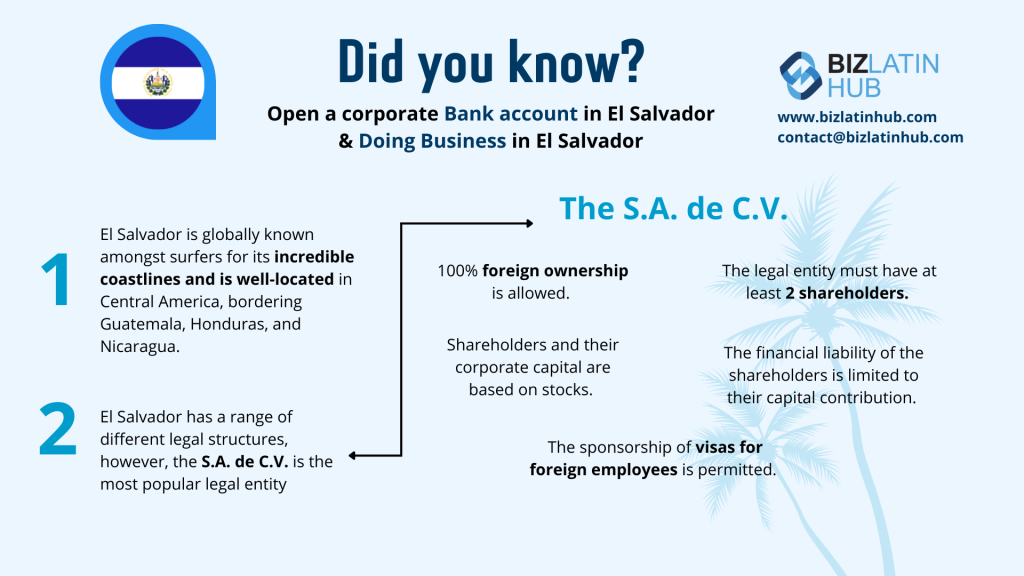

To open a corporate bank account in El Salvador, it is only possible when foreign investors are in the process of registering a company in El Salvador. Once the company has received its unique tax number, it can proceed to open a corporate bank account with a local financial institution. Working with a local provider will ensure you are informed on local regulations and avoid any pitfalls. Biz Latin Hub provides expert assistance with our comprehensive back-office services, ensuring your smooth entry into the El Salvadorian market.

Key takeaways on how to open a corporate bank account in El Salvador

| Which banks are best to open a corporate bank account in El Salvador? | Abank. Banco America Central. Banco Bandesal. Banco Cuscatlan. Banco ProCredit. |

| The four step process to open a corporate bank account in El Salvador: | Step 1: Prepare Supporting Documents Step 2: Choose a Suitable Bank and Complete Application Step 3: Verification and Submit Documents Step 4: Deposit Minimum Amount Step 5: Account Activation |

| Do all banks follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

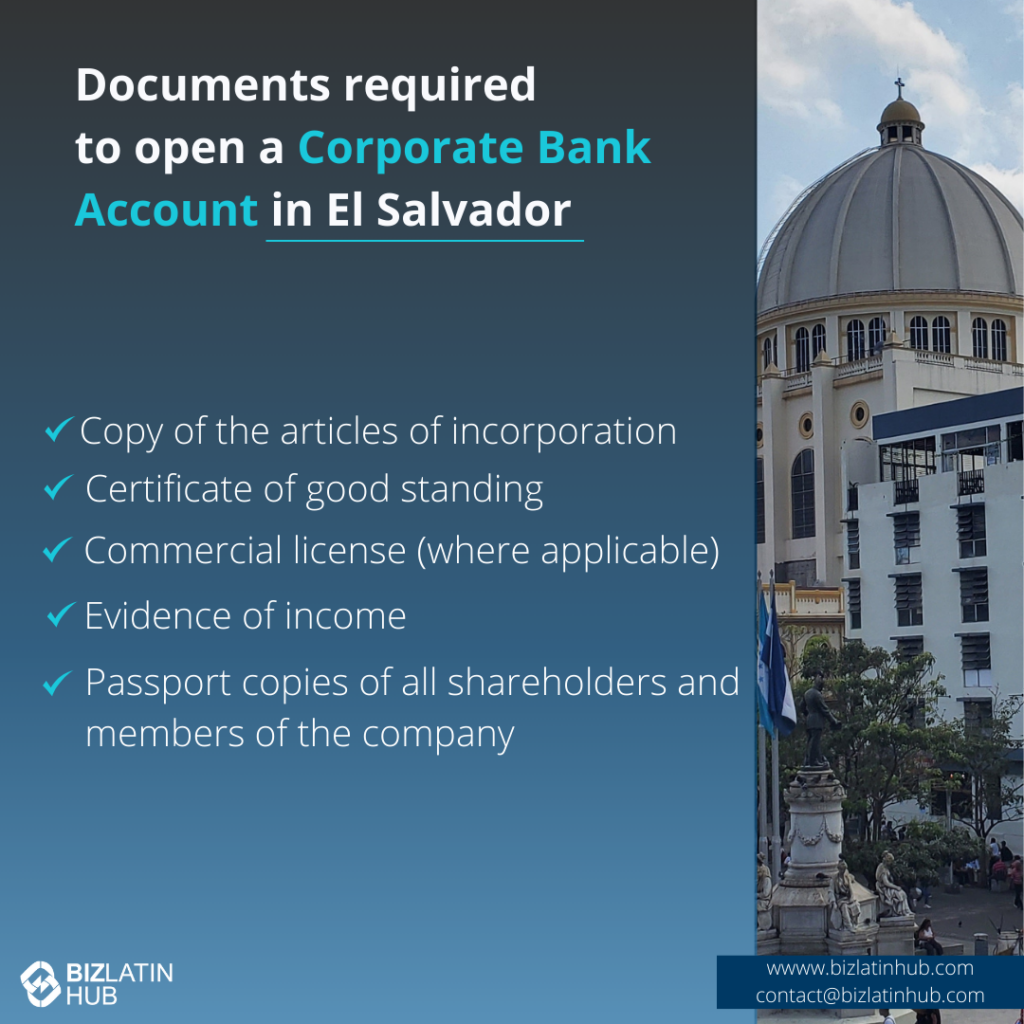

| What are the necessary documents when opening a corporate bank account in El Salvador? | Copy of the articles of incorporation Certificate of good standing Commercial license (where applicable) Evidence of income Passport copies of all shareholders and members of the company |

5 Key Steps to Open a Corporate Bank Account in El Salvador

To open a corporate bank account in El Salvador you will need to follow these five steps:

- Step 1: Prepare Supporting Documents

- Step 2: Choose a Suitable Bank and Complete Application

- Step 3: Verification and Submit Documents

- Step 4: Deposit Minimum Amount

- Step 5: Account Activation

Below we expore each of these steps in further detail. It’s important to note, while the bank account opening process is relatively easy and can take as little as a week, companies in El Salvador must wait between 3 to 6 months before they can make international bank transfers.

1. Prepare Supporting Documents

Assemble supporting documents, including a shareholders list that includes their personal data (Name, Address, passport number, position in the business etc). In our experience, we have learned the whole process runs smoother when required documents are to hand from the get go.

2. Choose a Suitable Bank and Complete Application

The bank you choose will significantly influence your financial operations and overall banking experience and requires adequate prior planning. The application will ask for basic details such as your name, nationality, occupation, and address.

Having gathered this information in the previous step should ensure no errors are made like missplet name and addresses. It is important to remeber your decision needs to align with your business priorities, such as robust online banking platforms, competitive fee structures, or seamless Bitcoin integration. All this must be considered to save wasted time.

3. Verification and Submit Documents

Usually, to open a corporate account with a local bank, the head of the business will travel to El Salvador to be interviewed by a branch manager and present all the required documentation. You can avoid the in-person interview by hiring a trusted local representative with Power of Attorney to conduct the interview on the company’s behalf.

It will be required to present either original or, depending on the bank, notarized documents for the interview to comply with local financial regualtions. It is worth taking this point into consideration when contemplating which bank to choose for your intented business practice.

4. Deposit Minimum Amount

After your corporate bank account is approved you will need to make an initial contribution and deposit 5% of the initial share capital (minimum USD$ 2000) into the account. The rest will have to be paid within a year of the company’s incorporation.

5. Account Activation

Once your 5% deposit has been confirmed, you will then have access to debit cards and online banking services(depending on the bank). This will also be the moment where instructions for using online banking apps, managing wire transfers, and other financial activities will be explained.

With your account activated you can now being processing invoices, pay employees and start making El Salvador the next success in your business expansion.

What Documents are Required for a Corporate Bank Account in El Salvador?

El Salvador

In El Salvador, this usually requires providing legal documentation, such as the company’s registration, tax identification number, and proof of business address. This account allows businesses to receive payments from customers, make supplier payments, pay employee salaries, and invest excess funds:

- Copy of the articles of incorporation: This confirms the legal formation of your company.

- Certificate of good standing: This is evidence that your company is compliant with all state requirements.

- Commercial license (where applicable): Some industries may require a commercial license to operate.

- Evidence of income: This can typically be proven with a copy of the income tax declaration of the company.

- Passport copies of all shareholders and members of the company are usually required for identification purposes.

What is the best bank for a foreign company in El Salvador?

It is crucial to know which banks are available within the country. El Salvador is home to several domestic banks, including:

- Abank.

- Banco America Central.

- Banco Bandesal.

- Banco Cuscatlan.

- Banco ProCredit.

It is also important to know which banks are available before you jump into the market. International banks with a presence in El Salvador include:

- Banco Agricola.

- Banco Atlantida.

- Banco Azteca.

- BICSA.

- Citibank.

- Banco Davivienda.

- Banco Industrial.

- Banco Promerica.

- Scotiabank.

Once a foreign entity has finished the incorporation process, and has decided on which bank to open an account with, there are several steps that the business must follow before the account can be activated. After completing these steps, a business will be ready to open a corporate bank account in El Salvador.

Our recommendation: We recommend that clients, as far as possible, choose a bank if they have a pre-existing relationship with it.

FAQs on banking in El Salvador

Based on our extensive experience, these are the most common queries our clients have

1. Can I open a corporate bank account online in El Salvador?

No. In El Salvador, you cannot do this online. However, you can initiate the process from abroad. You will need the support of a local attorney empowered through a Power of Attorney (POA) to act on your behalf. This attorney can submit the necessary documents and complete other formalities needed to open the account.

2. What documents do I need to open a company bank account in El Salvador?

You must provide the following documents:

- Copy of the articles of incorporation: This confirms the legal formation of your company.

- Certificate of good standing: This is evidence that your company is compliant with all state requirements.

- Commercial license (where applicable): Some industries may require a commercial license to operate.

- Evidence of income: This can typically be proven with a copy of the income tax declaration of the company.

- Passport copies: Passport copies of all shareholders and members of the company are usually required for identification purposes.

3. Who can have access to a company bank account in El Salvador?

Any member of the company who is authorized by the company’s shareholders can have access to the bank account. These authorized individuals must be duly registered with the bank, and their physical signatures will be required for account operations.

4. What is the best bank in El Salvador for foreign companies?

We recommend the following banks for foreign companies: Banco de America Central (BAC) and Banco Davivienda. These banks generally have shorter waiting times for conducting international transfers, which is especially advantageous considering the money laundering regulations in place.

5. Why do companies open bank accounts in El Salvador?

Companies open bank accounts in El Salvador for several reasons, to conduct commercial activities within the country.

The flexibility of holding accounts in both US Dollars and Bitcoin, as El Salvador recognizes Bitcoin as legal tender.

6. Does El Salvador have bank secrecy?

Yes. El Salvador has bank secrecy laws. This information is confidential and can only be disclosed to authorities such as the Attorney General’s Office, and the General Directorate of Internal Taxes when required for auditing processes under this law, and to those who demonstrate a legitimate interest, subject to prior authorization from the Superintendency.

Why Open a Corporate Bank Account in El Salvador?

A corporate bank account in El Salvador is a specialized financial account held by a business entity or corporation to manage its financial transactions and funds. It serves as a central repository for the company’s revenue, expenses, and capital. Corporate bank accounts offer various features tailored to the specific needs of businesses, such as online banking, wire transfers, and merchant services.

Despite the many challenges it faces, the small Central American nation of El Salvador is seeing modest but steady growth. The country’s GDP is projected to grow by 2.4 percent by the end of this year, and by 2 percent in 2023, according to a recent World Bank report.

The private sector remains stable. Meanwhile, the government has implemented many incentives to attract foreign investment. It’s little wonder then, that many foreign businesses and investors are considering domiciling in the country.

Biz Latin Hub can help you open a corporate bank account in El Salvador

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about banking in El Salvador, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about how to open a corporate bank account in El Salvador was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.