You must open a corporate bank account in Bolivia for seamless financial transactions, enabling you to manage operational expenses, pay salaries, and comply with local tax obligations. With a regulatory environment that supports business formation, securing a corporate bank account is an important step in registering a company in Bolivia. Biz Latin Hub provides expert assistance with our comprehensive back-office services, ensuring a smooth entry into the Bolivian market.

Key Takeaways

| A range of banks to choose from to open a corporate bank account in Bolivia: | Banco Bisa Banco de Crédito (BCP) Banco Económico Banco Fassil Banco Fie Banco Fortaleza Banco Ganadero Banco Mercantil Santa Cruz Banco de la Nación Argentina Banco Nacional de Bolivia (BNB) Banco Prodem BancoSol Bank Banco Unión |

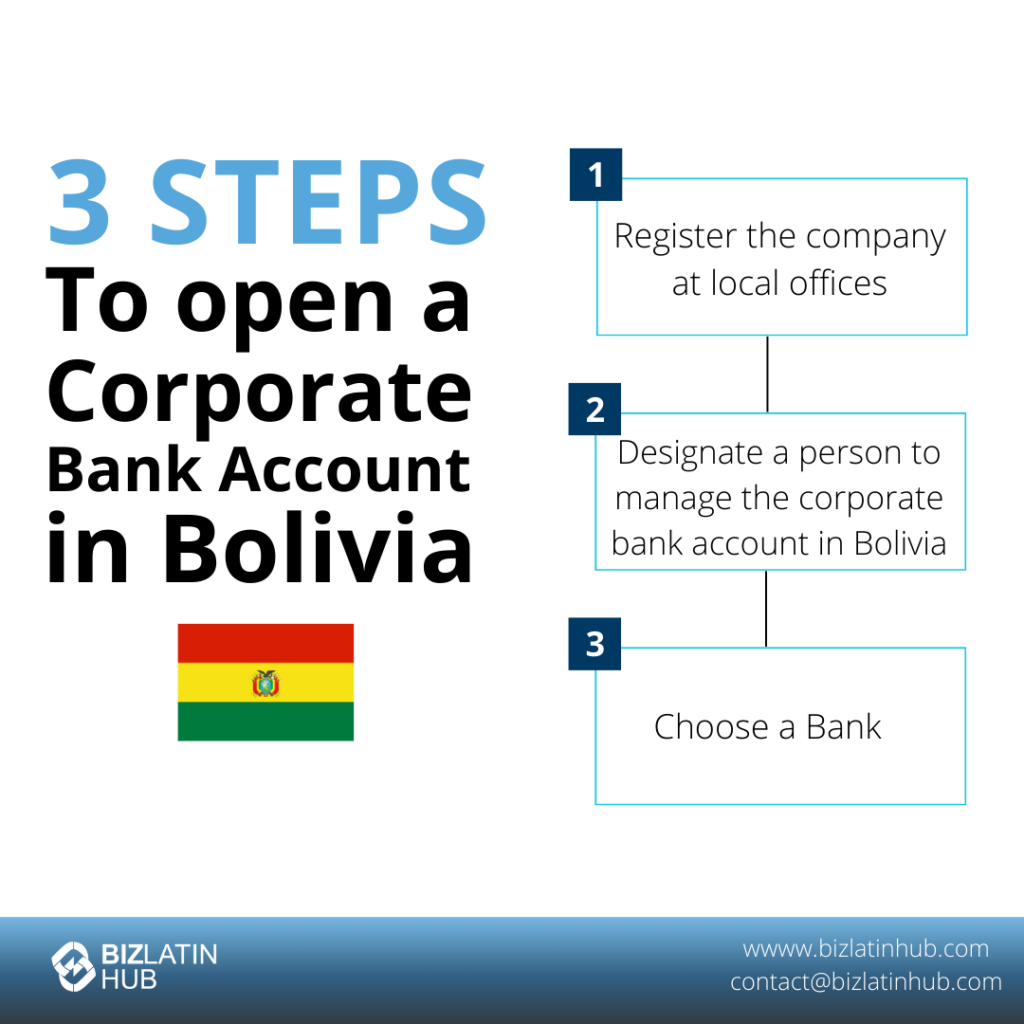

| There is a three step process to open a corporate bank account in Bolivia: | Step 1 – Register the company at local offices. Step 2 – Designate a person to manage the corporate bank account in Bolivia Step 3 – Choose a Bank. |

| Each corporate bank account will vary slightly: | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

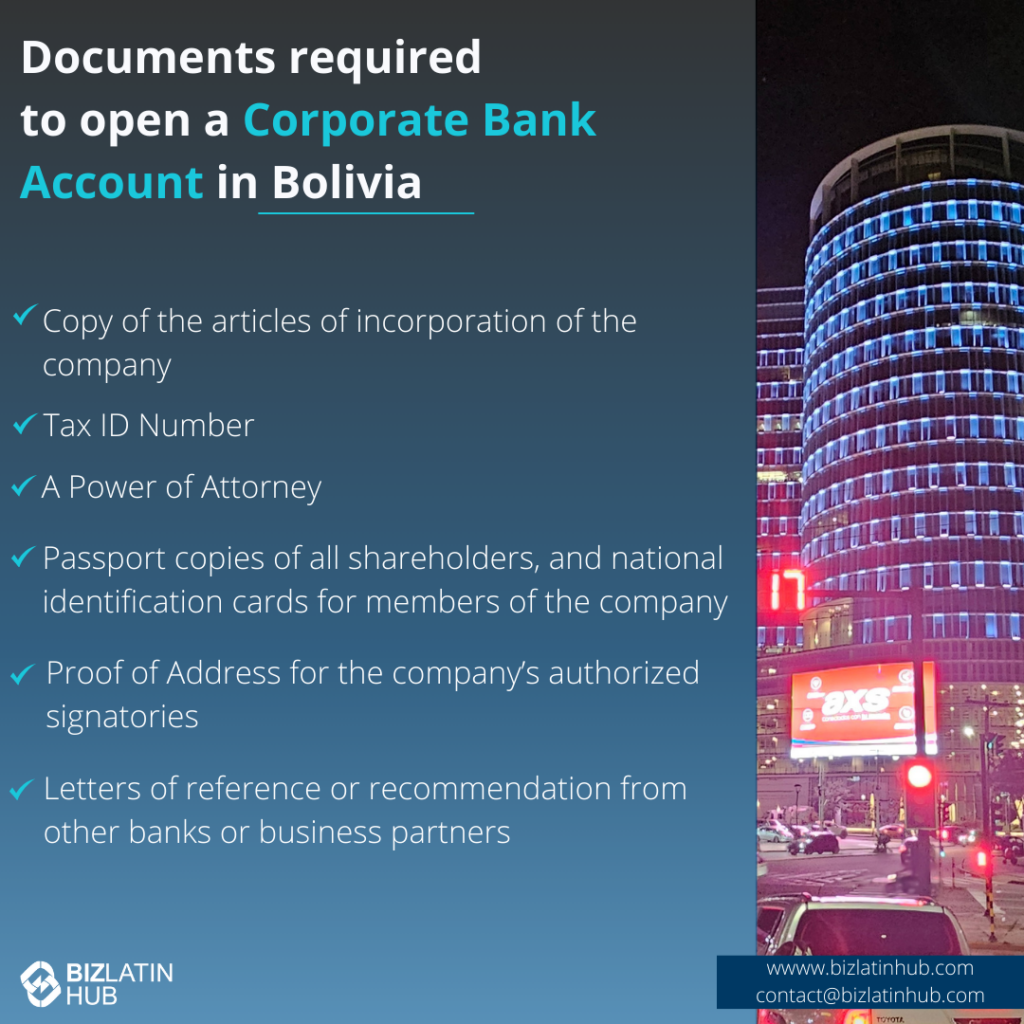

| You will need to provide documents when opening a corporate bank account in Bolivia: | Copy of the articles of incorporation of the company Tax ID Number A Power of Attorney Passport copies of all shareholders, and national identification cards for members of the company Proof of Address for the company’s authorized signatories Letters of reference or recommendation from other banks or business partners including their phone numbers and emails for verification. |

3 Steps to Open a Corporate Bank Account in Bolivia

Opening a corporate account is usually the last step of the company incorporation process. You cannot open a bank account unless your company is fully incorporated. Once you have completed all the legal requirements for incorporation, you must designate a person to manage the corporate account, and then choose a banking provider. At that point, you are ready to submit your application for a corporate account. Once the application is approved, you are on your way to being a fully operational company.

To open a corporate bank account in Bolivia you must follow these 3 steps:

- Step 1 – Register the company at local offices.

- Step 2 – Designate a person to manage the corporate bank account in Bolivia

- Step 3 – Choose a Bank.

1. Register the company at local offices

Companies must be registered at the Bolivian Registry of Commerce and at the Bolivian Tax Office. Make sure you also obtain a municipal operating license for your company. Once a company meets the requirements required for registry, it will be eligible to open a corporate bank account in Bolivia at any financial local entity.

2. Designate a person to manage the corporate bank account in Bolivia

Local and foreign companies should designate a person to manage the corporate account in Bolivia. This person must meet the following requirements:

- Locals: Must have a power of attorney (POA) with a banking authorization, granted by the company shareholders. Legal representatives can be designated to manage a corporate bank account in Bolivia.

- Foreigners: Must apply for a Bolivian temporary residence to receive a foreign identification number. Once this procedure is completed, the shareholder can grant the foreigner a power of attorney (POA) with banking authorization. Foreign legal representatives can also be designated to manage a corporate bank account, as long as an official identification is presented.

A corporate bank account in Bolivia can be managed by two different individuals, designated by the shareholders to act jointly, or separately, according to the POAs granted to them as authorized signatories. They are responsible for all the financial transactions in the corporate bank accounts.

3. Choose a bank

In light of the current situation surrounding COVD-19 and the lockdowns experienced by most countries in the region, financial institutions are making it possible to complete the entire process of opening a corporate bank account in Bolivia online, including accepting digital copies of required documents.

Banks like Banco Nacional de Bolivia and Banco Bisa accept digital signatures for documents and online processes.

What Are Some Commercial Banks in Bolivia?

There are a number of commercial banks in Bolivia you may choose from when opening a corporate bank account. Different providers will offer slightly different services. You should choose the option that best suits your business needs. Here is a list of the commercial banks operating in Bolivia for you to consider:

- Banco Bisa

- Banco de Crédito (BCP)

- Banco Económico

- Banco Fassil

- Banco Fie

- Banco Fortaleza

- Banco Ganadero

- Banco Mercantil Santa Cruz

- Banco de la Nación Argentina

- Banco Nacional de Bolivia (BNB)

- Banco Prodem

- BancoSol Bank

- Banco Unión

Our recommendation: We recommend Banco de Credito (BCP) to open a corporate bank account in Bolivia. This bank is one of the largest and most established banks in the country and offers a wide range of services tailored to corporate clients. With its reputation for reliability and comprehensive banking solutions, BCP can effectively meet your company’s financial needs.

What Documents You Need to Open a Corporate Bank Account in Bolivia?

When you apply for a corporate bank account, you will be asked to provide a number of official documents about your company. The exact list depends on which bank you choose as your provider. However, there are some key documents that every bank asks for. You should have them ready when you begin the process. The following documents are generally required to open the company bank account in Bolivia:

- Copy of the articles of incorporation of the company; this will include a commercial registry certificate, company bylaws and amendments (if any), and tax identification (NIT – Número de Identificación Tributaria).

- A POA granted from your company’s board of directors or shareholders authorizing the opening of the bank account and designating individuals with signing authority.

- Passport copies of all shareholders, and national identification cards for members of the company.

- Proof of Address for the company’s authorized signatories, which can be utility bills or similar documents.

- Letters of reference or recommendation from other banks or business partners including their phone numbers and emails for verification.

Common Questions on Opening a Corporate Bank Account in Bolivia

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Bolivia:

1. Who can have access to a company bank account in Bolivia?

Any company member authorized by the company’s shareholders or Board of Directors through a Power of Attorney can have access to the company bank account. Additionally, it is mandatory for a foreign individual to count with a Foreign Identification card, which is obtained after the foreign individual completes the residency request process in Bolivia.

2. Why do companies open bank accounts in Bolivia?

Companies choose to open bank accounts in Bolivia for routine business transactions like receiving payments, paying providers, and payroll, to meet legal requirements for maintaining corporate funds in a regulated financial institution, to accessing a range of banking services such as online banking, wire transfers, and establish a banking relationship that may be useful for obtaining credit, loans, or other forms of financing.

4. Can I open a corporate bank account online in Bolivia?

Although you can open a bank account from abroad with the support of the designated legal representative for your Bolivian company empowered through a power of attorney (POA), the process typically requires a physical presence at the bank branch or in-person meetings with bank representatives.

5. What is the best bank in Bolivia for foreign companies?

Two options we recommend are: Banco Bisa and Banco Mercantil Santa Cruz. In our experience, they provide services well-suited to the needs of foreign companies.

6. What are the types of corporate bank accounts in Bolivia?

The types of bank accounts in Bolivia are a checking account, a savings account, a foreign currency account, and a time deposit account.

7. What documents do I need to open a company bank account in Bolivia?

The following documents are required to open the company bank account:

- Copy of the articles of incorporation of the company; this will include a commercial registry certificate, company bylaws and amendments (if any), and tax identification (NIT – Número de Identificación Tributaria).

- A POA granted from your company’s board of directors or shareholders authorizing the opening of the bank account and designating individuals with signing authority.

- Passport copies of all shareholders, and national identification cards for members of the company.

- Proof of Address for the address for the company’s authorized signatories, which can be utility bills or similar documents.

- Letters of reference or recommendation from other banks or business partners including their phone numbers and emails for verification.

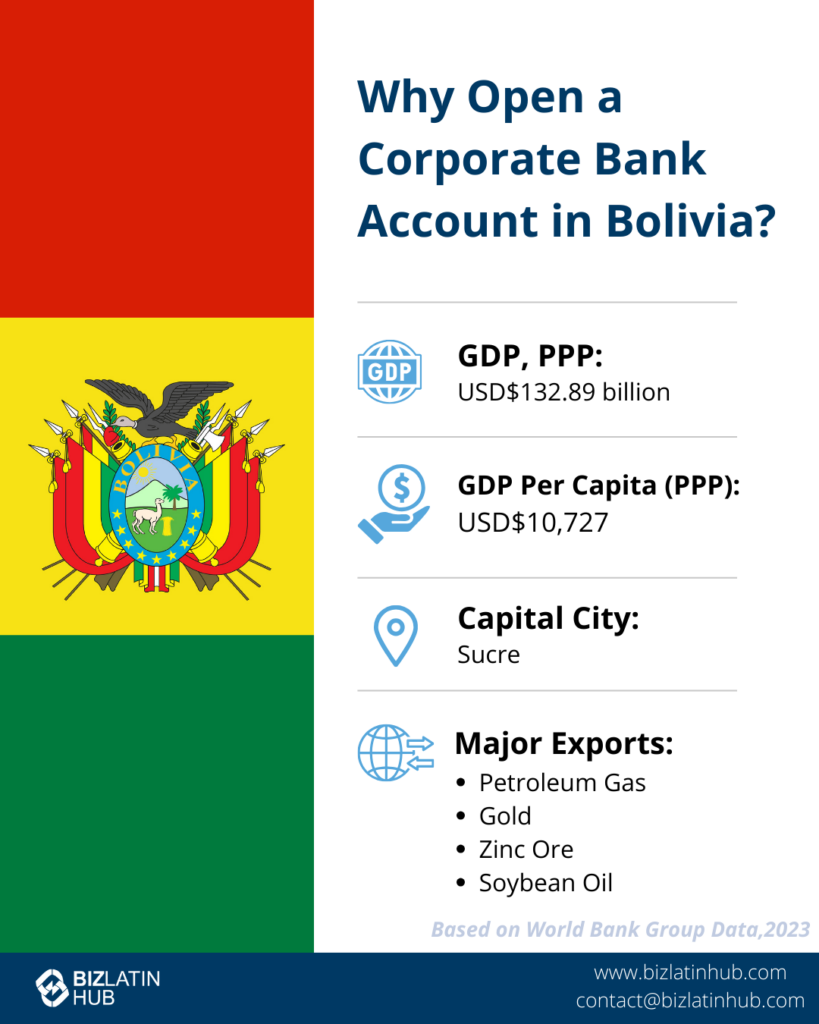

Why Open a Corporate Bank Account in Bolivia?

Opening a bank account in Bolivia is a key step for investors, offering access to a growing economy in South America. It simplifies transactions in Bolivian bolivianos, reduces international transfer costs, and ensures compliance with local financial regulations, enabling investments in sectors like mining, agriculture, and infrastructure.

A local account enhances credibility with Bolivian businesses and authorities while providing access to financial products tailored to the country’s market. It helps investors navigate the regulatory framework, adapt to local economic conditions, and capitalize on Bolivia’s emerging opportunities, establishing a strong foundation for success.

Open your Corporate Bank Account in Bolivia with Biz Latin Hub

Biz Latin Hub’s team will be glad to assist your company with the best legal advice and the application of the regulation for opening a corporate bank account in Bolivia. Finding support for doing business in a foreign culture and language is very beneficial. Therefore, it is strongly recommended to seek professional guidance and assistance.

Biz Latin Hub has vast experience in doing business in Latin America. Our multilingual team of local lawyers and trade experts provides a wide range of market entry and back-office services. We ensure high-quality work by supporting your business with tailor-made solutions. Take advantage of advice from our trade law specialists and other legal providers, hiring and recruitment services, taxation and accounting, visa procedure assistance, payroll management, and other professionals.

Get in touch with us to start your international business adventure now.

Learn more about our expert authors and team.